Mandatory 401(k) Roth Catch-up Details Confirmed by IRS January 2025

IRS Issues Guidance on Mandatory 401(k) Roth Catch-up Starting in 2026

Starting January 1, 2026, high-income earners will face a significant shift in retirement savings rules due to the new Mandatory Roth Catch-Up Contribution requirement. If you earn more than $145,000 annually (indexed for inflation), your catch-up contributions to 401(k), 403(b), or 457 plans will now go directly to Roth, rather than pre-tax.

The IRS just released guidance in January 2025 regarding how the new mandatory Roth catch-up provisions will work for high-income earners. This article dives into everything you need to know!

On January 10, 2025, the IRS issued proposed regulations that provided much-needed clarification on the details associated with the Mandatory Roth Catch-up Contribution rule for high-income earners that are set to take effect on January 1, 2026. Employers, payroll companies, and 401(k) providers alike will undoubtedly be scrambling for the remainder of 2025 to get their systems ready for this restriction that will be placed on 401(k) plans starting in 2026.

This is a major change within 401(k) plans, and it is not a welcome change for high-income earners, since individuals in high tax brackets typically like to defer as much as they can pre-tax into 401(k), 403(b), and 457 plans to reduce their current tax liability. Here’s a quick list of the items that will be covered in this article:

General overview of new mandatory 401(k) Roth Catch-up Requirement

Income threshold for employees that will be impacted by the new rule

Definition of “wages” for purposes of the income threshold

Will it apply to Simple IRA plans as well?

“First year of employment” exception for the new Roth rule

Will a 401(k) plan be required to adopt Roth deferrals prior to 1/1/26?

401(k) Mandatory Roth Catch-up Contributions

When an employee reaches age 50, they can make an additional employee deferral called a catch-up contribution. Prior to 2026, all employees were allowed to select whether they wanted to make their catch-up contributions in pre-tax, Roth, or a combination of both. Starting in 2026, the freedom of choice will be taken away from W-2 employees that have more than $145,000 in wages in the prior calendar year (indexed for inflation).

Employees that are above the $145,000 threshold for the previous calendar year, are with the SAME employer, and are age 50 or older, will not be given the option to make their catch-up in pre-tax dollars. If an employee over this wage threshold wishes to make a catch-up contribution to their qualified retirement plan (401K, 403b, 457b), they will only be given the Roth deferral option.

Definition of Wages

One of the big questions that surfaced when the Secure Act 2.0 regulations were first released regarding the mandatory Roth catch-up contribution was the definition of “wages” for the purpose of the $145,000 income threshold. The IRS confirmed in their new regulation that only wages subject to FICA tax would count towards the $145,000 threshold. This is good news for self-employed individuals such as sole proprietors and partnerships that have earnings that are more than the $145,000 threshold, but do not receive W-2 wage, allowing them to continue to make their catch-up contributions all pre-tax for years 2026+.

So essentially, you could have partners of a law firm making $500,000+, and they would be able to continue to make catch-up contributions all pre-tax, but the firm could have a W-2 attorney on their staff that makes $180,000 in wages, and that individual would be forced to make their catch-up contributions all in Roth dollars and pay income tax on those amounts.

Will Mandatory Roth Catch-up Apply to Simple IRA Plans?

Many small employers sponsor Simple IRA plans, which also allow employees aged 50 or older to make pre-tax catch-up contributions, but at lower dollar limits. Fortunately, Simple IRA plans have been granted a pass by the IRS when it comes to the new mandatory Roth catch-up contributions. All employees that are covered by a Simple IRA plan, regardless of their wages, will be allowed to continue to make their catch-up contributions, all pre-tax, for tax years 2026+.

First Year of Employment Exception

Since the $145,000 wage threshold is based on an employee’s “prior year” wages, the IRS confirmed in the new regulations that an employer is allowed to give employees a pass on making pre-tax catch-up contributions during the first calendar year that the company employs them. Meaning, if Sue is hired by Company ABC in February of 2025 and makes $250,000 from February – December in 2025, she would be allowed to contribute her 401(k) catch-up contributions all pre-tax if she is over 50 years old, since Sue doesn’t have wages with Company ABC in 2024, even though her wages for the 2025 were over the $145,000 threshold.

Some High-Income Employees Will Get A 2-Year Pass

There are also situations where new employees with wages over $145,000 will get a 2-year pass on the application of the mandatory Roth catch-up rule. Let’s say Tim is hired by a law firm as a W-2 employee on July 1, 2025, at an annual salary of $200,000. Tim automatically gets a pass for 2025 for the mandatory Roth catch-up, because he did not have wages in 2024 with that company. However, between July 1, 2025 – December 31, 2025, he will only earn half his salary ($100,000), so when they look at Tim’s W-2 wages for purposes of the mandatory Roth catch-up in 2026, his 2025 W-2 will only be showing $100,000, allowing him to make his catch-up contribution all pre-tax in both 2025 and 2026.

Will 401(k) Plans Be Forced to Adopt Roth Deferrals

Not all 401(k) or 403(b) plans allow employees to make Roth employee deferrals. Roth deferrals have historically been an optional provision within an employer-sponsored retirement plan that a company had to voluntarily adopt. When the regulations for the new mandatory Roth catch-up were first released, the regulations seemed to state that if a plan did not allow Roth deferrals, NO EMPLOYEES, regardless of their wage level, were allowed to make catch-up contributions to the plan.

In the proposed regulations that the IRS just released, the IRS clarified that if a retirement plan does not allow Roth deferrals, only the employees above the $145,000 wage threshold would be precluded from making contributions. Employees below the $145,000 wage threshold would still be able to make catch-up contributions pre-tax, even without the Roth deferral feature in the plan.

Due to this restriction, it is expected that if a plan did not previously allow Roth deferrals, many plans will elect to adopt a Roth deferral option by January 1, 2026, to avoid this restriction on their employees with wages in excess of $145,000 (indexed for inflation).

For more information on this new Mandatory Roth Catch-Up Contribution effective 2026, please see our article: https://www.greenbushfinancial.com/all-blogs/roth-catch-up-contributions-high-wage-earners-secure-act-2

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A Complex Mess: Simple IRA Maximum Contributions 2025 and Beyond

Prior to 2025, it was very easy to explain to an employee what the maximum Simple IRA contribution was for that tax year. Starting in 2025, it will be anything but “Simple”. Thanks to the graduation implementation of the Secure Act 2.0, there are 4 different limits for Simple IRA employee deferrals that both employees and companies will need to be aware of.

Prior to 2025, it was very easy to explain to an employee what the maximum Simple IRA contribution was for that tax year. Starting in 2025, it will be anything but “Simple”. Thanks to the gradual implementation of the Secure Act 2.0, there are 4 different limits for Simple IRA employee deferrals that both employees and companies will need to be aware of.

2025 Normal Simple IRA Deferral Limit

Like past years, there is a normal employee deferral limit of $16,500 in 2025.

NEW: Roth Simple IRA Deferrals

When Secure Act 2.0 passed, for the first time ever, it allowed Roth Deferrals to Simple IRA plans. However, due to the lack of guidance from the IRS, we are still not aware of any investment platforms that are currently accepting Roth deferrals into their Simple IRA platforms. So, for now, most employees are still limited to making pre-tax deferrals to their Simple IRA plan, but at some point, this will be another layer of complexity, whether or not an employee wants to make pre-tax or Roth Simple IRA deferrals.

2025 Age 50+ Catch-up Contribution

Like in past years, any employee aged 50+ is also allowed to make a catch-up contribution to their Simple IRA over and above the regular $16,500 deferral limit. In 2025, the age 50+ catch-up is $3,500, for a total of $20,000 for the year.

Under the old rules, this would have been it, plain and simple, but here are the new more complex Simple IRA employee deferral maximum contribution rules for 2025+.

NEW: Age 60 to 63 Additional Catch-up Contribution

Secure Act 2.0 introduced a new enhanced catch-up contribution starting in 2025, but it is only available to employees that are age 60 – 63. Employees ages 60 – 63 are now able to contribute the regular deferral limit ($16,500) PLUS the age 50 catch-up ($3,500) PLUS the new age 60 – 63 catch-up ($1,750).

The calculation for the new age 60 – 63 catch-up is an additional 50% above the current catch-up limit. So for 2025 it would be $3,500 x 50% = $1,750. For employees ages 60 – 63 in 2025, their deferral limit would be as follows:

Regular Deferral: $16,500

Regular Age 50+ Catch-up: $3,500

New Age 60 – 63 Catch-up: $1,750

Total: $21,750

But, the additional age 60 – 63 catch-up contribution is lost in the year that the employee turns age 64. When they turn 64, they revert back to the regular catch-up limit of $3,500

NEW: Additional 10% EE Deferral for ALL Employees

I wish I could say the complexity stops there, but it doesn’t. Introduced in 2024 was a new additional 10% employee deferral contribution that is available to ALL employees regardless of age, but automatic adoption of this additional 10% contribution depends on the size of the employer sponsoring the Simple IRA plan.

If the employer that sponsors the Simple IRA plan has no more than 25 employees who received $5,000 or more in compensation on the preceding calendar year, adoption of this new additional 10% deferral limit is MANDATORY, even though no changes have been made to the 5304 and 5305 Simple Forms by the IRS.

What that means is for 2025 is if an employer had 25 or fewer employees that made $5,000 in the previous year, the regular employee deferral limit AND the regular catch-up contribution limit will automatically be increased by 10% of the 2024 limit. Something odd to note here: The additional 10% is based just on the 2024 contribution limits, even though there are new increased limits for 2025. (This has been the most common interpretation of the new rules that we have seen to date)

Employee Deferral Limit: $16,500

Employee Deferral with Additional 10%: $17,600 ($16,000 2024 limit x 110%)

Employee 50+ Catch-up Limit: $3,500

Employee 50+ Catch-up Limit with Additional 10%: $3,850 ($3,500 2024 limit x 110%)

What this means is if an employee is covered by a Simple IRA plan in 2025 and that employer had less than 26 employees in 2024, for an employee under the age of 50, the Simple IRA employee deferral limit is not $16,500 it’s $17,600. For employees ages 50 – 59 or 64+, the employee deferral limit with the catch-up is not $20,000, it’s $21,450.

For employers that have 26 – 100 employees who, in the previous year, made at least $5,000 in compensation, in order for the employees to gain access to the additional 10% employee deferral, the company has to sponsor either a 4% matching contribution or 3% non-elective which is higher than the current standard 3% match and 2% non-elective.

NOTE: The special age 60 – 63 catch-up contribution is not increased by this 10% additional contribution because it was not in existence in 2024, and this 10% additional contribution is based on 2024 limits. The age 60 – 63 special catch-up contribution remains at $5,250, regardless of the size of the employer sponsoring the Simple IRA plan.

Summary of Simple IRA Employee Deferral Limits for 2025

Bringing all of these things together, here is a quick chart to illustrate the Simple IRA employee deferral limits for 2025:

EMPLOYER UNDER 26 EMPLOYEES

Employee Deferral Limit: $17,600

Employees Ages 50 – 59: $21,450

Employees Ages 60 – 63: $22,850

Employees Age 64+: $21,450

EMPLOYERS 26 EMPLOYEES or MORE

(Assuming they do not sponsor the enhanced 4% match or 3% non-elective ER contribution)

Employee Deferral Limit: $16,500

Employees Ages 50 – 59: $20,000

Employees Ages 60 – 63: $21,750

Employees Age 64+: $20,000

However, if the employer with 26+ employees sponsors the enhanced employer contribution amounts, the employee deferral contribution limits would be the same as the Under 26 Employees grid.

What a wonderful mess……

Voluntary Additional Simple IRA Non-Elective Contribution

Everything we have addressed up to this point focuses solely on the employee deferral limits to Simple IRA plans. Secure Act 2.0 also introduced a voluntary non-elective contribution that employers can make to their employees in Simple IRA plans. Prior to Secure Act 2.0, the only EMPLOYER contributions allowed to Simple IRA plans was either the 3% matching contribution or the 2% non-elective contribution.

Starting in 2024, employers that sponsor Simple IRA plans are now allowed to voluntarily make an additional non-elective employer contribution to all of the eligible employees based on the LESSER of 10% of compensation or $5,000. This additional employer contribution can be made any time prior to the company’s tax filing, plus extensions.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

New Age 60 – 63 401(k) Enhanced Catch-up Contribution Starting in 2025

Good news for 401(k) and 403(b) plan participants turning age 60 – 63 starting in 2025: there is now an enhanced employee catch-up contribution thanks to Secure Act 2.0 that passed back in 2022. For 2025, the employee contributions limits are as follows: Employee Deferral Limit $23,500, Age 50+ Catch-up Limit $7,500, and the New Age 60 – 63 Catch-up: $3,750.

Good news for 401(k) and 403(b) plan participants turning age 60 – 63 starting in 2025: there is now an enhanced employee catch-up contribution thanks to Secure Act 2.0 that passed back in 2022. For 2025, the employee contributions limits are as follows:

Employee Deferral Limit: $23,500

Age 50+ Catch-up: $7,500

New Age 60 – 63 Catch-up: $3,750

401K Age 60 – 63 Catch-up Contribution

Under the old rules, in 2025, a 401(k) plan participant age 60 – 63 would have been limited to the employee deferral limit of $23,500 plus the age 50+ catch-up of $7,500 for a total employee contribution of $31,000.

However, thanks to the passing of the Secure Act in 2022, an additional catch-up contribution will be introduced to employer-sponsored qualified retirement plans, only available to employees age 60 – 63, equal to “50% of the regular catch-up contribution for that plan year”. In 2025, the catch-up contribution is $7,500, making the additional catch-up contribution for employees age 60 – 63 $3,750 ($7,500 x 50%). Thus, a plan participant age 60 – 63 would be able to contribute the regular employee deferral limit of $23,500, plus the normal age 50+ catch-up of $7,500, PLUS the new age 60 – 63 catch-up contribution of $3,750, for a total employee contribution of $34,750 in 2025.

Age 64 – Revert Back To Normal 401(k) Catch-up Limit

This is a very odd way to assess a special catch-up contribution because it is ONLY available to employees between the ages of 60 and 63. In the year the 401(k) plan participant obtains age 64, the new additional age 60 – 63 contribution is completely eliminated. Here is a quick list of the contribution limits for 2025 based on an employee’s age:

Under Age 50: $23,500

Age 50 – 59: $31,000

Age 60 – 63: $34,750

Age 64+: $31,000

The Year The Employee OBTAINS Age 60 – 63

The employee just has to OBTAIN age 60 – 63 during that year to be eligible for the enhanced catch-up contribution. The enhanced catch-up contribution is not pro-rated based on WHEN the employee turns age 60. For example, if an employee turns 60 on December 31st, they are eligible to make the full $3,750 additional catch-up contribution for the year.

By that same token, if the employee turns age 64 by December 31st, they are no longer allowed to make the new enhanced catch-up contribution for that year.

Optional Provision At The Plan Level

The new 60 – 63 enhanced catch-up contribution is an OPTIONAL provision for qualified retirement plans, meaning some employers may allow this new enhanced catch-up contribution while others may not. If no action is taken by the employer sponsoring the plan, be default, the new age 60 – 63 catch-up contributions starting in 2025 will be allowed.

If an employer prefers to opt out of allowing employees ages 60 – 63 from making this new enhanced catch-up contribution, they will need to contact their TPA firm (third-party administrator) as soon as possible to amend their plan to disallow this new type of employee contributions starting in 2025.

Contact Payroll Company

Since this a brand new 401(k) employee contribution starting in 2025, we strongly recommend that plan sponsors reach out to their payroll company to make sure they are aware that your plan will either ALLOW or NOT ALLOW this new age 60 – 63 catch-up contribution, so the payroll system doesn’t incorrectly cap employees age 60 – 63 from making the additional catch-up contribution.

Formula: 50% of Normal Catch-up Contribution

For future years, the formula for this age 60 – 63 enhanced catch-up contribution is 50% of the regular catch-up contribution limit. The IRS usually announces the updated 401(k) contribution limits in either October or November of each year for the following calendar year. For example, if the IRS announces that the new catch-up limit in 2026 is $8,000, the enhanced age 60 – 63 catch-up contribution would be $4,000 over the regular $8,000 catch-up limit.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Leaving Your Job? What Should You Do With Your 401(k)?

When you separate service from an employer, you have to make decisions with regard to your 401K plan. It’s important to understand the pros and cons of each option while also understanding that the optimal solution often varies from person to person based on their financial situation and objectives. The four primary options are:

1) Leave it in the existing 401(k) plan

2) Rollover to an IRA

3) Rollover to your new employer’s 401(k) plan

4) Cash Distribution

When you separate from an employer, there are important decisions to make regarding your 401(k) plan. It’s crucial to understand the pros and cons of each option, as the optimal solution often varies depending on individual financial situations and objectives. The four primary options are:

Leave it in the existing 401(k) plan

Rollover to an IRA

Rollover to your new employer’s 401(k) plan

Cash Distribution

Option 1:Leave It In The Existing 401(k) Plan

If your 401(k) balance exceeds $7,000, your employer is legally prohibited from forcing you to take a distribution or roll over the funds. You can keep your balance invested in the plan. While no new contributions are allowed since you’re no longer employed, you can still change your investment options, receive statements, and maintain online access to the account.

PROS to Leaving Your Money In The Existing 401(k) Plan

#1: No Urgent Deadline to Move

Leaving a job often coincides with major life changes—whether retiring, job hunting, or starting a new position. It’s reassuring to know that you don't need to make an immediate decision regarding your 401(k), allowing time to evaluate options and choose the best one.

#2: You May Not Be Eligible Yet For Your New Employer’s 401(k) Plan

One of the distribution options that we will address later in this article is rolling over your balance from your former employer's 401(k) plan into your new employer’s 401(k) plan. However, it's not uncommon for companies to have a waiting period for new employees before they're eligible to participate and the new company’s 401(k) plan. If you must wait a year before you have the option to roll over your balance into your new employer's plan, the prudent solution may be just to leave the balance in your former employer’s 401(k) plan, and just roll it over once you become eligible for the new 401(k) plan.

#3: Fees May Be Lower

It's also prudent to do a fee assessment before you move your balance out of your former employer’s 401(k) plan. If you work for a large employer, it's not uncommon for there to be significant assets within that company’s 401(k) plan, which can result in lower overall fees to any plan participants that maintain a balance within that plan. For example, if you work for Company ABC, which is a big publicly traded company, they may have $500 million in their 401(k) plan when you total up all the employee's balances. That may result in total annual fees of under 0.50% depending on the platform. If your balance in the plan is $100,000, and you roll over your balance to either an IRA or a smaller employer’s 401(k) plan, the total fees could be higher because you are no longer part of a $500 million pool of assets. You may end up paying 1% or more in fees each year, depending on where you roll over your balance.

#4: Age 55 Rule

401(k) plans have a special distribution option that if you separate from service with the employer after reaching age 55, you are allowed to request cash distributions directly from that 401(k) plan, but you avoid the 10% early withdrawal penalty that normally exists in IRA accounts for taking distributions under the age of 59 ½. For individuals that retire after age 55, not before age 59 ½, this is one of the primary reasons why we advise some clients to maintain their balance in the former employer’s 401(k) plan and take distributions from that account to avoid the 10% penalty. If they were to inadvertently roll over the entire balance to an IRA, that 10% early withdrawal penalty exception would be lost.

CONS to Leaving Your Money In The Existing 401(k) Plan

#1: Scattered 401(k) Balance

I have met with individuals who have three 401(k) plans, all with former employers. When I start asking questions about the balance in each account, how each 401(k) account is invested, and who the providers are, most individuals with more than one 401(k) account have trouble answering those questions. From both a planning and investment strategy standpoint, it's often more efficient to have all your retirement dollars in one place so you can very easily assess your total retirement nest egg, how that nest egg is invested, and you can easily make investment changes or updates to your personal information.

#2: Forgetting to Update Addresses

It's not uncommon for individuals to move after they've left employment with a company, and over the course of the next 10 years, it's not uncommon for someone to move multiple times. Oftentimes, plan participants forget to go back to all their scattered 401K plans and update their mailing addresses, so they are no longer receiving statements on many of those accounts which makes it very difficult to keep track of what they have and what it's invested in.

#3: Limited Investment Options

401(k) plans typically limit plan participants to a set menu of investments which the plan participant has no control over. Rolling your balance into a new employer’s plan or an IRA could provide a broader range of investment options.

OPTION 2: Rollover to an IRA

The second option for plan participants is to roll over their 401(k) balance to an IRA(s). The primary advantage of the IRA rollover is that it allows employees to remove their balance from their former employers' 401(k) plan, but it does not generate tax liability. The pre-tax dollars within the 401(k) plan can be rolled directly to a Traditional IRA, and any Roth dollars in the 401(k) plan can be rolled over into a Roth IRA.

PROS of 401K Rollover to IRAs

#1: Full Control of Investment Options

As I just mentioned in the previous section, 401(k)’s typically have a set menu of investments available to plan participants by rolling over their balance to an IRA. The plan participant can choose to invest their IRA balance in whatever they would like - individual stocks, bonds, mutual funds, CD, etc.

#2: Consolidating Retirement Accounts

Since it's not uncommon for employees to have multiple employers over their career, as they leave employment with each company, if the employee has an IRA in their own name, they can keep rolling over the balances into that central IRA account to consolidate all their retirement accounts into a single account.

#3: Ease of Distributions in Retirement

It is sometimes easier to take distributions from an IRA than it is from a 401(k) plan. When you request a distribution from a 401(k) plan, you typically have to work through the plan’s administrator. The plan trustee may need to approve each distribution, and some plans are “lump-sum only,” which means you can’t take partial distributions from the 401(k) account. With those lump-sum-only plans, when you request your first distribution from the account, you have to remove your entire balance. When you roll over the balance to an IRA, you can often set up monthly reoccurring distributions, or you can request one-time distributions at your discretion.

#4: Avoid the 401(k) 20% Mandatory Fed Tax Withholding

When you request Distributions from a 401(k) plan, by law, they are required to withhold 20% for Federal Taxes from each distribution (unless it’s an RMD or hardship). But what if you don’t want them to withhold 20% for Fed taxes? With 401(k) plans, you don’t have a choice. By rolling over your balance to an IRA, you have the option to not withhold any taxes or electing a Fed amount less than 20% - it’s completely up to you.

#5: Discretionary Management

Most 401(k) investment platforms are set up as participant-directed platforms which means the plan participant has to make investment decisions with regard to their accounts without an investment advisor overseeing the account and trading it actively on their behalf. Some individuals like the idea of having an investment professional involved to actively manage their retirement accounts on their behalf, and rolling over the balance from 401(k) to an IRA can open up that option after the employee has separated from service.

CONS of 401(k) Rollover to IRAs

Here is a consolidated list based on some of the pros and cons already mentioned:

Fees could be higher in an IRA compared to the existing 401(k)

The Age 55 10% early withdrawal exception could be lost

No point in rolling to an IRA if the plan is just to roll over to the new employer’s plan once you have met the plan’s eligibility requirements

OPTION 3: Rollover to New Employer’s 401(k) Plan

To avoid repeating many of the pros and cons already mentioned here is a quick hit list of the pros and cons

PROS:

Keep retirement accounts consolidated in new employer plan

No tax liability incurred for rollover

Potentially lower fees compared to rolling over to an IRA

If the new plan allows 401(k) loans, rollover balances are typically eligible toward the max loan amount

Full balance eligible for age 55 10% early withdrawal penalty exception

A new advantage that I would add to this list is for employees over the age of 73 who are still working; if you keep your pre-tax retirement account balance within your current employer’s 401(k) plan, you can avoid the annual RMD requirement. When you turn certain ages, currently 73 but soon to be 75, the IRS forces you to start taking taxable distributions out of your pre-tax retirement accounts. However, there is an exception to that rule for any pretax balances maintained in a 401(k) plan with your current employer. The balance in your 401(k) plan with your CURRENT employer is not subject to annual RMDs so you avoid the tax hit associated with taking distributions from a pre-tax retirement account.

I put CURRENT in all caps because this 401(k) RMD exception does not apply to balances in former employer 401(k) plans. You must be employed by that company for the entire year to avoid the RMD requirement. Balances in former employer 401(k) plans are still subject to the RMD requirement.

CONS:

Potentially limited to investment options offered via the 401(k) investment menu

You may not be allowed to take distribution at any time from your 401(k) account after the rollover, whereas a rollover IRA would allow you to keep that option open.

Your personal investment advisor cannot manage those assets within the 401(k) plan

Possible distribution and tax withholding restrictions depend on the plan design

OPTION 4: Cash Distributions

I purposely saved cash distributions for last because it is rarely the optimal distribution option. When you request a cash distribution from a 401(k) plan and you are under the age of 59 ½, you will incur fed taxes, potentially state taxes depending on what state you reside in, and a 10% early withdrawal penalty. When you begin to total up the taxes and penalties, sometimes you’re losing 30% - 50% of your balance in the plan to taxes and penalties.

When you lose 30 to 50% of your retirement account balance in one shot, it can set you back years in the future when it comes to trying to figure out what date you can retire. While, it's not uncommon for a 25-year-old to not be overly concerned with their retirement date; making the decision to withdraw their entire account balance can end up being a huge regret when they are 75 and still working while all their friends retired 10 years before them.

However, as financial planners, we do acknowledge that someone losing their job can create financial disruption, and sometimes a balance needs to be reached between a cash distribution to help them bridge the financial gap to their next career while maintaining as much of their retirement account as possible. The good news is it's not an all-or-nothing decision. For clients that have a high degree of uncertainty, it can sometimes be prudent to roll over the balance from the 401(k) to an IRA which gives them maximum flexibility as to how much they can take from that IRA account for distributions, but usually reserves the right to allow them to roll over that IRA balance into a future employer’s 401(k) plan at their discretion.

Example: Samantha Was just laid off by Company XYZ; she has a $50,000 balance in their 401(k) plan and she is worried that she's not going to be able to pay her bills for the next few months while she's looking for her next job. She may want to roll over that $50,000 balance to an IRA so she can distribute $10,000 from the IRA, pay the taxes and the penalties, but continue to maintain the remaining $40,000 in the IRA untaxed. But if she struggles to continue to find her next career, she can always go back to the IRA and take additional distributions. Samantha then gets hired by Company ABC and is eligible to participate in that company's 401(k) plan after three months. At that time, she can make the decision to either roll over the IRA balance to her new 401(k) plan or just keep the IRA where it is.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

When Should High-Income Earners Max Out Their Roth 401(k) Instead of Pre-tax 401(k)?

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferral contributions all in Roth dollars and forgo the immediate tax deduction.

No Income Limits for Roth 401(k)

It’s common for high income earners to think they are not eligible to make Roth deferrals to their 401(k) because their income is too high. However, unlike Roth IRAs that have income limitations for making contributions, Roth 401(k) contributions have no income limitation.

401(k) Deferral Aggregation Limits

In 2024, the employee deferral limits are $23,000 for individuals under the age of 50, and $30,500 for individuals aged 50 or older. If your 401(k) plan allows Roth deferrals, the annual limit is the aggregate between both pre-tax and Roth deferrals, meaning you are not allowed to contribute $23,000 pre-tax and then turn around and contribute $23,000 Roth in the same year. It’s a combined limit between the pre-tax and Roth employee deferral sources in the plan.

Scenario 1: Business Owner Has Abnormally Low-Income Year

Business owners from time to time will have a tough year for their business. They may have been making $300,000 or more per year for the past year but then something unexpected happens or they make a big investment in their business that dramatically reduces their income from the business for the year. We counsel these clients to “never waste a bad year for the business”.

Normally, a business owner making over $300,000 per year would be trying to max out their pre-tax deferral to their 401(K) plans in an effort to reduce their tax liability. But, if they are only showing $80,000 this year, placing a married filing joint tax filer in the 12% federal tax bracket, I’ll ask, “When are you ever going to be in a tax bracket below 12%?”. If the answer is “probably never”, then it an opportunity to change the tax plan, max out their Roth deferrals to the 401(k) plan, and realize that income at their abnormally lower rate. Plus, as the Roth source grows, after age 59 ½ they will be able to withdrawal the Roth source ALL tax free including the earnings.

Scenario 2: Change In Employment Status

Whenever there is a change in employment status such as:

Retirement

High income spouse loses a job

Reduction from full-time to part-time employment

Leaving a high paying W2 job to start a business which shows very little income

All these events may present an abnormally low tax year, similar to the business owner that experienced a bad year for the business, that could justify the switch from pre-tax deferrals to Roth deferrals.

The Value of Roth Compounding

I’ll pause for a second to remind readers of the big value of Roth. With pre-tax deferrals, you realize a tax benefit now by avoiding paying federal or state income taxes on those employee deferrals made to your 401(k) plan. However, you must pay tax on those contributions AND the earnings when you take distributions from that account in retirement. The tax liability is not eliminated, just deferred.

For example, if you are 40 years old, and you defer $23,000 into your 401K plan, if you get an 8% annual rate of return on that $23,000, it will grow to $157,515 when you turn age 65. As you withdraw that $157,515 in retirement, you’ll pay income tax on all of it.

Now instead let’s assume you made the $23,000 employee deferral all Roth, with the same 8% rate of return per year, reaching the same $157,515 balance at age 65, now you can withdrawal the full $157,515 all tax free.

Scenario 3: Too Much In Pre-Tax Retirement Accounts Already

When high income earners have been diligently saving in their 401(k) plan for 30 plus years, sometimes they amass huge pre-tax balances in their retirement plans. While that sounds like a good thing, sometimes it can come back to haunt high-income earnings in retirement when they hit their RMD start date. RMD stands for required minimum distribution, and when you reach a specific age, the IRS forces you to begin taking distributions from your pre-tax retirement account whether you need to our not. The IRS wants their income tax on that deferred tax asset.

The RMD start age varies depending on your date of birth but right now the RMD start age ranges from age 73 to age 75. If for example, you have $3,000,000 in a Traditional IRA or pre-tax 401(k) and you turn age 73 in 2024, your RMD for the 2024 would be $113,207. That is the amount that you would be forced to withdrawal out of your pre-tax retirement account and pay tax on. In addition to that income, you may also be showing income from social security, investment income, pension, or rental income depending on your financial picture at age 73.

If you are making pre-tax contributions to your retirement now, normally the goal is to take that income off that table now and push it into retirement when you will hopefully be in a lower tax bracket. However, if your pre-tax balances become too large, you may not be in a lower tax bracket in retirement, and if you’re not going to be in a lower tax bracket in retirement, why not switch your contributions to Roth, pay tax on the contributions now, and then you will receive all of the earning tax free since you will now have money in a Roth source.

Scenario 4: Multi-generational Wealth

It’s not uncommon for individuals to engage a financial planner as they approach retirement to map out their distribution plan and verify that they do in fact have enough to retire. Sometimes when we conduct these meetings, the clients find out that not only do they have enough to retire, but they will not need a large portion of their retirement plan assets to live off and will most likely pass it to their kids as inheritance.

Due to the change in the inheritance rules for non-spouse beneficiaries that inherit a pre-tax retirement account, the non-spouse beneficiary now is forced to deplete the entire account balance 10 years after the decedent has passed AND potentially take RMDs during the 10- year period. Not a favorable tax situation for a child or grandchild inheriting a large pre-tax retirement account.

If instead of continuing to amass a larger pre-tax balanced in the 401(k) plan, say that high income earner forgoes the tax deduction and begins maxing out their 401K contributions at $31,500 per year to the Roth source. If they retire at age 65, and their life expectancy is age 90, that Roth contribution could experience 25 years of compounding investment returns and when their child or grandchild inherits the account, because it’s a Roth IRA, they are still subject to the 10 year rule, but they can continue to accumulate returns in that Roth IRA for another 10 years after the decedent passes away and then distribute the full account balance ALL TAX FREE. That is super powerful from a tax free accumulate standpoint.

Very few strategies can come close to replicating the value of this multigenerational wealth accumulation strategy.

One more note about this strategy, Roth sources are not subject to RMDs. Unlike pre-tax retirement plans which force the account owner to begin taking distributions at a specific age, Roth accounts do not have an RMD requirement, so the money can stay in the Roth source and continue to compound investment returns.

Scenario 5: Tax Diversification Strategy

The pre-tax vs Roth deferrals strategy is not an all or nothing decision. You are allowed to allocate any combination of pre-tax and Roth deferrals up to the annual contribution limits each year. For example, a high-income earner under the age of 50 could contribute $13,000 pre-tax and $10,000 Roth in 2024 to reach the $23,000 deferral limit.

Remember, the pre-tax strategy assumes that you will be in lower tax bracket in retirement than you are now, but some individuals have the point of view that with the total U.S. government breaking new debt records every year, at some point they are probably going to have to raise the tax rates to begin to pay back our massive government deficit. If someone is making $300,000 and paying a top Fed tax rate of 24%, even if they expect their income to drop in retirement to $180,000, who’s to say the tax rate on $180,000 income in 20 years won’t be above the current 24% rate if the US government needs to generate more tax return to pay back our national debt?

To hedge against this risk, some high-income earnings will elect to make some Roth deferrals now and pay tax at the current tax rate, and if tax rates go up in the future, anything in that Roth source (unless the government changes the rules) will be all tax free.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Should I Contribute to Retirement?

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. Quick internet search led me to two popular answers.

Whatever you need to contribute to get the match from the employer,

10-15% of your compensation.

As with most questions around financial planning, the answer should really be, “it depends”. We all know it is important to save for retirement, but knowing how much is enough is the real issue and typically there is more work involved than saying 10-15% of your pay.

In this article, I will address some of the variables at play when coming up with your number and provide detail as to why the two answers previously mentioned are so common.

Expenses and Income Replacement

Creating a budget and tracking expenses is usually the best way to estimate what your spending needs will be in retirement. Unfortunately, this is time-consuming and is becoming more difficult considering how easy it is to spend money these days. Automatic payments, subscriptions, payment apps, and credit cards make it easy to purchase but also more difficult to track how much is leaving your bank accounts.

Most financial plans we create start with the client putting together an itemized list of what they believe they spend on certain items like clothes, groceries, vacations, etc. A copy of our expense planner template can be found here. These are usually estimates as most people don’t track expenses in that much detail. Since these are estimates, we will use household income, taxes, and bank/investment accounts as a check to see if expenses appear reasonable.

What do expenses have to do with contributions to your retirement account now? Throughout your career, you receive a paycheck and use those funds to pay for the expenses you have. At some point, you no longer have the paycheck but still have the expenses. Most retirees will have access to social security and others may have a pension, but rarely does that income cover all your expenses. This means that the shortfall often comes from retirement accounts and other savings.

Not taking taxes, inflation, or investment gains into account, if your expenses are $50,000 per year and Social Security income is $25,000 a year, that is a $25,000 shortfall. 20 years of retirement times a $25,000 shortfall means $500,000 you’d need saved to fund retirement. Once we have an estimate of the coveted “What’s My Number?” question, we can create a savings plan to try and achieve that goal.

Cash Flow

As we age, some of the larger expenses we have in life go away. Student loan debt, mortgages, and children are among those expenses that stop at some point in most people’s lives. At the same time, your income is usually higher due to experience and raises throughout your career. As expenses potentially go down and income is higher, there may be cash flow that frees up allowing people to save more for retirement. The ability to save more as we get older means the contribution target amount may also change over time.

Timing of Contributions

Over time, the interest that compounds in retirement accounts often makes up most of the overall balance.

For example, if you contribute $2,000 a year for 30 years into a retirement account, you will end up saving $60,000. If you were able to earn an annual return of 6%, the ending balance after 30 years would be approximately $158,000. $60,000 of contributions and $98,000 of earnings.

The sooner the contributions are in an account, the sooner interest can start compounding. This means, that even though retirement saving is more cash flow friendly as we age, it is still important to start saving early.

Contribute Enough to Receive the Full Employer Match

Knowing the details of your company’s retirement plan is important. Most employers that sponsor a retirement plan make contributions to eligible employees on their behalf. These contributions often come in the form of “Non-Elective” or “Matching”.

Non-Elective – Contributions that will be made to eligible employees whether employees are contributing to the plan or not. These types of contributions are beneficial because if a participant is not able to save for retirement from their own paycheck, the company will still contribute. That being said, the contribution amount made by the employer, on its own, is usually not enough to achieve the level of savings needed for retirement. Adding some personal savings in addition to the employer contribution is recommended.

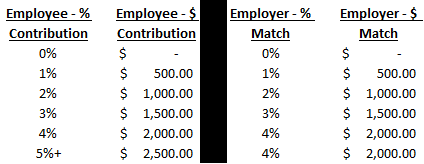

Matching – Employers will contribute on behalf of the employee if the employee is contributing to the plan as well. This means if the employee is contributing $0 to the retirement plan, the company will not contribute. The amount of matching varies by company, so knowing “Match Formula” is important to determine how much to contribute. For example, if the matching formula is “100% of compensation up to 4% of pay”, that means the employer will contribute a dollar-for-dollar match until they contribute 4% of your compensation. Below is an example of an employee making $50,000 with the 4% matching contribution at different contribution rates.

As you can see, this employee could be eligible for a $2,000 contribution from the employer, if they were to save at least 4% of their pay. That is a 100% return on your money that the company is providing.

Any contribution less than 4%, the employee would not be taking advantage of the employer contribution available to them. I’m not a fan of the term “free money”, but that is often the reasoning behind the “Contribute Enough to Receive the Full Employer Match” response.

10%-15% of Your Compensation

As said previously, how much you should be contributing to your retirement depends on several factors and can be different for everyone. 10%-15% over a long-term period is often a contribution rate that can provide sufficient retirement savings. Math below…

Assumptions

Age: 25

Retirement Age: 65

Current Income: $30,000

Annual Raises: 2%

Social Security @ 65: $25,000

Annualized Return: 6%

Step 1: Estimate the Target Balance to Accumulate by 65

On average, people will need an estimated 90% of their income for early retirement spending. As we age, spending typically decreases because people are unable to do a lot of the activities we typically spend money on (i.e. travel). For this exercise, we will assume a 65-year-old will need 80% of their income throughout retirement.

Present Salary - $30,000

Future Value After 40 Years of 2% Raises - $65,000

80% of Future Compensation - $52,000

$52,000 – income needed to replace

$25,000 – social security @ 65

$27,000 – amount needed from savings

X 20 – years of retirement (Age 85 - life expectancy)

$540,000 – target balance for retirement account

Step 2: Savings Rate Needed to Achieve $540,000 Target Balance

40 years of a 10% annual savings rate earning 6% interest per year, this person could have an estimated balance of $605,000. $181,000 of contributions and $424,000 of compounded interest.

I hope this has helped provide a basic understanding of how you can determine an appropriate savings rate for yourself. We recommend reaching out to an advisor who can customize your plan based on your personal needs and goals.

About Rob……...

Hi, I’m Rob Mangold, Partner at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Federal Disaster Area Penalty-Free IRA & 401(k) Distribution and Loan Options

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Qualified Disaster Recovery Distributions (QDRD)

In December 2022, the passing of the Secure Act 2.0 made permanent, a distribution option within both 401(K) plans and IRAs, that allows individuals to distribute up to $22,000 from either a 401(k) or IRA, and that distribution is exempt from the 10% early withdrawal penalty. Typically, when an individual is under the age of 59½ and takes a distribution from a 401(K) or IRA, the distribution is subject to both taxes and a 10% early withdrawal penalty.

For an individual, it’s an aggregate of $22,000 between both their 401(k) and IRA accounts, meaning, they can’t distribute $22,000 from their IRA and then another $22,000 from their 401(k), and avoid the 10% penalty on the full $44,000.

If you are married, if each spouse has an IRA and/or 401(k) plan, each spouse would be eligible to process a qualified disaster recovery distribution for the full $22,000 and avoid the 10% penalty on the combined $44,000.

Taxation of Federal Disaster Distributions

Even though these distributions are exempt from the 10% early withdrawal penalty, they are still subject to federal and state income taxes, but the taxpayer has two options:

The taxpayer can elect to include the full amount of the distribution as taxable income in the year that the QDRD takes place; OR

The taxpayer can elect to spread the taxable amount evenly over a 3-year period that begins the year that distribution occurred.

Here is an example of the tax options. Tim is age 40, he lives in Florida, and his area experiences a hurricane. Shortly after the hurricane, the area where Tim’s house is located was officially declared a Federal Disaster Area by FEMA. To help pay for the damage to his primary residence, Tim processes a $12,000 qualified disaster recovery distribution from his Traditional IRA. Tim would not have to pay the 10% early withdrawal penalty due to the QDRD exception, but he would be required to pay federal income tax on the full $12,000. He has the option to either report the full $12,000 on his tax return in the year the distribution took place, or he could elect to spread the $12,000 tax liability over the next 3 years, reporting $4,000 in additional taxable income each year beginning the year that the QDRD took place.

Repayment Option

If an individual completes a disaster recovery distribution from their 401(k) or IRA, they have the option to repay the money to the account within 3 years of the date of the distribution. This allows them to recoup the taxes paid on the distribution by filing an amended tax return(s) for the year or years that the tax liability was reported from the QDRD.

180 Day & Financial Loss Requirement

To make an individual eligible to request a QDRD, not only does their primary residence have to be located within a Federal Disaster area, but they also need to request the QDRD within 180 days of the disaster, and they must have sustained an economic loss on account of the disaster.

QDRD Are Optional Provisions Within 401(k) Plans

If you have a 401(k) plan, a Qualified Disaster Recovery Distribution is an OPTIONAL provision that must be adopted by the plan sponsor of a 401(k) to provide their employees with this distribution option. In other words, your employer is not required to allow these disaster recovery distributions, they have to adopt them. If you live in an area that is declared a federal disaster area and your 401(k) plan does not allow this type of distribution option, you can contact your employer and request that it be added to the plan. Many companies may not be aware that this is a voluntary distribution option that can be added to their plan.

If you have an IRA, as long as you meet the criteria for a QDRD, you are eligible to request this type of distribution.

If you have a 401(k) plan with a former employer and their plan does not allow QDRD, you may be able to rollover the balance in the 401(k) to an IRA, and then request the QDRD from the IRA.

What Changed?

Prior to the passing of Secure Act 2.0, Congress had to authorize these Qualified Disaster Recovery Distributions for each disaster. Section 331 of the Secure Act 2.0 made these QDRDs permanent.

However, one drawback is in the past, these qualified disaster recovery distributions were historically allowed up to $100,000, but the new tax law lowered the maximum QDRD amount to only $22,000.

$100,000 401(k) Loan for Disaster Relief

In addition to the qualified disaster recovery distributions, Secure Act 2.0, also allows plan participants in 401(K) plans to request loans up to the LESSER of $100,000 or 100% of their vested balance in the plan.

Typically, when plan participants request loans from a 401(K) plan, the maximum amount is the LESSER of $50,000 or 50% of their vested balance in the plan. Secure Act 2.0, doubled that amount. The eligibility requirements to receive a disaster recovery 401(k) loan are the same as the eligibility requirements for a Qualified Disaster Recovery Distribution.

In addition to the higher loan limit, plan participants eligible for a 401(K) qualified disaster recovery loan, are also allowed to delay the start date of their loan payments for up to 1 year from the loan processing date. Normally when a 401(K) loan is requested, loan payments begin immediately.

These loans are still subject to the 5-year duration limit, but with the optional 12-month delay in the loan payment start date, the maximum duration of these qualified disaster loans is technically 6 years.

401(K) Loans Are an Optional Provision

Similar to Qualified Disaster Recovery Distributions, 401(k) loans are an optional provision that must be adopted by the plan sponsor of a 401(k) plan. Some plans allow plan participants to take loans while others do not, so the ability to take these disaster recovery loans will vary from plan to plan.

Loans Are Only Available In Qualified Retirement Plans

The $100,000 loan option is only available for Qualified Retirement Plans such as 401(k) and 403(b) plans. IRAs do not provide a loan option. The $22,000 Qualified Disaster Recovery Distribution is the only option for IRAs unless Congress specifically authorizes a higher maximum distribution amount for a specific Federal Disaster, which is within their power to do.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Starting in 2024, 401(k) Plan Will Be Required to Cover Part-time Employees

In the past, companies have been allowed to limit access to their 401(k) plan to just full-time employees but that is about to change starting in 2024. With the passing of the Secure Act, beginning in 2024, companies that sponsor 401(K) plans will be required to allow part-time employees to participate in their qualified retirement plans.

In the past, companies have been allowed to limit access to their 401(k) plan to just full-time employees but that is about to change starting in 2024. With the passing of the Secure Act, beginning in 2024, companies that sponsor 401(K) plans will be required to allow part-time employees to participate in their qualified retirement plans.

It’s very important for companies to make note of this now because many companies will need to start going through their employee census data to identify the part-time employees that will become eligible for the 401(K) plan on January 1, 2024. Failure to properly notify these part-time employees of their eligibility to participate in the plan could result in plan compliance failures, DOL penalties, and it could require the company to make a mandatory employer contribution to those employees for the missed deferral opportunity.

Full-time Employee Restriction

Prior to the passing of the Secure Act 1.0 in December 2019, 401(K) plans were allowed to limit participation in plans to employees that had completed 1 year of service which is commonly defined as 12 months of employment AND 1,000 hours worked within that 12-month period. The 1 year wait with the 1,000 hours requirement allowed companies to keep part-time employees who work less than 1,000 hours from participating in the company’s 401(k) plan.

Secure Act 1.0

When Congress passed Secure Act 1.0 in December 2019, it included a new provision that requires 401(K) plans to cover part-time employees who have completed three consecutive years of service and worked 500 or more hours during each of those years to participate in the plan starting in 2024. For purposes of the 3 consecutive years and 500 hours requirement, companies are only required to track employee service back to January 1, 2021, any services prior to that date, can be disregarded for purposes of this new part-time employee coverage requirement.

Example: John works for Company ABC which sponsors a 401(k) plan. The plan restricts eligibility to 1 year and 1,000 hours. John has been working part-time for Company ABC since March 2020 and he worked the following hours in 2021, 2022, and 2023:

2021 Hours Worked: 560

2022 Hours Worked: 791

2023 Hours Worked: 625

Since John had never worked more than 1,000 hours in a 12-month period, he was never eligible to participate in the ABC 401(k) plan. However, under the new Secure Act 1.0 rules, ABC would be required to allow John to participate in the plan starting January 1, 2024, because he works for three consecutive years with more than 500 hours.

Excluded Employees

The new part-time employee coverage requirement does not apply to employees covered by a collective bargaining agreement or nonresident aliens. 401(K) plans are still allowed to exclude those employees regardless of hours worked.

Employee Deferrals Only

For the part-time employees that meet the 3 consecutive years and 500+ hours of service each year, while the new rules require them to be offered the opportunity to participate in the 401(k) plan, it only requires plans to make them eligible to participate in the employee deferral portion of the plan. It does not require them to be eligible for EMPLOYER contributions. For part-time employees who become eligible to participate under these new rules, they are allowed to put their own money into the plan, but the company is not required to provide them with an employer matching, employer non-elective, profit sharing, or safe harbor contributions until that employee has met the plan’s full eligibility requirements.

In the example we looked at previously with John, John would be allowed to voluntarily make employee contributions from his paycheck but if the company sponsors an employer matching contribution that requires employees to work 1 year and 1,000 hours to be eligible, John would not be eligible to receive the employer matching contribution even though he is eligible to make employee contributions to the plan.

Secure Act 2.0

Up until now, we have covered the new part-time employee coverage requirements under Secure Act 1.0. However, in December 2022, Congress passed Secure Act 2.0, which changed the part-time employee coverage requirements beginning January 1, 2025. The main change that Secure Act 2.0 made is it reduced the 3 Consecutive Years down to 2 Consecutive Years starting in 2025. Both still require 500 or more hours each year but now a part-time employee will only need to complete 2 consecutive years of 500 or more hours instead of 3 beginning in 2025.

Also in 2025, under Secure Act 2.0, for purposes of assessing the 2 consecutive years with 500 or more hours, companies only have to look at service dating back to January 1, 2023, employment before that date is excluded from this part-time employee coverage exception.

2024 & 2025 Summary

Starting in 2024, employers will need to look back as far as January 1, 2021, and identify part-time employees who worked at least 3 consecutive years with 500 or more hours worked in each of those three years.

Starting in 2025, employers will need to look at both definitions of part-time employees. The Secure Act 1.0, three consecutive years of 500 hours or more going back to January 1, 2021, and separately, the Secure Act 2.0, 2 consecutive years of 500 hours or more going back to January 1, 2023. An employee could technically become eligible under either definition.

Penalties For Not Notifying Part-time Employees of Eligibility

Companies should take this new part-time employee eligibility rule very seriously. Failure to properly notify part-time employees of their eligibility to make employee deferrals to the 401(K) plan could result in a plan compliance failure and the assessment of Department of Labor penalties. The DOL conducts random audits of 401(K) plans and one of the primary pieces of information that they typically request during an audit is for the employer to provide a full employee census file and be able to prove that they properly notified each eligible employee of their ability to participate in the company’s 401(K) plan.

In addition to fines for not properly notifying these new part-time employees of their ability to participate in the plan, the DOL could require the company to make a “QNEC” (Qualified Non-Elective Contribution) on behalf of those part-time employees which is a pure EMPLOYER contribution. Even though these part-time employees might not be eligible for other employer contributions in the plan, this QNEC funded by the employer is to make up for the missed employee deferral opportunity. The DOL is basically saying that since the company did not properly notify the employee of their ability to make contributions out of their paycheck, now the company has to fund those contributions on their behalf. They could assign the QNEC amount equal to the average percentage of compensation amount deferred by the rest of the employees covered by the plan which could be a very costly mistake for an employer.

Why The Rule Change?

There are two primary drivers that led to the adoption of this new 401(k) part-time employee coverage requirement. First, acknowledging a change in the U.S. labor force, where instead of employees working one full-time job, more employees are working multiple part-time jobs. By working multiple part-time jobs with different employers, while that employee may work more than 1000 hours a year, they may never become eligible to participate in any of their employer’s 401(K) plans because they were not considered full-time with any single employer.

This brings us to the second driver of this new rule, which is increasing access for more employees to an employer-based retirement-saving solution. Given the increase in life expectancy, there is a retirement savings shortfall issue within the U.S., and giving employees easier access to employer-based solutions may encourage more employees to save more for retirement.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Fewer 401(k) Plans Will Require A 5500 Audit Starting in 2023

401(K) plans with over 100 eligible plan participants are considered “large plans” in the eyes of DOL and require an audit to be completed each year with the filing of their 5500. These audits can be costly, often ranging from $8,000 - $30,000 per year.

Starting in 2023, there is very good news for an estimated 20,000 401(k) plans that were previously subject to the 5500 audit requirement. Due to a recent change in the way that the DOL counts the number of plan participants for purposes of assessing a large plan filer status, many plans that were previously subject to a 401(k) audit, will no longer require a 5500 audit for plan year 2023 and beyond.

401(K) plans with over 100 eligible plan participants are considered “large plans” in the eyes of DOL and require an audit to be completed each year with the filing of their 5500. These audits can be costly, often ranging from $8,000 - $30,000 per year.

Starting in 2023, there is very good news for an estimated 20,000 401(k) plans that were previously subject to the 5500 audit requirement. Due to a recent change in the way that the DOL counts the number of plan participants for purposes of assessing a large plan filer status, many plans that were previously subject to a 401(k) audit, will no longer require a 5500 audit for plan year 2023 and beyond.

401(K) 5500 Audit Requirement

A little background first on the audit rule: if a company sponsors a 401K plan and they have 100 or more participants at the beginning of the year, that plan is now considered a “large plan”, and the plan is required to submit an audit report with their annual 5500 filings.

For plans that are just above the 100 plan participant threshold, the DOL provides some relief in the “80 – 120 rule”, which basically states that if the plan was a “small plan” filer in the previous year, the plan can remain a small plan filer until the plan participant count reaches 121.

Old Plan Participant Count Method

Not all employees count toward the 100 or 121 audit threshold. Under the old rules, the company only had to count employees who were:

Eligible to participate in the plan; and

Terminated employees with a balance still in the plan

But under the older rules, ALL plan-eligible employees had to be counted whether or not they had a balance in the plan. For example, if a landscaping company had:

150 employees

95 employees are eligible to participate in the plan

Of the 95 eligible employees, 27 employees have balances in the 401(K) plan

35 terminated employees with a balance still in the plan

Under the 2022 audit rules, this plan would be subject to the 5500 audit requirement because they had 95 eligible plan participants PLUS 35 terminated employees with balances, bringing the plan participant audit count to 130, making them a “large plan” filer. A local accounting firm might charge $10,000 for the plan audit each year.

New Plan Participant Count Method

Starting in 2023, the way that the DOL counts plan participants to determine “large plan” filer status changed. Now, instead of counting all eligible plan participants whether or not they have a balance in the plan, starting in 2023, the DOL will only count:

Eligible employees that HAVE A BALANCE in the plan

Terminated employees with balances still in the plan

Looking at the same landscaping company in the previous example:

150 employees

95 employees are eligible to participate in the plan

Of the 95 eligible employees, 27 employees have balances in the 401(K) plan

35 terminated employees still have balances in the plan

Under the new DOL rules, this 401(K) plan would no longer require a 5500 audit because they only have to count the 27 eligible employees WITH BALANCES in the plan and the 35 terminated employees with balances, bringing the total employee audit count to 62. The plan would be allowed to file as a “small plan” starting in 2023 and would no longer have to incur the $10,000 cost for the 5500 audit each year.

20,000 Fewer 401(k) Plans Requiring An Audit

The DOL expects this change to eliminate the 5500 audit required for approximately 20,000 401(k) plans. The primary purpose of this change is to encourage more companies that do not already offer a 401(k) plan to their employees to adopt one and to lower the annual cost for many companies that would otherwise be subject to a 5500 audit requirement.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

3 New Startup 401(k) Tax Credits

When Congress passed the Secure Act 2.0 in December 2022, they introduced new tax credits and enhanced old tax credits for startup 401(k) plans for plan years 2023 and beyond. There are now 3 different tax credits that are available, all in the same year, for startup 401(k) plans that now only help companies to subsidize the cost of sponsoring a retirement plan but also to offset employer contributions made to the employee to enhance a company’s overall benefits package.

When Congress passed the Secure Act 2.0 in December 2022, they introduced new tax credits and enhanced old tax credits for startup 401(k) plans. There are now 3 different tax credits that are available for startup 401(k) plans that were put into place to help companies to subsidize the cost of sponsoring a retirement plan and also to subsidize employer contributions made to the employees to enhance the company’s overall benefits package. Here are the 3 startup 401(k) credits that are now available to employers:

Startup Tax Credit (Plan Cost Credit)

Employer Contribution Tax Credit

Automatic Enrollment Tax Credit

Startup Tax Credit

To incentivize companies to adopt an employer-sponsored retirement plan for their employees, Secure Act 2.0 enhanced the startup tax credits available to employers starting in 2023. This tax credit was put into place to help businesses offset the cost of establishing and maintaining a retirement plan for their employees for the first 3 years of the plan’s existence. Under the new Secure 2.0 credit, certain businesses will be eligible to receive a tax credit for up to 100% of the annual plan costs.

A company must meet the following requirement to be eligible to capture this startup tax credit:

The company may have no more than 100 employees who received compensation of $5,000 or more in the PRECEDING year; and

The company did not offer a retirement plan covering substantially the same employees during the PREVIOUS 3 YEARS.

The plan covers at least one non-HCE (non-Highly Compensated Employee or NHCE)

To identify if you have a NHCE, you have to look at LAST YEAR’s compensation and both this year’s and last year’s ownership percentage. For the 2023 plan year, a NHCE is any employee that:

Does NOT own more than 5% of the company; and

Had less than $135,000 in compensation in 2022. For the compensation test, you look back at the previous year’s compensation to determine who is a HCE or NHCE in the current plan year. For 2023, you look at 2022 compensation. The IRS typically increases the compensation threshold each year for inflation.

A note here about “attribution rules”. The IRS is aware that small business owners have the ability to maneuver around ownership and compensation thresholds, so there are special attribution rules that are put into place to limit the “creativity” of small business owners. For example, ownership is shared or “attributed” between spouses, which means if you own 100% of the business, your spouse that works for the business, even though they are not an owner and only earn $30,000 in W2, they are considered a HCE because they are attributed your 100% ownership in the business.

Besides just attribution rules, employer-sponsored retirement plans also has control group rules, affiliated service group rules, and other fun rules that further limit creativity. Especially for individuals that are owners of multiple businesses, these special 401(k) rules can create obstacles when attempting to qualify for these tax credits. Bottom line, before blindly putting a retirement plan in place to qualify for these tax credits, make sure you talk to a professional within the 401(k) industry that understands all of these rules.

401(k) Startup Tax Credit Amount

Let’s assume your business qualifies for the 401(k) startup tax credit, what is the amount of the tax credit? Here are the details:

For companies with 50 employees or less: The credit covers 100% of the company’s plan costs up to an annual limit of the GREATER of $500 or $250 multiplied by the number of plan-eligible NHCE, up to a maximum credit of $5,000.

For companies with 51 to 100 employees: The credit covers 50% of the company’s plan costs up to an annual limit of the GREATER of $500 or $250 multiplied by the number of plan-eligible NHCE, up to a maximum credit of $5,000.

This is a federal tax credit that is available to eligible employers for the first 3 years that the new plan is in existence. If you have enough NHCE’s, you could technically qualify for $5,000 each year for the first 3 years that the retirement plan is in place.

A note on the definition of “plan-eligible NHCEs”. These are NHCEs that are also eligible to participate in your plan in the current plan year. NHCEs that are not eligible to participate because they have yet to meet the eligibility requirement, do not count toward the max credit calculation.

What Type of Plan Costs Qualify For The Credit?

Qualified costs include costs paid by the employer to:

Setup the Plan

Administer the Plan (TPA Fees)

Recordkeeping Fees

Investment Advisory Fees

Employee Education Fees

To be eligible for the credit, the costs must be paid by the employer directly to the service provider. Fees charged against the plan assets or included in the mutual fund expense ratios do not qualify for the credit. Since historically many startup plans use 401(k) platforms that utilize higher expense ratio mutual funds to help subsidize some of the out-of-pocket cost to the employer, these higher tax credits may change the platform approach for start-up plans because the employer and the employee may both be better off by utilizing a platform with low expense ratio mutual funds, and the employer pays the TPA, recordkeeping, and investment advisor fees directly in order to qualify for the credit.