Leaving Your Job? What Should You Do With Your 401(k)?

When you separate service from an employer, you have to make decisions with regard to your 401K plan. It’s important to understand the pros and cons of each option while also understanding that the optimal solution often varies from person to person based on their financial situation and objectives. The four primary options are:

1) Leave it in the existing 401(k) plan

2) Rollover to an IRA

3) Rollover to your new employer’s 401(k) plan

4) Cash Distribution

When you separate from an employer, there are important decisions to make regarding your 401(k) plan. It’s crucial to understand the pros and cons of each option, as the optimal solution often varies depending on individual financial situations and objectives. The four primary options are:

Leave it in the existing 401(k) plan

Rollover to an IRA

Rollover to your new employer’s 401(k) plan

Cash Distribution

Option 1:Leave It In The Existing 401(k) Plan

If your 401(k) balance exceeds $7,000, your employer is legally prohibited from forcing you to take a distribution or roll over the funds. You can keep your balance invested in the plan. While no new contributions are allowed since you’re no longer employed, you can still change your investment options, receive statements, and maintain online access to the account.

PROS to Leaving Your Money In The Existing 401(k) Plan

#1: No Urgent Deadline to Move

Leaving a job often coincides with major life changes—whether retiring, job hunting, or starting a new position. It’s reassuring to know that you don't need to make an immediate decision regarding your 401(k), allowing time to evaluate options and choose the best one.

#2: You May Not Be Eligible Yet For Your New Employer’s 401(k) Plan

One of the distribution options that we will address later in this article is rolling over your balance from your former employer's 401(k) plan into your new employer’s 401(k) plan. However, it's not uncommon for companies to have a waiting period for new employees before they're eligible to participate and the new company’s 401(k) plan. If you must wait a year before you have the option to roll over your balance into your new employer's plan, the prudent solution may be just to leave the balance in your former employer’s 401(k) plan, and just roll it over once you become eligible for the new 401(k) plan.

#3: Fees May Be Lower

It's also prudent to do a fee assessment before you move your balance out of your former employer’s 401(k) plan. If you work for a large employer, it's not uncommon for there to be significant assets within that company’s 401(k) plan, which can result in lower overall fees to any plan participants that maintain a balance within that plan. For example, if you work for Company ABC, which is a big publicly traded company, they may have $500 million in their 401(k) plan when you total up all the employee's balances. That may result in total annual fees of under 0.50% depending on the platform. If your balance in the plan is $100,000, and you roll over your balance to either an IRA or a smaller employer’s 401(k) plan, the total fees could be higher because you are no longer part of a $500 million pool of assets. You may end up paying 1% or more in fees each year, depending on where you roll over your balance.

#4: Age 55 Rule

401(k) plans have a special distribution option that if you separate from service with the employer after reaching age 55, you are allowed to request cash distributions directly from that 401(k) plan, but you avoid the 10% early withdrawal penalty that normally exists in IRA accounts for taking distributions under the age of 59 ½. For individuals that retire after age 55, not before age 59 ½, this is one of the primary reasons why we advise some clients to maintain their balance in the former employer’s 401(k) plan and take distributions from that account to avoid the 10% penalty. If they were to inadvertently roll over the entire balance to an IRA, that 10% early withdrawal penalty exception would be lost.

CONS to Leaving Your Money In The Existing 401(k) Plan

#1: Scattered 401(k) Balance

I have met with individuals who have three 401(k) plans, all with former employers. When I start asking questions about the balance in each account, how each 401(k) account is invested, and who the providers are, most individuals with more than one 401(k) account have trouble answering those questions. From both a planning and investment strategy standpoint, it's often more efficient to have all your retirement dollars in one place so you can very easily assess your total retirement nest egg, how that nest egg is invested, and you can easily make investment changes or updates to your personal information.

#2: Forgetting to Update Addresses

It's not uncommon for individuals to move after they've left employment with a company, and over the course of the next 10 years, it's not uncommon for someone to move multiple times. Oftentimes, plan participants forget to go back to all their scattered 401K plans and update their mailing addresses, so they are no longer receiving statements on many of those accounts which makes it very difficult to keep track of what they have and what it's invested in.

#3: Limited Investment Options

401(k) plans typically limit plan participants to a set menu of investments which the plan participant has no control over. Rolling your balance into a new employer’s plan or an IRA could provide a broader range of investment options.

OPTION 2: Rollover to an IRA

The second option for plan participants is to roll over their 401(k) balance to an IRA(s). The primary advantage of the IRA rollover is that it allows employees to remove their balance from their former employers' 401(k) plan, but it does not generate tax liability. The pre-tax dollars within the 401(k) plan can be rolled directly to a Traditional IRA, and any Roth dollars in the 401(k) plan can be rolled over into a Roth IRA.

PROS of 401K Rollover to IRAs

#1: Full Control of Investment Options

As I just mentioned in the previous section, 401(k)’s typically have a set menu of investments available to plan participants by rolling over their balance to an IRA. The plan participant can choose to invest their IRA balance in whatever they would like - individual stocks, bonds, mutual funds, CD, etc.

#2: Consolidating Retirement Accounts

Since it's not uncommon for employees to have multiple employers over their career, as they leave employment with each company, if the employee has an IRA in their own name, they can keep rolling over the balances into that central IRA account to consolidate all their retirement accounts into a single account.

#3: Ease of Distributions in Retirement

It is sometimes easier to take distributions from an IRA than it is from a 401(k) plan. When you request a distribution from a 401(k) plan, you typically have to work through the plan’s administrator. The plan trustee may need to approve each distribution, and some plans are “lump-sum only,” which means you can’t take partial distributions from the 401(k) account. With those lump-sum-only plans, when you request your first distribution from the account, you have to remove your entire balance. When you roll over the balance to an IRA, you can often set up monthly reoccurring distributions, or you can request one-time distributions at your discretion.

#4: Avoid the 401(k) 20% Mandatory Fed Tax Withholding

When you request Distributions from a 401(k) plan, by law, they are required to withhold 20% for Federal Taxes from each distribution (unless it’s an RMD or hardship). But what if you don’t want them to withhold 20% for Fed taxes? With 401(k) plans, you don’t have a choice. By rolling over your balance to an IRA, you have the option to not withhold any taxes or electing a Fed amount less than 20% - it’s completely up to you.

#5: Discretionary Management

Most 401(k) investment platforms are set up as participant-directed platforms which means the plan participant has to make investment decisions with regard to their accounts without an investment advisor overseeing the account and trading it actively on their behalf. Some individuals like the idea of having an investment professional involved to actively manage their retirement accounts on their behalf, and rolling over the balance from 401(k) to an IRA can open up that option after the employee has separated from service.

CONS of 401(k) Rollover to IRAs

Here is a consolidated list based on some of the pros and cons already mentioned:

Fees could be higher in an IRA compared to the existing 401(k)

The Age 55 10% early withdrawal exception could be lost

No point in rolling to an IRA if the plan is just to roll over to the new employer’s plan once you have met the plan’s eligibility requirements

OPTION 3: Rollover to New Employer’s 401(k) Plan

To avoid repeating many of the pros and cons already mentioned here is a quick hit list of the pros and cons

PROS:

Keep retirement accounts consolidated in new employer plan

No tax liability incurred for rollover

Potentially lower fees compared to rolling over to an IRA

If the new plan allows 401(k) loans, rollover balances are typically eligible toward the max loan amount

Full balance eligible for age 55 10% early withdrawal penalty exception

A new advantage that I would add to this list is for employees over the age of 73 who are still working; if you keep your pre-tax retirement account balance within your current employer’s 401(k) plan, you can avoid the annual RMD requirement. When you turn certain ages, currently 73 but soon to be 75, the IRS forces you to start taking taxable distributions out of your pre-tax retirement accounts. However, there is an exception to that rule for any pretax balances maintained in a 401(k) plan with your current employer. The balance in your 401(k) plan with your CURRENT employer is not subject to annual RMDs so you avoid the tax hit associated with taking distributions from a pre-tax retirement account.

I put CURRENT in all caps because this 401(k) RMD exception does not apply to balances in former employer 401(k) plans. You must be employed by that company for the entire year to avoid the RMD requirement. Balances in former employer 401(k) plans are still subject to the RMD requirement.

CONS:

Potentially limited to investment options offered via the 401(k) investment menu

You may not be allowed to take distribution at any time from your 401(k) account after the rollover, whereas a rollover IRA would allow you to keep that option open.

Your personal investment advisor cannot manage those assets within the 401(k) plan

Possible distribution and tax withholding restrictions depend on the plan design

OPTION 4: Cash Distributions

I purposely saved cash distributions for last because it is rarely the optimal distribution option. When you request a cash distribution from a 401(k) plan and you are under the age of 59 ½, you will incur fed taxes, potentially state taxes depending on what state you reside in, and a 10% early withdrawal penalty. When you begin to total up the taxes and penalties, sometimes you’re losing 30% - 50% of your balance in the plan to taxes and penalties.

When you lose 30 to 50% of your retirement account balance in one shot, it can set you back years in the future when it comes to trying to figure out what date you can retire. While, it's not uncommon for a 25-year-old to not be overly concerned with their retirement date; making the decision to withdraw their entire account balance can end up being a huge regret when they are 75 and still working while all their friends retired 10 years before them.

However, as financial planners, we do acknowledge that someone losing their job can create financial disruption, and sometimes a balance needs to be reached between a cash distribution to help them bridge the financial gap to their next career while maintaining as much of their retirement account as possible. The good news is it's not an all-or-nothing decision. For clients that have a high degree of uncertainty, it can sometimes be prudent to roll over the balance from the 401(k) to an IRA which gives them maximum flexibility as to how much they can take from that IRA account for distributions, but usually reserves the right to allow them to roll over that IRA balance into a future employer’s 401(k) plan at their discretion.

Example: Samantha Was just laid off by Company XYZ; she has a $50,000 balance in their 401(k) plan and she is worried that she's not going to be able to pay her bills for the next few months while she's looking for her next job. She may want to roll over that $50,000 balance to an IRA so she can distribute $10,000 from the IRA, pay the taxes and the penalties, but continue to maintain the remaining $40,000 in the IRA untaxed. But if she struggles to continue to find her next career, she can always go back to the IRA and take additional distributions. Samantha then gets hired by Company ABC and is eligible to participate in that company's 401(k) plan after three months. At that time, she can make the decision to either roll over the IRA balance to her new 401(k) plan or just keep the IRA where it is.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

401(K) Cash Distributions: Understanding The Taxes & Penalties

When an employee unexpectedly loses their job and needs access to cash to continue to pay their bills, it’s not uncommon for them to elect a cash distribution from their 401(K) account. Still, they may regret that decision when the tax bill shows up the following year and then they owe thousands of dollars to the IRS in taxes and penalties that they don’t have.

When an employee unexpectedly loses their job and needs access to cash to continue to pay their bills, it’s not uncommon for them to elect a cash distribution from their 401(K) account. Still, they may regret that decision when the tax bill shows up the following year and then they owe thousands of dollars to the IRS in taxes and penalties that they don’t have. But I get it; if it’s a choice between working a few more years or losing your house because you don’t have the money to make the mortgage payments, taking a cash distribution from your 401(k) seems like a necessary evil. If you go this route, I want you to be aware of a few strategies that may help you lessen the tax burden and avoid tax surprises after the 401(k) distribution is processed. In this article, I will cover:

How much tax do you pay on a 401(K) withdrawal?

The 10% early withdrawal penalty

The 401(k) 20% mandatory fed tax withholding

When do you remit the taxes and penalties to the IRS?

The 401(k) loan default issue

Strategies to help reduce the tax liability

Pre-tax vs. Roth sources

Taxes on 401(k) Withdrawals

When your employment terminates with a company, that triggers a “distributable event,” which gives you access to your 401(k) account with the company. You typically have the option to:

Leave your balance in the current 401(k) plan (if the balance is over $5,000)

Take a cash distribution

Rollover the balance to an IRA or another 401(k) plan

Some combination of options 1, 2, and 3

We are going to assume you need the cash and plan to take a total cash distribution from your 401(k) account. When you take cash distributions from a 401(k), the amount distributed is subject to:

Federal income tax

State income tax

10% early withdrawal penalty

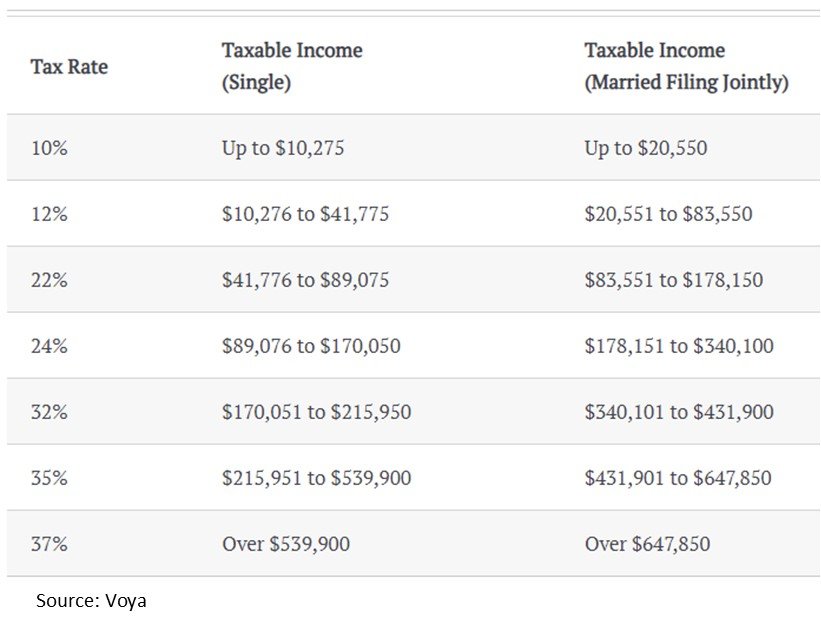

I’m going to assume your 401(k) account consists of 100% of pre-tax sources; if you have Roth contributions, I will cover that later on. When you take distributions from a 401(k) account, the amount distributed is subject to ordinary income tax rates, the same tax rates you pay on your regular wages. The most common question I get is, “how much tax am I going to owe on the 401(K) withdrawal?”. The answer is that it varies from person to person because it depends on your personal income level for the year. Here are the federal income tax brackets for 2022:

Using the chart above, if you are married and file a joint tax return, and your regular AGI (adjusted gross income) before factoring in the 401(K) distribution is $150,000, if you take a $20,000 distribution from your 401(k) account, it would be subject to a Fed tax rate of 24%, resulting in a Fed tax liability of $4,800.

If instead, you are a single filer that makes $170,000 in AGI and you take a $20,000 distribution from your 401(k) account, it would be subject to a 32% fed tax rate resulting in a federal tax liability of $6,400.

20% Mandatory Fed Tax Withholding Requirement

When you take a cash distribution directly from a 401(k) account, they are required by law to withhold 20% of the cash distribution amount for federal income tax. This is not a penalty; it’s federal tax withholding that will be applied toward your total federal tax liability in the year that the 401(k) distribution was processed. For example, if you take a $100,000 cash distribution from your 401(K) when they process the distribution, they will automatically withhold $20,000 (20%) for fed taxes and then send you a check or ACH for the remaining $80,000. Again, this 20% federal tax withholding is not optional; it’s mandatory.

Here's where people get into trouble. People make the mistake of thinking that since taxes were already withheld from the 401(k) distribution, they will not owe more. That is often an incorrect assumption. In our earlier example, the single filer was in a 32% tax bracket. Yes, they withheld 20% in federal income tax when the distribution was processed, but that tax filer would still owe another 12% in federal taxes when they file their taxes since their federal tax bracket is higher than 20%. If that single(k) tax filer took a $100,000 401(k) distribution, they could own an additional $12,000+ when they file their taxes.

State Income Taxes

If you live in a state with a state income tax, you should also plan to pay state tax on the amount distributed from your 401(k) account. Some states have mandatory state tax withholding similar to the required 20% federal tax withholding, but most do not. If you live in New York, you take a $100,000 401(k) distribution, and you are in the 6% NYS tax bracket, you would need to have a plan to pay the $6,000 NYS tax liability when you file your taxes.

10% Early Withdrawal Penalty

If you request a cash distribution from a 401(k) account before reaching a certain age, in addition to paying tax on the distribution, the IRS also hits you with a 10% early withdrawal penalty on the gross distribution amount.

Under the age of 55: If you are under the age of 55, in the year that you terminate employment, the 10% early withdrawal penalty will apply.

Between Ages 55 and 59½: If you are between the ages of 55 and 59½ when you terminate employment and take a cash distribution from your current employer’s 401(k) plan, the 10% early withdrawal penalty is waived. This is an exception to the 59½ rule that only applies to qualified retirement accounts like 401(k)s, 403(b)s, etc. But the distribution must come from the employer’s plan that you just terminated employment with; it cannot be from a previous employer's 401(k) plan.

Note: If you rollover your balance to a Traditional IRA and then try to take a distribution from the IRA, you lose this exception, and the under age 59½ 10% early withdrawal penalty would apply. The distribution has to come directly from the 401(k) account.

Age 59½ and older: Once you reach 59½, you can take cash distributions from your 401(k) account, and the 10% penalty no longer applies.

When Do You Pay The 10% Early Withdrawal Penalty?

If you are subject to the 10% early withdrawal penalty, it is assessed when you file your taxes; they do not withhold it from the distribution amount, so you must be prepared to pay it come tax time. The taxes and penalties add up quickly; let’s say you take a $50,000 distribution from your 401(k), age 45, in a 24% Fed tax bracket and a 6% state tax bracket. Here is the total tax and penalty hit:

Gross 401K Distribution: $50,000

Fed Tax Withholding (24%) ($12,000)

State Tax Withholding (6%) ($3,000)

10% Penalty ($5,000)

Net Amount: $30,000

In the example above, you lost 40% to taxes and penalties. Also, remember that when the 401(k) platform processed the distribution, they probably only withheld the mandatory 20% for Fed taxes ($10,000), meaning another $10,000 would be due when you filed your taxes.

Strategies To Reduce The Tax Liability

There are a few strategies that you may be able to utilize to reduce the taxes and penalties assessed on your 401(k) cash distribution.

The first strategy involves splitting the distribution between two tax years. If it’s toward the end of the year and you have the option of taking a partial cash distribution in December and then the rest in January, that would split the income tax liability into two separate tax years, which could reduce the overall tax liability compared to realizing the total distribution amount in a single tax year.

Note: Some 401(k) plans only allow “lump sum distributions,” which means you can’t request partial withdrawals; it’s an all or none decision. In these cases, you may have to either request a partial withdrawal and partial rollover to an IRA, or you may have to rollover 100% of the account balance to an IRA and then request the distributions from there.

The second strategy is called “only take what you need.” If your 401(k) balance is $50,000, and you only need a $20,000 cash distribution, it may make sense to rollover the entire balance to an IRA, which is a non-taxable event, and then withdraw the $20,000 from your IRA account. The same taxes and penalties apply to the IRA distribution that applies to the 401(k) distribution (except the age 55 rule), but it allows the $30,000 that stays in the IRA to avoid taxes and penalties.

Strategy three strategy involved avoiding the mandatory 20% federal tax withholding in the same tax year as the distribution. Remember, the 401(K) distribution is subject to the 20% mandatory federal tax withholding. Even though they're sending that money directly to the federal government on your behalf, it actually counts as taxable income. For example, if you request a $100,000 distribution from your 401(k), they withhold $20,000 (20%) for fed taxes and send you a check for $80,000, even though you only received $80,000, the total $100,000 counts as taxable income.

IRA distributions do not have the 20% mandatory federal tax withholding, so you could rollover 100% of your 401(k) balance to your IRA, take the $80,000 out of your IRA this year, which will be subject to taxes and penalties, and then in January next year, process a second $20,000 distribution from your IRA which is the equivalent of the 20% fed tax withholding. However, by doing it this way, you pushed $20,000 of the income into the following tax year, which may be taxed at a lower rate, and you have more time to pay the taxes on the $20,000 because the tax would not be due until the tax filing deadline for the following year.

Building on this example, if your federal tax liability is going to be below 20%, by taking the distribution from the 401K you are subject to the 20% mandatory fed tax withholding, so you are essentially over withholding what you need to satisfy the tax liability which creates more taxable income for you. By rolling over the money to an IRA, you can determine the exact amount of your tax liability in the spring, and distribute just that amount for your IRA to pay the tax bill.

Loan Default

If you took a 401K loan and still have an outstanding loan balance in the plan, requesting any type of distribution or rollover typically triggers a loan default which means the outstanding loan balance becomes fully taxable to you even though no additional money is sent to you. For example, if You have an $80,000 balance in the 401K plan, but you took a loan two years ago and still have a $20,000 outstanding loan balance within the plan, if you terminate employment and request a cash distribution, the total amount subject to taxes and penalties is $100,000, not $80,000 because you have to take the outstanding loan balance into account. This is also true when they assess the 20% mandatory fed tax withholding. The mandatory withholding is based on the balance plus the outstanding loan balance. I mention this because some people are surprised when their check is for less than expected due to the mandatory 20% federal tax withholding on the outstanding loan balance.

Roth 401(k) Early Withdrawal Penalty

401(k) plans commonly allow Roth deferrals which are after-tax contributions to the plan. If you request a cash distribution from a Roth 401(k) source, the portion of the account balance that you actually contributed to the plan is returned to you tax and penalty-free; however, the earnings that have accumulated on that Roth source you have to pay tax and potentially the 10% early withdrawal penalty on. This is different from pre-tax sources which the total amount is subject to taxes and penalties.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

401K Loans: Pros vs Cons

There are a number of pros and cons associated with taking a loan from your 401K plan. There are definitely situations where taking a 401(k) loan makes sense but there are also number of situations where it should be avoided.

There are a number of pros and cons associated with taking a loan from your 401K plan. There are definitely situations where taking a 401(k) loan makes sense but there are also number of situations where it should be avoided. Before taking a loan from your 401(k), you should understand:

How 401(k) loans work

How much you are allowed to borrow

Duration of the loans

What is the interest rate that is charged

How the loans are paid back to your 401(k) account

Penalties and taxes on the loan balance if you are laid off or resign

How it will impact your retirement

Sometimes Taking A 401(k) Loan Makes Sense

People are often surprised when I say “taking a 401(k) loan could be the right move”. Most people think a financial planner would advise NEVER touch your retirement accounts for any reasons. However, it really depends on what you are using the 401(k) loan for. There are a number of scenarios that I have encountered with 401(k) plan participants where taking a loan has made sense including the following:

Need capital to start a business (caution with this one)

Resolve a short-term cash crunch

Down payment on a house

Payoff high interest rate credit cards

Unexpected health expenses or financial emergency

I will go into more detail regarding each of these scenarios but let’s do a quick run through of how 401(k) loans work.

How Do 401(k) Loans Work?

First, not all 401(k) plans allow loans. Your employer has to voluntary allow plan participants to take loans against their 401(k) balance. Similar to other loans, 401(k) loans charge interest and have a structured payment schedule but there are some differences. Here is a quick breakout of how 401(k) loans work:

How Much Can You Borrow?

The maximum 401(k) loan amount that you can take is the LESSER of 50% of your vested balance or $50,000. Simple example, you have a $20,000 vested balance in the plan, you can take a 401(K) loan up to $10,000. The $50,000 limit is for plan participants that have balances over $100,000 in the plan. If you have a 401(k) balance of $500,000, you are still limited to a $50,000 loan.

Does A 401(k) Loan Charge Interest?

Yes, 401(k) loans charge interest BUT you pay the interest back to your own 401(k) account, so technically it’s an interest free loan even though there is interest built into the amortization schedule. The interest rate charged by most 401(k) platforms is the Prime Rate + 1%.

How Long Do You Have To Repay The 401(k) Loan?

For most 401(k) loans, you get to choose the loan duration between 1 and 5 years. If you are using the loan to purchase your primary residence, the loan policy may allow you to stretch the loan duration to match the duration of your mortgage but be careful with this option. If you leave the employer before you payoff the loan, it could trigger unexpected taxes and penalties which we will cover later on.

How Do You Repay The 401(k) Loan?

Loan payments are deducted from your paycheck in accordance with the loan amortization schedule and they will continue until the loan is paid in full. If you are self employed without payroll, you will have to upload payments to the 401(k) platform to avoid a loan default.

Also, most 401(K) platforms provide you with the option of paying off the loan early via a personal check or ACH.

Not A Taxable Event

Taking a 401(k) loan does not trigger a taxable event like a 401(k) distribution does. This also gives 401(k)’s a tax advantage over an IRA because IRA’s do not allow loans.

Scenarios Where Taking A 401(k) Loans Makes Sense

I’ll start off on the positive side of the coin by providing you with some real life scenarios where taking a 401(k) loan makes sense, but understand that all of the these scenarios assume that you do not have idle cash set aside that could be used to meet these expenses. Taking a 401(k) loan will rarely win over using idle cash because you lose the benefits of compounded tax deferred interest as soon as you remove the money from your account in the form of a 401(k) loan.

Payoff High Interest Rate Credit Cards

If you have credit cards that are charging you 12%+ in interest and you are only able to make the minimum payment, this may be a situation where it makes sense to take a loan from your 401(k) and payoff the credit cards. But………but…….this is only a wise decision if you are not going to run up those credit card balances again. If you are in a really bad financial situation and you may be headed for bankruptcy, it’s actually better NOT to take money out of your 401(k) because your 401(k) account is protected from your creditors.

Bridge A Short-Term Cash Crunch

If you run into a short-term cash crunch where you have a large expense but the money needed to cover the expense is delayed, a 401(k) loan may be a way to bridge the gap. A hypothetical example would be buying and selling a house simultaneously. If you need $30,000 for the down payment on your new house and you were expecting to get that money from the proceeds from the sale of the current house but the closing on your current house gets pushed back by a month, you might decide to take a $30,000 loan from your 401(k), close on the new house, and then use the proceeds from the sale of your current house to payoff the 401(k) loan.

Using a 401(k) Loan To Purchase A House

Frequently, the largest hurdle for first time homebuyers when planning to buy a house is finding the cash to satisfy the down payment. If you have been contributing to your 401(k) since you started working, it’s not uncommon that the balance in your 401(k) plan might be your largest asset. If the right opportunity comes along to buy a house, it may makes sense to take a 401(k) loan to come up with the down payment, instead of waiting the additional years that it would take to build up a down payment outside of your 401(k) account.

Caution with this option. Once you take a loan from your 401(k), your take home pay will be reduced by the amount of the 401(k) loan payments over the duration of the loan, and then you will a have new mortgage payment on top of that after you close on the new house. Doing a formal budget in advance of this decision is highly recommended.

Capital To Start A Business

We have had clients that decided to leave the corporate world and start their own business but there is usually a time gap between when they started the business and when the business actually starts making money. It is for this reason that one of the primary challenges for entrepreneurs is trying to find the capital to get the business off the ground and get cash positive as soon as possible. Instead of going to a bank for a loan or raising money from friends and family, if they had a 401(k) with their former employer, they may be able to setup a Solo(K) plan through their new company, rollover their balance into their new Solo(K) plan, take a 401(k) loan from their new Solo(k) plan, and use that capital to operate the business and pay their personal expenses.

Again, word of caution, starting a business is risky, and this strategy involves spending money that was set aside for the retirement years.

Reasons To Avoid Taking A 401(k) Loan

We have covered some Pro side examples, now let’s look at the Con side of the 401(k) loan equation.

Your Money Is Out of The Market

When you take a loan from your 401(k) account, that money is removed for your 401(k) account, and then slowly paid back over the duration of the loan. The money that was lent out is no longer earning investment return in your retirement account. Even though you are repaying that amount over time it can have a sizable impact on the balance that is in your account at retirement. How much? Let’s look at a Steve & Sarah example:

Steve & Sarah are both 30 years old

Both plan to retire age 65

Both experience an 8% annualize rate of return

Both have a 401(K) balance of $150,000

Steve takes a $50,000 loan for 5 years at age 30 but Sarah does not

Since Sarah did not take a $50,000 loan from her 401(k) account, how much more does Sarah have in her 401(k) account at age 65? Answer: approximately $102,000!!! Even though Steve was paying himself all of the loan interest, in hindsight, that was an expensive loan to take since taking out $50,000 cost him $100,000 in missed accumulation.

401(k) Loan Default Risk

If you have an outstanding balance on a 401(k) loan and the loan “defaults”, it becomes a taxable event subject to both taxes and if you are under the age of 59½, a 10% early withdrawal penalty. Here are the most common situations that lead to a 401(k) loan defaults:

Your Employment Ends: If you have an outstanding 401(K) loan and you are laid off, fired, or you voluntarily resign, it could cause your loan to default if payments are not made to keep the loan current. Remember, when you were employed, the loan payments were being made via payroll deduction, now there are no paychecks coming from that employer, so no loan payment are being remitted toward your loan. Some 401(k) platforms may allow you to keep making loan payments after your employment ends but others may not past a specified date. Also, if you request a distribution or rollover from the plan after your have terminated employment, that will frequently automatically trigger a loan default if there is an outstanding balance on the loan at that time.

Your Employer Terminates The 401(k) Plan: If your employer decides to terminate their 401(k) plan and you have an outstanding loan balance, the plan sponsor may require you to repay the full amount otherwise the loan will default when your balance is forced out of the plan in conjunction with the plan termination. There is one IRS relief option in the instance of a plan termination that buys the plan participants more time. If you rollover your 401(k) balance to an IRA, you have until the due date of your tax return in the year of the rollover to deposit the amount of the outstanding loan to your IRA account. If you do that, it will be considered a rollover, and you will avoid the taxes and penalties of the default but you will need to come up with the cash needed to make the rollover deposit to your IRA.

Loan Payments Are Not Started In Error: If loan payments are not made within the safe harbor time frame set forth by the DOL rules, the loan could default, and the outstanding balance would be subject to taxes and penalties. A special note to employees on this one, if you take a 401(k) loan, make sure you begin to see deductions in your paycheck for the 401(k) loan payments, and you can see the loan payments being made to your account online. Every now and then things fall through the cracks, the loan is issued, the loan deductions are never entered into payroll, the employee doesn’t say anything because they enjoy not having the loan payments deducted from their pay, but the employee could be on the hook for the taxes and penalties associated with the loan default if payments are not being applied. It’s a bad day when an employee finds out they have to pay taxes and penalties on their full outstanding loan balance.

Double Taxation Issue

You will hear 401(k) advisors warn employees about the “double taxation” issue associated with 401(k) loans. For employees that have pre-tax dollars within their 401(k) plans, when you take a loan, it is not a taxable event, but the 401(k) loan payments are made with AFTER TAX dollars, so as you make those loan payments you are essentially paying taxes on the full amount of the loan over time, then once the money is back in your 401(k) account, it goes back into that pre-tax source, which means when you retire and take distributions, you have to pay tax on that money again. Thus, the double taxation issue, taxed once when you repay the loan, and then taxed again when you distribute the money in retirement.

This double taxation issue should be a deterrent from taking a 401(k) loan if you have access to cash elsewhere, but if a 401(k) loan is your only access to cash, and the reason for taking the loan is justified financially, it may be worth the double taxation of those 401(k) dollars.

I’ll illustrate this in an example. Let’s say you have credit card debt of $15,000 with a 16% interest rate and you are making minimum payments. That means you are paying the credit card company $2,400 per year in interest and that will probably continue with only minimum payments for a number of years. After 5 or 6 years you may have paid the credit card company $10,000+ in interest on that $15,000 credit card balance.

Instead, you take a 401(k) loan for $15,000, payoff your credit cards, and then pay back the loan over the 5-year period, you will essentially have paid tax on the $15,000 as you make the loan payments back to the plan BUT if you are in a 25% tax bracket, the tax bill will only be $3,755 spread over 5 years versus paying $2,000 - $2,500 in interest to the credit card company EVERY YEAR. Yes, you are going to pay tax on that $15,000 again when you retire but that was true even if you never took the loan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.