Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents opportunities to use retirement savings to pay off debt; but before doing so, it is important to consider the possible consequences.

Clients often come to us saying they have some amount left on a mortgage and they would feel great if they could just pay it off. Lower monthly bills and less debt when living on a fixed income is certainly good, both from a financial and psychological point of view, but taking large distributions from retirement accounts just to pay off debt may lead to tax consequences that can make you worse off financially.

Below are three items I typically consider before making a recommendation for clients. Every retiree is different so consulting with a professional such as a financial planner or accountant is recommended if you’d like further guidance.

Impact on State Income and Property Taxes

Depending on what state you are in, withdrawals from IRA’s could be taxed very differently. It is important to know how they are taxed in your state before making any big decision like this. For example, New York State allows for tax free withdrawals of IRA accounts up to a maximum of $20,000 per recipient receiving the funds. Once the $20,000 limit is met in a certain year, any distribution you take above that will be taxed.

If someone normally pulls $15,000 a year from a retirement account to meet expenses and then wanted to pull another $50,000 to pay off a mortgage, they have created $45,000 of additional taxable income to New York State. This is typically not a good thing, especially if in the future you never have to pull more than $20,000 in a year, as you would have never paid New York State taxes on the distributions.

Note: Another item to consider regarding states is the impact on property taxes. For example, New York State offers an “Enhanced STAR” credit if you are over the age of 65, but it is dependent on income. Here is an article that discusses this in more detail STAR Property Tax Credit: Make Sure You Know The New Income Limits.

What Tax Bracket Are You in at the Federal Level?

Federal income taxes are determined using a “Progressive Tax” calculation. For example, if you are filing single, the first $9,700 of taxable income you have is taxed at a lower rate than any income you earn above that. Below are charts of the 2019 tax tables so you can review the different tax rates at certain income levels for single and married filing joint ( Source: Nerd Wallet ).

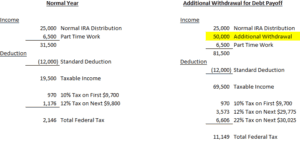

There isn’t much of a difference between the first two brackets of 10% and 12%, but the next jump is to 22%. This means that, if you are filing single, you are paying the government 10% more on any additional taxable income from $39,475 – $84,200. Below is a basic example of how taking a large distribution from the IRA could impact your federal tax liability.

How Will it Impact the Amount of Social Security You Pay Tax on?

This is usually the most complicated to calculate. Here is a link to the 2018 instructions and worksheets for calculating how much of your Social Security benefit will be taxed ( IRS Publication 915 ). Basically, by showing more income, you may have to pay tax on more of your Social Security benefit. Below is a chart put together with information from the IRS to show how much of your benefit may be taxed.

To calculate “Combined Income”, you take your Adjusted Gross Income + Nontaxable Interest + Half of your Social Security benefit. For the purpose of this discussion, remember that any amount you withdraw from your IRA is counted in your Combined Income and therefore could make more of your social security benefit subject to tax.

Peace of mind is key and usually having less bills or debt can provide that, but it is important to look at the cost you are paying for it. There are times that this strategy could make sense, but if you have questions about a personal situation please consult with a professional to put together the correct strategy.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

How Much Will Your Paycheck Increase In 2018?

U.S taxpayers have a big reason to celebrate this week. By the end of February, you should see your paycheck increase. The government released the new payroll withholding tables this week which will lower the amount of taxes withheld from your paycheck and increase your take home pay. Naturally the next question is "How much will my paycheck go

U.S taxpayers have a big reason to celebrate this week. By the end of February, you should see your paycheck increase. The government released the new payroll withholding tables this week which will lower the amount of taxes withheld from your paycheck and increase your take home pay. Naturally the next question is "How much will my paycheck go up?" Out of curiously, I spent my Saturday morning comparing the 2017 tax tables to the new 2018 tax tables to answer that question. Yes, this is what nerds do on their weekends.

The Calculation

Like most financial calculations, it's long and boring. I will provide you with the cliff notes version. The government provides your company with tax withholding tables that they enter into the payroll system. It tells your employer how much to withhold in fed taxes from each pay check. The three main variables in the calculation are:

Payroll frequency (weekly, bi-weekly, etc)

The number of withholding allowances that you claim

The amount of your pay

Single Filers or Head of Household

If you are a single or head of household tax filer, I ran the following calculations based on a bi-weekly payroll schedule and an employee claiming one withholding allowance. The table below illustrates how much your annual take home pay may increase under the new tax withholding tables at various salary levels.

Based on this analysis, it looks like a single filer’s paycheck will increase between 2% – 3% as soon as the new withholding tables are entered into the payroll system. If you want to know how much your bi-weekly pay will increase, just take the annual numbers listed above and divide them by 26 pay periods. If the payroll frequency at your company is something other than bi-weekly or you claim more than one withholding allowance, your percentage increase in take home pay will deviate from the table listed above.

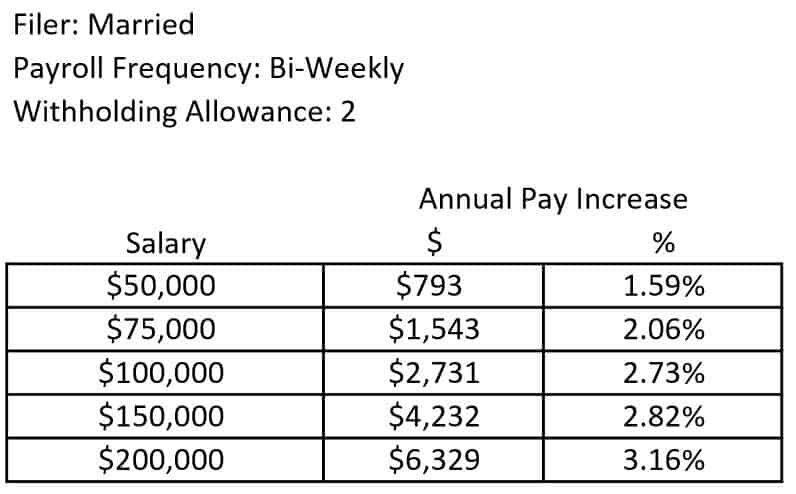

Married Couples Filing Joint

For employees that are married and file a joint tax return, below is the calculations based on a bi-weekly payroll schedule and two withholding allowances. The table below illustrates how much your annual take home pay may increase under the new tax withholding tables at various salary levels.

Even though I added an additional withholding allowance in the calculation for the married employee, I was surprised that the “range” of the percentage increase in the take home pay for a married employee was noticeably wider than a single tax filer. As you will see in the table above, the increase in take home pay for an employee in this category range from 1.5% – 3.1%.

Another interesting observation, in the single filer table, the percentage increase in take home pay actually diminished as the employee’s annual compensation increased. In contrast, for the married employee, the percentage increase in annual take home pay gradually increased as the employee’s annual salary increased. Conclusion…..get married in 2018? Nothing says love like new withholding tables.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Have To Pay Taxes On My Inheritance?

Whenever people come into large sums of money, such as inheritance, the first question is “how much will I be taxed on this money”? Believe it or not, money you receive from an inheritance is likely not taxable income to you.

Whenever people come into large sums of money, such as inheritance, the first question is “how much will I be taxed on this money”? Believe it or not, money you receive from an inheritance is likely not taxable income to you.

Of course there are some caveats to this. If the inherited money is from an estate, there is a chance the money received was already taxed at the estate level. The current federal estate exclusion is $5,430,000 (estate taxes and the exclusion amount varies for states). Therefore, if the estate was large enough, a portion of the inheritance may have been subject to estate tax which is 40% in most cases. That being said, whether the money was or was not taxed at the estate level, you as an individual do not have to pay income taxes on the money.

Although the inheritance itself is not taxable, you may end up paying taxes if there is appreciation after the money is inherited. The type of account and distribution will dictate how the income will be taxed.

Basis Of Inherited Property

Typically, the basis of inherited property is the fair market value of the property on the date of the decedent’s death or the fair market value of the property on the alternate valuation date if the estate uses the alternate valuation date for valuing assets. An estate will choose to value assets on an alternate date subsequent to the date of death if certain assets, such as stocks, have depreciated since the date of death and the estate would pay less tax using the alternate date.

What the fair market value basis means is that if you inherit stock that was originally purchased for $500 and at the date of death has appreciated to $10,000, you will have a “step-up” basis of $10,000. If you turn around and sell the stock for $11,000, you will have a $1,000 gain and if you sell the stock for $9,000, you will have a $1,000 loss.

Inheriting a personal residence also provides for a step-up in basis but the gain or loss may be treated differently. If no one lives in the inherited home after the date of death, it will be treated similar to the stock example above. If you move into the home after death, any subsequent sale at a loss will not be deductible as it will be treated as your personal asset but a gain would have to be recognized and possibly taxed. If you rent the property subsequent to inheritance, it could be treated as a trade or business which would be treated differently for tax purposes.

Inheriting An IRA or Retirement Plan Account

Please read our article “Inherited IRA’s: How Do They Work” for a more detailed explanation of the three different types of distribution options.

When you inherit a retirement account, and you are not the spouse of the decedent, in most cases you will only have one option, fully distribute the account balance 10 years following the year of the decedents death. The SECURE Act that was passed in December 2019 dramatically change the distribution options available to non-spouse beneficiaries. See the article below:

If you are the spouse of the of the decedent, you are able to treat the retirement account as if it was yours and not be forced to take one of the options above. You will have to pay taxes on distributions but you do not have to start withdrawing funds immediately unless there are required minimum distributions needed.

Note: If the inherited account was an after tax account (i.e. Roth), the inheritor must choose one of the options presented above but no tax will be paid on distributions.

Non-Qualified Annuities

Non-qualified annuities are an exception to the step-up in basis rule. The non-spousal inheritor of a non-qualified annuity will have to take either a lump sum or receive payments over a specified time period. If the inheritor chooses a lump sum, the portion that represents the gain (lump sum balance minus decedent’s contributions) will be taxed as ordinary income. If the inheritor chooses a series of payments, distributions will be treated as last in, first out. Last in, first out means that the appreciation will be distributed first and fully taxable until there is only basis left.

If the spouse inherits the annuity, they most likely have the option to treat the annuity contract as if they were the original owner.

This article concentrated on inheritance at a federal level. There is no inheritance tax at a federal level but some states do have an inheritance tax and therefore meeting with a professional is recommended. New York currently does not have an inheritance tax.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.