College Savings or Retirement First? How to Decide in 2026

Should you save for your child’s college or your own retirement first? It’s one of the most common questions we hear from families trying to balance competing financial goals. Our analysis at Greenbush Financial Group shows that in most cases, prioritizing retirement creates greater long-term security—while still leaving room to build meaningful college savings over time. This guide explains why the order matters, how 529 plans fit in, and how to create a balanced strategy that protects both your future and your child’s opportunities.

One of the most common financial planning questions we hear at Greenbush Financial Group is whether to prioritize saving for your children’s college or for your own retirement. Both goals are important—but when resources are limited, the right order can make a major difference in your long-term security. In most cases, it makes sense to secure your retirement first, then allocate additional savings toward education goals. Here’s why that order matters and how to balance both effectively.

Why Retirement Comes First

Retirement should almost always take priority for one simple reason: there are no loans for retirement. Your future financial independence depends on your ability to replace your income when you stop working—and that window to save is limited.

Key Reasons to Prioritize Retirement

You can’t borrow for it. Your children can access student loans, grants, or scholarships; you cannot do the same for retirement income.

Compounding works best early. The earlier you contribute to retirement accounts like a 401(k) or IRA, the more time your investments have to grow tax-deferred or tax-free.

Employer matches add free money. If you skip retirement contributions to fund college, you may also miss out on employer matching contributions that could increase your savings rate.

Tax advantages are stronger. Retirement accounts typically offer better tax deferral and protection benefits than education accounts.

The Case for Funding College Early

While retirement usually takes priority, it’s also important to plan for education costs strategically. A balanced approach can help you avoid high student loan debt while still protecting your own future.

Benefits of Starting College Savings Early

Tax-free growth. 529 plans grow tax-free and withdrawals are tax-exempt when used for qualified education expenses.

High contribution limits. You can contribute up to $19,000 per year per parent ($38,000 for married couples) in 2026 without triggering the gift tax, and you can front-load five years’ worth at once.

State tax benefits. Many states offer income tax deductions or credits for 529 plan contributions.

Investment flexibility. Funds can be used for tuition, room and board, and even graduate school.

For families with younger children, consistent 529 contributions—even modest ones—can grow meaningfully over 15–18 years while you continue building your retirement savings.

Balancing Both Goals

It doesn’t have to be all-or-nothing. You can take a blended approach:

Maximize employer match in your 401(k) or SIMPLE IRA first.

Open a 529 plan and set up automatic contributions (even $100 per month makes a difference).

Reevaluate each year—as income rises, you can shift additional funds toward college savings.

Use windfalls wisely. Bonuses, tax refunds, or side-income can go toward education savings without disrupting retirement.

Encourage student participation. Teen jobs, scholarships, or community college for core credits can reduce overall cost.

At Greenbush Financial Group, we often model side-by-side scenarios showing how redirecting amounts from retirement to college savings can alter your future income security.

How Retirement Savings Can Help with College

One overlooked advantage: saving for retirement can indirectly help with college funding.

Lower FAFSA impact: Retirement assets aren’t counted toward federal financial aid formulas, while 529 balances are.

Penalty-free withdrawals: The IRS allows penalty-free (but taxable) withdrawals from IRAs for qualified education expenses if needed later.

Future flexibility: A strong retirement foundation may let parents help pay off loans later without jeopardizing their future.

Action Steps to Get Started

Review your retirement contribution rate and increase it until you reach your employer’s match or target savings goal.

Set up a 529 plan for each child, even if contributions start small.

Reassess annually as college costs and retirement targets evolve.

Meet with a financial planner to model the long-term trade-offs of different savings rates.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

FAQs: College Savings vs. Retirement

-

Should I ever prioritize college savings over retirement?Only if your retirement plan is fully funded or you’re on track with a strong pension. Otherwise, we believe that your future security should come first.

-

Can I use my IRA for college expenses?Yes, you can withdraw IRA funds penalty-free (though taxable) for qualified higher education costs, but this should often be a last resort.

-

How much should I contribute to a 529 plan?Many families aim for about one-third of projected costs; the rest can come from cash flow, aid, or loans. Even small, consistent contributions grow substantially over time.

-

What if I can’t afford both?Focus on retirement first. You could potentially help your child repay loans later, but you can’t finance your own retirement.

-

Are there other college savings options besides 529s?Yes—Coverdell ESAs and custodial UGMA/UTMA accounts can also be used, though they have different tax and financial aid impacts.

2026 Mandatory Roth Catch-Up Contributions for Higher Earners: What the New Rules Mean for Retirement Savers

Starting in 2026, higher-income workers age 50 and older will be required to make retirement plan catch-up contributions on a Roth (after-tax) basis under SECURE Act 2.0. This change impacts 401(k), 403(b), and governmental 457(b) plans and could increase current taxable income for many pre-retirees. Our analysis at Greenbush Financial Group explains who is affected, how the rule works, and the planning strategies that can help turn this tax shift into a long-term advantage.

Beginning in 2026, higher-earning workers will be required to make all retirement plan catch-up contributions on a Roth (after-tax) basis. This rule, created under SECURE Act 2.0, applies to individuals earning above a specific wage threshold and affects 401(k), 403(b), and governmental 457(b) plans. Our analysis at Greenbush Financial Group shows that while the change increases current taxable income, it can also create meaningful long-term tax benefits if planned correctly. This article explains who is impacted, how the rule works, and what planning steps to consider before 2026.

What Is the Mandatory Roth Catch-Up Rule in 2026?

The mandatory Roth catch-up rule requires certain high earners to make all catch-up contributions as Roth contributions, rather than pre-tax.

Under prior rules, employees age 50 and older could choose whether catch-up contributions were pre-tax or Roth. Starting in 2026, that choice is removed for higher earners.

At Greenbush Financial Group, this is one of the most common sources of confusion we see among pre-retirees who are aggressively saving in the final working years.

Who Is Subject to Mandatory Roth Catch-Up Contributions?

The rule applies if both of the following are true:

You are age 50 or older

Your prior-year wages exceed $150,000, indexed for inflation

Wages are based on W-2 compensation

Income from self-employment or investments does not count toward this threshold

If your wages are at or below the threshold, you may still choose between pre-tax or Roth catch-up contributions.

Which Retirement Plans Are Affected by the Rule?

Mandatory Roth treatment applies to catch-up contributions made to:

401(k) plans

403(b) plans

Governmental 457(b) plans

It does not apply to:

IRAs (Traditional or Roth)

SEP IRAs

SIMPLE IRAs (which follow separate contribution rules)

Catch-Up Contribution Limits for 2026

While final IRS-indexed numbers will be confirmed closer to 2026, current rules provide context for how the change applies.

General framework:

Standard elective deferral limit (under age 50): indexed annually

Catch-up contributions (age 50+): additional amount above the standard limit

Ages 60–63: enhanced catch-up limits under SECURE Act 2.0, also subject to Roth-only treatment for higher earners

Our analysis at Greenbush Financial Group suggests that many high earners will still benefit from maximizing these Roth catch-up dollars despite losing the immediate tax deduction.

Why Congress Implemented the Mandatory Roth Requirement

The shift to Roth catch-up contributions serves two primary purposes:

Increases near-term tax revenue for the federal government

Expands long-term tax-free retirement savings for participants

Because Roth contributions are taxed upfront, the rule accelerates tax collection while potentially reducing future required minimum distributions.

Tax Impact: Higher Income Today, Lower Taxes Later

Mandatory Roth catch-ups create a trade-off.

Short-term impact:

Higher taxable income

Reduced ability to lower current-year tax bills

Long-term benefits:

Tax-free growth

Tax-free withdrawals in retirement

Reduced exposure to future tax rate increases

Potentially lower Medicare IRMAA and Social Security taxation later in life

At Greenbush Financial Group, we often see this rule align well with broader Roth conversion strategies already being implemented for higher-income households.

Employer and Plan Administration Considerations

Employers must ensure their retirement plans are properly updated to allow Roth catch-up contributions.

Key considerations:

Plans that do not allow Roth contributions may need amendments

Failure to comply could eliminate the ability to make catch-up contributions entirely

Payroll and recordkeeping systems must track Roth-only catch-ups correctly

This is an important operational issue for both employers and employees to confirm well before 2026.

Planning Strategies Before 2026

There is still time to plan proactively.

Strategies to consider:

Evaluating partial Roth conversions during lower-income years

Coordinating catch-up contributions with overall tax bracket management

Reviewing whether employer plans are Roth-enabled

According to guidance from the Internal Revenue Service, compliance will be strictly tied to wage reporting, making advance planning essential.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Frequently Asked Questions About Mandatory Roth Catch-Up Contributions

-

What is the mandatory Roth catch-up rule starting in 2026?It requires higher-earning employees age 50+ to make all retirement plan catch-up contributions on a Roth (after-tax) basis.

-

What income level triggers mandatory Roth catch-ups?The rule applies to individuals with prior-year W-2 wages above $150,000 (2025 amount), indexed for inflation.

-

Does this rule apply to IRAs?No. The mandatory Roth catch-up requirement only applies to employer retirement plans, not IRAs.

-

Can I still make pre-tax contributions if I’m a high earner?Yes. The rule only affects catch-up contributions; standard employee deferrals may still be pre-tax.

-

What happens if my employer’s plan doesn’t offer Roth contributions?If Roth contributions are not available, catch-up contributions may not be permitted until the plan is amended.

-

Is mandatory Roth catch-up a bad thing for retirees?Not necessarily. While taxes may increase today, Roth catch-ups can significantly reduce taxes in retirement if used strategically.

2026 New York State Mandatory IRA Rules: What Employers Must Do to Stay Compliant

New York State’s Secure Choice IRA program is creating new compliance requirements for many employers beginning in 2026. Businesses with 10 or more employees that do not already offer a qualified retirement plan may be required to enroll workers in this state-facilitated Roth IRA program. Our analysis at Greenbush Financial Group explains who must comply, employer responsibilities, potential penalties, and why alternative retirement plans like SIMPLE IRAs or 401(k)s may offer greater long-term value.

New York State now requires many employers to offer a retirement savings option through the state-mandated Secure Choice IRA program. If your business has at least 10 employees and does not already offer a qualified retirement plan, participation is mandatory. Our analysis at Greenbush Financial Group shows that understanding who must comply, how the program works, and what alternatives exist can help business owners avoid penalties while improving employee retention. This article explains New York’s mandatory IRA rules and outlines smarter planning options for employers.

What Is the New York State Mandatory IRA Program?

The New York State mandatory IRA requirement applies through the New York State Secure Choice Savings Program, a state-facilitated retirement savings option for private-sector employees.

Secure Choice is designed for workers who do not have access to an employer-sponsored retirement plan. Employers act as facilitators, while the state oversees the program’s administration.

Key characteristics:

Roth IRA structure for employees

Automatic payroll deductions

No employer contributions required

State-administered investment options

Which New York Employers Are Required to Offer a Mandatory IRA?

Under New York law, participation is mandatory if all of the following apply:

You have 10 or more employees

You have been in business for at least two years

You do not currently offer a qualified retirement plan such as a 401(k), SIMPLE IRA, or SEP IRA

At Greenbush Financial Group, we commonly see confusion around part-time and seasonal employees. For Secure Choice purposes, employees are generally counted if they are on payroll, regardless of hours worked.

Which Businesses Are Exempt From the Requirement?

You are exempt from the New York mandatory IRA requirement if your business already offers:

A 401(k) or Safe Harbor 401(k)

A SIMPLE IRA

A SEP IRA

A defined benefit or cash balance pension plan

Offering any qualified retirement plan removes the obligation to participate in Secure Choice. This exemption often creates an opportunity for employers to choose a more flexible and customizable plan instead.

How the Secure Choice IRA Works for Employees

Eligible employees are automatically enrolled unless they opt out.

Default program features include:

Automatic enrollment at a preset contribution rate

Contributions made on a Roth (after-tax) basis

Employee-owned accounts that move with them if they change jobs

Limited investment menu selected by the state

Employees can:

Change contribution amounts

Opt out at any time

Withdraw funds subject to Roth IRA rules and penalties

Employer Responsibilities Under the Mandatory IRA Law

Although employers do not contribute financially, they still carry administrative responsibilities.

Employer duties include:

Registering with the Secure Choice program

Providing employee information

Processing payroll deductions

Submitting contributions on schedule

Distributing required employee notices

Failure to comply may result in state enforcement actions once deadlines are fully phased in.

Deadlines and Penalties for Non-Compliance

New York’s rollout is being phased in by employer size, with enforcement expected to increase through 2026.

Potential consequences of non-compliance include:

Monetary penalties

State enforcement notices

Increased scrutiny for repeat violations

Our analysis at Greenbush Financial Group suggests that many business owners delay action simply because they are unaware the rule applies to them.

Is Secure Choice the Best Option for Employers?

For some businesses, Secure Choice meets the minimum requirement. However, it may not be the best long-term solution.

Limitations of the mandatory IRA include:

No employer contribution flexibility

Roth-only structure

Limited investment choices

Reduced perceived benefit compared to a 401(k)

In contrast, alternatives such as SIMPLE IRAs or 401(k) plans can:

Increase tax deductions for employers

Improve employee recruitment and retention

Offer higher contribution limits

Allow customized plan design

At Greenbush Financial Group, we often help employers compare Secure Choice with private retirement plans to determine the most cost-effective and strategic solution.

Planning Considerations for Business Owners

When deciding how to comply, consider:

Your employee demographics and turnover

Tax deductions available to the business

Administrative complexity

Long-term growth and scalability

Choosing the right retirement plan is not just about compliance; it is a strategic business decision.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Frequently Asked Questions About New York State Mandatory IRAs

-

Is the New York State Secure Choice IRA mandatory for all businesses?No. It is only mandatory for businesses with 10 or more employees that do not already offer a qualified retirement plan.

-

Do employers have to contribute to the Secure Choice IRA?No. Employers are not allowed or required to make contributions; only employee payroll deductions are permitted.

-

What happens if my business ignores the mandatory IRA requirement?Non-compliance may result in penalties and enforcement actions as the state increases oversight.

-

Can employees opt out of the New York mandatory IRA?Yes. Employees are automatically enrolled but may opt out or change contributions at any time.

-

Does offering a SIMPLE IRA exempt my business from Secure Choice?Yes. Offering a SIMPLE IRA, 401(k), or SEP IRA fully satisfies the requirement.

-

Is Secure Choice better than a 401(k) for small businesses?Not always. While Secure Choice is simple, many businesses benefit more from private plans with higher limits and tax advantages.

How Rich Retirees Use Debt to Save on Taxes and Protect Their Investments

Borrowing in retirement might seem surprising, but for high-net-worth retirees, strategic debt can be a powerful financial planning tool. Instead of triggering large capital gains taxes by selling investments, many wealthy retirees use low-cost borrowing to access liquidity while keeping their portfolios fully invested. In this article, Greenbush Financial Group explains how securities-backed lines of credit, HELOCs, margin loans, and other strategies can help retirees manage taxes, preserve growth, and maintain financial flexibility.

It might sound counterintuitive: if you’ve saved millions for retirement, why borrow money at all? Yet many wealthy retirees intentionally use debt as a financial planning tool. Strategic borrowing can help preserve portfolio value, manage taxes, and access liquidity without triggering large capital gains.

The key isn’t whether you borrow—but how and when. Here’s why financially independent retirees still use leverage, and how they do it at the lowest possible cost.

The Strategy Behind Borrowing in Retirement

For many retirees, the instinct is to pay off all debt before leaving the workforce. That’s smart for high-interest loans or unstable budgets—but not always for those with significant assets. Wealthy retirees often continue borrowing because it offers flexibility that selling investments does not.

The main reasons include:

Avoiding large taxable sales in brokerage or trust accounts

Keeping investments fully invested during market growth

Accessing liquidity for real estate, business, or family needs

Taking advantage of low interest rates or deductible borrowing options

At Greenbush Financial Group, we see this most often with clients who have appreciated portfolios or taxable trusts—they’d rather borrow temporarily than realize large capital gains and lose compounding potential.

Why Borrowing Can Be Cheaper Than Selling

Borrowing money doesn’t trigger taxes; selling investments does. If you sell appreciated assets to raise cash, you could owe capital gains tax of up to 23.8% federally (20% long-term plus 3.8% Net Investment Income Tax), plus potential state taxes.

Example:

A retiree with $1 million in long-term appreciated stock may owe over $200,000 in taxes if sold outright. Borrowing $250,000 against a portfolio or property can access cash immediately—often at interest rates of 5–6%—while deferring or avoiding that tax bill entirely.

For many, the after-tax cost of borrowing is lower than the effective tax cost of liquidation.

Common Low-Cost Borrowing Strategies for Retirees

There are several ways high-net-worth retirees access cash without disrupting their investment or tax strategy.

1. Securities-Backed Lines of Credit (SBLOCs)

An SBLOC allows you to borrow against your taxable investment portfolio, typically up to 50–70% of its value.

Rates often range between 5–7%, depending on the lender.

Interest-only payments are common, offering flexibility.

No credit check or underwriting is required beyond the assets themselves.

Caution: if markets decline sharply, the lender can require additional collateral or partial repayment.

2. Home Equity Lines of Credit (HELOCs)

Even wealthy retirees may use HELOCs to fund large expenses such as renovations, second homes, or bridge financing.

Interest may be deductible if used for home improvements.

Flexible draw periods make it easy to access only what you need.

Current rates vary, but fixed options can provide predictability.

3. Margin Loans for Portfolio Liquidity

Margin loans through brokerage accounts allow investors to borrow directly against securities.

Typically used for short-term needs or opportunistic purchases.

Rates depend on account size—often lower for high-net-worth clients.

Requires careful monitoring to avoid margin calls during volatility.

4. Cash Value Life Insurance Loans

Retirees with permanent life insurance policies can borrow against accumulated cash value tax-free.

No credit check or repayment schedule.

Interest accrues against the policy, not external debt.

Works best when used sparingly and managed over decades.

5. Family or Trust Lending

Some retirees lend to children or family trusts using IRS-approved Applicable Federal Rates (AFRs)—currently well below most commercial lending rates.

Can serve estate-planning goals while keeping assets in the family.

Requires formal loan documents and consistent payment terms.

When Borrowing Makes Sense (and When It Doesn’t)

Borrowing in retirement can be powerful, but it’s not for everyone.

It can make sense if:

You have a large taxable portfolio or illiquid real estate holdings

You expect long-term investment growth exceeding borrowing costs

You’re managing capital gains, Roth conversions, or Medicare thresholds

It’s risky if:

You need stable monthly cash flow

Your investments are volatile or highly concentrated

You’re carrying multiple types of debt already

Borrowing should support—not replace—a comprehensive income plan.

How Rich Retirees Keep Borrowing Costs Low

Wealthy retirees often have access to rates below what most consumers see because they borrow against assets, not income. Lenders view a $3 million portfolio differently than a paycheck.

Ways they minimize cost include:

Negotiating private banking relationships for rate discounts

Keeping large asset balances at lending institutions

Using securities-based lines instead of personal loans

Deducting certain interest payments when eligible under IRS rules

At Greenbush Financial Group, we often coordinate between a client’s lender, tax preparer, and investment advisor to ensure each borrowing decision fits their larger tax and income strategy.

The Bottom Line

Even for retirees who are financially independent, liquidity and tax management matter. Borrowing can be a smart, temporary tool to access cash without dismantling a well-built portfolio. When used strategically, the right type of low-cost loan can help preserve wealth, reduce taxes, and maintain flexibility.

The key is to treat debt as part of a coordinated plan, not a shortcut. A thoughtful lending strategy can make your money work harder—even when you no longer need a paycheck.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

FAQs: Borrowing in Retirement

-

Why would a wealthy retiree take on debt?To access liquidity without selling investments and triggering capital gains taxes.

-

What’s the difference between an SBLOC and a margin loan?Both use investments as collateral, but SBLOCs are separate from trading accounts and often carry more flexible terms.

-

Can retirees deduct interest on borrowed funds?In some cases, yes—if the loan proceeds are used for investment or home improvement purposes.

-

Is borrowing against investments risky?It can be if markets decline and collateral values drop, so monitoring and limits are essential.

-

What’s the cheapest way for retirees to borrow?Securities-backed credit lines and family lending arrangements typically offer the lowest rates for high-net-worth households.

NYS Retiree Medicare Part B and IRMAA Reimbursement Process Explained

New York State retiree health benefits include a powerful perk: reimbursement for Medicare Part B premiums after age 65. But many retirees don’t realize that IRMAA surcharges can also be reimbursed — and that process is manual. This guide explains how NYS Part B reimbursement works automatically through pension increases, how IRMAA (Income-Related Monthly Adjustment Amount) raises Medicare premiums for higher earners, what form you must file to get IRMAA money back, and how to claim up to four years of missed reimbursements.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

For individuals who retire from New York State service, the retiree health benefits are among the most generous in the country. One of the most valuable — and often misunderstood — features is how Medicare Part B premiums and IRMAA surcharges are reimbursed after age 65.

This article explains, in plain language:

How New York State automatically reimburses retirees for Medicare Part B premiums

How IRMAA (Income-Related Monthly Adjustment Amount) works and why higher earners pay more

The manual process required to get reimbursed for IRMAA

How far back you can go to reclaim missed IRMAA reimbursements

What retirees (and spouses) need to do each year to stay reimbursed

How Does New York State Reimburse Retirees for Medicare Part B Premiums?

Once a New York State retiree reaches age 65 and enrolls in Medicare, the Medicare Part B premium reimbursement is automatic.

There is no form to file and no annual application required for the base Medicare Part B premium.

Here’s how it works:

When you turn 65 and enroll in Medicare Part B during your open enrollment window

New York State automatically increases your monthly pension by the amount of the standard Medicare Part B premium

This applies to:

The retiree

A spouse who is covered under the New York State retiree health plan

That automatic pension increase is why New York State retiree health benefits are considered so lucrative — the reimbursement applies to both the retiree and their spouse, which can amount to thousands of dollars per year.

2026 Medicare Part B Example

In 2026, the base Medicare Part B premium is $202.90 per month.

Example:

A New York State retiree is receiving a pension of $2,000 per month

Upon turning 65 and enrolling in Medicare Part B

Their pension automatically increases to $2,202.90 per month

That increase directly offsets the Medicare Part B premium that is being deducted from their Social Security check.

If you are only paying the standard Medicare Part B premium, no action is required beyond enrolling in Medicare on time.

Understanding IRMAA: Why Higher-Income Retirees Pay More for Medicare

Medicare premiums are income-based. As income rises, so does the Medicare Part B premium — this additional charge is known as IRMAA (Income-Related Monthly Adjustment Amount).

2026 IRMAA Income Thresholds

For 2026, IRMAA begins when income exceeds:

Single filers: $109,000

Married filing jointly: $218,000

Above those levels, Medicare Part B premiums increase in steps as income rises.

IRMAA Example for a NYS Retiree

Let’s say:

A single New York State retiree

With retiree health benefits

Earns $200,000 in 2026

Instead of paying the base $202.90 per month, their Medicare Part B premium increases to $527.50 per month due to IRMAA.

That’s an additional $324.60 per month, or nearly $3,900 per year, in extra Medicare costs.

How IRMAA Reimbursements Work for New York State Retirees

New York retirees are often pleasantly surprised to find out that the retiree health plan not only reimbursement them for the standard Medicare premium but also the IRMAA amount but the IRMAA reimbursement process is not automatic.

What Happens Automatically vs. Manually

✅ Base Medicare Part B premium

Reimbursed automatically through an increased pension payment

❌ IRMAA surcharge

Requires a physical application each year

To receive reimbursement for IRMAA, the retiree must:

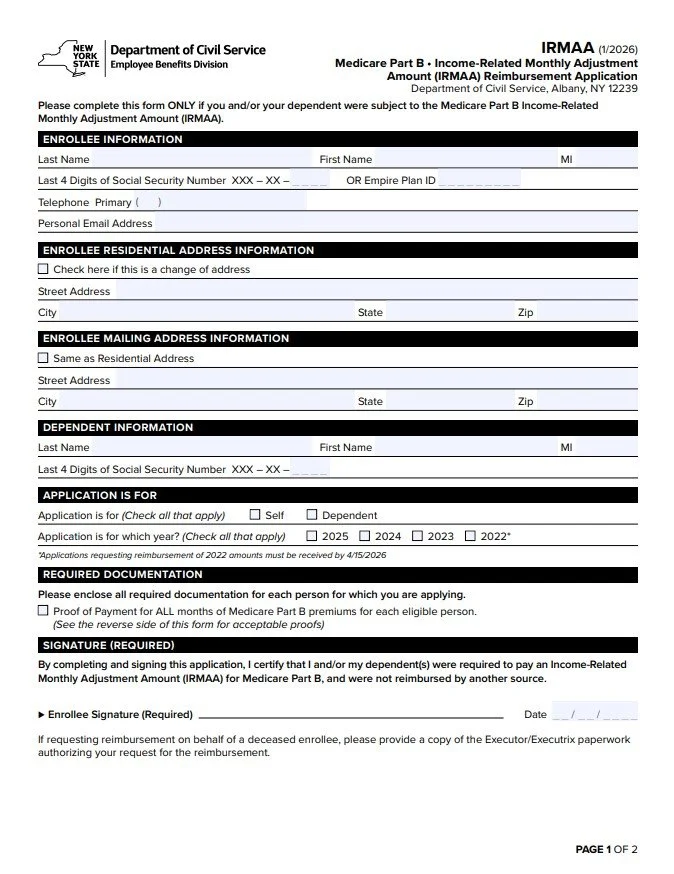

Complete the IRMAA reimbursement form from the New York State Department of Civil Service (below is a picture of the form)

Attach documentation from Social Security showing:

The Medicare Part B premiums paid for the year

Mail the form and documentation to New York State

Receive reimbursement by check

You Can Go Back Up to Four Years to Reclaim Missed IRMAA Reimbursements

If you’re reading this and realizing you’ve been paying IRMAA for years without reimbursement — there’s good news.

New York State allows retirees to go back up to four years to recoup IRMAA premiums already paid.

On the IRMAA reimbursement form, you can:

Check the boxes for each year you were subject to IRMAA

Submit the required Social Security tax documentation for each year

When approved, New York State will issue reimbursement checks for those prior years.

A Simple Annual Reminder Strategy

For our clients who we know will be subject to IRMAA every year, we recommend a very simple system:

Set a recurring reminder for January or February

When your Social Security tax form arrives showing Medicare premiums paid:

Complete the IRMAA reimbursement form

Attach the documentation

Mail it to New York State

That’s it.

New York State does not advertise this process — which is exactly why many retirees miss out on thousands of dollars they’re entitled to receive.

If you’re a New York State retiree — especially one with higher retirement income — understanding this process can mean thousands of dollars back in your pocket every year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Attention Non-Spouse 10-Year Beneficiaries: 2030 Is Rapidly Approaching

If you inherited an IRA or other retirement account from a non-spouse after December 31, 2019, the SECURE Act’s 10-year rule may create a major tax event in 2030. Many beneficiaries don’t realize how much the account can grow during the 10-year window—potentially forcing large taxable withdrawals if they wait until the final year. In this article, we explain how the 10-year rule works, why 2030 is a high-risk tax year, and planning strategies that can reduce the tax hit long before the deadline arrives.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

If you inherited an IRA or other retirement account from a non-spouse after December 31, 2019, the clock is ticking—and for many families, the tax consequences are coming into sharper focus.

The SECURE Act, which went into effect in 2020, dramatically changed how non-spouse beneficiaries must handle inherited retirement accounts. While these rules may have seemed far off at the time, 2030 is now just around the corner for those who inherited accounts in the first year of the new law.

In this article, we’ll cover:

How the SECURE Act’s 10-year rule works

Why 2030 could trigger significant tax liabilities

How market growth has quietly made the problem bigger

Practical tax-planning strategies to consider now

Why waiting until the last year can be costly

A Quick Refresher: What Changed Under the SECURE Act?

Prior to 2020, most non-spouse beneficiaries could “stretch” distributions from an inherited IRA over their lifetime. This allowed smaller required distributions and, in many cases, never required the account to be fully depleted.

That all changed with the SECURE Act.

For most non-spouse beneficiaries:

The inherited retirement account must be fully depleted within 10 years

The rule applies to anyone who passed away after December 31, 2019

All pre-tax dollars distributed during that period are taxable income

From the IRS’s perspective, this rule change was a revenue raiser—it ensures that inherited retirement assets become taxable within a defined window.

Why 2030 Is Such a Big Deal

For individuals who inherited a retirement account from someone who passed away in 2020, the 10-year clock runs out at the end of 2030.

That means:

Only five tax years remain (2026–2030) before the final distribution year

Any remaining balance must be distributed—and taxed—by the end of year 10

Large balances could result in substantial one-year tax spikes

Many beneficiaries have only been taking small distributions or the minimum required amounts. While that may have felt prudent at the time, it can create a tax bombshell in the final year if the account balance is still large.

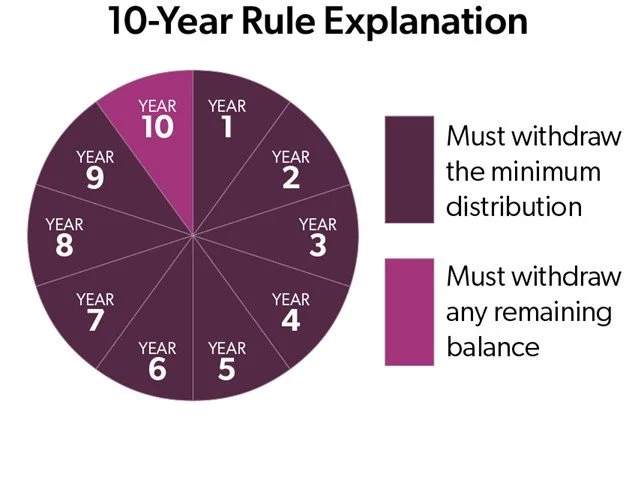

RMD Rules Add Another Layer of Complexity

Required Minimum Distribution (RMD) rules under the SECURE Act depend on whether the original account owner was already taking RMDs when they passed away.

Some beneficiaries were required to take annual RMDs

Others were not required to take annual distributions—but still must empty the account by year 10

Regardless of which category you fall into, the key issue remains the same:

Waiting too long often concentrates taxable income into fewer years.

Market Growth Has Made the Problem Bigger

Ironically, strong market performance over the past several years has amplified the issue.

For individual that have a large allocation to stocks within their inherited IRA, since the market returns have been so strong over the past few years, they may have seen the balance in their inherited IRA increase despite taking RMDs from the account each year.

This is great from a wealth-building perspective, but it also means:

Larger balances remain late in the 10-year window

Larger forced distributions

Larger tax bills await

In short, investment success can unintentionally worsen the tax outcome if distributions aren’t coordinated with a broader tax plan.

Why Smoothing Income Often Makes Sense

For many non-spouse beneficiaries, the goal should be tax smoothing—intentionally spreading distributions over the remaining years to avoid one massive taxable event in year 10.

This often means:

Taking more than the minimum each year

Coordinating distributions with your current income level

Evaluating how many years remain in your 10-year window

The sooner this planning happens, the more flexibility you typically have.

One Common Strategy: Offset Taxes With 401(K) Contributions

One tax-planning strategy we often explore with clients involves maximizing employer-sponsored retirement plan contributions.

Here’s a simplified example:

A 50-year-old employee is contributing $15,000 to their 401(k)

In 2026, they may be eligible to contribute up to $32,500

That’s an additional $17,500 of potential pre-tax deferrals

A possible strategy:

Take a $17,500 distribution from the inherited IRA (taxable)

Increase payroll deferrals so more income flows into the 401(k) pre-tax

Use the inherited IRA distribution to supplement take-home pay

Result:

Taxable income from the inherited IRA distribution is fully offset by pre-tax retirement contributions, while also shifting assets into the inherited IRA owner's personal 401(k) account, which does not have a 10-year distribution restriction.

A Critical Caveat for 2026

High-income earners should be aware that starting in 2026, certain catch-up contributions for those over age 50 may be required to be made as Roth contributions. Roth deferrals do not provide an immediate tax deduction, which could limit the effectiveness of this strategy.

When Waiting Can Make Sense

Not every situation calls for accelerating distributions.

For individuals who plan to retire before the 10-year period ends, delaying distributions may be intentional and strategic. Once paychecks stop:

Ordinary income may drop significantly

Larger inherited IRA distributions could fall into lower tax brackets

This can be a very effective approach—but only when planned in advance.

The Real Warning Sign to Watch For

This article isn’t about fear—it’s about awareness.

If you:

Inherited a retirement account after 2019

Have only been taking small distributions or RMDs

Haven’t mapped out the remaining years of your 10-year window

There’s a real risk that a large, avoidable tax liability is waiting at the end of the road.

Final Thoughts

The SECURE Act permanently changed the landscape for non-spouse beneficiaries, and 2030 is approaching faster than many realize. Thoughtful, proactive tax planning—especially in the final years of the 10-year period—can make a meaningful difference in outcomes.

Now is the time to:

Count the remaining years

Project future tax exposure

Coordinate investment, distribution, Medicare premium, and tax strategies

Advanced planning today can help turn a looming tax problem into a manageable—and sometimes even strategic—opportunity.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

New York State Secure Choice Law — Companies Are Now Required to Sponsor Retirement Plans for Employees

New York’s SECURE Choice program is changing how many employers must handle retirement benefits. If your business doesn’t currently offer a qualified retirement plan, you may be required to either register for SECURE Choice or implement an alternative plan option. In this article, we break down who must comply, key deadlines, and what employers should do now to avoid penalties and ensure employees have a retirement savings solution.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The New York State Secure Choice Savings Program requires most companies and not-for-profit organization in New York to either:

Sponsor a qualified employer-sponsored retirement plan, or

Register for the state-run Roth IRA program and remit employee contributions.

This law affects businesses based on size and existing retirement plan offerings. In this article, we’ll explain:

Who is covered under the law

Important effective dates by company size

What qualifies as an exempt employer-sponsored retirement plan

How to certify exemptions

Employer responsibilities in remitting contributions

How employees interact with their state-run IRAs

Penalties for non-compliance

Practical tips for employers to prepare

What Is the NY Secure Choice Savings Program?

The Secure Choice program is a state-sponsored retirement savings program that allows participating employees to save for retirement through automatic payroll deductions into a Roth IRA. Employers who do not already offer a qualified plan are required to facilitate the program.

The program is overseen by the New York Secure Choice Savings Program Board and is designed to expand retirement savings access to private-sector workers across the state.

Who Must Comply?

An employer must either offer a employer-sponsored retirement plan or participate in the Secure Choice program if all of the following are true:

The employer has 10 or more employees in New York during the prior calendar year;

The employer has been in business for at least two years;

The employer does not already offer an employer-sponsored retirement plan to employees.

Employers with fewer than 10 employees are generally not required to participate in the state program, though they must still register and certify exemption if applicable.

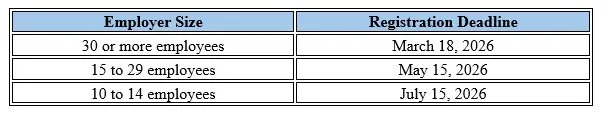

Effective Dates Based on Employer Size

Secure Choice implementation in 2026 is staggered based on the number of New York employees:

These are the dates by which employers must either:

Register for the Secure Choice program, or

Certify exemption via the official state portal.

Exemptions: Qualifying Employer-Sponsored Retirement Plans

However, even if an employer meets the employee-size threshold above, it is exempt from the Secure Choice program if it already sponsors an employer-sponsored retirement plan. Employers must still certify their exemption through the Secure Choice portal.

Qualifying employer-sponsored plans include:

401(k) plans

403(a) qualified annuity plans

403(b) tax-sheltered annuity plans

SEP IRAs

SIMPLE IRA plans

457(b) plans

If you offer one of the above, your business can avoid participation in the state program — but you must still submit an exemption through the official portal.

How to Certify an Exemption

Employers seeking exemption need to log in to the Secure Choice employer portal and submit documentation of their qualified plan. Details include:

Federal Employer Identification Number (EIN)

Access Code (typically sent to employers by mail or email)

Plan documentation showing current retirement plan offerings

Official website for registration and exemptions: www.NewYorkSecureChoice.com

Employer Responsibilities if Participating in Secure Choice

If your business does not qualify for an exemption, you must:

Register for Secure Choice by the deadline assigned to your employer size.

Automatically enroll eligible employees into the program. (Eligibility is all employee age 18 or older with earned taxable wages)

Set up payroll deductions and begin subtracting employee contributions.

Remit contributions to the state-administered Roth IRAs.

Upload employee data and maintain records via the program portal.

Employers do not contribute to the accounts, and they cannot offer matching contributions under the Secure Choice IRA program.

How Contributions Work

Remitting Employee Payroll Contributions

Contributions are deducted from employee paychecks via automatic payroll withholding.

Employers are responsible for timely remittance of these contributions to the state program’s recordkeeper (program administrators).

Employers do not make employer contributions.

Default Contribution and Adjustments

Employees are typically auto-enrolled at a default 3% contribution rate of gross pay.

Employees may adjust the contribution amount or opt out entirely within the enrollment period or later open enrollment windows.

Employee Experience With Secure Choice

Account Setup and Features

Each participating employee gets a Roth IRA account through the Secure Choice program.

Contributions are after-tax, meaning withdrawals in retirement are generally tax-free (subject to Roth IRA rules).

Accounts are portable — employees keep them even if they change jobs.

Investing, Contribution Limits, and Withdrawals

Employees can choose investment options provided by the program or stay with the default investment.

They can change contribution rates or opt out after the initial enrollment period.

Roth IRA contribution limits apply (e.g., the standard IRA annual limits — $7,500 for 2026 before catch-up, potentially higher with catch-up contributions for those 50+, etc.).

Distributions follow general Roth IRA rules (qualified distributions tax-free and penalty-free after meeting age/service requirements).

How Employees Are Enrolled in the NY Secure Choice Roth IRA Program

A common question from employers is whether they are responsible for enrolling employees, or whether employees must sign themselves up. Under the New York State Secure Choice Savings Program, the process works as follows:

Employers Facilitate Enrollment — Employees Do Not Self-Enroll

Employers do not actively “sign up” employees, and employees do not enroll themselves directly. Instead, enrollment happens through automatic payroll facilitation by the employer.

Here’s how the process works step-by-step:

Step 1: Employer Registers and Uploads Employee Information

Once an employer registers for Secure Choice (or confirms participation is required), the employer must:

Upload required employee data into the Secure Choice employer portal, including:

Employee name

Social Security number or Tax ID

Date of hire

Contact information

Identify eligible employees who meet program requirements

For newly hired employees, the employer needs to enroll them in the Secure Choice Program within 30 days of their hire date

This step triggers the enrollment process, but it does not immediately deduct contributions.

Step 2: Employees Receive Enrollment Notice From the State Program

After the employer uploads employee information:

The Secure Choice program (or its appointed program administrator) sends official enrollment notices directly to employees

The notice explains:

That the employee will be automatically enrolled

The default contribution rate

How to opt out or change contribution levels

Where to access their account online

This communication comes from the state program, not the employer.

Step 3: Automatic Enrollment Occurs Unless the Employee Opts Out

If the employee takes no action during the notice period:

The employee is automatically enrolled in a state-sponsored Roth IRA

Payroll deductions begin at the default contribution rate (generally 3% of gross pay, unless adjusted by the employee)

If the employee chooses to opt out:

No deductions are taken

The employer must maintain records showing the opt-out election

Step 4: Employer Begins Payroll Withholding and Remittance

Once enrollment is active:

The employer withholds the elected contribution amount from each paycheck

Contributions are remitted to the Secure Choice program on a recurring basis, aligned with payroll schedules

The employer’s role is limited to withholding and remitting contributions — similar to payroll taxes

Importantly:

Employers do not select investments

Employers do not manage accounts

Employers do not provide investment advice

Employers do not contribute employer funds

Step 5: Ongoing Employee Control

After enrollment:

Employees manage their own accounts directly through the Secure Choice program

Employees can:

Change contribution percentages

Opt out or opt back in later

Select or change investment options

Request distributions (subject to Roth IRA rules)

The account belongs to the employee and is fully portable if they change jobs.

Penalties for Non-Compliance

While specific penalties in the Secure Choice law are still being formalized, failure to register or certify your exemption by the applicable deadline can subject employers to:

Administrative penalties and fines

Potential liability for missed remittance obligations

Ongoing penalties until compliance is achieved

For example, programs in other states have assessed penalties like $250 per employee per month for non-compliance, escalating over time. While New York’s specific fines may vary, the risk of enforcement is real and growing as the program rolls out statewide. However, as of February 2026, New York has yet to communicate when penalities will begin and what the amounts will be.

Tips for Employers

Start Early — Don’t Wait

Act well in advance of your registration deadline. If your company currently sponsors an employer-sponsored retirement plan, it’s making sure someone on your team will be logging into the NYS portal to file the exemption. For companies that plan to implement an employer-sponsored retirement plan prior to their deadline, there is extreme urgency to start evaluating as soon as possible both the type of plan that is best for the company and the platform for their plan. Establishing an employer-sponsored plan often involves:

Plan design and adoption

Document creation and compliance testing

Employee communications and elections

Payroll integration

If it’s the intent of your company / organization not establish a retirement plan and enroll employees in the state-mandated Roth IRAs, advanced action is still required. Companies will be required to gather the employee data and upload it to the NYS Secure Choice website, confirm how payroll will handle the automatic Roth deductions from payroll, who will be responsible for remitting the contributions to the NYS platform each pay period, and communication to the employees in advance of the payroll deduction is highly recommended.

Many businesses will be acting on these requirements in 2026 — waiting until the last minute can create unnecessary compliance risk.

Evaluate Whether to Offer Your Own Plan

Offering a 401(k) or other qualified plan may be more attractive for recruiting and retention, may allow employer matching, and could provide tax incentives not available under the state program. Also, there are a number of tax credits currently available to help offset some or all of the plan fees associated with establishing an employer-sponsored retirement plan for the first time. See our article below for detail on the start-up plan tax credits available:

GFG Article: 3 New Start-up 401(k) Tax Credits

How Many Other States Have Similar Mandated Retirement Programs?

New York is not alone in adopting a mandatory retirement savings program for private-sector employees. In fact, Secure Choice builds on a growing national trend aimed at addressing the retirement savings gap for workers who do not have access to an employer-sponsored plan.

As of today:

More than a dozen states (15+) have enacted legislation requiring certain employers to either:

Offer a qualified employer-sponsored retirement plan, or

Participate in a state-facilitated IRA program funded through payroll deductions.

Several of these programs are fully operational, while others are in various stages of implementation or phased rollout.

States that were early adopters (such as California, Oregon, and Illinois) now have millions of workers enrolled and billions of dollars in assets within their state-facilitated retirement programs.

New York Has Selected Vestwell

New York has selected a company by the name of Vestwell to serve as the program administrator for the state-mandated Roth IRA accounts.

Choosing a Startup Retirement Plan Provider: What Employers Should Know

For many employers, the Secure Choice law will prompt a first-time decision about whether to start an employer-sponsored retirement plan instead of participating in the state-run IRA program. While this can be a positive move for employee recruitment and retention, it’s important to understand that not all startup plan providers — or pricing models — are the same.

There Are Many Choices — and Fees Vary Widely

Employers exploring startup plans will quickly find a wide range of providers, including bundled platforms, payroll-integrated solutions, and self-directed providers. Costs can differ significantly depending on:

Plan administration fees

Investment platform and fund expenses

Recordkeeping and compliance costs

Per-participant charges

Advisor or fiduciary service fees (if applicable)

Some providers advertise low headline pricing but layer on additional costs elsewhere. Others charge flat fees that may be economical at certain asset levels but expensive for smaller plans. Understanding how fees are structured — and how they may grow over time — is critical when selecting a provider.

Start-up 401(k) Provider

In the past, we have worked with companies that successfully used Employee Fiduciary as a start-up 401(k) solution. Employee Fiduciary is a national-level 401(k) provider that offers flexibility with plan design, Vanguard index funds for investment options, and fee transparency.

Disclosure: This statement is not an endorsement of Employee Fiduciary or their 401(k) solution. Our firm has had experience in working with Employee Fiduciary in the past, and since we do not offer investment services to start-up plans, we want to be able to connect readers with what I, as the author of this article, deem to be a high-quality start-up 401(k) plan solution. Our firm does not receive any form of compensation for referring clients to Employee Fiduciary.

Conclusion

The New York Secure Choice Savings Program represents a significant change for private employers in the state. Whether you must register for the state-run IRA program or certify exemption with your existing retirement plan, compliance is mandatory and deadlines are coming fast in 2026.

By planning ahead — and consulting legal, tax, or benefits professionals if needed — employers can meet these requirements smoothly while ensuring their employees have access to valuable retirement savings opportunities.

A Note on Our Firm’s Focus

Our firm does not offer solutions for brand-new startup plans. We specialize in working with established retirement plans that already have at least $250,000 in plan assets, for which we provide investment management and plan consulting services.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Trump Accounts For Minor Children Explained: A New Wealth-Building Opportunity

Trump Accounts are a new retirement savings vehicle created under the 2025 tax reform that allow parents, grandparents, and even employers to contribute up to $5,000 per year for a minor child — even if the child has no earned income. In this article, we explain how Trump Accounts work, contribution limits, tax rules, planning opportunities, and the key considerations to understand before opening one.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Over the past several months, we’ve received a lot of questions from parents and grandparents about the new Trump Accounts created under the 2025 tax reform. Most of those questions fall into a few clear categories:

How do Trump Accounts get set up?

Who can fund them, and how much can be contributed?

What makes them different from traditional or Roth IRAs?

And most importantly—are they really worth it?

What’s driving so much interest is that these accounts can be a tremendous long-term wealth-building opportunity for children and grandchildren. Unlike traditional or Roth IRAs, which require earned income to contribute, Trump Accounts allow up to $5,000 per year in contributions even if the child has no income at all. That creates decades of potential tax-deferred compounding.

That said, Trump Accounts also come with a unique set of rules, especially while the account owner is a minor. In this article, we’ll break down how Trump Accounts work, how they’re funded, how they interact with other retirement accounts, and where the real planning opportunities—and responsibilities—exist.

What Is a Trump Account?

A Trump Account is a new type of retirement account designed specifically for minors, created as part of the One Big Beautiful Bill Act of 2025. Conceptually, it is built on the framework of a traditional IRA, but with special rules that apply from birth through age 17.

The goal of these accounts is simple: to jump-start retirement savings as early as possible, even before a child has their first job.

Contribution Limits and Funding Rules

Annual Contribution Limits

Total annual contributions are limited to $5,000 per year

Of that amount, up to $2,500 may come from an employer

These limits apply beginning in 2026 and will be indexed for inflation in future years

Who Can Contribute?

Trump Accounts can receive contributions from several sources:

Parents, grandparents, or other individuals (after-tax)

Employers (pre-tax)

Government or charitable entities (pre-tax)

A one-time $1,000 federal government contribution for eligible children

Importantly, individual contributions are made with after-tax dollars, meaning they create “basis” in the account, while employer and government contributions are pre-tax.

The $1,000 Government Contribution

As part of a pilot program, the federal government will contribute $1,000 to a Trump Account for children born between 2025 and 2028, provided the parent or guardian opts in.

Key points:

The contribution is pre-tax

It does not count toward the $5,000 annual limit

Parents must actively elect the contribution—it is not automatic

This is essentially “free money,” and for many families, that alone may justify opening the account.

How Trump Accounts Can Be Invested

Trump Accounts have very strict investment rules:

Accounts must be established with initial trustees selected by the U.S. Treasury

Individuals may have only one Trump Account

Investments are limited to unleveraged mutual funds or ETFs

The investments must track a qualified index of primarily U.S. equities

Holding cash is virtually not allowed

Total investment fees cannot exceed 0.10%

At this time, the list of approved custodians has not yet been released, and is expected sometime in 2026.

How and When Trump Accounts Are Set Up

Trump Accounts cannot be opened with a traditional custodian yet.

Here’s what we know about the setup process:

Accounts become operational starting July 4, 2026

All accounts must initially be opened using U.S. Treasury–approved trustees

A new IRS Form 4547 and an online application at trumpaccounts.gov are expected to launch in mid-2026

To establish the accounts Form 4547 or the special application can be submitted prior to the July 4, 2026 program launch date

That same process will be used to request the $1,000 government contribution

Once established, families can begin making annual contributions.

Special Rule for Working Minors

One of the most powerful planning features applies to minors who do have earned income.

If a child earns income:

They can contribute to a Trump Account

They can also contribute to a traditional IRA or Roth IRA

The contribution limits do not reduce or affect one another

In other words, a working minor can fund both account types in the same year, creating even more long-term compounding potential.

Roth Conversion Opportunity After Age 18

Once the account owner turns 18, Trump Accounts largely revert to standard traditional IRA rules.

This is where advanced planning opportunities emerge:

It can then be converted to a Roth IRA

Once converted, future growth and qualified withdrawals may be tax-free

However, there’s an important catch.

Tracking Basis Is Critical

Individual contributions were made with after-tax dollars

Employer and government contributions are pre-tax

Investment growth is pre-tax

This creates a mixed-tax account, requiring careful basis tracking over time. If records aren’t maintained, the IRS may treat withdrawals as fully taxable.

Beware of Kiddie Tax: Roth conversions trigger a taxable event for any pre-tax contributions or earnings held within the Trump Account. Conversions and distributions from IRAs are considered unearned income of the minor child, which can trigger the Kiddie tax, making the taxable distribution amount subject to tax at the parent’s tax rate instead of the child’s.

Employer Contributions Are Allowed

Employers are permitted to contribute to Trump Accounts:

Contributions are pre-tax

They may be made for the employee or the employee’s dependent child

Employer contributions count toward the $5,000 annual limit (up to $2,500)

This opens the door for unique employer-based benefits and planning strategies.

How Trump Account Distributions Work After Age 18

Once a child reaches age 18, Trump Accounts undergo an important transition. While these accounts are designed for minors, the distribution rules after age 18 closely resemble those of a traditional IRA, which introduces both flexibility and responsibility.

Understanding how distributions work at this stage is critical, because mistakes can create unnecessary taxes or penalties.

No Distributions Before Age 18

First, it’s important to note that Trump Accounts do not allow distributions prior to age 18. Until then, the account is strictly a long-term retirement vehicle.

Once the account owner reaches the year they turn 18, distributions become available—but that does not mean they are penalty-free.

Traditional IRA Rules Apply After Age 18

Beginning in the year the child turns 18, the Trump Account is treated much like a traditional IRA for tax purposes. That means:

Distributions are generally taxable

Early withdrawals may be subject to a 10% penalty

The account follows pro-rata taxation rules if it contains both after-tax and pre-tax money

How Distributions Are Taxed

Trump Accounts typically hold two types of money:

After-tax contributions (from parents, grandparents, or others)

Pre-tax dollars, which include:

Employer contributions

Government contributions (including the $1,000 pilot contribution)

All investment growth

When a distribution is taken, the IRS does not allow the account owner to choose which dollars come out. Instead, each withdrawal is treated as a proportional mix of taxable and non-taxable funds.

Example (Simplified)

If 25% of the account consists of after-tax contributions, then:

25% of any distribution is tax-free

75% is taxable as ordinary income

This makes accurate recordkeeping essential, since the after-tax portion (known as “basis”) must be documented to avoid overpaying taxes.

Early Withdrawal Penalties Still Apply

Although distributions are allowed after age 18, they are not automatically penalty-free.

Withdrawals before age 59½ generally incur a 10% early withdrawal penalty

Certain exceptions may apply, such as:

Qualified higher education expenses

Limited first-time home purchase expenses

Certain structured payment arrangements

Absent one of these exceptions, both income taxes and penalties may apply.

Rollovers and Roth Conversions Instead of Distributions

Rather than taking cash distributions, many families will focus on rollovers and Roth conversions, which are allowed once the account owner turns 18.

At that point:

The Trump Account can be rolled into a traditional IRA

It may then be converted to a Roth IRA

A Roth conversion is taxable on the pre-tax portion of the account, but once completed, future growth and qualified withdrawals can be tax-free.

This strategy can be especially powerful if conversions are done during low-income years, though taxes still must be paid—ideally using funds outside the account to avoid penalties.

Final Thoughts

Trump Accounts represent a powerful but complex planning tool. For families focused on long-term retirement wealth for children or grandchildren, they offer an early start that was never possible before. However, the rules around taxation, investment limitations, and recordkeeping mean these accounts should be used strategically, not blindly.

As always, thoughtful planning—and understanding how these accounts fit into the bigger financial picture—makes all the difference.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQ)

1. Do children need earned income to have a Trump Account?

No. Earned income is not required.

2. Are contributions tax-deductible?

Individual contributions are not deductible. Employer and government contributions are pre-tax.

3. Can grandparents contribute?

Yes, as long as total annual limits are respected.

4. Can a child have more than one Trump Account?

No. Only one account per individual is allowed.

5. When can withdrawals be taken?

Distributions follow traditional IRA rules and generally are penalty-free after age 59½.

6. Are Roth conversions allowed?

Yes, starting at age 18 once the account follows IRA rules.

7. Are these accounts required to invest in stocks?

Yes. Investments must track qualified U.S. equity indexes.

8. Is the $1,000 government contribution automatic?

No. Parents must opt in using the IRS process.