What Caused The Market To Sell Off In September?

What Caused The Market To Sell Off In September?

The stock market experienced a fairly significant drop in the month of September. In September, the S&P 500 Index dropped 4.8% which represents the sharpest monthly decline since March 2020. I wanted to take some time today to evaluate:

· What caused the market drop?

· Do we think this sell off is going to continue?

· Have the recent market events caused us to change our investment strategy?

September Is Historically A Bad Month

Looking back at history, September is historically the worse performing month for the stock market. Since 1928, the S&P 500 Index has averaged a 1% loss in September (WTOP News). Most investors have probably forgotten that in September 2020, the market experienced a 10% correction, but rallied significantly in the 4th quarter.

The good news is the 4th quarter is historically the strongest quarter for the S&P 500. Since 1945, the stock market has averaged a 3.8% return in the final three months of the year (S&P Global).

The earned income penalty ONLY applies to taxpayers that turn on their Social Security prior to their normal retirement age. Once you have reached your normal retirement age, this penalty does not apply.

Delta Variant

The emergence of the Delta Variant slowed economic activity in September. People cancelled travel plans, some individuals avoided restaurants and public events, employees were out sick or quarantined, and it delayed some companies from returning 100% to an office setting. However, we view this as a temporary risk as vaccination rates continue to increase, booster shots are distributed, and the death rates associated with the virus continue to stay at well below 2020 levels.

China Real Estate Risk

Unexpected risks surfaced in the Chinese real estate market during September. China's second largest property developer Evergrande Group had accumulated $300 billion in debt and was beginning to miss payments on its outstanding bonds. This spread fears that a default could cause issues other places around the globe. Those risks subsided as the month progressed and the company began to liquidate assets to meet its debt payments.

Rising Inflation

In September we received the CPI index report for August that showed a 5.3% increase in year over year inflation which was consistent with the higher inflation trend that we had seen earlier in the year. In our opinion, inflation has persisted at these higher levels due to:

· Big increase in the money supply

· Shortage of supply of good and services

· Rising wages as companies try to bring employees back into the workforce

The risk here is if the rate of inflation continues to increase then the Fed may be forced to respond by raising interest rates which could slow down the economy. While we acknowledge this as a risk, the Fed does not seem to be in a hurry to raise rates and recently announced plans to pare back their bond purchases before they begin raising the Fed Funds Rate. Fed Chairman Powell has called the recent inflation trend “transitory” due to a bottleneck in the supply chain as company rush to produce more computer chips, construction materials, and fill labor shortages to meet consumer demand. Once people return to work and the supply chain gets back on line, the higher levels of inflation that we are seeing could subside.

Rising Rates Hit Tech Stocks

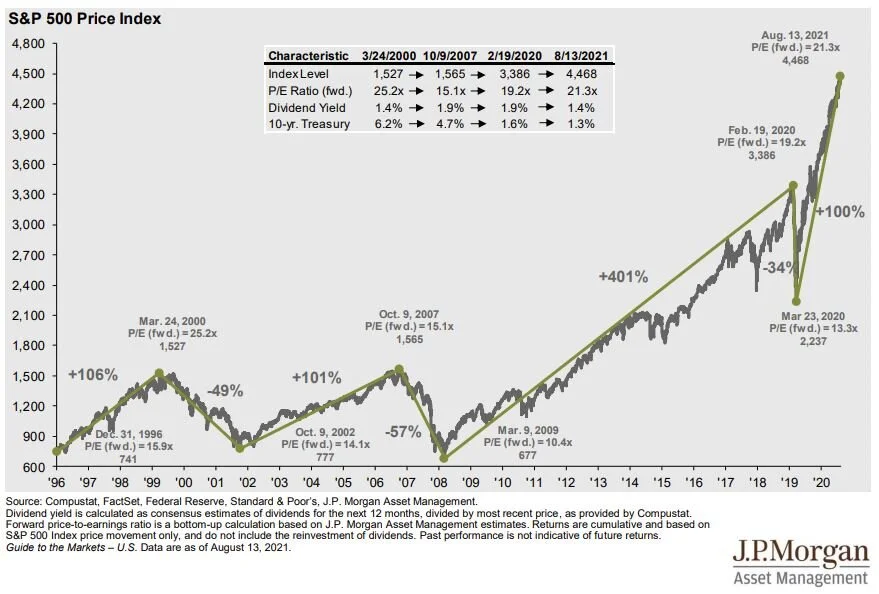

Interest rates rose throughout the month of September which caused mortgage rates to move higher, but more recently there has been an inverse relationship between interest rates and tech stocks. As interest rates rise, tech stocks tend to fall. We attribute this largely to the higher valuations that these tech stocks trade at. As interest rates rise, it becomes more difficult to justify the multiples that these tech stocks are trading at. It is also important to acknowledge that these tech companies have become so large that the tech sector now represents about 30% of the S&P 500 Index (JP Morgan Guide to the Markets).

Risk of a Government Shutdown

Toward the end of the month, the news headlines were filled with the risk of the government shutdown which has been a reoccurring issue for the U.S. government for the past 20 years. This was nothing new, but it just added more uncertainty to the pile of negative headlines that plagued the markets in September. It was announced on September 30th that Congress had approved a temporary funding bill to extend the deadline to December 3rd.

Expectation Going Forward

Even though the Stock Market faced a pile of bad news in September, our internal investment thesis at our firm has not changed. Our expectation is that:

· The economy will continue to gain strength in coming quarters

· There is a tremendous amount of liquidity still in the system from the stimulus packages that has yet to be spent

· People will begin to return to work to produce more goods and services

· Those additional goods and services will then ease the current supply chain bottleneck

· Interest rates will move higher but they still remain at historically low levels

· The risk of the delta variant will diminish increasing the demand for travel

We will continue to monitor the economy, financial markets, and will release more articles in the future as the economic conditions continue to evolve in the coming months.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do You Have To Pay Tax On Your Social Security Benefits?

I have some unfortunate news. If you look at your most recent paycheck, you are going to see a guy by the name of “FICA” subtracting money from your take-home pay. Part of that FICA tax is sent to the Social Security system, which entitles you to receive Social Security payments when you retire. The unfortunate news is that, even though it was a tax that you paid while you were working, when you go to receive your payments from Social Security, most retirees will have to pay some form of Income Tax on it. So, it’s a tax you pay on a tax? Pretty much!

In this article, I will be covering:

· The percent of your Social Security benefit that will be taxable

· The tax rate that you pay on your Social Security benefits

· The Social Security earned income penalty

· State income tax exceptions

· Withholding taxes from your Social Security payments

What percent of your Social Security benefit is taxable?

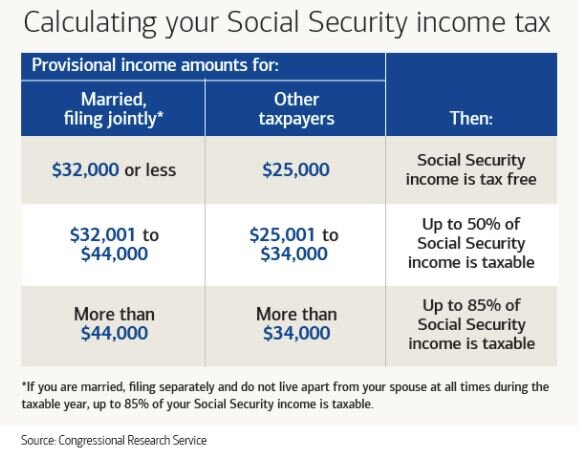

First, let’s start off with how much of your Social Security will be considered taxable income. It ranges from 0% to 85% of the amount received. Where you fall in that range will depend on the amount of income that you have each year. Here is the table for 2021:

But, here’s the kicker. 50% of your Social Security benefit that you receive counts towards the income numbers that are listed in the table above to arrive at your “combined Income” amount. Here is the formula:

Adjusted Gross Income (AGI) + nontaxable interest + 50% of your SS Benefit = Combined Income

If you are a single tax filer, and you are receiving $30,000 in Social Security benefits, you are already starting at a combined income level of $15,000 before you add in any of your other income from employment, pensions, pre-tax distributions from retirement accounts, investment income, or rental income.

As you will see in the table, if your combined income for a single filer is below $25,000, or a joint filer below $32,000, you will not have to pay any tax on your Social Security benefit. Taxpayers above those thresholds will have to pay some form of tax on their Social Security benefits. But, I have a small amount of good news: no one has to pay tax on 100% of their benefit, because the highest percentage is 85%. Therefore, everyone at a minimum receives 15% of their benefit tax free.

NOTE: The IRS does not index the combined income amounts in the table above for inflation, meaning that even though an individual’s Social Security and wages tends to increase over time, the dollar amounts listed in the table stay the same from year to year. This has caused more and more taxpayers to have to pay tax on a larger portion of their Social Security benefit over time.

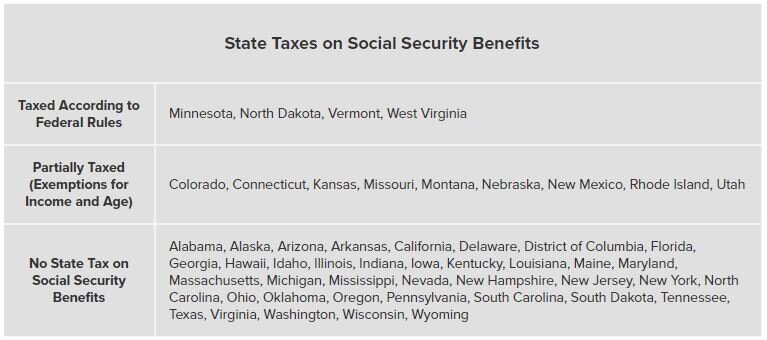

Tax Rate on Social Security Benefits

Your Social Security benefits are taxed as ordinary income. There are no special tax rates for Social Security like capital gains rates for investment income. Social Security is taxed at the federal level but may or may not be taxed at the state level. Currently there are 37 states in the U.S. that do not tax Social Security benefits. There are 4 states that tax it at the same level as the federal government and there are 13 states that partially tax the benefit. Here is table:

Withholding Taxes From Your Social Security Benefit

For taxpayers that know that will have to pay tax on their Social Security benefit, it is usually a good idea to have Social Security withholding taxes taken directly from your Social Security payments. Otherwise, you will have to issue checks for estimated tax payments throughout the year which can be a headache. They only provide you with four federal tax withholding options:

· 7%

· 10%

· 12%

· 22%

These percentages are applied to the full amount of your Social Security benefit, not to just the 50% or 85% that is taxable. Just something to consider when selecting your withholding elections.

To make a withholding election, you have to complete Form W-4V (Voluntary Withholding Request). Once you have completed the form, which only has 7 lines, you can mail it or drop it off at the closest Social Security Administration office.

Social Security Earned Income Penalty

If you elect to turn on your Social Security benefit prior to your Normal Retirement Age (NRA) AND you plan to keep working, you have to be aware of the Social Security earned income penalty. Your Normal Retirement Age is the age that you are entitled to receive your full Social Security benefit, and it’s based on your date of birth.

The earned income penalty ONLY applies to taxpayers that turn on their Social Security prior to their normal retirement age. Once you have reached your normal retirement age, this penalty does not apply.

Basically, the IRS limits how much you are allowed to make each year if you elect to turn on your Social Security early. If you earn over those amounts, you may have to pay all or a portion of the Social Security benefit back to the government. In the Chart below “FRA” stands for “Fully retirement age”, which is the same as “Normal Retirement Age” (NRA). Also note that for married couples, the earned income numbers below apply to your personal earnings, and do not take into consideration your spouse’s income.

INCOME UNDER $18,960: If you earned income is below $18,960, no penalty, you get to keep your full social security benefit

INCOME OVER $18,960: You lose $1 of your social security benefit for every $2 you earn over the threshold. Example:

· You turn on your social security at age 63

· Your social security benefit is $20,000 per year

· You make $40,000 per year in wages

Since you made $40,000 in wages, you are $21,040 over the $18,960 limit:

$21,040 x 50% ($1 reduction for every $2 earned) = $10,520 penalty.

The following year, your $20,000 Social Security benefit would be reduced by $10,520 for the assessment of the earned income penalty. Ouch!!

As a general rule of thumb, if you plan on working prior to your Social Security normal retirement age, and your wages will be in excess of the $18,960 limit, it usually make sense to wait to turn on your Social Security benefit until your wages are below the threshold or you reach normal retirement age.

NOTE: You will see in the middle row of the table “In the calendar year FRA is reached”. In the year that you reach your full retirement age for social security the wage threshold his higher and the penalty is lower (a $1 penalty for every $3 over the threshold).

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

College Savings Account Options

There are a lot of different types of accounts that you can use to save for college. But, certain accounts have advantages over others such as:

· Tax deductions for contributions

· Tax free accumulation and withdrawal

· The impact on college financial aid

· Who has control over the account

· Accumulation rate

The types of college savings account that I will be covering in this article are:

· 529 accounts

· Coverdell accounts (also know as ESA’s)

· UTMA / UGMA accounts

· Brokerage Accounts

· Savings Accounts

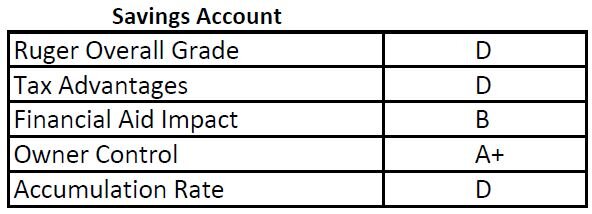

To make it easy to compare and contrast each option, I will have a grading table at the beginning of each section that will provide you with some general information on each type of account, as well as my overall grade on the effectiveness of each college saving option.

529 Plans

I’ll start with my favorite which are 529 College Savings Plan accounts. As a Financial Planner, I tend to favor 529 accounts as primary college savings vehicles due to the tax advantages associated with them. Many states offer state income tax deductions for contributions up to specific dollar amounts, so there is an immediate tax benefit. For example, New York provides a state tax deduction for up to $5,000 for single filers, and $10,000 for joint filers for contributions to NYS 529 accounts year. There is no income limitation for contributing to these accounts.

NOTE: Every now and then I come across individuals that have 529 accounts outside of their home state and they could be missing out on state tax deductions.

However, the bigger tax benefit is that fact that all of the investment returns generated by these accounts can be withdrawn tax free, as long as they are used for a qualified college expense. For example, if you deposit $5K into a 529 account when your child is 2 years old, and it grows to $15,000 by the time they go to college, and you use the account to pay qualified expenses, you do not pay tax on any of the $15,000 that is withdrawn. That is huge!! With many of the other college savings options like UTMA or brokerage accounts, you have to pay tax on the gains.

There is also a control advantage, in that the parent, grandparent, or whoever establishes the accounts has full control as to when and how much is distributed from the account. This is unlike UTMA / UGMA accounts, where once the child reaches a certain age, the child can do whatever they want with the account without the account owner’s consent.

A 529 account does count against the financial aid calculation, but it is a minimal impact in most cases. Since these accounts are typically owned by the parents, in the FAFSA formula, 5.6% of the balance would count against the financial aid reward. So, if you have a $50,000 balance in a 529 account, it would only set you back $2,800 per year in financial aid.

I gave these account an “A” for an accumulation rating because they have a lot of investment option available, and account owners can be as aggressive or conservative as they would like with these accounts. Many states also offer “age based portfolios” where the account is allocated based on the age of the child, and when the will turn 18. These portfolios automatically become more conservative as they get closer to the college start date.

The contributions limits to these accounts are also very high. Lifetime contributions can total $400,000 or more (depending on your state) per beneficiary.

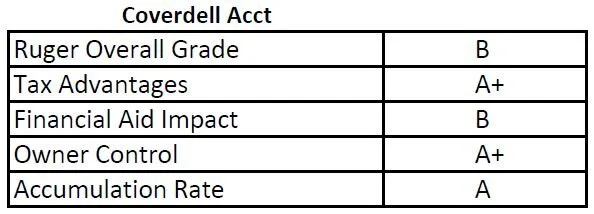

Coverdell Accounts (Education Savings Accounts)

Coverdell accounts have some of the benefits associated with 529 accounts, but there are contribution and income restrictions associated with these types of accounts. First, as of 2021, only taxpayers with adjusted gross income below $110,000 for single filers and $220,000 for joint filers are eligible to contribute to Coverdell accounts.

The other main limiting factor is the contribution limits. You are limited to a $2,000 maximum contribution each year until the beneficiary’s 18th birthday. Given the rising cost of college, it is difficult to accumulate enough in these accounts to reach the college savings goals for many families. Similar to 529 accounts, these accounts are counted as an asset of the parents for purposes of financial aid.

The one advantage these accounts have over 529 accounts is that the balance can be used without limitations for qualified expenses to an elementary or secondary public, private, or religious school. The federal rules recently changed for 529 accounts allowing these types of qualified withdrawal, but they are limited to $10,000 and depending on the state you live in, the state may not recognize these as qualified withdrawals from a 529 account.

If there is money left over in these Coverdell account, they also have to be liquidated by the time the beneficiary of the account turns age 30. 529 accounts do not have this restriction.

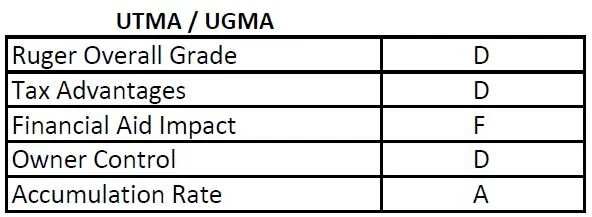

UTMA & UGMA Accounts

UGMA & UTMA accounts get the lowest overall grade from me. With these accounts, the child is technically the owner of the account. While the child is a minor, the parent is often assigned as the custodian of the account. But once the child reaches legal age, which can be 18, 19, or 21, depending on the state you live in, the child is then awarded full control over the account. This can be a problem when your child decides at age 18 that buying a Porsche is a better idea than spending that money on college tuition.

Also, because these accounts are technically owned by the child, they are a wrecking ball for the financial aid calculation. As I mentioned before, when it is an asset of the parent, 5.6% of the balance counts against financial aid, but when it is an asset of the child, 20% of the account balance counts against financial aid.

There are no special tax benefits associated with UTMA and UGMA accounts. No tax deductions for contributions and the child pays taxes on the gains.

Unlike 529 and Coverdell accounts, where you can change the beneficiary list on the account, with UTMA and UGMA accounts, the beneficiary named on the account cannot be changed.

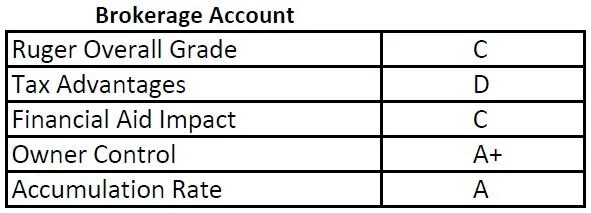

Brokerage Accounts

Parents can use brokerage accounts to accumulate money for college instead of the cash sitting in their checking account earning 0.25% per year. The disadvantage is the parents have to pay tax on all of the investment gains in the account once they liquidate them to pay for college. If the parents are in a higher tax bracket, they could lose up to 40%+ of those gains to taxes versus the 529 accounts where no taxes are paid on the appreciation. But, it also has the double whammy that if the parents realize capital gains from the liquidation, their income will be higher in the FAFSA calculation two years from now.

Sometimes, a brokerage account can complement a 529 account as part of a comprehensive college savings strategy. Many parents do not want to risk “over funding” a 529 account, so once the 529 accounts have hit a comfortable level, they will begin contributing the rest of the college savings to a brokerage account to maintain flexibility.

Savings Accounts

The pros and cons of a savings account owned by the parent or guardian of the child will have similar pros and cons of a brokerage account with one big drawback. Last I checked, most savings accounts were earning under 1% in interest. The cost of college since 1982 has increased by 6% per year (JP Morgan College Planning Essentials 2021). If the cost of college is going up by 6% per year, and your savings is only earning 1% per year, even though the balance in your savings account did not drop, you are losing ground to the tune of 5% PER YEAR. By having your college savings accounts invested in a 529, Coverdell, or brokerage account, it will at least provide you with the opportunity to keep pace with or exceed the inflation rate of college costs.

Can The Cost of College Keep Rising?

Let’s say the cost of attending college keeps rising at 6% per year, and you have a 2-year-old child that you want to send to state school which may cost $25,000 per year today. By the time they turn 18, it would cost $67,000 PER YEAR, times 4 years of college, which is $268,000 for a bachelor’s degree! The response I usually get when people hear these number is “there is no way that they can allow that to happen!!”. People were saying that 10 years ago, and guess what? It happened. This is what makes having a solid college savings strategy so important for your overall financial plan.

NOTE: As Financial Planners, we are seeing a lot more retirees carry mortgages and HELOC’s into retirement and the reason is usually “I helped the kids pay for college”.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Beware of Annuities

I’ll come right out and say “I’m not a fan of annuities”. They tend to carry:

1) Higher internal fees

2) Surrender charges that prevent investors from getting out of them

3) “Guarantees” that are inferior to alternative investment solutions

Unfortunately, annuities pay Financial Professionals a lot of money, which is why it is not uncommon for Investment Advisors to present them as a primary solution. For example, some annuities pay Investment Professionals 5% - 8% of the amount invested, so if you invest $200,000 in the annuity, the advisor gets paid $10,000 to $16,000 as soon as you deposit the money to the annuity. Compared to an Investment Advisor that may be charging you 1% per year to manage your portfolio, it will take them 5 to 8 years to earn that same amount.

To be fair, there are a few situations where I think annuities make sense, and I will share those with you in this article. In general, however, I think investors should be very cautious when they are presented with an annuity as a primary investment solution, and I will explain why.

Fixed Annuities & Variable Annuities

There are two different types of annuities. Fixed annuities and variable annuities. Within those categories, there are a lot of different flavors, such as indexed annuities, guaranteed income benefits, non-qualified, qualified, etc. Annuities are often issued by banks, investment firms, insurance companies, employer sponsored plan providers, or directly to the consumer. It is important to understand that not all annuities are the same and they can vary greatly from provider to provider. The points that I will be making in this article are my personal option based on my 20 years of experience in the investment industry.

Annuities Have High Fees

My biggest issue with annuities in general is the higher internal costs associated with them. When you read the fine print, annuities can carry:

· Commissions

· Contract fees

· Mortality expenses

· Surrender fees

· Rider fees

· Mutual fund expense ratios

· Penalties for surrender prior to age 59½

When you total all of those annual fees, it can sometimes be between 2% - 4% PER YEAR. The obvious questions is, “How is your money supposed to grow if the insurance company is assessing fees of 2% - 4% per year?”

Sub-Par Guarantees

The counter argument to this is that the insurance company is offering you “guarantees” in exchange for these higher fees. During the annuity presentation, the broker might say “if you invest in this annuity, you are guaranteed not to lose any money. It can only make money”. Who wouldn’t want that? But the gains in these annuities are often either capped each year, or get chipped away by the large internal fees associated with the annuity contract. So, even though you may not “lose money”, you may not be making as much as you could in a different investment solution.

Be The Insurance Company

At a high level, this is how insurance companies work. They sell you an annuity, then the insurance company turns around and invests your money, and hands you back a lower rate of return, often in the form of “guarantees”. That is how they stay in business. So, my question is “Why wouldn’t you just keep your money, invest it like the insurance would have, and you keep all of the gains”?

The answer: Fear. Most investments involve some level of risk, meaning you could lose money. Annuity presentations prey on this fear. They will usually show financial illustrations from recessions, such as when the market went down 30%, but the annuity lost no value. For retirees, this can be very appealing, because the working years are over and now they just have their life savings to last them for the rest of their lives.

But like other successful investors, insurance companies rely on the historical returns of the stock market, which suggest that over longer periods of time (10+ year) the stock market tends to appreciate in value. See the charge of the S&P 500 Index below. Even with the pull backs and recessions, the value of the stock market has historically moved higher.

Annuity Surrender Fees Lock You In

The insurance company knows they are going to have your money for a long period of time because most annuities carry “surrender fees”. Most surrender schedules last 5 – 10 YEARS!! This means if you change your mind and want out of the annuity before the surrender period is up, the annuity company hits you with big fees. So, before you write the check to fund the annuity, make sure it’s 100% the right decision.

Do Not Invest an IRA In An Annuity

This situation always baffles me. We will come across investors that have an IRA invested in an annuity. Annuities by themselves have the advantage of being “tax deferred vehicles” meaning you do not pay taxes on the gains accumulated in the annuity until you make a withdrawal. You pay money to the insurance company to have that benefit since annuities are insurance products.

An IRA by itself is also a tax deferred account. You can choose to invest your IRA in whatever you want – cash, stocks, bonds, mutual funds, or an annuity. So, here is my question: since an IRA is already tax deferred vehicle, why would you pay extra fees to an annuity company to invest it in a tax deferred annuity? It makes no sense to me.

The answer, again, is usually fear. An individual retires, they meet with an investment advisor that recommends that they rollover their 401(k) into an IRA, and uses the fear of losing money in the market to convince them to move their full 401(k) into an annuity product. I completely understand the fear of losing money in retirement, and for some individuals it may make sense to put a portion of their retirement assets into something like an annuity that offers some guarantees. But in my experience, it rarely makes sense to invest the majority of your retirement assets in an annuity.

Guaranteed Minimum Income Benefits

Another sparkling gem associated with annuities that is often appealing to retirees are annuities that carry a GMIB, or “Guaranteed Minimum Income Benefit”. These annuities are usually designed to go up by a “guaranteed” 5% - 8% per year, and then at a set age will pay you a set monthly amount for the rest of your life. Now that sounds wonderful, but here is the catch that I want you to be aware of. For most annuity companies, the value of your annuity associated with the “guaranteed increases” only matters if you annuitize the contract with that insurance company. After 10 years, if instead you decided to surrender the annuity, you typically do not receive those big, guaranteed increases, but instead get the actual value of the underlying investments less the big fees. This is why there is often more than one “balance” illustrated on your annuity statement.

Here is the catch of the GMIB – when you go to turn it on, the annuity company decides what that fictitious GMIB balance will equal in the form of a monthly benefit for the rest of your life. Also, with some annuities, they cap the guaranteed increase after a set number of years. In general, what I have found is annuities that were issued with GMIB prior to 2008 tend to be fairly generous, because that was before the 2008/2009 recession. After 2008, the guarantees associated with these GMIB’s became less advantageous.

When Do Annuities Make Sense

I have given you the long list of reason why I am not a fan of annuities but there are a few situations where I think annuities can make sense:

1) Overspending protection

2) CD’s vs Fixed Annuity

Overspending Protection

When people retire, for the first time in their lives, they often have access to their 401(K), 403(b), or other retirement account. Having a large dollar amount sitting in accounts that you have full access to can sometimes be a temptation to overspend, make renovation to your house, go on big vacations, etc. But when you retire, when the money is gone, it is gone. For individuals that do not trust themselves to not spend through the money, turning that lump sum of money into a guaranteed money payment for the rest of their lives may be beneficial. In these cases, it may make sense for an individual to purchase an annuity with their retirement dollars, because it lowers the risk of them running out of money in retirement.

CD’s vs Fixed Annuities

For individuals that have a large cash reserve, and do not want to take any risk, sometimes annuity companies will offer attractive fixed annuity rates. For example, your bank may offer a 2 year CD at a 2%, but there may be an insurance company that will offer you a fixed annuity at a rate of 3.5% per year for 7 years. The obvious benefit is a higher interest rate each year. The downside is usually that the annuity carries surrender fees if you break the annuity before the maturity date. But if you don’t see any need to access the cash before the end of the surrender period, it may be worth collecting the higher interest rate.

Final Advice

Selecting the right investment vehicle is a very important decision. Before selecting an investment solution, it often makes sense to meet with a few different firms to listen to the approach of each advisor to determine which is the most appropriate for your financial situation. If you go into one of these meetings and an annuity is the only solution that is present, I would be very cautious about moving forward with that solution before you have vetted other options.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Paying Tax On Inheritance?

Not all assets are treated the same tax wise when you inherit them. It’s important to know what the tax rules are and the distribution options that are available to you as a beneficiary of an estate. In this video we will cover the tax treatment on inheriting a:

· House

· Retirements Accounts

· Stock & Mutual Funds

· Life Insurance

· Annuities

· Trust Assets

We will also cover the:

· Distribution options available to spouse and non-spouse beneficiaries of retirement accounts

· Federal Estate Tax Limits

· Biden’s Proposed Changes To The Estate Tax Rules

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Impact of Inflation on Stocks, Bonds, and Cash

The inflation fears are rising in the market and we are releasing this video to help you to better understand how inflation works and the impact that is has on stock, bonds, and cash.

The inflation fears are rising in the market and we are releasing this video to help you to better understand how inflation works and the impact that is has on stock, bonds, and cash. In this video we will go over:

· How inflation works

· Recent inflation trends that are spooking the markets

· Do we have to worry about hyperinflation like in the 80’s

· How stocks perform in inflationary environments

· The risk to bonds in inflationary environments

· How cash melts due to inflation

· The Feds reaction to inflation

· Inflation conspiracy theories that are building momentum

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Retirement Account Withdrawal Strategies

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you in more ways than one. Click to read more on how this can effect you.

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you more in taxes long-term, causing you to deplete your retirement assets faster, pay higher Medicare premiums, and reduce the amount of inheritance that your heirs would have received. Retirees will frequently have some combination of the following income and assets in retirement:

· Pretax 401(k) and IRA’s

· Roth IRA IRA’s

· After tax brokerage accounts

· Social Security

· Pensions

· Annuities

As Certified Financial Planner’s®, we look at an individual’s income needs, long-term goals, and map out the optimal withdraw strategy. In this article, I will be sharing with you some of the considerations that we use with our clients when determining the optimal withdrawal strategy.

Layer One : Pension Income

When you develop a withdrawal strategy for your retirement assets it’s similar to building a house. You have to start with a foundation which is taxable income that you expect to receive before you begin taking withdrawals from your retirement accounts. For retirees that have pensions, this is the first layer. Income from pensions are typically taxable income at the federal level but may or may not be taxable at the state level depending on which state you live in and who the sponsor of the pension plan is. While pensions are great, retirees that have pension income have to be very careful about how they make withdrawals from their retirement accounts because any withdraws from pre-tax accounts will stack up on top of their pension income making those withdrawal potentially subject to higher tax rates or cause you to lose tax deductions and credits that were previously received.

Layer Two: Social Security

Social Security income is also something that has to be factored into the mix. Most retirees will have to pay federal income tax on a large portion of their Social Security benefit. When we are counseling clients on their Social Security filing strategy, one of the largest influencers in that decision is what type of retirement accounts that have and how much is in each account. Delaying Social Security each year, increases the amount that an individual receives in the range of 6% to 8% per year forever. As financial planners, we view this as a “guaranteed rate of return” which is tough to replicate in other asset classes. Not turning your Social Security benefit prior to your normal retirement age can:

· Increase 50% spousal benefit

· Increase the survivor benefit

· Increase the value of SS cost of living adjustments

· Reduce the amount required to be withdrawn for other sources

For purposes of this article, we will just look at Social Security as another layer of income but know that depending on your financial situation your Social Security filing strategy does factor into your asset withdrawal strategy.

Roth Accounts: Last To Touch

In most situations, Roth assets are typically the last asset that you touch in retirement. Since Roth assets accumulate and are withdrawn tax free, they are by far the most valuable vehicle to accumulate wealth long-term. The longer they accumulate, the more valuable they are.

The other wonderful feature about Roth IRAs is that there is no required minimum distributions (RMD’s) at age 72. Meaning the government does not force you to take distributions once you have reached a certain age so you can continue to accumulate wealth within that asset class.

Roth’s are also one of the most valuable assets to pass onto beneficiaries because they can continue to accumulate tax free and are withdrawn tax free. For spousal beneficiaries, they can roll over the balance into their own Roth IRA and continue to accumulate wealth tax free. For non-spouse beneficiaries, under the new 10 year rule, they can continue to accumulate wealth for a period of up to 10 years after inheriting the Roth before they are required to distribute the full balance but they don’t pay tax on any of it.

Financial Nerd Note: While Roth are great accumulation vehicles, it’s impossible to protect them from a long term care event spend down situation. They cannot be transferred into a Medicaid trust and they are subject to full spend down for purposes of qualifying for Medicaid in New York since there is no RMD requirements. It’s just a risk that I want you to be aware of.

Pre-tax Assets

Pre-taxed retirement assets often include:

· Traditional & Rollover IRAs

· 401k / 403b / 457 plans

· Deferred compensation plans

· Qualified Annuities

When you withdraw money from these pre-tax sources you have to pay federal income tax on the amount withdrawn but you may also have to pay state income tax as well. If you live in a state that has state income tax, it’s very important to understand the taxation rules for retirement accounts within your state.

For example, New York has a unique rule that each person over the age of 59½ is allowed to withdraw $20,000 from a pre-tax retirement account without having to pay state income tax. Any amounts withdrawn over that threshold in a given tax year are subject to state income tax.

Pretax retirement accounts are usually subject to something called a required minimum distribution (RMD). The IRS requires you to start taking small distributions out of your pre-tax retirement accounts at 72. Without proper guidance, retirees often make the mistake of withdrawing from their after tax assets first, and then waiting until they are required to take the RMD’s from their pre-tax retirement accounts at age 72 and beyond. But this creates a problem for many retirees because it causes:

· The distribution to be subject to higher tax rates

· Loss of tax deductions and credits

· Increase the tax ability of Social Security Increase Medicare premiums Loss of certain property tax credits for

seniors

· Other adverse consequences……

Instead as planners, we proactively plan ahead and ask questions like:

“instead of waiting until age 72 and taking larger RMD’s from the pre-tax account, does it make sense to start making annual distribution from the pre-tax retirement accounts leading up to age 72, thus spreading those distribution in lower amounts, across more tax year resulting in:

· Lower tax liability

· Lower Medicare premiums

· Maintaining tax deductions and credits

· The assets last longer due to a lower aggregate tax liability

· More inheritance for their family members

Since everyone’s tax situation and retirement income situation is different, we have to work closely with their tax professional to determine what the right amount is to withdraw out of the pre-tax retirement accounts each year to optimize their net worth long-term.

After Tax Accounts

After tax assets can include:

· Savings accounts

· Brokerage accounts

· Non-qualified annuities

· Life Insurance with cash value

Just because I’m listing them as “after tax assets” does not mean the whole account value is free and clear of taxes. What I’m referring to is the accounts listed above typically have some “cost basis” meaning a portion of the account it what was originally contributed to the account and can be withdrawal tax fee. The appreciation within the account would be taxes at either ordinary income or capital gains rates depending on the type of the account and how long the assets have been held in the account.

Having after tax assets often provides retirees with a tax advantage because they may be able to “choose their tax rate” when they retire. Meaning they can choose to withdrawal “X” amount from an after tax source and pay little know taxes and show very little taxable income in any given year which opens the door for more long term advanced tax planning.

Withdrawal Strategies

Now that have covered all of the different types of retirement assets and how they are taxed, let move into some of the common withdrawal strategies that we use with our clients:

Retirees With All Three: Pre-tax, Roth, and After-tax Assets

When retirees have all three types of retirement account sources, the strategy usually involves leaving the Roth assets for last, and then meeting with their accountant to determine the amount that should be withdrawn out of their pre-tax and after tax accounts year to minimize the amount of aggregate taxes that they pay long term.

Example: Jim and Carol are both age 67 and just retired and they financial picture consists of the following:

Joint brokerage account: $200,000

401(k)’s: $500,000

Roth IRA‘s: $50,000

Combined Social Security: $40,000

Annual Expenses $100,000

Residents of New York State

An optimal withdrawal strategy may include the following:

Assuming we recommend that they turn on Social Security at their normal retirement age, it will provide them with $40,000 pre-tax Income, 85% of their Social Security benefit will be taxed at the federal level but there will be no state tax deal, resulting in an estimated $35,000 after tax.

That means we need an additional $65,000 after-tax per year from another source to meet their $100,000 per year in expenses. Instead of taking all the money from their joint brokerage account, we could have them rollover their 401(k) balances into Traditional IRAs and then take $20,000 distributions each from their accounts which they not have to pay state income tax on because it’s below the $20K threshold. That would result in another $40,000 in pre-tax income, translating to $35,000 after-tax.

The final $30,000 that is needed to meet their annual expenses would most likely come from their after tax brokerage account unless their accountant advises differently.

This strategy accomplishes a number of goals:

1) We are withdrawing pre-tax retirement assets in smaller increments and taking advantage of the New York

State tax free portion every year. This should result in lower total taxes paid over their lifetime as opposed to waiting until RMD’s start at age 72 and then being required to take larger distributions which could push them over the $20,000 annual limit making them subject in your state tax income tax and higher federal tax rates.

2) We are preserving the after-tax brokerage account for a longer period of time as opposed to using it all to supplement their expenses which would only last for about two years and then they would be forced to take all of their distributions from their pre-tax retirement account making them subject to a higher tax liability

3) For the Roth accounts, we are law allowing them to continue to accumulate as much as possible resulting in more tax free dollars to be withdrawn in the future, or if they pass onto their children, they are inheriting a larger assets that can be withdrawn tax free.

All Pre-Tax Retirement Savings

It’s not uncommon for retirees to have 100% of their retirement savings all within a pre-tax sources like 401(k)s, 403(b)s, traditional IRA‘s, and other types of pre-tax retirement account. This makes the withdrawal strategy slightly more tricky because if there are any big one-time expenses that are incurred during retirement, it forces the retiree to take a large withdrawal from a pre-tax source which also increases the tax liability associate the distribution.

A common situation that we often have to maneuver around is retirees that have plans to purchase a second house in retirement but in order to do that they need to have the cash to come up with a down payment. If they don’t have any after-tax retirement savings, those amounts will most likely have to come from a pre-tax account. Withdrawing $60,000 or more for a down payment can lead to a higher tax liability, higher Medicare premiums the following year, and make a larger portion of your Social Security taxable. For clients in the situation, we often have to plan a few year ahead, and will begin taking pre-text Distributions over multiple tax years leading up to the purchase of the retirement house in an effort to spread the tax liability over multiple years and avoiding the adverse tax and financial consequences of taking one large distribution.

Since many retirees are afraid of taking on debt in retirement, we often get the question in these second house situations is “Should I just take a big distribution from my retirement, pay for the house in full, and not have a mortgage?” If all of the retirement assets are tied up in pre-tax sources, it typically makes the most sense to take a mortgage which allows you to then take smaller distributions from your IRA accounts over multiple tax years to make the mortgage payments compared to taking an enormous tax hit by withdrawing $200,000+ out of a pre-tax return account in a single year.

Pensions With No Need For Retirement Accounts

For retirees that have pensions, it’s not uncommon for their pension and Social Security to provide enough income to meet all of their expenses. But these individual may also have pre-tax retirement accounts and the question becomes “what do we do with them if we don’t need them, and we expect the kids to inherit them?”

This situation often involves a Roth conversion strategy where each year we convert money from the pre-tax IRA’s over to Roth IRA’s. This allows those retirement accounts to accumulate tax free and ultimately withdrawn tax free by the beneficiaries. Versus if they continue to accumulate in pre-tax retirement accounts, the beneficiaries will have to distribute those accounts within 10 years and pay tax on the full balance.

Also when those retirees turn age 72 they have to start taking required minimum distributions which they don’t necessarily need. Since they are receiving pension and Social Security income, those distributions from the retirement accounts could be subject to higher tax rates. By proactively moving assets from a pre-tax source to a Roth source we are essentially reducing the amount of retirement assets that will be subject to RMD’s at age 72 because Roth assets are not subject to RMD‘s.

Using this Roth conversion strategy, it’s also not uncommon for us to have these retirees delay their Social Security. Since Social Security is taxable at the federal level, if we delay Social Security, it gives us more room to process larger Roth conversions because it free up those lower tax brackets. At the same time, it also allows Social Security to accumulate at a guaranteed rate of 6% - 8%.

Nerd Note: When you process these Roth conversions, make sure you’re taking into account the tax liability that’s being generated. You have to have a way to pay the taxes on the amounts converted because the money goes directly from your traditional IRA to your Roth IRA. Retirees that implement this strategy typically have large cash holdings, after tax retirement holdings, or we convert some of the money, and take pre-tax IRA distribution to cover the taxes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Estimated Tax Payments Still Due April 15th

The IRS extended the tax filing deadline for 2020 from April 15th to May 15th. Click to read more on the questions that we are getting from business owners, retirees, and individuals taxpayers.

The IRS extended the tax filing deadline for 2020 from April 15th to May 15th. The question that we are getting from business owners, retirees, and individuals taxpayer are:

1) Are my 1st Quarter Estimated Tax Payments Due On 4/15 or 5/15?

2) When is the deadline for making IRA contributions for 2020?

3) When is my 2020 tax liability due: April 15th or May 15th?

4) How are the $10,200 in tax free unemployment benefits begin handled? Do you have to amend your 2020 tax return?

DISCLOSURE: This is for educational purposes only. This is not tax advice. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

COVID-19 Distribution Tax Forms!!!

If you took a COVID distribution from a retirement account, IRA, 401(K), in 2020, you will have to report it on your taxes. Here are the special tax forms that you will need to report your COVID distribution. DISCLOSURE: This is for…

If you took a COVID distribution from a retirement account, IRA, 401(K), in 2020, you will have to report it on your taxes. Here are the special tax forms that you will need to report your COVID distribution.

DISCLOSURE: This is for educational purposes only. This is not tax advice. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The GameStop Surge: 5 Investment Lessons

In this video, we will be explaining what is driving the price surge in GameStop, AMC, and other companies in the markets. More importantly there are 5 very important investment lessons that investors can learn from the recent GameStop anomaly that we will present in the video.

In this video, we will be explaining what is driving the price surge in GameStop, AMC, and other companies in the markets. More importantly there are 5 very important investment lessons that investors can learn from the recent GameStop anomaly that we will present in the video.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.