Beware of Annuities

I’ll come right out and say “I’m not a fan of annuities”. They tend to carry:

1) Higher internal fees

2) Surrender charges that prevent investors from getting out of them

3) “Guarantees” that are inferior to alternative investment solutions

Unfortunately, annuities pay Financial Professionals a lot of money, which is why it is not uncommon for Investment Advisors to present them as a primary solution. For example, some annuities pay Investment Professionals 5% - 8% of the amount invested, so if you invest $200,000 in the annuity, the advisor gets paid $10,000 to $16,000 as soon as you deposit the money to the annuity. Compared to an Investment Advisor that may be charging you 1% per year to manage your portfolio, it will take them 5 to 8 years to earn that same amount.

To be fair, there are a few situations where I think annuities make sense, and I will share those with you in this article. In general, however, I think investors should be very cautious when they are presented with an annuity as a primary investment solution, and I will explain why.

Fixed Annuities & Variable Annuities

There are two different types of annuities. Fixed annuities and variable annuities. Within those categories, there are a lot of different flavors, such as indexed annuities, guaranteed income benefits, non-qualified, qualified, etc. Annuities are often issued by banks, investment firms, insurance companies, employer sponsored plan providers, or directly to the consumer. It is important to understand that not all annuities are the same and they can vary greatly from provider to provider. The points that I will be making in this article are my personal option based on my 20 years of experience in the investment industry.

Annuities Have High Fees

My biggest issue with annuities in general is the higher internal costs associated with them. When you read the fine print, annuities can carry:

· Commissions

· Contract fees

· Mortality expenses

· Surrender fees

· Rider fees

· Mutual fund expense ratios

· Penalties for surrender prior to age 59½

When you total all of those annual fees, it can sometimes be between 2% - 4% PER YEAR. The obvious questions is, “How is your money supposed to grow if the insurance company is assessing fees of 2% - 4% per year?”

Sub-Par Guarantees

The counter argument to this is that the insurance company is offering you “guarantees” in exchange for these higher fees. During the annuity presentation, the broker might say “if you invest in this annuity, you are guaranteed not to lose any money. It can only make money”. Who wouldn’t want that? But the gains in these annuities are often either capped each year, or get chipped away by the large internal fees associated with the annuity contract. So, even though you may not “lose money”, you may not be making as much as you could in a different investment solution.

Be The Insurance Company

At a high level, this is how insurance companies work. They sell you an annuity, then the insurance company turns around and invests your money, and hands you back a lower rate of return, often in the form of “guarantees”. That is how they stay in business. So, my question is “Why wouldn’t you just keep your money, invest it like the insurance would have, and you keep all of the gains”?

The answer: Fear. Most investments involve some level of risk, meaning you could lose money. Annuity presentations prey on this fear. They will usually show financial illustrations from recessions, such as when the market went down 30%, but the annuity lost no value. For retirees, this can be very appealing, because the working years are over and now they just have their life savings to last them for the rest of their lives.

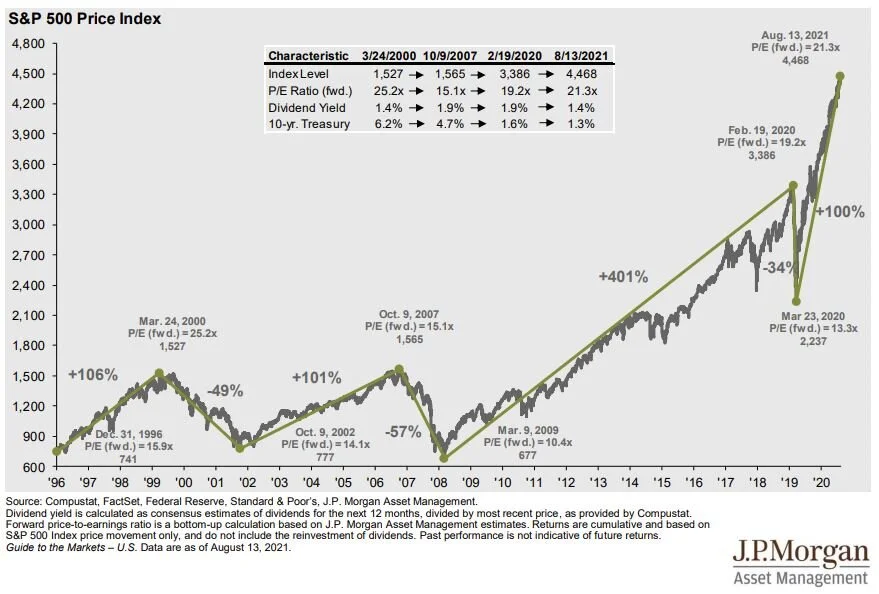

But like other successful investors, insurance companies rely on the historical returns of the stock market, which suggest that over longer periods of time (10+ year) the stock market tends to appreciate in value. See the charge of the S&P 500 Index below. Even with the pull backs and recessions, the value of the stock market has historically moved higher.

Annuity Surrender Fees Lock You In

The insurance company knows they are going to have your money for a long period of time because most annuities carry “surrender fees”. Most surrender schedules last 5 – 10 YEARS!! This means if you change your mind and want out of the annuity before the surrender period is up, the annuity company hits you with big fees. So, before you write the check to fund the annuity, make sure it’s 100% the right decision.

Do Not Invest an IRA In An Annuity

This situation always baffles me. We will come across investors that have an IRA invested in an annuity. Annuities by themselves have the advantage of being “tax deferred vehicles” meaning you do not pay taxes on the gains accumulated in the annuity until you make a withdrawal. You pay money to the insurance company to have that benefit since annuities are insurance products.

An IRA by itself is also a tax deferred account. You can choose to invest your IRA in whatever you want – cash, stocks, bonds, mutual funds, or an annuity. So, here is my question: since an IRA is already tax deferred vehicle, why would you pay extra fees to an annuity company to invest it in a tax deferred annuity? It makes no sense to me.

The answer, again, is usually fear. An individual retires, they meet with an investment advisor that recommends that they rollover their 401(k) into an IRA, and uses the fear of losing money in the market to convince them to move their full 401(k) into an annuity product. I completely understand the fear of losing money in retirement, and for some individuals it may make sense to put a portion of their retirement assets into something like an annuity that offers some guarantees. But in my experience, it rarely makes sense to invest the majority of your retirement assets in an annuity.

Guaranteed Minimum Income Benefits

Another sparkling gem associated with annuities that is often appealing to retirees are annuities that carry a GMIB, or “Guaranteed Minimum Income Benefit”. These annuities are usually designed to go up by a “guaranteed” 5% - 8% per year, and then at a set age will pay you a set monthly amount for the rest of your life. Now that sounds wonderful, but here is the catch that I want you to be aware of. For most annuity companies, the value of your annuity associated with the “guaranteed increases” only matters if you annuitize the contract with that insurance company. After 10 years, if instead you decided to surrender the annuity, you typically do not receive those big, guaranteed increases, but instead get the actual value of the underlying investments less the big fees. This is why there is often more than one “balance” illustrated on your annuity statement.

Here is the catch of the GMIB – when you go to turn it on, the annuity company decides what that fictitious GMIB balance will equal in the form of a monthly benefit for the rest of your life. Also, with some annuities, they cap the guaranteed increase after a set number of years. In general, what I have found is annuities that were issued with GMIB prior to 2008 tend to be fairly generous, because that was before the 2008/2009 recession. After 2008, the guarantees associated with these GMIB’s became less advantageous.

When Do Annuities Make Sense

I have given you the long list of reason why I am not a fan of annuities but there are a few situations where I think annuities can make sense:

1) Overspending protection

2) CD’s vs Fixed Annuity

Overspending Protection

When people retire, for the first time in their lives, they often have access to their 401(K), 403(b), or other retirement account. Having a large dollar amount sitting in accounts that you have full access to can sometimes be a temptation to overspend, make renovation to your house, go on big vacations, etc. But when you retire, when the money is gone, it is gone. For individuals that do not trust themselves to not spend through the money, turning that lump sum of money into a guaranteed money payment for the rest of their lives may be beneficial. In these cases, it may make sense for an individual to purchase an annuity with their retirement dollars, because it lowers the risk of them running out of money in retirement.

CD’s vs Fixed Annuities

For individuals that have a large cash reserve, and do not want to take any risk, sometimes annuity companies will offer attractive fixed annuity rates. For example, your bank may offer a 2 year CD at a 2%, but there may be an insurance company that will offer you a fixed annuity at a rate of 3.5% per year for 7 years. The obvious benefit is a higher interest rate each year. The downside is usually that the annuity carries surrender fees if you break the annuity before the maturity date. But if you don’t see any need to access the cash before the end of the surrender period, it may be worth collecting the higher interest rate.

Final Advice

Selecting the right investment vehicle is a very important decision. Before selecting an investment solution, it often makes sense to meet with a few different firms to listen to the approach of each advisor to determine which is the most appropriate for your financial situation. If you go into one of these meetings and an annuity is the only solution that is present, I would be very cautious about moving forward with that solution before you have vetted other options.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.