When Should High-Income Earners Max Out Their Roth 401(k) Instead of Pre-tax 401(k)?

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferral contributions all in Roth dollars and forgo the immediate tax deduction.

No Income Limits for Roth 401(k)

It’s common for high income earners to think they are not eligible to make Roth deferrals to their 401(k) because their income is too high. However, unlike Roth IRAs that have income limitations for making contributions, Roth 401(k) contributions have no income limitation.

401(k) Deferral Aggregation Limits

In 2024, the employee deferral limits are $23,000 for individuals under the age of 50, and $30,500 for individuals aged 50 or older. If your 401(k) plan allows Roth deferrals, the annual limit is the aggregate between both pre-tax and Roth deferrals, meaning you are not allowed to contribute $23,000 pre-tax and then turn around and contribute $23,000 Roth in the same year. It’s a combined limit between the pre-tax and Roth employee deferral sources in the plan.

Scenario 1: Business Owner Has Abnormally Low-Income Year

Business owners from time to time will have a tough year for their business. They may have been making $300,000 or more per year for the past year but then something unexpected happens or they make a big investment in their business that dramatically reduces their income from the business for the year. We counsel these clients to “never waste a bad year for the business”.

Normally, a business owner making over $300,000 per year would be trying to max out their pre-tax deferral to their 401(K) plans in an effort to reduce their tax liability. But, if they are only showing $80,000 this year, placing a married filing joint tax filer in the 12% federal tax bracket, I’ll ask, “When are you ever going to be in a tax bracket below 12%?”. If the answer is “probably never”, then it an opportunity to change the tax plan, max out their Roth deferrals to the 401(k) plan, and realize that income at their abnormally lower rate. Plus, as the Roth source grows, after age 59 ½ they will be able to withdrawal the Roth source ALL tax free including the earnings.

Scenario 2: Change In Employment Status

Whenever there is a change in employment status such as:

Retirement

High income spouse loses a job

Reduction from full-time to part-time employment

Leaving a high paying W2 job to start a business which shows very little income

All these events may present an abnormally low tax year, similar to the business owner that experienced a bad year for the business, that could justify the switch from pre-tax deferrals to Roth deferrals.

The Value of Roth Compounding

I’ll pause for a second to remind readers of the big value of Roth. With pre-tax deferrals, you realize a tax benefit now by avoiding paying federal or state income taxes on those employee deferrals made to your 401(k) plan. However, you must pay tax on those contributions AND the earnings when you take distributions from that account in retirement. The tax liability is not eliminated, just deferred.

For example, if you are 40 years old, and you defer $23,000 into your 401K plan, if you get an 8% annual rate of return on that $23,000, it will grow to $157,515 when you turn age 65. As you withdraw that $157,515 in retirement, you’ll pay income tax on all of it.

Now instead let’s assume you made the $23,000 employee deferral all Roth, with the same 8% rate of return per year, reaching the same $157,515 balance at age 65, now you can withdrawal the full $157,515 all tax free.

Scenario 3: Too Much In Pre-Tax Retirement Accounts Already

When high income earners have been diligently saving in their 401(k) plan for 30 plus years, sometimes they amass huge pre-tax balances in their retirement plans. While that sounds like a good thing, sometimes it can come back to haunt high-income earnings in retirement when they hit their RMD start date. RMD stands for required minimum distribution, and when you reach a specific age, the IRS forces you to begin taking distributions from your pre-tax retirement account whether you need to our not. The IRS wants their income tax on that deferred tax asset.

The RMD start age varies depending on your date of birth but right now the RMD start age ranges from age 73 to age 75. If for example, you have $3,000,000 in a Traditional IRA or pre-tax 401(k) and you turn age 73 in 2024, your RMD for the 2024 would be $113,207. That is the amount that you would be forced to withdrawal out of your pre-tax retirement account and pay tax on. In addition to that income, you may also be showing income from social security, investment income, pension, or rental income depending on your financial picture at age 73.

If you are making pre-tax contributions to your retirement now, normally the goal is to take that income off that table now and push it into retirement when you will hopefully be in a lower tax bracket. However, if your pre-tax balances become too large, you may not be in a lower tax bracket in retirement, and if you’re not going to be in a lower tax bracket in retirement, why not switch your contributions to Roth, pay tax on the contributions now, and then you will receive all of the earning tax free since you will now have money in a Roth source.

Scenario 4: Multi-generational Wealth

It’s not uncommon for individuals to engage a financial planner as they approach retirement to map out their distribution plan and verify that they do in fact have enough to retire. Sometimes when we conduct these meetings, the clients find out that not only do they have enough to retire, but they will not need a large portion of their retirement plan assets to live off and will most likely pass it to their kids as inheritance.

Due to the change in the inheritance rules for non-spouse beneficiaries that inherit a pre-tax retirement account, the non-spouse beneficiary now is forced to deplete the entire account balance 10 years after the decedent has passed AND potentially take RMDs during the 10- year period. Not a favorable tax situation for a child or grandchild inheriting a large pre-tax retirement account.

If instead of continuing to amass a larger pre-tax balanced in the 401(k) plan, say that high income earner forgoes the tax deduction and begins maxing out their 401K contributions at $31,500 per year to the Roth source. If they retire at age 65, and their life expectancy is age 90, that Roth contribution could experience 25 years of compounding investment returns and when their child or grandchild inherits the account, because it’s a Roth IRA, they are still subject to the 10 year rule, but they can continue to accumulate returns in that Roth IRA for another 10 years after the decedent passes away and then distribute the full account balance ALL TAX FREE. That is super powerful from a tax free accumulate standpoint.

Very few strategies can come close to replicating the value of this multigenerational wealth accumulation strategy.

One more note about this strategy, Roth sources are not subject to RMDs. Unlike pre-tax retirement plans which force the account owner to begin taking distributions at a specific age, Roth accounts do not have an RMD requirement, so the money can stay in the Roth source and continue to compound investment returns.

Scenario 5: Tax Diversification Strategy

The pre-tax vs Roth deferrals strategy is not an all or nothing decision. You are allowed to allocate any combination of pre-tax and Roth deferrals up to the annual contribution limits each year. For example, a high-income earner under the age of 50 could contribute $13,000 pre-tax and $10,000 Roth in 2024 to reach the $23,000 deferral limit.

Remember, the pre-tax strategy assumes that you will be in lower tax bracket in retirement than you are now, but some individuals have the point of view that with the total U.S. government breaking new debt records every year, at some point they are probably going to have to raise the tax rates to begin to pay back our massive government deficit. If someone is making $300,000 and paying a top Fed tax rate of 24%, even if they expect their income to drop in retirement to $180,000, who’s to say the tax rate on $180,000 income in 20 years won’t be above the current 24% rate if the US government needs to generate more tax return to pay back our national debt?

To hedge against this risk, some high-income earnings will elect to make some Roth deferrals now and pay tax at the current tax rate, and if tax rates go up in the future, anything in that Roth source (unless the government changes the rules) will be all tax free.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Process of Selling A Business - Pitfalls To Avoid

For business owners, selling the business is often the single most important financial transaction in their lifetime. Since this is such an important event, we created a video series that will guide business owners through the

For business owners, selling the business is often the single most important financial transaction in their lifetime. Since this is such an important event, we created a video series that will guide business owners through the selling process. Dave Wojeski, a partner at Greenbush Financial, has spent years in the merger acquisition space, focusing on business transaction between $5M and $100M in value. Over the course of these 3 videos, Dave will share the following information about the sell side of these business transactions:

Video 1: Valuation & Prepping Your Business For Sale

Knowing when it’s the right time to sell your business

How to determine the value of your business

The returns that buyers typical expect from the acquisition of your business

Prepping your business for sale to command a higher valuation

Video 2: The Process of Selling Your Business

The steps associated with selling your business

Professionals involved in the selling process

Letter of Intent (LOI), Due Diligence, and Purchase Agreement Terms

Special considerations when selling the business to your children

Video 3: Pitfalls To Avoid When Selling Your Business

Common pitfalls to avoid when selling your business

Employment agreements post sale

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The New PPP Loan Forgiveness Application & Early Submission

It just keeps getting better for small business owners. On June 17, 2020, the SBA released the updated PPP Forgiveness Application. In addition to making the forgiveness application easier to complete, the new application

It just keeps getting better for small business owners. On June 17, 2020, the SBA released the updated PPP Forgiveness Application. In addition to making the forgiveness application easier to complete, the new application also provided additional guidance on a number of questions that arose when the SBA extended the forgiveness period to 24 weeks.

But it gets better. On June 22nd, the SBA issued additional guidance allowing borrowers to apply for forgiveness prior to the end of the 8 week or 24 week covered period if the borrowers had already spent their full PPP loan amount.

With so much that has happened since the Paycheck Protection Program was first launched. Here is a quick recap of the events leading up to the release of the new PPP Forgiveness Application and the new guidance:

March 27, 2020: Congress passed the CARES Act which created the PPP Loan Program

April 2020: The SBA opens the window for companies to access the PPP Loans

May 15, 2020: The SBA released the first version of the PPP Loan Forgiveness Application

June 5, 2020: Congress passed the PPP Flexibility Act

Extended Covered Period to 24 Weeks

Reduced payroll cost requirement from 75% to 60%

Extended rehire safe harbor from June 30th to December 31st

June 17, 2020: SBA releases the updated PPP Forgiveness Application

June 22, 2020: SBA allows companies to apply for forgiveness prior to the end of the covered period

In this article we are going to address:

How to complete the new PPP Forgiveness Application

The EZ Forgiveness Application vs the Long Form PPP Forgiveness Application

Which companies are eligible to submit the PPP EZ Forgiveness Application

The new max comp limits of $20,833 and $46,154

Ability to apply for forgiveness prior to the end of the covered period

PPP EZ Forgiveness Application – Form 3508EZ

Instead of releasing just one forgiveness application, the SBA actually released two separate PPP Forgiveness applications:

PPP Loan Forgiveness EZ - Form 3508EZ

PPP Loan Forgiveness Revised – Form 3508

The good news is both applications are much shorter than the initial 12 page Forgiveness Application that was released on May 15th, but making it even better, we now also have an EZ application which will make the Paycheck Protection Program Forgiveness Application process even easier for many companies. The EZ application is only 3 pages long. giving companies access to a shorter forgiveness application made sense to us because the PPP loan amount was calculated based on 10 weeks of payroll and with the extension of the covered period to 24 weeks, companies now have 24 weeks of payroll to cover a loan amount based on 10 weeks. The result, most companies will most likely be able to reach the full PPP forgiveness amount on Payroll Costs alone without having to take into account rent, utilities, and other qualified expenses.

Who Is Eligible To Use The PPP EZ Forgiveness Application?

Companies will only be able to utilize the PPP EZ Forgiveness Application if they satisfy one of the following three criteria. I will give you the short and sweet version first followed by the long technical version of the criteria. Short and sweet:

You have no employees (Sole Proprietors or Owner Only Entities)

You did not reduce employee HEADCOUNT (FTE’s) and did not reduce WAGES by more than 25% for employees making less than $100,000 in 2019 during the covered period compared to January 1, 2020 – March 31, 2020

You did not reduce employee WAGES by more than 25% for employees making less than $100,000 in 2019 but you reduced the number of FTE’s during the covered period. However, the reduction in FTE’s was because CDC, OSHA, or other government agencies limited the capacity that the business could operate at during the covered period.

Here is the long technical version of the three criteria:

The borrower is a self-employed individual, independent contractor, or sole proprietor who had no employees at the time of the PPP loan application and did not include any employee salaries in the computation of the average monthly payroll in the PPP Application Form (SBA Form 2483).

The borrower did not reduce annual salary or hourly wages of any employee by more than 25% during the covered period compared to January 1, 2020 and March 31, 2020 AND The borrower did not reduce the number of employees or the average paid hours of employees between January 1, 2020 and the end of the covered period.

The borrower did not reduce annual salary or hourly wages of any employee by more than 25% during the covered period compared to January 1, 2020 – March 31, 2020 AND the borrower was unable to operate during the covered period at the same level of business activity as before February 15, 2020, due to compliance with requirements established or guidelines issued between March 1, 2020 and December 31, 2020 by the Secretary of Health, CDC, or OSHA, related to the maintenance of standards of sanitation, social distancing, or any other work or customer safety requirement related to COVID-19.

Again, you just have to be able to satisfy ONE of the three criteria listed above. You do not need to satisfy all three.

Reduction In Wages of Employees

Per the criteria mentioned above, if you reduced wages by more than 25% during the covered period for employees that made under $100,000 in 2019, you would not be able to complete the PPP EZ Application.

At first look this seems pretty self-explanatory but it’s really not. If you just read that statement for what it is, it would lead you to look at just your year-end payroll report for 2019, determine who had an annual compensation of $100,000 or less, and then you would look to see if any of those employees had wage reductions of greater than 25% during the covered period.

However, the way the guidance was written, it would imply that the $100,000 annualized compensation applies on a per pay period basis, meaning if in ANY pay period in 2019, you paid an employee higher than a $100,000 annualized wage, that employee would not be subject to the wage reduction calculation. It’s best to illustrate this in an example.

Let’s say Jim is one of your employees and in 2019 you paid Jim a total of $80,000. His $80,000 in compensation included $75,000 in base pay plus his $5,000 annual bonus that was paid to him in the final pay period in December. Your payroll is run on a biweekly basis meaning for purposes of assessing the $100,000 annual compensation limit, any employee that received more than $3,846.15 in any bi-weekly pay period in 2019, would not be subject to the wage reduction calculation. Since in Jim’s last paycheck of 2019, he received his regular bi-weekly wage of $2,884.15 plus his annual bonus of $5,000, his final paycheck in December was for $7,884.15. Thus Jim is excluded from the wage reduction calculation and can be ignored for purposes of assessing whether or not you are eligible to complete the PPP EZ Forgiveness Application even though his total compensation for 2019 was under $100,000.

Whether or not it was the SBA’s intention to assess the $100,000 limit in this manner, we cannot be 100% certain, but as of today, that’s how it reads.

Now that we have all of that fun stuff out of the way, let’s get to completing the PPP Forgiveness EZ Application. For the purpose of this article we are focusing on the EZ application because given the new 24 week covered period, the new safe harbor exceptions, and the ability to submit the application early, we expect that a lot of companies will qualify to submit the EZ Forgiveness application.

How To Complete the PPP Loan Forgiveness EZ Application

Here is what the first page of the PPP Loan Forgiveness Application Form 3508EZ looks like:

There are no worksheets that need to be completed!! It’s just this page and a second page that has a bunch of lines that Borrower has to initial certifying that they followed all of the rules associated with the PPP Loan Program.

Top Section: The top section of the form is just general information on your company, your PPP loan, and your payroll schedule.

Covered Period: If your PPP loan was issued prior to June 5th, you have the option to either select the 8 week covered period or 24 week covered period. The covered period beings on the date that you received the PPP loan. One might ask, why would anyone choose the 8 week covered period? There are actually a few reasons.

Reason 1: The company has already spent all of the PPP loan money within the 8 week period.

Reason 2: By electing the 24 week covered period, it also potentially creates a 24 week covered period for the FTE (full time equivalent employee) calculation and the 25% wage reduction calculation. But the guidance that we just received from the SBA on June 22nd which allows companies to file the forgiveness application prior to the end of the covered period could change this. The SBA issued guidance allowing companies to file the forgiveness application early but they did clarify what happens if the company receives full forgiveness but then reduces wages or FTE’s prior the end of the full 24 week covered period. We are flying blind right now until we get more guidance from the SBA on this.

For companies that have not spent 100% of their PPP loan amount, it think this new guidance creates a wait and see approach, as to whether the company should select the 8 week covered period or select the 24 week covered period with the ability to apply for forgiveness early.

For companies that have been able to spend 80% to 90% of their PPP loan during the 8 week covered period, that were planning on reducing employees or wages after the covered period was complete, depending on the guidance that the SBA issues, it may be advantageous for those companies to stick with the 8 week period, as opposed to being subject to the 24 week covered period calculations that could reduce the forgiveness amount.

The only other downside to selecting the 8 week period is the compensation limit for each owner and each employee is capped at a lower level compared to the 24 week covered period. We will cover this when we get to the Payroll Cost portion of the forgiveness application.

What is the “End Date” of your Covered Period?

With this change, I’m not really sure what is considered the new “end date” for the Covered Period. Being able to apply for forgiveness prior to the end of the covered period makes the end date of the covered period seem irrelevant. Maybe the new end date of the covered period is the day that you submit the forgiveness application. That makes more sense to me because that would be the time period that you would be submitting payroll data for and the nonpayroll expenses that have either been paid or incurred, but it’s not clear at this point.

Alternative Payroll Covered Period: As mentioned above, the covered period begins the day the PPP loan hit your business checking account. However, companies are allowed to elect to begin their covered period at the beginning of their next payroll period following the receipt of the PPP Loan.

Example: Company XYZ has a bi-weekly payroll schedule. They receive their PPP loan on April 26th in the middle of one of their payroll periods. The company could voluntarily elect an alternative payroll covered period beginning on May 5th with would be the first day of the next payroll period. This could make the calculations a little easier since the payroll dates will match up with a covered period.

The extension of the covered period to 24 weeks and the ability to file for forgiveness early may render the Payroll Covered Period feature irrelevant for many companies. It was more relevant when companies had to make sure they could fit in their 8 weeks of payroll into their 8 week covered period to maximize their forgiveness amount.

Line 1: Payroll Costs: The new PPP Forgiveness Application came with different compensation limits for owner-employees and regular employees.

Sole Proprietors & Owner Only Entities

If you are a sole proprietor or owner only entity, the Payroll Cost calculation is going to be very easy. For each owner, the payroll cost is the LESSER OF $20,833 or 2.5 months of compensation from 2019. If you are a sole proprietor that made more than $100,000 in 2019, you can just enter $20,833 on that line and move on. For companies with multiple owners with no employees, you would just total up the compensation amounts with the cap for each owner and enter it on that line.

For Companies With Employees

If your company has employees and satisfies one of the three criteria making you eligible to complete the PPP Forgiveness EZ Application, using your own personal excel spreadsheet, you can total up the Payroll Costs for the owners and employees as follows:

Different Max Compensation Limits For Owner-Employees & Employees

The new forgiveness application provided updated guidance on the maximum compensation allowed for both owners and employees during the covered period. Under the old 8 week covered period, compensation was capped at $15,385 for both owners and employees. With the new 24 week covered period, compensation is capped at the following:

Owner-employees: $20,833

Employees: $46,154

The math makes sense because it’s the $100,000 compensation cap, dividend by 52 weeks, multiplied by a 24 week forgiveness period. Unfortunately for owners, the cap was only increased to $20,833 and there is an additional restriction. The compensation cap for owner-employees will be the LESSER OF:

$20,833; or

5 months of the owners 2019 compensation

But also using the same math, it would seem prudent that the $46,154 compensation cap for each employee would be reduced if you submit your PPP Forgiveness application prior to the end of the covered period. Example: If you file your forgiveness application after 15 weeks it would seem prudent that each employee's compensation would be limited to $28,846 which is the $100,000 cap, divided by 52 weeks, multiplied by 15 weeks, but the SBA has yet to issue guidance on this.

So column 1 of your excel spreadsheet is compensation paid during the covered period to owner-employees and employees with these compensation caps imposed.

For Employees: Health & Retirement Contributions Are In Addition To Comp Limit

The next two columns in your excel spreadsheet should be “Health Insurance Costs” and “Employer Retirement Contributions”.

For employees, the maximum compensation for any single non-owner employee during the 24 week covered period is $46,154, but that cap just applies to their compensation. In addition to the $46,154 cap, the company can also include the following amounts in “Payroll Costs” for each employee:

Employer contributions for employee health insurance

Employer contributions to employee retirement plans

For sole proprietors and partners, these amounts are not counted in addition to the $20,833 for owner employees. It’s not 100% clear how retirement contributions will work for owner-employees of S-corp and C-corp, but as of today, I would guess that they are going to be limited as well to the $20,833 for compensation, health insurance, and employer contributions to retirement plans. Guidance needed from the SBA on this.

But again, we expect this to be irrelevant for many companies because most companies will be able to meet the full forgiveness amount on just the 24 weeks of payroll without having to factor in these other “Payroll Costs”.

Total up all of those columns on your excel spreadsheet and you have reached your Line 1: Payroll Cost for the forgiveness application.

Line 2: Business Mortgage Interest: Any interest payments on a covered mortgage obligation that was in place prior to February 15, 2020. As of right now the definition is either PAID or INCURRED during the covered period.

Line 3: Rent or Lease Payments: Payments of rent during the covered period for a lease that was in place prior to February 15, 2020. Similar to mortgage interest, the cost can either be PAID or INCURRED during the covered period.

Line 4: Business Utility Payments: The payment of utilities during the covered period include electricity, gas, water, transportation, telephone , and internet services that were in place prior to February 15, 2020.

The Forgiveness Calculation

The rest of the form, Lines 5 – 8, are fairly self explanatory. You are adding up your total qualified costs in comparing that to your loan amount to determine the percentage of your forgiveness.

Page 2: PPP Loan Forgiveness EZ Application

Page 2 of the PPP EZ Loan Application looks like this:

The Borrower just has to initial on each line, sign the bottom of the form, and the application is complete. The next step is to gather all the supporting documentation for the expenses that are listed on the PPP application and submit the forgiveness application with those supporting documents to your bank to formally begin the forgiveness process. the bank has 60 days from the date you submit your forgiveness application to either accept the application or reject it.

The PPP Loan Forgiveness Application - Form 3508 ("Long Form")

If you don't qualify to submit the EZ Loan Forgiveness Application, then you would have to complete what I call the PPP Loan Forgiveness Long Form. Now even though I call it the long form it's still shorter then the 12 page loan forgiveness application that was released by the SBA on May 15th. The long form requires you to:

Complete the PPP Application Worksheets

Run the FTE Calculations

Run the Wage Reduction Calculation

Determine if you satisfy any of the Safe Harbors

We will cover the long form in a separate article.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

SBA PPP Loan New 24 Week Covered Period & Additional Changes

On June 3, 2020, Congress passed the Paycheck Protection Program (PPP) Flexibility Act which provided much needed relief to many businesses that were trying to qualify for full forgiveness of their SBA PPP Loan

On June 3, 2020, Congress passed the Paycheck Protection Program (PPP) Flexibility Act which provided much needed relief to many businesses that were trying to qualify for full forgiveness of their SBA PPP Loan within the 8 week covered period. This bill changed the Covered Period from 8 weeks to 24 weeks which will provide companies with more time to spend their PPP loan. But there were also other changes that were made to PPP program that we will cover in this article including:

Covered Period extended to 24 weeks

Non-payroll cost increased from 25% to 40% of the loan amount

Max Employee Comp may increase from $15,385 to $46,153

Companies will have until December 31st to restore FTE’s (full time equivalents)

Additional safe harbors for FTE calculation

Companies can defer employer payroll taxes in addition to the PPP loan

Loan duration extended from 2 years to 5 years

New questions that the PPP Flexibility Act creates

New 24 Week Covered Period

This is probably the most important change that was made to the Paycheck Protection Program. Companies will now have a 24 week covered period to spend their PPP loan Instead of the original 8 week period and qualify for full forgiveness of the loan amount. Since the SBA PPP Loans were calculated based on 10 weeks of payroll, companies were finding it challenging to spend the full loan amount within an 8 week period. The new bill did not change the definition of qualified expenses. They are still:

Payroll

Employee health insurance

Employer contributions to retirement plans

Mortgage interest

Rent payments

Utilities

But a lot of small businesses didn't have enough “non-payroll costs” within the 8 week period to reach the full amount of their PPP loan. Also, many companies weren't able to hire their employees back until a few weeks into their Covered Period, so they did not have 8 weeks worth of payroll for many of their employees.

Changing the Covered Period to 24 weeks will make qualifying for full forgiveness of the PPP loan very easy for many companies. They now have a loan that was calculated based on 10 weeks of payroll but have 24 week of payroll to spend it on. While there are still grey areas regarding some of the non-payroll costs associated with the PPP, the change to a 24 week Covered Period for most employers, will make them irrelevant because most employers will be able to spend the full loan amount on straight payroll costs.

24 Week Covered Period Is Optional

The new PPP Flexibility Act does not require companies that received PPP loans to adopt a 24 week Covered Period. If the company received their PPP loan prior to the signing of the new PPP Flexibility Act, they can elect to continue to use their original 8 week Covered Period. This is a favorable option for companies that have already spent their full PPP loan and have not had a reduction in employee headcount or reduced wages.

However, companies that have spent the full PPP loan amount but have experienced a reduction in employee headcount or reduced wages, may want to consider adhering to the new 24 week covered period because it will provide them with more time to bring employees back and make the company eligible for full forgiveness of the loan.

Ability To Apply For Forgiveness Early

This raises a question that we will hopefully get guidance on from the SBA or Treasury soon. If a company is 15 weeks into their 24 week covered period, they have already spent the full PPP loan amount on qualified expenses, and they have restored FTE’s and wages, can they apply for forgiveness prior to the end of their 24 week period or do they have to wait?

We don't know the answer to this one yet but a lot of companies are going to be asking this question. It seems like adding the ability to apply early for forgiveness would benefit both the borrower and the banks. The banks do not want to be servicing a 1% loan any longer than they have to. But allowing this also creates some issues. All of the forgiveness calculations are based on a set Covered Period, if you have some companies applying for forgiveness after 12 weeks, others at 18 weeks, and some at 24 weeks, it could definitely complicate the forgiveness calculations.

Non-Payroll Costs Increased from 25% to 40%

Prior to the passing of the PPP Flexibility Act, companies were required to spend at least 75% of the PPP loan amount on payroll cost in order to qualify for full forgiveness. The new bill changed that. Now companies only need to spend a minimum of 60% of the PPP loan amount on payroll costs to be eligible for full forgiveness. But arguably, not that many companies will need this now since they have 24 weeks of payroll costs to work with; but it adds some additional flexibility.

The 60% Cliff

While Congress may have loosened their restrictions on the minimum amount that needs to be used toward payroll costs it seems like it comes with a cliff. While the old rules carried a 75% payroll cost threshold, it was assumed that for companies that fell short of the threshold, they would still qualify for partial forgiveness of the PPP loan amount. Under this new 60% payroll threshold, as of today, it seems that if companies are unable to meet the 60% threshold, that none of the loan will qualify for forgiveness. This will be an important feature to pay attention to for businesses like restaurants and bars that have been completely shut down and are only now starting to hire back employees. Even with 24 weeks to work with, companies need to be aware of this possible 60% “all or none” forgiveness threshold that now seems to exist. Again, hopefully this is something that they will address in future guidance.

Max Employee Comp $15,385 to $46,153

The PPP Flexibility Act did not change the $100,000 annual compensation limit for employees and owners. However, under the old 8 week covered period, each employee was limited to $15,385 in compensation during the covered period.

$100,000 / 52 weeks x 8 weeks = $15,385

Now that companies have a 24 week Covered Period, it would seem that the maximum compensation for each employee would naturally increase from $15,385 to $46,153.

$100 / 52 weeks x 24 weeks = $46,153

This has not been 100% confirmed yet but it will hopefully be addressed in the future guidance.

You Cannot Increase Your PPP Loan Amount

This potential increase in the per employee compensation amount raises the question from employers, “Can I go back and ask for more money from the SBA for my PPP loan?” The short answer to that is “no”. The PPP Flexibility Act did not change the calculation of the PPP loan amount, just other features of the program. They also specifically stated in the new bill, that the ability to apply for a PPP loan would not extend beyond June 30th. As of today, there is a still about $100 Billion dollars allocated to the PPP loan program that is available to companies that have not yet applied for a PPP loan.

For companies that would have qualified for the PPP loan but originally opted not to take it because they were completely shut down and doubted their ability to meet the 75% threshold of payroll within the 8 week Covered Period, this 24 week extension may now change their minds.

FTE Rehired Date Extended to December 31, 2020

They also provided companies with a lot more time to bring back employees to avoid being penalized on the forgiveness amount of their loan. Many companies are just now starting to open up but are by no means back to 100% of their staff and that was hurting them during the loan forgiveness process. Under the old rules, the FTE (full time equivalent) calculation was based on the last day of the borrower’s 8 week covered period but there was a safe harbor that stated as long as the employee headcount and wages were restored by June 30th, no FTE penalty would be assessed.

Under the new PPP Flexibility Act, with a 24 week Covered Period, Employers will have more time to bring back employees and restore wages to their pre COVID-19 levels. The new act also extended the safe harbor FTE provision from June 30th to December 31, 2020, so companies will have until the end of the year to restore their employee headcount and wages to their February 15, 2020 level in order to avoid FTE penalties during the forgiveness process.

Additional FTE Safe Harbors

The new bill enhanced some of the FTE safe harbor provisions. These safe harbors were in place to protect companies that had a reduction in their FTE’s but restored them by a specific date and based the calculations on alternative comparison periods. The new PPP Flexibility Act added to this list of FTE safe harbors which will now include:

There was an inability to rehire individuals who were employees of the eligible recipient on February 15th,

There was an inability to hire similarly qualified employees for unfilled positions on or before December 31, 2020, or

There was an inability to return to the same level of business activity as such business was operating at before February 15th due to compliance with requirements established or guidance issued by the Secretary of Health and Human Services, the Director of the Center for Disease Control and Prevention, or the Occupational Safety and Health Administration During the period beginning March 2020 and ending December 2020.

To further clarify this new safe harbor language, if you are a restaurant owner and for the remainder of the year you are required to operate at a limited capacity due to restrictions set forth by these public health organizations, you can access these safe harbors, and your loan forgiveness amount will not be reduced due to the inability to restore your FTE headcount.

Companies Can Defer Employer Payroll Taxes & Get PPP Forgiveness

One of the relief provisions within the CARES Act was providing companies with the option to defer their employer’s 6.2% share of Social Security Taxes until 2021 and 2022. This provision allowed companies to avoid having to pay those taxes now and they had to repay those amounts 50% in 2021 and 50% in 2022. The taxes are still due but the payments are delayed so it's essentially an interest free loan for companies.

Under the old PPP provisions, companies were able to elect this up until the point that they receive forgiveness of their PPP loan. Once the loan was forgiven, they were no longer able to defer these employer taxes. The PPP Flexibility Act changed this. Now companies will be able to have their PPP loan completely forgiven and will also be able to continue to defer the employer’s share of the FICA taxes until 2021 and 2022.

Loan Duration Extended from 2 Years to 5 Years

For companies that do not receive full forgiveness of their PPP loan, it then operates as a traditional SBA loan subject to the term of the loan. Originally the PPP loans were amortized for 2 years and carried a 1% interest rate. With only a 2 year amortization, once the 6 month deferment to payments was up, companies could have had sizable loan payments given the short duration of the amortization schedule. The PPP Flexibility Act now allows those loans to be amortized over 5 years.

But we need guidance on this feature. It seems like all PPP loans issued after the passage of this Flexibility Act will adhere to the 5 year amortization schedule, but for PPP loans issued prior to the passing of this bill is it an optional provision on the part of the banks? They will hopefully address this in the Q&A document. If borrowers have to negotiate with their bank to extend the duration of their loan, they could have a tough time doing so because again, the banks do not want to be servicing loans with a 1% interest rate for 5 years. The banks want those loans forgiven as soon as possible so they can get reimbursed by the SBA and then make new loans at higher interest rates.

Extension of Loan Payments

The original Paycheck Protection Program allowed borrowers to defer loan payments for a 6 month period. This in most cases would prevent companies from ever having to make a payment on their PPP loan before it was forgiven. With the new 24 week Covered Period (6 months), they extended the payment deferral for these PPP Loans to “the date the lender receives the forgiveness amount from the SBA”, which in many cases will now be longer than the 6 month period.

This Creates New Questions

The other positive of this PPP Covered Period extension is it gives the SBA and Treasury more time to issue much needed guidance on some of these grey areas that exist within the PPP program. We already covered a number of these unanswered questions earlier in the article but there is a big one that remains unanswered. With the Covered Period being extended to 24 weeks, most companies will reach the end of their covered period in October and November, and the forgiveness process could take over 60 days bringing the actual forgiveness event in 2021. Since, as of right now, companies cannot take a deduction for expenses paid with the forgiven PPP loan, accountants will be challenged on how to account for those expenses if forgiveness is still pending. Which is probably something that needs to be addressed as some point in the Q&A.

New Forgiveness Application

The first version of the SBA PPP Forgiveness Application was released a few weeks ago but given these changes to the PPP Program, I would be greatly surprised if they don't go back and create a revised Forgiveness Application. Hopefully, the next application is a lot shorter than 11 pages and it should be. Since many companies will be able to satisfy the full PPP loan amount with just payroll cost for their employees, it seems like that should be an option on a single page, certifying the amount that was spent on straight payroll, that employee headcount and wages have been restored by a given date, in turn making the forgiveness process much easier for everyone. After all of the madness that everyone has been through with this everchanging PPP program, a one-page PPP forgiveness application would be a welcomed gift for business owners, bankers, and financial professionals.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus Relief: $100K 401(k) Loans & Penalty Free Distributions

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans.

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans. These new distribution options will provide employees and business owners with access to their retirement accounts with the:

10% early withdrawal penalty waived

Option to spread the income tax liability over a 3-year period

Option to repay the distribution and avoid taxes altogether

401(k) loans up to $100,000 with loan payments deferred for 1 year

Many individuals and small businesses are in a cash crunch. Individuals are waiting for their IRS Stimulus Checks and many small business owners are in the process of applying for the new SBA Disaster Loans and SBA Paycheck Protection Loans. Since no one knows at this point how long it will take the IRS checks to arrive or how long it will take to process these new SBA loans, people are looking for access to cash now to help bridge the gap. The CARES Act opened up options within pre-tax retirement accounts to provide that bridge.

10% Early Withdrawal Penalty Waived

Under the CARES Act, “Coronavirus Related Distributions” up to $100,000 are not subject the 10% early withdrawal penalty for individuals under the age of 59½. The exception will apply to distributions from:

IRA’s

401(K)

403(b)

Simple IRA

SEP IRA

Other types of Employer Sponsored Plans

To qualify for the waiver of the 10% early withdrawal penalty, you must meet one of the following criteria:

You, your spouse, or a dependent was diagnosed with the COVID-19

You are unable to work due to lack of childcare resulting from COVID-19

You own a business that has closed or is operating under reduced hours due to COVID-19

You have experienced adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced because of COVID-19

They obviously made the definition very broad and it’s anticipated that a lot of taxpayers will qualify under one of the four criteria listed above. The IRS may also take a similar broad approach in the application of these new qualifying circumstances.

Tax Impact

While the 10% early withdrawal penalty can be waived, in most cases, when you take a distribution from a pre-tax retirement account, you still have to pay income tax on the distribution. That is still true of these Coronavirus Related Distributions but there are options to help either mitigate or completely eliminate the income tax liability associated with taking these distributions from your retirement accounts.

Tax Liability Spread Over 3 Years

Normally when you take a distribution from a pre-tax retirement account, you have to pay income tax on the full amount of the distribution in the year that the distribution takes place.

However, under these new rules, by default, if you take a Coronavirus-Related Distribution from your 401(k), IRA, or other type of employer sponsored plan, the income tax liability will be split evenly between 2020, 2021, and 2022 unless you make a different election. This will help individuals by potentially lowering the income tax liability on these distributions by spreading the income across three separate tax years. However, taxpayers do have the option to voluntarily elect to have the full distribution taxed in 2020. If your income has dropped significantly in 2020, this may be an attractive option instead of deferring that additional income into a tax year where your income has returned to it’s higher level.

1099R Issue

I admittedly have no idea how the tax reporting is going to work for these Coronavirus-Related Distributions. Normally when you take a distribution from a retirement account, the custodian issues you a 1099R Tax Form at the end of the year for the amount of the distribution which is how the IRS cross checks that you reported that income on your tax return. If the default option is to split the distribution evenly between three separate tax years, it would seem logical that the custodians would now have to issue three separate 1099R tax forms for 2020, 2021, and 2022. As of right now, we don’t have any guidance as to how this is going to work.

Repayment Option

There is also a repayment option associated with these Coronavirus Related Distributions, that will provide taxpayers with the option to repay these distributions back into their retirement accounts within a 3-year period and avoid having to pay income tax on these distributions. If individuals elect this option, not only did they avoid the 10% early withdrawal penalty, but they also avoided having to pay tax on the distribution. The distribution essentially becomes an “interest free loan” that you made to yourself using your retirement account.

The 3-year repayment period begins the day after the individual receives the Coronavirus Related Distribution. The repayment is technically treated as a “rollover” similar to the 60 day rollover rule but instead of having only 60 days to process the rollover, taxpayers will have 3 years.

The timing of the repayment is also flexible. You can either repay the distribution as a:

Single lump sum

Partial payments over the course of the 3 year period

Even if you do not repay the full amount of the distribution, any amount that you do repay will avoid income taxation. If you take a Coronavirus Related Distribution, whether you decide to have the distribution split into the three separate tax years or all in 2020, if you repay a portion or all of the distribution within that three year window, you can amend your tax return for the year that the taxes were paid on that distribution, and recoup the income taxes that you paid.

Example: I take a $100,000 distribution from my IRA in April 2020. Since my income is lower in 2020, I elect to have the full distribution taxed to me in 2020, and remit that taxes with my 2020 tax return. The business has a good year in 2021, so in January 2022 I return the full $100,000 to my IRA. I can now amend my 2020 tax return and recapture the income tax that I paid for that $100,000 distribution that qualified as a Coronavirus Related Distribution.

No 20% Withholding Requirement

Normally when you take cash distributions from employee sponsored retirement plans, they are subject to a mandatory 20% federal tax withholding; that requirement has been waived for these Coronavirus Related Distributions up to the $100,000 threshold, so plan participants have access to their full account balance.

Cash Bridge Strategy

Here are some examples as to how individuals and small business owners may be able to use these strategies.

For small business owners that intend to apply for the new SBA Disaster Loan (EIDL) and/or SBA Paycheck Protection Program (PPP), the underwriting process will most likely take a few weeks before the company actually receives the money for the loan. Some businesses need cash sooner than that just to keep the lights on while they are waiting for the SBA money to arrive. A business owner could take a $100,000 from the 401(K) plan, use that money to operate the business, and they have 3 years to return that money to 401(k) plan to avoid having to pay income tax on that distribution. The risk of course, is if the business goes under, then the business owner may not have the cash to repay the loan. In that case, if the owner was under the age of 59½, they avoided the 10% early withdrawal penalty, but would have to pay income tax on the distribution amount.

For individuals and families that are struggling to make ends meet due to the virus containment efforts, they could take a distribution from their retirement account to help subsidize their income while they are waiting for the IRS Stimulus checks to arrive. When they receive the IRS stimulus checks or return to work full time, they can repay the money back into their retirement account prior to the end of the year to avoid the tax liability associated with the distribution for 2020.

401(k) Plan Sponsors

I wanted to issue a special note the plan sponsors of these employer sponsored plans, these Coronavirus Related Distributions are an “optional” feature within the retirement plan. If you want to provide your employees with the opportunity to take these distributions from the plan, you will need to contact your third party administrator, and authorize them to make these distributions. This change will eventually require a plan amendment but companies have until 2022 to amend their plan to allow these Coronavirus Related Distributions to happen now, and the amendment will apply retroactively.

$100,000 Loan Option

The CARES Act also opened up the option to take a $100,000 loan against your 401(k) or 403(b) balance. Normally, the 401(k) maximum loan amount is the lesser of:

50% of your vested balance OR $50,000

The CARES Act includes a provision that will allow plan sponsors to amend their loan program to allow “Coronavirus Related Loans” which increases the maximum loan amount to the lesser of:

100% of your vested balance OR $100,000

To gain access to these higher loan amounts, plan participants have to self attest to the same criteria as the waiver of the 10% early withdrawal penalty. But remember, loans are an optional plan provision within these retirement plans so your plan may or may not allow loans. If the plan sponsors want to allow these high threshold loans, similar to the Coronavirus Related Distributions, they will need to contact their plan administrator authorizing them to do so and process the plan amendment by 2022.

No Loan Payments For 1 Year

Normally when you take a 401(K) loan, the company begins the payroll deductions for your loan payment immediately after you receive the loan. The CARES act will allow plan participants that qualify for these Coronavirus loans to defer loan payments for up to one year. The loan just has to be taken prior to December 31, 2020.

Caution

While the CARES ACT provides some new distribution and loan options for individuals impacted by the Coronavirus, there are always downsides to using money in your retirement account for purposes other than retirement. The short list is:

The money is no longer invested

If the distribution is not returned to the account within 3 years, you will have a tax liability

If you use your retirement account to fund the business and the business fails, you could have to work a lot longer than you anticipated

If you take a big 401(k) loan, even though you don’t have to make loan payments now, a year from the issuance of the loan, you will have big deductions from your paycheck as those loan payments are required to begin.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus SBA Loan Forgiveness Program

On March 27, 2020, Congress officially passed the CARES Act which includes the SBA Paycheck Protection Program. This program offers loans to small businesses that can be forgiven if certain conditions are met.

On March 27, 2020, Congress officially passed the CARES Act which includes the SBA Paycheck Protection Program. This program offers loans to small businesses that can be forgiven if certain conditions are met. A special note, this SBA program is separate from the SBA Disaster Loan Program called the Economic Injury Disaster Loan Program.

In this article we will review:

The terms of the Paycheck Protection Program

How the loan amount is calculated

Deferred Payments for 6 to 12 months

How to apply for the loans

The loan forgiveness process

Restrictions on what the loans can be used for

Other loan programs available to small businesses

Paycheck Protection Program

This is a new loan program sponsored by the SBA that was put in place to provide small business owners with access to cash to sustain normal business operations over the course of the next 8 weeks. While these are technically loans, if the guidelines of the program are followed, business owners will:

Never have to make a loan payment

Have the full loan amount forgiven

There are no fees to apply for the loan

Higher and faster approval rates compared to other lending programs

Business Expenses Covered By These Loans

This program is very specific about what the money can be used for. In order to qualify for forgiveness of the loan amount, the loan proceeds have to be used for:

Payroll & commission payments

Mortgage or rent payments

Group health benefits including insurance premiums

Vacation, medical, or sick leave payments

Utility payments

Interest on debt obligations previous to February 15, 2020

More specifically, it’s to cover expenses incurred between February 15, 2020 and June 30, 2020.

Who Qualifies For These SBA Loans?

Most small businesses will be eligible to apply for these loans. Here are the application requirements:

The business has been in operation since February 15, 2020

The business has 500 or less employees

The business has paid salaries, payroll taxes, or Form 1099 non-employee compensation

Ability to demonstrate that your business was economically affected by COVID-19

Sole proprietors, independent contractors, and 501(c)(3) entities are also eligible to apply.

Terms of the Loans

There are a number of unique features about this SBA loan program that will make it very appealing to small business owners:

No fees to apply for the loan

No collateral required

No personal guarantees

Maximum interest rate of 4%

Maximum 10-year amortization

Ability to defer payments for 6 to 12 months (depending on your lender)

No pre-payment penalty

Loan forgiveness if program requirements are met

Loan Forgiveness

There are requirements that have to be met in order for all or a portion of the loan amount to be forgiven by the SBA.

The money has to be spent on qualified expenses (listed above)

The expenses have to be incurred within 8 weeks after the loan is approved

The business has to maintain the same number of employees between Feb 15th and June 30th that it did during same period in 2019 or from January 1, 2020 until February 15, 2020

You cannot reduce employee wages by more than 25% for employee with less than $100K in compensation

Going outside of these requirements will either reduce or eliminate the amount of the loan that is forgiven by the SBA. We are still waiting for clarification on a number of business scenarios concerning employee headcount and wage calculations. The CARES Act was over 800 pages long, but it does seem as of right now, that if you rehire employees that were previously laid off at the beginning of the period, or restore wages that were previously reduced, you will not be penalized as long as you do this by either the end the initial 8 week period or June 30th. We still need clarification as to which deadline will apply.

Is The Loan Forgiveness Amount Taxable?

No. Within this program, the amount that is forgiven is considered a tax-free grant from the U.S. government.

How Is The Amount Of The SBA Loan Calculated?

Since this program was implemented to help businesses support payroll expenses, when you apply for the loan, you will need to submit payroll documentation for the previous 12 months. The calculation for these loans is very simple:

Total payroll expenses for the previous 12 months

DIVIDED by 12 months

MULTIPLIED by 2.5

In the calculation of the total payroll expenses, any employees making more than $100,000, they cap their compensation at $100,000 for purposes of the maximum loan calculation. Also, the amount available in the form this SBA loan is the LESSER of:

2.5 times monthly payroll expenses OR $10 million dollars

Here is a quick example:

Company XYX has 1 owner and 3 employees with the following payroll expenses for the past 12 months:

Owner: $200,000

Employee 1: $90,000

Employee 2: $60,000

Employee 3: $50,000

Since the owner’s salary is capped at $100,000, it will result in the following maximum loan amount:

$300,000 / 12 Months = $25,000

$25,000 x 2.5 = $62,500

If the company is approved for the $62,500 loan, depending on their bank, they may be able to defer making loan payments for 6 months, and as long as the company spends that money within the next 8 weeks on expenses outlined by the SBA program, maintains headcount and employee wages, they will be eligible for full forgiveness of the loan after that 8 week period without pre-payment penalty or a taxable event.

How Do You Apply For These Loans?

For the Paycheck Protection Program, these loans will be issued through banks. When you call your banker you will need to let them know that you are applying for an SBA Paycheck Protection Loan. The SBA serves as a guarantor for these loans so if the borrower meets the SBA criteria, the bank issues the loan, but if the borrower defaults on the loan, the SBA reimburses the bank for those losses.

Choose Your Bank Wisely

Not all banks will be participating in this loan program, so you first have to identify which banks in your area are participating in this SBA Paycheck Protection Program. These loans are going to be in high demand so the banks are most likely going to be overwhelmed with loan applications which could slow down the turnaround time of these loans. It is prudent to reach out to your professional network, like your accountant, investment advisor, or independent commercial broker, to determine which banks have the capacity to get these loans through quickly.

It will be extremely important for business owners to submit all of the proper documentation for the loan on the first attempt. If information is missing from the application or you submit the wrong supporting documentation, it could really slow down the process. The banks receive a fee from the government for every loan that they process so they have a big incentive to focus on the loans that all of the proper documentation so they can approve them quickly.

Start The Process Now

For our clients that we believe meet the criteria for this SBA Loan Program, our top recommendation is to start the process now otherwise you could end up in the back of a very long line. But before you do, you should consult with you accountant, financial advisor, or commercial lender to make sure this is the right program for you. There are multiple programs out there right now to help support small businesses due to the economic crisis caused by the Coronavirus. If you take a loan from one program, it could disqualify you from access to other SBA loans or tax credits that are available that could be more beneficial for your business. Here is our article on the SBA Disaster Loan Program which will be another popular option for businesses impacted by the Coronavirus containment efforts.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

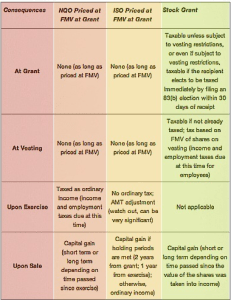

Stock Options 101: ISO, NQSO, and Restricted Stock

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

Stock options give you the right to purchase a specific number of shares of the company’s stock at a fixed price. There is typically a vesting schedule attached to option grants that specify when you have the right to exercise your stock options. Companies can offer employees:

Incentive Stock Options (“ISO”)

Nonqualified Stock Options (“NQSO”)

Restricted Stock

It is very important to understand how these different types of options and grants are taxed otherwise it could lead to unfortunate tax surprises down the road.

Non-Qualified Stock Options (NQSO)

A non-qualified stock option (NQSO) is a type of stock option that does not qualify for special favorable tax treatment under the US Internal Revenue Code. Thus the word nonqualified applies to the tax treatment (not to eligibility or any other consideration). NQSOs are the most common form of stock option and may be granted to employees, officers, directors, contractors, and consultants.

You pay taxes on these options at the time of exercise. For tax purposes, the exercise spread is compensation income and is therefore reported on your IRS Form W-2 for the calendar year of exercise.

Example: Your stock options have an exercise price of $30 per share. You exercise them when the price of your company stock is $100 per share. You have a $70 spread ($100 – 30) and thus $70 per share is included in your W2 as ordinary income.

Your company will withhold taxes—income tax, Social Security, and Medicare—when you exercise the options.

When you sell the shares, whether immediately or after a holding period, your proceeds are taxed under the rules for capital gains and losses. You report the stock sale on Form 8949 and Schedule D of your IRS Form 1040 tax return.

Incentive Stock Options (ISO)………..

Incentive stock options (ISOs) qualify for special tax treatment under the Internal Revenue Code and are not subject to Social Security, Medicare, or withholding taxes. However, to qualify they must meet rigid criteria under the tax code. ISOs can be granted only to employees, not to consultants or contractors. There is a $100,000 limit on the aggregate grant value of ISOs that may first become exercisable (i.e. vest) in any calendar year. Also, for an employee to retain the special ISO tax benefits after leaving the company, the ISOs must be exercised within three months after the date of termination.

After you exercise these options, if you hold the acquired shares for at least two years from the date of grant and one year from the date of exercise, you incur favorable long-term capital gains tax (rather than ordinary income tax) on all appreciation over the exercise price. However, the paper gains on shares acquired from ISOs and held beyond the calendar year of exercise can subject you to the alternative minimum tax (AMT). This can be problematic if you are hit with the AMT on theoretical gains but the company's stock price then plummets, leaving you with a big tax bill on income that has evaporated.

Very Important: If you have been granted ISOs, it’s important to understand how the alternative minimum tax can affect you prior to exercising your stock options.

Restricted Stock……………….

Your company may no longer be granting you stock options, or may be granting fewer than before. Instead, you may be receiving restricted stock. While these grants don't give you the same potentially life-altering, wealth-building upside as stock options, they do have additional benefits compared to ISO’s and NQSO’s.

The value of stock options, such as ISO’s and NQSO’s, depend on how much (or whether) your company's stock price rises above the price on the grant date. By contrast, restricted stock has value at vesting even if the stock price has not moved or even dropped since grant.

Depending on your attitude toward risk and your experience with swings in your company's stock price, the certainty of your restricted stock's value can be appealing. By contrast, stock options (ISO & NQSO) have great upside potential but can be "underwater" (i.e. having a market price lower than the exercise price). This is why restricted stock is often granted to a newly hired executive. It may be awarded as a hiring bonus or to make up for compensation and benefits, including in-the-money options and nonqualified retirement benefits, forfeited by leaving a prior employer.

Of course, the very essence of restricted stock is that you must remain employed until the shares vest to receive its value. While you may have between 30 and 90 days to exercise stock options after voluntary termination, unvested grants of restricted stock are often forfeited immediately. Thus, it is an extremely effective “golden handcuff” to keep you at your company.

Fewer Decisions

Unlike a stock option, which requires you to decide when to exercise and what exercise method to use, restricted stock involves fewer decisions. When you receive the shares at vesting—which can be based simply on the passage of time or the achievement of performance goals—you may have a choice of tax-withholding methods (e.g. cash, sell shares for taxes), or your company may automatically withhold enough vested shares to cover the tax withholding. Restricted stock is considered "supplemental" wages, following the same tax rules and W-2 reporting that apply to grants of nonqualified stock options.

Tax Decisions

The most meaningful decision with restricted stock grants is whether to make a Section 83(b) election to be taxed on the value of the shares at grant instead of at vesting. Whether to make this election, named after the section of the Internal Revenue Code that authorizes it, is up to you. (It is not available for Restricted Stock Units (RSUs), which are not "property" within the meaning of Internal Revenue Code Section 83)

If a valid 83(b) election is made within 30 days from the date of grant, you will recognize as of that date ordinary income based on the value of the stock at grant instead of recognizing income at vesting. As a result, any appreciation in the stock price above the grant date value is taxed at capital gains rates when you sell the stock after vesting.

While this can appear to provide an advantage, you face significant disadvantages should the stock never vest and you forfeit it because of job loss or other reasons. You cannot recover the taxes you paid on the forfeited stock. For this reason, and the earlier payment date of required taxes on the grant date value, you usually do better by not making the election. However, this election does provide one of the few opportunities for compensation to be taxed at capital gains rates. In addition, if you work for a startup pre-IPO company, it can be very attractive for stock received as compensation when the stock has a very small current value and is subject to a substantial risk of forfeiture. Here, the downside risk is relatively small.

Dividends

Unlike stock options, which rarely carry dividend equivalent rights, restricted stock typically entitles you to receive dividends when they are paid to shareholders.

However, unlike actual dividends, the dividends on restricted stock are reported on your W-2 as wages (unless you made a Section 83(b) election at grant) and are not eligible for the lower tax rate on qualified dividends until after vesting.

Comparison Chart

Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide tax advice. For tax advice, please consult your accountant.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Year End Tax Strategies

The end of the year is always a hectic time but taking the time to sit with a tax professional and determine what tax strategies will work best for you may save thousands on your tax bill due April 15th. As the deadline for your taxes starts to get closer, you may be in such a rush to file them on time that you make some mistakes in the process, but

The end of the year is always a hectic time but taking the time to sit with a tax professional and determine what tax strategies will work best for you may save thousands on your tax bill due April 15th. As the deadline for your taxes starts to get closer, you may be in such a rush to file them on time that you make some mistakes in the process, but don't worry, you won't be the only one. If you don't have the relevant tax strategy in place, you are more prone to mistakes. So, the purpose of this article is to discuss some of the most common tax strategies that may apply to you. It may be worth contacting a company that specializes in tax services if you're unsure of how to go about these strategies though. Some of the deadlines for these strategies aren't until tax filing but the majority include an action item that must be done by December 31st to qualify and therefore taking the time before year end is crucial.

Taxable Investment Accounts

Offset some of the realized gains incurred during the year by selling investments in loss positions. Often times dividends received and sales made in a taxable investment account are reinvested. Although the owner of the account never received cash in the transaction, the gain is still realized and therefore taxable. This may cause an issue when the cash is not available to pay the tax bill. By selling investments in a loss position prior to 12/31, you will offset some, if not all, of the gain realized during the year. If possible, sell enough investments in a loss position to take advantage of the maximum $3,000 loss that can be claimed on your tax return.

Note: The IRS recognized this strategy was being abused and implemented the "wash sale" rule. If you sell an investment in a loss position to diminish gains and then repurchase the same investment within 30 days, the IRS does not allow you to claim the loss therefore negating the strategy.

Convert a Traditional IRA to a Roth IRA

If you are in a low income year and will be taxed at a lower tax bracket than projected in the future, it may make sense to convert part of a traditional IRA to a Roth IRA. The current maximum contribution to a Roth IRA in a single year is $5,500 if under 50 and $6,500 if 50 plus. You will pay taxes on the distributions from the traditional but the benefit of a Roth is that all the contributions and earnings accumulated is tax free when distributed as long as the account has been opened for at least 5 years. Roth accounts are typically the last touched during retirement because you want the tax free accumulation as long as possible. Also, Roth accounts can be passed to a beneficiary who can continue accumulating tax free. Roth money is after tax money and therefore the IRS allows you to withdraw contributions tax and penalty free and let the earnings continue to accumulate tax free. If you don't have the cash come tax time to cover the conversion, you can convert the Roth money back to a traditional IRA by tax filing plus extension and the account will be treated as the Roth conversion never took place.

Donate to Charity if you Itemize

If you itemize deductions on your tax return, go through your closet and donate any clothing or household goods that you no longer use. There are helpful tools online that will allow you to value the items donated but be sure you keep record of what was donated and have the charity give you a receipt.

Max Out Your Employer Sponsored Retirement Plan

If you know you will be hit with a big tax bill and want to defer some of the taxes, max out your retirement plan if you haven't already. Employer sponsored plans, such as 401(k)'s, must be funded through payroll by 12/31 and therefore it is important to make this determination early and request your payroll department start upping your contribution for the remaining payroll periods in the year. The maximum for 401(k)'s in 2015 and 2016 is $18,000 if under 50 and $24,000 if 50 plus.

Business Owners – Cut Checks by 12/31

If your company had a great year and the cash is available, use it to pay for expenses you would normally hold off on. This could mean paying state taxes early, paying invoices you usually wait until the end of the payment term, paying monthly expenses like health or general insurance, or buying new office equipment. This might also mean investing in new office furniture such as chairs and desks, or more storage space for all of your paperwork and electronics. Above all, by getting the checks cut by 12/31, you realize the expense in the current year and will decrease your tax bill.

Business Owners – Set Up a Retirement Plan