2024 Market Outlook: Investors Are In For A Few Surprises

Investors have to be ready for many surprises in 2024. While the US economy was able to escape a recession in 2023, if anything, it has increased the chances of either a recession or a market pullback in the first half of 2024. While many investors remember how bad the Great Recession was back in 2008 and 2009, very few remember what the market conditions were like prior to the recession beginning. As an investment firm, we archive a lot of that data, so we reference it at any time to determine where the market may be headed today, and the historical data is alarming.

Rewind the clock to January 2008

In January 2008, the US economy was already in a recession, but it had not officially been declared yet that's because a recession, by textbook definition, is two consecutive quarters of negative GDP, but you don't get the quarterly GDP readings until after each calendar quarter end, so while the recession in the US officially began December 2007, investors didn't realize recession had been declared until mid-way through 2008. So what were the forecasts for the S&P 500 in January 2008?

The broker-dealer that we were with at the time was forecasting in January 2008 that the S&P 500 Index would be up 16% in 2008. We now know that 2008 was the first year of the Great Recession, and the S&P 500 ended up posting a loss of 36% for the year. Many investors don't realize that historically, the consensus is very bad at predicting a coming recession because they failed to recognize the patterns in the economy and monetary policy that tend to be very good predictors of recessions. Investors are often more worried about missing out on the next 20% rally in the markets, which is why they get caught when the market begins its steep sell-off.

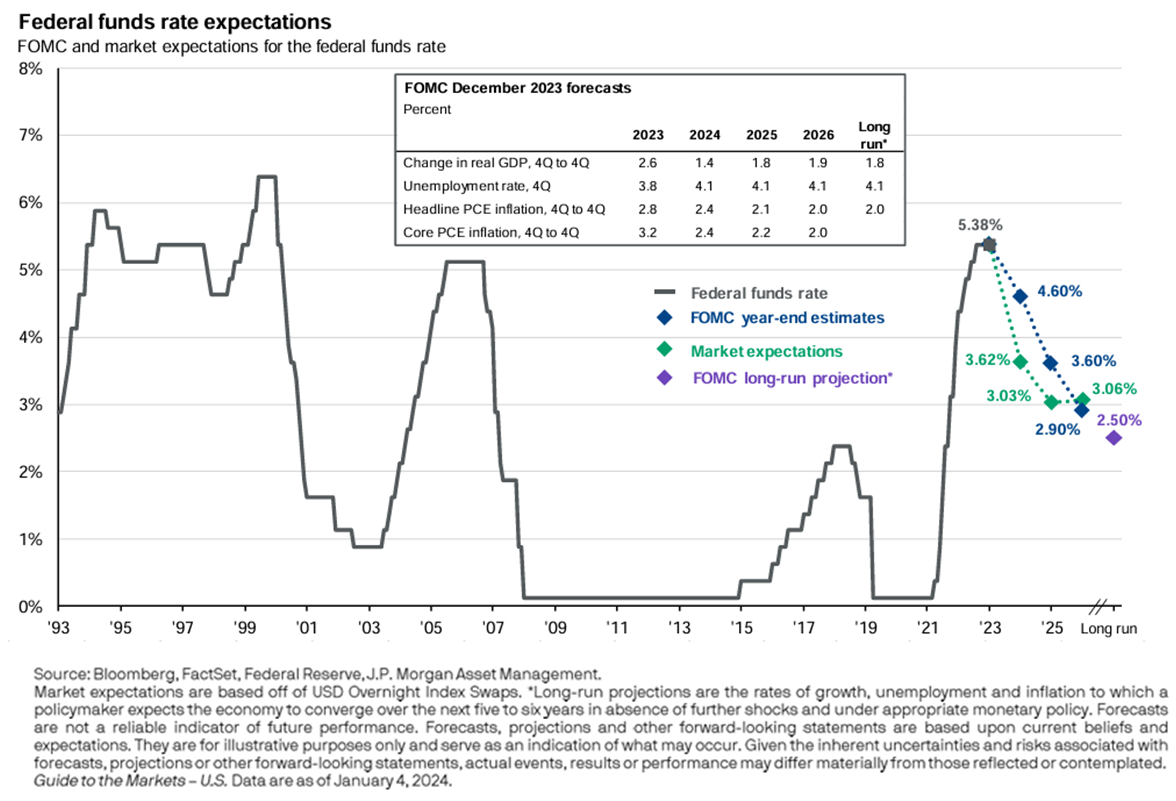

What were some of these economists looking at in January 2008 that made them so wrong? Towards the end of 2007, we had already begun to see the cracks within the US housing market, the economy had already started to slow, but in September 2007, the Federal Reserve began to lower interest rates which stock forecasters saw as a bullish signal that the monetary stimulus of lower interest rates would mean growth for the stock market in 2008. This echoes much of the same rhetoric that I heard in the fourth quarter of 2023 as the Fed decided to go on pause and then built in rate cuts to their 2024 forecast.

If you look back at history, there's a pattern between the US economy and the Fed funds rate, and it's fairly consistent over time. Here is a chart of the Fed funds rate going back to 1993. You will see the same pattern in the chart, The Fed raises rates to fight inflation, they pause (which is the tabletop portion at each of the mountain peaks), and then rates drop rapidly when the economy slows by too much, and the economy enters a recession. The Fed is historically very bad at delivering soft landings, which is a reduction in inflation without a recession.

Why is that? I think largely it's because we have the largest economy in the world, so picture a battleship in a bathtub, it takes a long time to turn, and because it's so large, once you've begun the turn you can't just stop the turn on a dime, so our turns tend to overshoot their mark, creating prolonged bull market rallies past what the consensus expects, but also an inability to stop the economy from slowing too much in an effort to fight inflation before it dips into a recession.

Here is the pattern

This chart shows our current rate hike cycle as well as the five rate hike cycles before us. For the five rate hike cycles preceding our current cycle, four of the five resulted in a recession. But that means one of the five created a soft landing, which one was it?

The 1994/1995 rate hike cycle was one of the very few soft landings that the Fed has engineered in history, so could that be done again? What was different about the mid-90s compared to the other four rate hike cycles that led us into a recession?

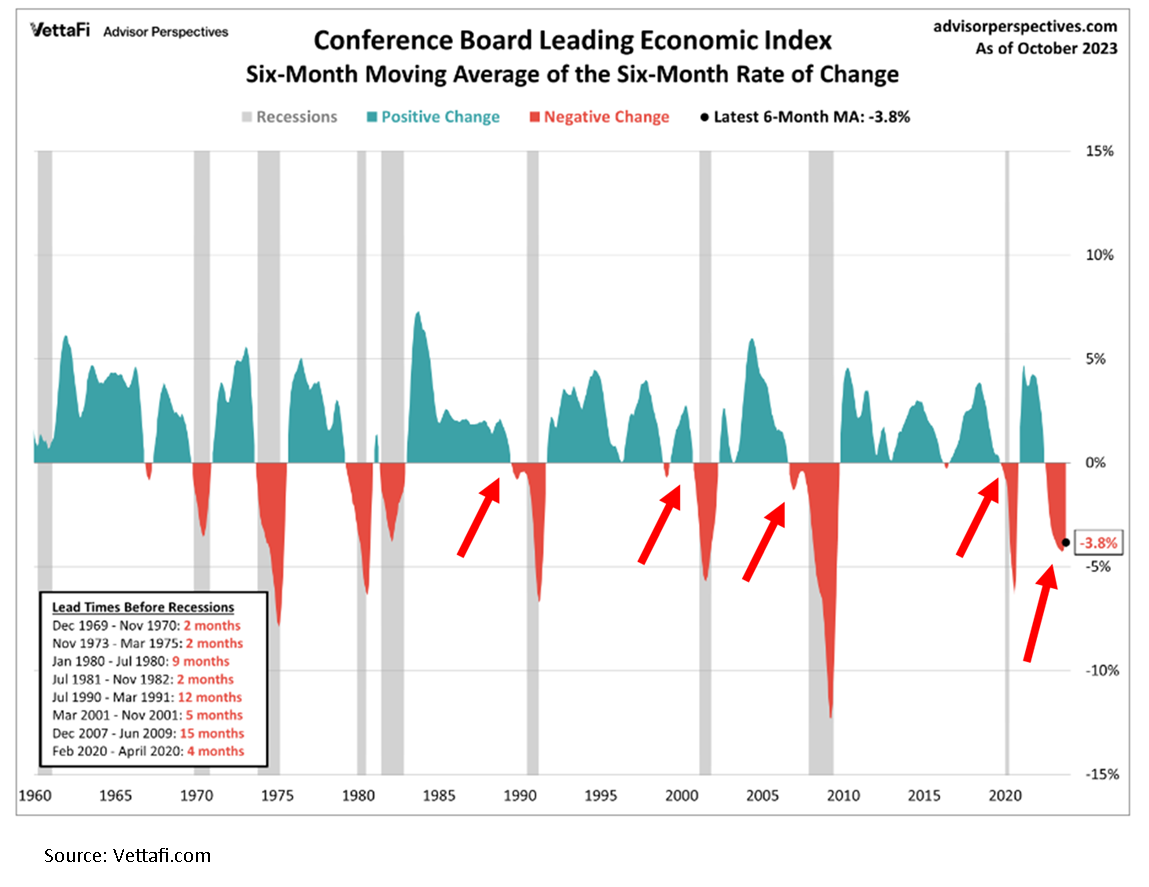

Leading Economic Index

The leading economic index is comprised of multiple economic indicators such as manufacturing hours worked, consumer sediment, building permits, and more. Its parts are considered by many to be forward-looking measurements of economic activity, which is why it's called the leading index. Below is a historical chart of the LEI index going back to 1960. The way you read the chart, when it's blue the leading indicators in aggregate are positive, when it's red, the leading indicators in aggregate are contracting.

If you look at the four rate hike cycles that led to a recession, the leading indicators index was contracting in all four prior to the recession beginning, serving as a warning sign. But if you look at 1995 in the chart, the leading indicators index never contracted, which means the Fed was able to bring down inflation without slowing the economy.

But on the far right-hand side of the chart, look at where we are now. Not only has the leading indicators index contracted similar to the four rate hike cycles that caused the recession, but it's contracted at a level so deep that we've never been at this level without already being in a recession. If we avoid a recession over the next 12 months, it will be the first time that the LEI index has been this low without a recession preceding it.

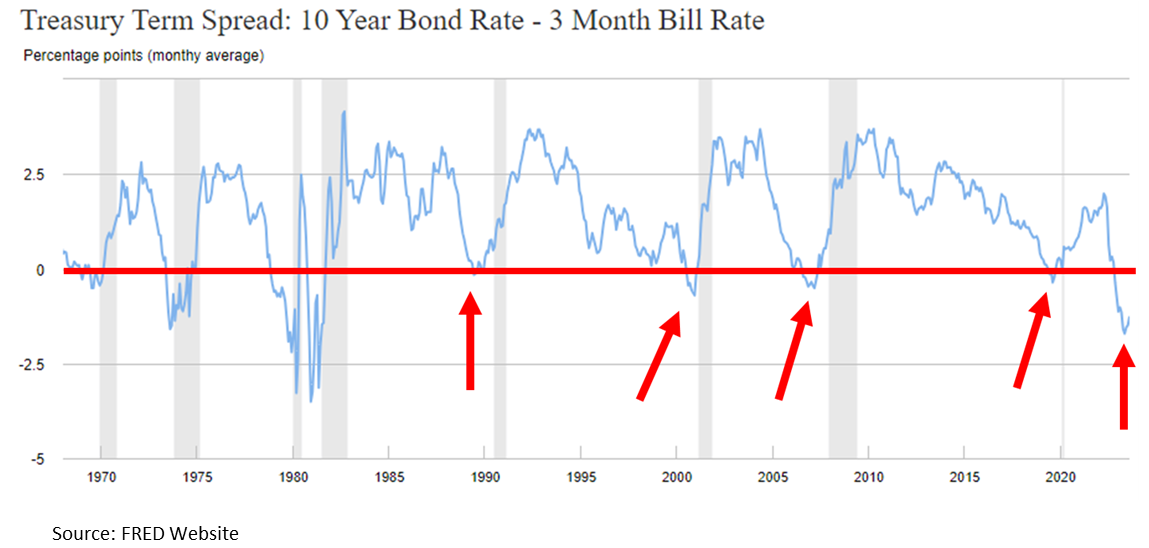

Inverted yield curve

There is a technical indicator in the bond market called the yield curve, which tracks both short-term and long-term interest rates. Without getting into the technical details of how it works, when the yield curve inverts, which means short-term interest rates are higher than long-term interest rates, historically, it's a bearish signal, and it increases the likelihood of a recession occurring. In the past, an inverted yield curve has been a very good predictor of a coming recession. See the chart below.

Anytime The blue line drops below the red line the yield curve is inverted, the gray bars on the chart are the recessions, so when all of the previous 5 recessions the yield curve gave us an advance warning before the recession actually occurred. On the far right-hand side of the chart, that is where we are now, not just slightly inverted, but far more heavily inverted than the previous four recessions. Similar to the leading indicators index historical behavior, if we were to avoid a recession in the next 12 months, that would be the exception to the rule.

Returning to our original question of why was the 1994/1995 soft landing different, notice on the inverted yield curve chart during 1995, the yield curve never inverted, making it much different than the situation we're in now.

Magnitude and pace of rate hikes

After going through this exercise and understanding the patterns of the leading indicators index as well as the yield curve, let's return to our first chart, which showed the six rate hike cycles, including the one we're in now.

The gold line is the rate hike cycle that we're in now, the others are the five previous rate hike cycles. Again four of those five caused the recession, and the reason why the gold line on the chart is higher than the rest the Fed raised rates higher and faster than they had in the previous five rate hike cycles which begs the question, if the catalyst that caused the recessions is stronger, wouldn't the occurance of a recession be more likely?

Said another way, think of the Fed as a bully that likes to push kids at school, the kids represent the US economy, and the force that the bully uses to push the kids is measured by the magnitude of the interest rate increase. There are six kids standing in the hallway as the bully approaches, the first four he pushes with half of his strength, and the kids fall over on the floor, the fifth child gets nudged but does not fall over, but the bully is now running full speed at the sixth child and we're trying to figure out how it's going to end.

With history as a guide, I have a difficult time envisioning a situation where that sixth student remains on their feet.

No Recession

So what if we're wrong? What if, by some miracle, in the face of all these historic trends, the US economy avoids a recession? I would then add that while it is, of course, possible that we could avoid a recession because it's happened before, that does not necessarily mean we are going avoid a 10% plus market correction at some point in 2024 because the stock market looks to be priced for perfection. You can see this in the future earnings expectations for the S&P 500. Blue bars on the chart are the earnings expectations going into 2024 that are already baked into the S&P 500 stock prices.

It seems that not only is the consensus expecting no recession, but they are also expecting significant earnings growth. Again, with the leading economic indicators being so negative right now and the Fed not expected to lower rates until mid-2024, how do the companies in the S&P 500 meet those aggressive earnings expectations when it seems like the consumer is softening? I completely understand that the stock market is a forward-looking animal, but it seems more likely that we're repeating the mistakes of the past because the stock market can only go so far without the economy and the stock market is already way ahead even as we head into 2024. That was the most puzzling aspect of 2023, the stock market continued to rally throughout all of 2023, while the U.S. economy continued to slow throughout 2023.

The Consumer Is Not As Strong As They Seem

I continue to hear the phrase, “consumer spending remains strong”, and I agree that the consumer has been more resilient that even I expected in 2023. However, much of that spending is being done on credit. Take a look at how much credit card debt has risen in the U.S. post COVID, quickly breaking through over $1 Trillon dollars.

Not only has the level of credit card debt risen to record levels but the interest rates being charged on that debt is significantly higher than it was just a year ago, resulting in less discretionary income for consumers with credit card debt.

Buffet & Munger

Many people know the famous investor Warren Buffet and his famous quote: “Be fearful when others are greedy, and be greedy when others are fearful.” But many people don’t know that Warren had a fellow billionaire partner in Berkshire Hathaway named Charlie Munger. Charlie just passed away in 2023 at the age of 99, and Charlie had a famous quote of his own:

“The world is full of foolish gamblers, and they will not do as well as the patient investors.”

Living in a world of FOMO (Fear Of Missing Out), patience is probably the most difficult investment discipline to master, but I personally have found it to be the most rewarding discipline during my 20+ year career in the investment industry. The year 2024 may be lining up to be another history lesson as FOMO investors fail to recognize the historical pattern between interest rates and the economy dating back 50 years but time will tell.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.