What Happens To My Pension If The Company Goes Bankrupt?

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should know the answer to. While some employees are aware of the PBGC (Pension Benefit Guarantee Corporation) which is an organization that exists to step in and provide pension benefits to employees if the employer becomes insolvent, very few are aware that the PBGC itself may face insolvency within the next ten years. So if the company can’t make the pension payments and the PBGC is out of money, are employees left out in the cold?

Pension shortfall

When a company sponsors a pension plan, they are supposed to make contributions to the plan each year to properly fund the plan to meet the future pension payments that are due to the employees. However, if the company is unable to make those contributions or the underlying investments that the pension plan is invested in underperform, it can lead to shortfalls in the funding.

We have seen instances where a company files for bankruptcy and the total dollar amount owed to the pension plan is larger than the total assets of the company. When this happens, the bankruptcy courts may allow the company to terminate the plan and the PBGC is then forced to step in and continue the pension payments to the employees. While this seems like a great system since up until now that system has worked as an effective safety net for these failed pension plans, the PBGC in its most recent annual report is waiving a red flag that it faces insolvency if Congress does not make changes to the laws that govern the premium payments to the PBGC.

What is the PBGC?

The PBGC is a federal agency that was established in 1974 to protect the pension benefits of employees in the private sector should their employer become insolvent. The PBGC does not cover state or government sponsored pension plans. The number of employees that were plan participants in an insolvent pension plan that now receive their pension payments from the PBGC is daunting. According to the 2017 PBGC annual report, the PBGC “currently provides pension payments to 840,000 participants in 4,845 failed single-employer plans and an additional 63,000 participants across 72 multi-employer plans.”

Wait until you hear the dollar amounts associate with those numbers. The PBGC paid out $5.7 Billion dollars in pension payments to the 840,000 participants in the single-employer plans and $141 Million to the 63,000 participants in the multi-employer plans in 2017.

Where Does The PBGC Get The Money To Pay Benefits?

So where does the PBGC get all of the money needed to make billions of dollars in pension payments to these plan participants? You might have guessed “the taxpayers” but for once that’s incorrect. The PBGC’s operations are financed by premiums payments made by companies in the private sector that sponsor pension plans. The PBGC receive no taxpayer dollars. The corporations that sponsor these pension plans pay premiums to the PBGC each year and the premium amounts are set by Congress.

Single-Employer vs Multi-Employer Plans

The PBGC runs two separate insurance programs: “Single-Employer Program” and “Multi-Employer Program”. It’s important to understand the difference between the two. While both programs are designed to protect the pension benefits of the employees, they differ greatly in the level of benefits guaranteed. The assets of the two programs are also kept separate. If one programs starts to fail, the PBGC is not allowed to shift assets over from the other program to save it.

The single-employer program protects plans that are sponsored by single employers. The PBGC steps in when the employer goes bankrupt or can no longer afford to sponsor the plan. The Single-Employer Program is the larger of the two programs. About 75% of the annual pension payments from the PBGC come from this program. Some examples of single-employer companies that the PBGC has had to step into to make pension payments are United Airlines, Lehman Brothers, and Circuit City.

The Multi-Employer program covers pension plans created and funded through collective bargaining agreements between groups of employers, usually in related industries, and a union. These pension plans are most commonly found in construction, transportation, retail food, manufacturing, and services industries. When a plan runs out of money, the PBGC does not step in and takeover the plan like it does for single-employer plans. Instead, it provides “financial assistance” and the guaranteed amounts of that financial assistants are much lower than the guaranteed amounts offered under the single-employer program. For example, in 2017, the PBGC began providing financial assistance to the United Furniture Workers Pension Fund A (UFW Plan), which covers 10,000 participants.

Maximum Guaranteed Amounts

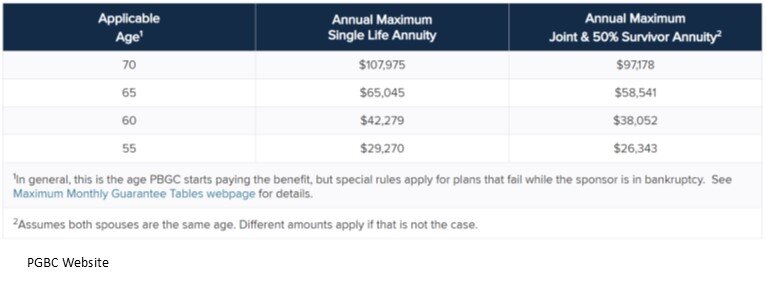

The million dollar question. What is the maximum monthly pension amount that the PBGC will guarantee if the company or organization goes bankrupt? There are maximum dollar amounts for both the single-employer and multi-employer program. The maximum amounts are indexed for inflation each year and are listed on the PBGC website. To illustrate the dramatic difference between the guarantees associated with the pension pensions in a single-employer plan versus a multi-employer plan; here is an example from the PBGC website based on the 2018 rates.

“PBGC’s guarantee for a 65-year-old in a failed single-employer plan can be up to $60,136 annually, while a participant with 30 years of service in a failed multi-employer plan caps out at $12,870 per year. The multi-employer program guarantee for a participant with only 10 years of service caps out at $4,290 per year.”

It’s a dramatic difference.

For the single-employer program the PBGC provides participants with a nice straight forward benefits table based on your age. Below is a sample of the 2018 chart. However, the full chart with all ages can be found on the PBGC website.

Unfortunately, the lower guaranteed amounts for the multi-employer plans are not provided by the PBGC in a nice easy to read table. Instead they provide participant with a formula that is a headache for even a financial planner to sort through. Here is a link to the formula for 2018 on the PBGC website.

PBGC Facing Insolvency In 2025

If the organization guaranteeing your pension plan runs out of money, how much is that guarantee really worth? Not much. If you read the 138 page 2017 annual report issued by the PBGC (which was painful), at least 20 times throughout the report you will read the phase:

“The Multi-employer Program faces very serious challenges and is likely to run out of money by the end of fiscal year 2025.”

They have placed a 50% probability that the multi-employer program runs out of money by 2025 and a 99% probability that it runs out of money by 2036. Not good. The PBGC has urged Congress to take action to fix the problem by raising the premiums charged to sponsors of these multi-employer pension plans. While it seems like a logical move, it’s a double edged sword. While raising the premiums may fix some of the insolvency issues for the PBGC in the short term, the premium increase could push more of the companies that sponsor these plans into bankruptcy.

There is better news for the Single-Employer Program. As of 2017, even though the Single-Employer Program ran a cumulative deficit of $10.9 billion dollars, over the next 10 years, the PBGC is expected to erase that deficit and run a surplus. By comparison the multi-employer program had accumulated a deficit of $65.1 billion dollars by the end of 2017..

Difficult Decision For Employees

While participants in Single-Employer plans may be breathing a little easier after reading this article, if the next recession results in a number of large companies defaulting on their pension obligations, the financial health of the PBGC could change quickly without help from Congress. Employees are faced with a one-time difficult decision when they retire. Option one, take the pension payments and hope that the company and PBGC are still around long enough to honor the pension payments. Or option two, elect the lump sum, and rollover then present value of your pension benefit to your IRA while the company still has the money. The right answer will vary on a case by case basis but the projected insolvency of the PBGC’s Multi-employer Program makes that decision even more difficult for employees.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.