Can You Contribute To An IRA & 401(k) In The Same Year?

The answer to this question depends on the following items:

Do you want to contribute to a Roth IRA or Traditional IRA?

What is your income level?

Will the contribution qualify for a tax deduction?

Are you currently eligible to participate in a 401(k) plan?

Is your spouse covered by a 401(k) plan?

If you have the choice, should you contribute to the 401(k) or IRA?

Advanced tax strategy: Maxing out both and spousal IRA contributions

Traditional IRA

Traditional IRA’s are known for their pre-tax benefits. For those that qualify, when you make contributions to the account you receive a tax deduction, the balance accumulates tax deferred, and then you pay tax on the withdrawals in retirement. The IRA contribution limits for 2022 are:

Under Age 50: $6,000

Age 50+: $7,000

However, if you or your spouse are covered by an employer sponsored plan, depending on your level of income, you may or may not be able to take a deduction for the contributions to the Traditional IRA. Here are the phaseout thresholds for 2022:

Note: If both you and your spouse are covered by a 401(k) plan, then use the “You Are Covered” thresholds above.

BELOW THE BOTTOM THRESHOLD: If you are below the thresholds listed above, you will be eligible to fully deduct your Traditional IRA contribution

WITHIN THE PHASEOUT RANGE: If you are within the phaseout range, only a portion of your Traditional IRA contribution will be deductible

ABOVE THE TOP THRESHOLD: If your MAGI (modified adjusted gross income) is above the top of the phaseout threshold, you would not be eligible to take a deduction for your contribution to the Traditional IRA

After-Tax Traditional IRA

If you find that your income prevents you from taking a deduction for all or a portion of your Traditional IRA contribution, you can still make the contribution, but it will be considered an “after-tax” contribution. There are two reasons why we see investors make after-tax contributions to traditional IRA’s. The first is to complete a “Backdoor Roth IRA Contribution”. The second is to leverage the tax deferral accumulation component of a traditional IRA even though a deduction cannot be taken. By holding the investments in an IRA versus in a taxable brokerage account, any dividends or capital gains produced by the activity are sheltered from taxes. The downside is when you withdraw the money from the traditional IRA, all of the gains will be subject to ordinary income tax rates which may be less favorable than long term capital gains rates.

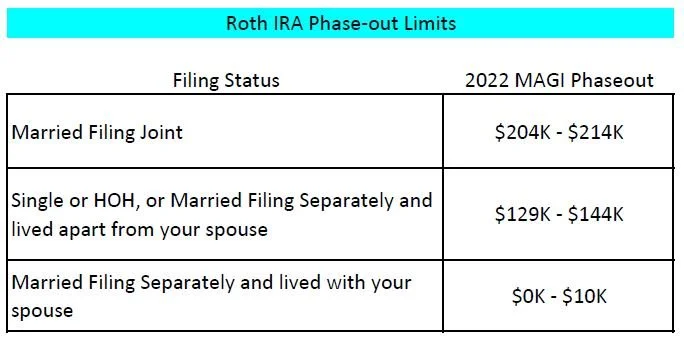

Roth IRA

If you are covered by a 401(K) plan and you want to make a contribution to a Roth IRA, the rules are more straight forward. For Roth IRAs, you make contributions with after-tax dollars but all the accumulation is received tax free as long as the IRA has been in existence for 5 years, and you are over the age of 59½. Unlike the Traditional IRA rules, where there are different income thresholds based on whether you are covered or your spouse is covered by a 401(k), Roth IRA contributions have universal income thresholds.

The contribution limits are the same as Traditional IRA’s but you have to aggregate your IRA contributions meaning you can’t make a $6,000 contribution to a Traditional IRA and then make a $6,000 contribution to a Roth IRA for the same tax year. The IRA annual limits apply to all IRA contributions made in a given tax year.

Should You Contribute To A 401(k) or an IRA?

If you have the option to either contribute to a 401(k) plan or an IRA, which one should you choose? Here are some of the deciding factors:

Employer Match: If the company that you work for offers an employer matching contribution, at a minimum, you should contribute the amount required to receive the full matching contribution, otherwise you are leaving free money on the table.

Roth Contributions: Does your 401(k) plan allow Roth contributions? Depending on your age and tax bracket, it may be advantageous for you to make Roth contributions over pre-tax contributions. If your plan does not allow a Roth option, then it may make sense to contribute pre-tax up the max employer match, and then contribute the rest to a Roth IRA.

Fees: Is there a big difference in fees when comparing your 401(k) account versus an IRA? With 401(k) plans, typically the fees are assessed based on the total assets in the plan. If you have a $20,000 balance in a 401(K) plan that has $10M in plan assets, you may have access to lower cost mutual fund share classes, or lower all-in fees, that may not be available within a IRA.

Investment Options: Most 401(k) plans have a set menu of mutual funds to choose from. If your plan does not provide you with access to a self-directed brokerage window within the 401(k) plan, going the IRA route may offer you more investment flexibility.

Easier Is Better: If after weighing all of these options, it’s a close decision, I usually advise clients that “easier is better”. If you are going to be contributing to your employer’s 401(k) plan, it may be easier to just keep everything in one spot versus trying to successfully manage both a 401(k) and IRA separately.

Maxing Out A 401(k) and IRA

As long as you are eligible from an income standpoint, you are allowed to max out both your employee deferrals in a 401(k) plan and the contributions to your IRA in the same tax year. If you are age 51, married, and your modified AGI is $180,000, you would be able to max your 401(k) employee deferrals at $27,000, you are over the income limit for deducting a contribution to a Traditional IRA, but you would have the option to contribute $7,000 to a Roth IRA.

Advanced Tax Strategy: In the example above, you are above the income threshold to deduct a Traditional IRA but your spouse may not be. If your spouse is not covered by a 401(k) plan, you can make a spousal contribution to a Traditional IRA because the $180,000 is below the income threshold for the spouse that is NOT COVERED by the employer sponsored retirement plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.