The New PTET Tax Deduction for Business Owners

The PTET (pass-through entity tax) is a deduction that allows business owners to get around the $10,000 SALT cap that was put in place back in 2017. The PTET allows the business entity to pay the state tax liability on behalf of the business owner and then take a deduction for that expense.

Above is our video about the PTET (pass-through entity tax) deduction which allows business owners to get around the $10,000 SALT cap that was put in place back in 2017. The PTET allows the business entity to pay the state tax liability on behalf of the business owner and then take a deduction for that expense. This special tax deduction can save a business owner thousands of dollars in taxes. Currently, 31 states, including New York, have some form of PTET program. In this video, Dave Wojeski & Michael Ruger will cover:

How the PTET deduction works?

Which type of entities are eligible for the PTET deduction

Deadlines for electing into the PTET program

How the estimated tax payments are calculated and the deadlines for remitting them

Changes to the PTET S-corp rules in 2022

The new NYC PTET program available in 2023

The challenges faced by companies that have multiple owners that are residents of different states

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Additional Disclosure: Wojeski & Company, American Portfolios and Greenbush Financial Group LLC are unaffiliated entities. Neither APFS nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions.

401(K) Cash Distributions: Understanding The Taxes & Penalties

When an employee unexpectedly loses their job and needs access to cash to continue to pay their bills, it’s not uncommon for them to elect a cash distribution from their 401(K) account. Still, they may regret that decision when the tax bill shows up the following year and then they owe thousands of dollars to the IRS in taxes and penalties that they don’t have.

When an employee unexpectedly loses their job and needs access to cash to continue to pay their bills, it’s not uncommon for them to elect a cash distribution from their 401(K) account. Still, they may regret that decision when the tax bill shows up the following year and then they owe thousands of dollars to the IRS in taxes and penalties that they don’t have. But I get it; if it’s a choice between working a few more years or losing your house because you don’t have the money to make the mortgage payments, taking a cash distribution from your 401(k) seems like a necessary evil. If you go this route, I want you to be aware of a few strategies that may help you lessen the tax burden and avoid tax surprises after the 401(k) distribution is processed. In this article, I will cover:

How much tax do you pay on a 401(K) withdrawal?

The 10% early withdrawal penalty

The 401(k) 20% mandatory fed tax withholding

When do you remit the taxes and penalties to the IRS?

The 401(k) loan default issue

Strategies to help reduce the tax liability

Pre-tax vs. Roth sources

Taxes on 401(k) Withdrawals

When your employment terminates with a company, that triggers a “distributable event,” which gives you access to your 401(k) account with the company. You typically have the option to:

Leave your balance in the current 401(k) plan (if the balance is over $5,000)

Take a cash distribution

Rollover the balance to an IRA or another 401(k) plan

Some combination of options 1, 2, and 3

We are going to assume you need the cash and plan to take a total cash distribution from your 401(k) account. When you take cash distributions from a 401(k), the amount distributed is subject to:

Federal income tax

State income tax

10% early withdrawal penalty

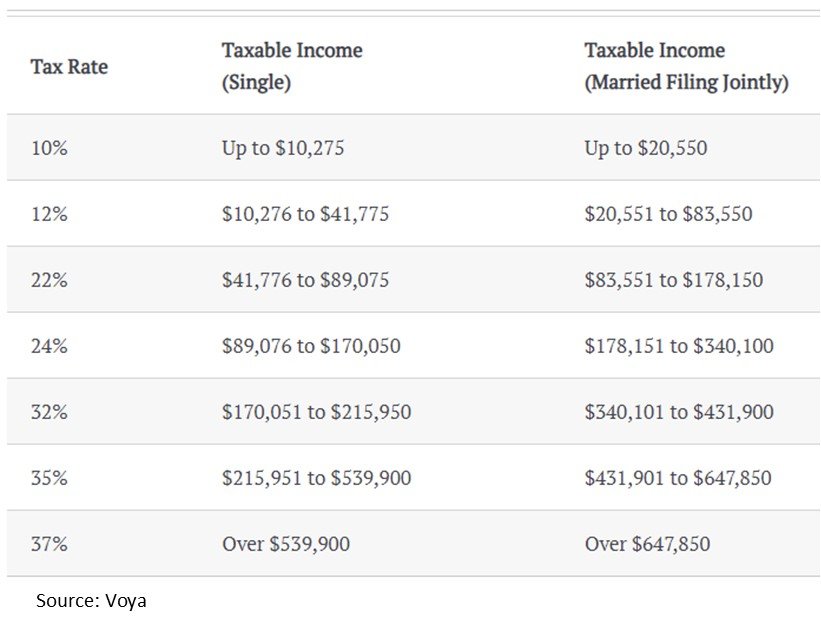

I’m going to assume your 401(k) account consists of 100% of pre-tax sources; if you have Roth contributions, I will cover that later on. When you take distributions from a 401(k) account, the amount distributed is subject to ordinary income tax rates, the same tax rates you pay on your regular wages. The most common question I get is, “how much tax am I going to owe on the 401(K) withdrawal?”. The answer is that it varies from person to person because it depends on your personal income level for the year. Here are the federal income tax brackets for 2022:

Using the chart above, if you are married and file a joint tax return, and your regular AGI (adjusted gross income) before factoring in the 401(K) distribution is $150,000, if you take a $20,000 distribution from your 401(k) account, it would be subject to a Fed tax rate of 24%, resulting in a Fed tax liability of $4,800.

If instead, you are a single filer that makes $170,000 in AGI and you take a $20,000 distribution from your 401(k) account, it would be subject to a 32% fed tax rate resulting in a federal tax liability of $6,400.

20% Mandatory Fed Tax Withholding Requirement

When you take a cash distribution directly from a 401(k) account, they are required by law to withhold 20% of the cash distribution amount for federal income tax. This is not a penalty; it’s federal tax withholding that will be applied toward your total federal tax liability in the year that the 401(k) distribution was processed. For example, if you take a $100,000 cash distribution from your 401(K) when they process the distribution, they will automatically withhold $20,000 (20%) for fed taxes and then send you a check or ACH for the remaining $80,000. Again, this 20% federal tax withholding is not optional; it’s mandatory.

Here's where people get into trouble. People make the mistake of thinking that since taxes were already withheld from the 401(k) distribution, they will not owe more. That is often an incorrect assumption. In our earlier example, the single filer was in a 32% tax bracket. Yes, they withheld 20% in federal income tax when the distribution was processed, but that tax filer would still owe another 12% in federal taxes when they file their taxes since their federal tax bracket is higher than 20%. If that single(k) tax filer took a $100,000 401(k) distribution, they could own an additional $12,000+ when they file their taxes.

State Income Taxes

If you live in a state with a state income tax, you should also plan to pay state tax on the amount distributed from your 401(k) account. Some states have mandatory state tax withholding similar to the required 20% federal tax withholding, but most do not. If you live in New York, you take a $100,000 401(k) distribution, and you are in the 6% NYS tax bracket, you would need to have a plan to pay the $6,000 NYS tax liability when you file your taxes.

10% Early Withdrawal Penalty

If you request a cash distribution from a 401(k) account before reaching a certain age, in addition to paying tax on the distribution, the IRS also hits you with a 10% early withdrawal penalty on the gross distribution amount.

Under the age of 55: If you are under the age of 55, in the year that you terminate employment, the 10% early withdrawal penalty will apply.

Between Ages 55 and 59½: If you are between the ages of 55 and 59½ when you terminate employment and take a cash distribution from your current employer’s 401(k) plan, the 10% early withdrawal penalty is waived. This is an exception to the 59½ rule that only applies to qualified retirement accounts like 401(k)s, 403(b)s, etc. But the distribution must come from the employer’s plan that you just terminated employment with; it cannot be from a previous employer's 401(k) plan.

Note: If you rollover your balance to a Traditional IRA and then try to take a distribution from the IRA, you lose this exception, and the under age 59½ 10% early withdrawal penalty would apply. The distribution has to come directly from the 401(k) account.

Age 59½ and older: Once you reach 59½, you can take cash distributions from your 401(k) account, and the 10% penalty no longer applies.

When Do You Pay The 10% Early Withdrawal Penalty?

If you are subject to the 10% early withdrawal penalty, it is assessed when you file your taxes; they do not withhold it from the distribution amount, so you must be prepared to pay it come tax time. The taxes and penalties add up quickly; let’s say you take a $50,000 distribution from your 401(k), age 45, in a 24% Fed tax bracket and a 6% state tax bracket. Here is the total tax and penalty hit:

Gross 401K Distribution: $50,000

Fed Tax Withholding (24%) ($12,000)

State Tax Withholding (6%) ($3,000)

10% Penalty ($5,000)

Net Amount: $30,000

In the example above, you lost 40% to taxes and penalties. Also, remember that when the 401(k) platform processed the distribution, they probably only withheld the mandatory 20% for Fed taxes ($10,000), meaning another $10,000 would be due when you filed your taxes.

Strategies To Reduce The Tax Liability

There are a few strategies that you may be able to utilize to reduce the taxes and penalties assessed on your 401(k) cash distribution.

The first strategy involves splitting the distribution between two tax years. If it’s toward the end of the year and you have the option of taking a partial cash distribution in December and then the rest in January, that would split the income tax liability into two separate tax years, which could reduce the overall tax liability compared to realizing the total distribution amount in a single tax year.

Note: Some 401(k) plans only allow “lump sum distributions,” which means you can’t request partial withdrawals; it’s an all or none decision. In these cases, you may have to either request a partial withdrawal and partial rollover to an IRA, or you may have to rollover 100% of the account balance to an IRA and then request the distributions from there.

The second strategy is called “only take what you need.” If your 401(k) balance is $50,000, and you only need a $20,000 cash distribution, it may make sense to rollover the entire balance to an IRA, which is a non-taxable event, and then withdraw the $20,000 from your IRA account. The same taxes and penalties apply to the IRA distribution that applies to the 401(k) distribution (except the age 55 rule), but it allows the $30,000 that stays in the IRA to avoid taxes and penalties.

Strategy three strategy involved avoiding the mandatory 20% federal tax withholding in the same tax year as the distribution. Remember, the 401(K) distribution is subject to the 20% mandatory federal tax withholding. Even though they're sending that money directly to the federal government on your behalf, it actually counts as taxable income. For example, if you request a $100,000 distribution from your 401(k), they withhold $20,000 (20%) for fed taxes and send you a check for $80,000, even though you only received $80,000, the total $100,000 counts as taxable income.

IRA distributions do not have the 20% mandatory federal tax withholding, so you could rollover 100% of your 401(k) balance to your IRA, take the $80,000 out of your IRA this year, which will be subject to taxes and penalties, and then in January next year, process a second $20,000 distribution from your IRA which is the equivalent of the 20% fed tax withholding. However, by doing it this way, you pushed $20,000 of the income into the following tax year, which may be taxed at a lower rate, and you have more time to pay the taxes on the $20,000 because the tax would not be due until the tax filing deadline for the following year.

Building on this example, if your federal tax liability is going to be below 20%, by taking the distribution from the 401K you are subject to the 20% mandatory fed tax withholding, so you are essentially over withholding what you need to satisfy the tax liability which creates more taxable income for you. By rolling over the money to an IRA, you can determine the exact amount of your tax liability in the spring, and distribute just that amount for your IRA to pay the tax bill.

Loan Default

If you took a 401K loan and still have an outstanding loan balance in the plan, requesting any type of distribution or rollover typically triggers a loan default which means the outstanding loan balance becomes fully taxable to you even though no additional money is sent to you. For example, if You have an $80,000 balance in the 401K plan, but you took a loan two years ago and still have a $20,000 outstanding loan balance within the plan, if you terminate employment and request a cash distribution, the total amount subject to taxes and penalties is $100,000, not $80,000 because you have to take the outstanding loan balance into account. This is also true when they assess the 20% mandatory fed tax withholding. The mandatory withholding is based on the balance plus the outstanding loan balance. I mention this because some people are surprised when their check is for less than expected due to the mandatory 20% federal tax withholding on the outstanding loan balance.

Roth 401(k) Early Withdrawal Penalty

401(k) plans commonly allow Roth deferrals which are after-tax contributions to the plan. If you request a cash distribution from a Roth 401(k) source, the portion of the account balance that you actually contributed to the plan is returned to you tax and penalty-free; however, the earnings that have accumulated on that Roth source you have to pay tax and potentially the 10% early withdrawal penalty on. This is different from pre-tax sources which the total amount is subject to taxes and penalties.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

$7,500 EV Tax Credit: Use It or Lose It

Claiming the $7,500 tax credit for buying an EV (electric vehicle) or hybrid vehicle may not be as easy as you think. First, it’s a “use it or lose it credit” meaning if you do not have a federal tax liability of at least $7,500 in the year that you buy your electric vehicle, you cannot claim the full $7,500 credit and it does not carryforward to future tax years.

Claiming the $7,500 tax credit for buying an EV (electric vehicle) or hybrid vehicle may not be as easy as you think. First, it’s a “use it or lose it credit” meaning if you do not have a federal tax liability of at least $7,500 in the year that you buy your electric vehicle, you cannot claim the full $7,500 credit and it does not carryforward to future tax years. Normally, most individuals and business owners adopt tax strategies to reduce their tax liability but this use it or lose it EV tax credit could cause some taxpayers to do the opposite, to intentionally create a larger federal tax liability, if they think their federal tax liability will be below the $7,500 credit threshold.

There are several other factors that you also have to consider to qualify for this EV tax credit which include:

New income limitations for claiming the credit

Limits on the purchase price of the car

The type of EV / hybrid vehicles that qualify for the credit

Inflation Reduction Act (August 2022) changes to the EV tax credit rules

Buying an EV in 2022 vs 2023+

Tax documents that you need to file with your tax return

State EV tax credits that may be available

Inflation Reduction Act Changes To EV Tax Credits

On August 16, 2022, the Inflation Reduction Act was signed into law, which changed the $7,500 EV Tax Credits that were previously available. The new law expanded and limited the EV tax credits depending on your income level, what type of EV car you want, and when you plan to buy the car. Most of the changes do not take place until 2023 and 2024, so depending on your financial situation it may be better to purchase an EV in 2022 or it may be beneficial to wait until 2023+.

$7,500 EV Tax Credit

If you purchase an electronic vehicle or hybrid that qualifies for the EV tax credit, you may be eligible to claim a tax credit of up to $7,500 in the tax year that you purchased the car. This is the government’s way of incentivizing consumers to buy electric vehicles. The Inflation Reduction Act also opened up a new $4,000 tax credit for used EVs.

New Income Limits for EV Tax Credits

Starting in 2023, your income (modified AGI) will need to be below the following thresholds to qualify for the federal EV tax credits on a new EV or hybrid:

Single Filers: $150,000

Married Filing Joint: $300,000

Single Head of Household: $225,000

There are lower income thresholds to be eligible for the used EV tax credit which is as follows:

Single Filers: $75,000

Married Filing Joint: $150,000

Single Head of Household: $112,500

Before the passage of the Income Reduction Act, there were no income limitations to claim the $7,500 Tax Credit. Taxpayers with incomes level above the new thresholds may have an incentive to purchase their new EV before December 31, 2022, before the income limitations take effect in 2023.

Restriction on EV Cars That Qualify

Not all EV or hybrid vehicles will qualify for the EV tax credit. The passage of the Inflation Reduction Act made several changes in this category.

Removal of the Manufacturers Cap

On the positive side, Tesla and GM cars will once again be eligible for the EV tax credit. Under the old EV tax credit rules, once a car manufacturer sold over 200,000 EVs, vehicles made by that manufacturer were no longer eligible for the $7,500 tax credit. The new legislation that just passed eliminated those caps making Tesla, GM, and Toyota vehicles once again eligible for the credit. The removal of the cap does not take place until January 1, 2023.

Purchase Price Limit

Adding restrictions, the Inflation Reduction Act introduced a cap on the purchase price of new EVs and hybrids that qualify for the $7,500 EV tax credit. The limit on the manufacturer’s suggested retail price is as follows:

Sedans: $55,000

SUV / Trucks / Vans: $80,000

If the MSRP is above those prices, the vehicle no longer qualified for the EV tax credit.

Assembly & Battery Requirements

Another change was made to the EV tax credit under the new legislation that will most likely limit the number of vehicles that are eligible for the credit. The new law introduced a final assembly and battery component requirement. First, to be eligible for the credit, the final assembly of the vehicle needs to take place in North America. Second, the battery used to power the vehicle must be made up of key materials and consist of components that are either manufactured or assembled in North America.

Leases Do Not Qualify

If you lease a car, that does not qualify toward the EV tax credit because you technically do not own the vehicle, the manufacturer does. You have to buy the vehicle to be eligible for the $7,500 EV tax credit.

Are You Eligible For The EV Tax Credit?

Bringing everything together, starting in 2023, to determine whether or not you will be eligible for the $7,500 EV Tax Credit, you will have to make sure that:

Your income is below the EV tax credit limits

The purchase price of the vehicle is below the EV tax credit limit

The vehicles assembly and battery components meet the new requirement

Once there is more clarification around the assembly and components piece of the new legislation there will undoubtedly be a website that lists all of the vehicles that are eligible for the $7,500 tax credit that you will be able to use to determine which vehicles qualify.

Timing of The Tax Credit

Under the current EV tax credit rule, you purchase the vehicle now, but you do not receive the tax credit until you file your taxes for that calendar year. Starting in 2024, the tax credit will be allowed to occur at the point of sale which is more favorable for consumers. Logistically, it would seem that an individual would assign the credit to the car dealer, and then the car dealer would receive an advance payment from the US Department of Treasury to apply the discount or potentially allow the car buyer to use the credit toward the down payment on the vehicle.

However, car buyers will have to be careful here. Since your eligibility for the tax credit is income based, if you apply for the credit in advance, but then your income for the year is over the MAGI threshold, you may owe that money back to the IRS when you file your taxes. It will be interesting to see how this is handled since the credits are being awarded in advance.

A Use It or Lose It Tax Credit

There are going to be some challenges with the new EV tax credit rule beyond limiting the number of people that qualify and the number of cars that qualify. The primary one is that the $7,500 EV federal tax credit is not a “refundable tax credit.” A refundable tax credit means if your total federal tax liability is less than the credit, the government gives you a refund of the remaining amount, so you receive the full amount as long as you qualify. The EV tax credit is still a “non-refundable tax credit” meaning if you do not have a federal tax liability of at least $7,500 in the year that you purchase the new EV vehicle, you may lose all or a portion of the $7,500 that you thought you were going to receive.

For example, let’s say you are a single tax filer, and you make $50,000 per year. If you just take the standard deduction, with no other tax deductions, your federal tax liability may be around $4,200 in 2023. You buy a new EV in 2023, you meet the income qualifications, and the vehicle meets all of the manufacturing qualifications, so you expect to receive $7,500 when you file your taxes for 2023. However, since your federal tax liability was only $4,200 and the EV tax credit is not refundable, you would only receive a tax credit of $4,200, not the full $7,500.

No EV Tax Credit Carryforward

With some tax deductions, there is something called tax carryforward, meaning if you do not use the tax deduction in the current tax year, you can “carry it forward” to be used in future tax years to offset future income. The EV tax credit does not allow carryforward, if you can’t use all of it in the year of the EV purchase, you lose it.

Intentionally Creating Federal Tax Liability

If you are in this scenario where you purchase an EV but you expect your federal tax liability to be below the full $7,500 credit threshold, you may have to do what I call “opposite tax planning”. Normally you are trying to find ways to reduce your tax bill, but in these cases, you are trying to find ways to increase your tax liability to get the maximum refund from the government. But how do you intentionally increase your tax liability? Here are a few ideas:

Stop or reduce the contributions being made to your pre-tax retirement accounts. When you make pretax contributions to retirement accounts it reduces your tax liability. But you have to be careful here, if your company offers an employer match, you could be leaving free money on the table, so you have to conduct some analysis here. In many cases, 401(k) / 403(b) allows either pre-tax or Roth contributions. If you are making pre-tax contributions, you may be able to just switch to Roth contributions, which are after-tax contributions, and still take advantage of the employer match.

Push more income into the current tax year. If you are a small business owner, you may want to push more income into the current tax year. If you are a W2 employee, you are expecting to receive a bonus payment, and you have a good working relationship with your employer, you may be able to request that they pay the bonus to you this year as opposed to the spring of next year.

Delay tax-deductible expenses into the following tax year. Again, if you are a small business owner and have control over when you realize expenses, you could push those into the following year. For W2 employees, if you have enough tax deductions to itemize, you may want to push some of the itemized deductions into the following tax year.

Delay getting married until the following tax year. Kidding but not kidding. Nothing says I love you like a full $7,500 tax credit. Use it toward the wedding. You may not qualify under the single file income limit but maybe you would qualify under the joint filer limit.

State EV Tax Credit

The $7,500 EV tax credit is a federal tax credit but some states also have EV tax credits in addition to the federal tax credit and those credits could have different criteria to qualify. It’s worth looking into before purchasing your new or used EV.

EV Tax Credit Tax Forms

In 2022, you apply for the federal EV tax credit when you file your tax return. You will have to file Form 8936 with your tax return.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can You Contribute To An IRA & 401(k) In The Same Year?

There are income limits that can prevent you from taking a tax deduction for contributions to a Traditional IRA if you or your spouse are covered by a 401(k) but even if you can’t deduct the contribution to the IRA, there are tax strategies that you should consider

The answer to this question depends on the following items:

Do you want to contribute to a Roth IRA or Traditional IRA?

What is your income level?

Will the contribution qualify for a tax deduction?

Are you currently eligible to participate in a 401(k) plan?

Is your spouse covered by a 401(k) plan?

If you have the choice, should you contribute to the 401(k) or IRA?

Advanced tax strategy: Maxing out both and spousal IRA contributions

Traditional IRA

Traditional IRA’s are known for their pre-tax benefits. For those that qualify, when you make contributions to the account you receive a tax deduction, the balance accumulates tax deferred, and then you pay tax on the withdrawals in retirement. The IRA contribution limits for 2022 are:

Under Age 50: $6,000

Age 50+: $7,000

However, if you or your spouse are covered by an employer sponsored plan, depending on your level of income, you may or may not be able to take a deduction for the contributions to the Traditional IRA. Here are the phaseout thresholds for 2022:

Note: If both you and your spouse are covered by a 401(k) plan, then use the “You Are Covered” thresholds above.

BELOW THE BOTTOM THRESHOLD: If you are below the thresholds listed above, you will be eligible to fully deduct your Traditional IRA contribution

WITHIN THE PHASEOUT RANGE: If you are within the phaseout range, only a portion of your Traditional IRA contribution will be deductible

ABOVE THE TOP THRESHOLD: If your MAGI (modified adjusted gross income) is above the top of the phaseout threshold, you would not be eligible to take a deduction for your contribution to the Traditional IRA

After-Tax Traditional IRA

If you find that your income prevents you from taking a deduction for all or a portion of your Traditional IRA contribution, you can still make the contribution, but it will be considered an “after-tax” contribution. There are two reasons why we see investors make after-tax contributions to traditional IRA’s. The first is to complete a “Backdoor Roth IRA Contribution”. The second is to leverage the tax deferral accumulation component of a traditional IRA even though a deduction cannot be taken. By holding the investments in an IRA versus in a taxable brokerage account, any dividends or capital gains produced by the activity are sheltered from taxes. The downside is when you withdraw the money from the traditional IRA, all of the gains will be subject to ordinary income tax rates which may be less favorable than long term capital gains rates.

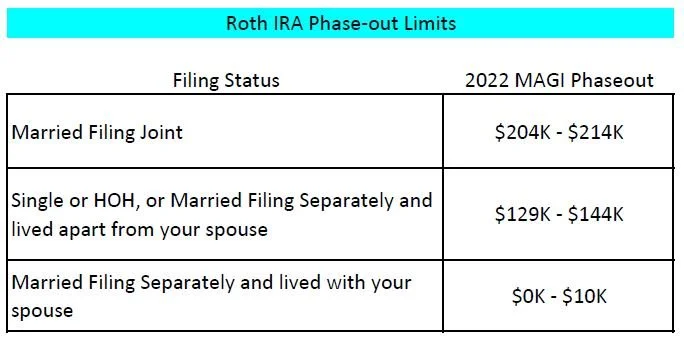

Roth IRA

If you are covered by a 401(K) plan and you want to make a contribution to a Roth IRA, the rules are more straight forward. For Roth IRAs, you make contributions with after-tax dollars but all the accumulation is received tax free as long as the IRA has been in existence for 5 years, and you are over the age of 59½. Unlike the Traditional IRA rules, where there are different income thresholds based on whether you are covered or your spouse is covered by a 401(k), Roth IRA contributions have universal income thresholds.

The contribution limits are the same as Traditional IRA’s but you have to aggregate your IRA contributions meaning you can’t make a $6,000 contribution to a Traditional IRA and then make a $6,000 contribution to a Roth IRA for the same tax year. The IRA annual limits apply to all IRA contributions made in a given tax year.

Should You Contribute To A 401(k) or an IRA?

If you have the option to either contribute to a 401(k) plan or an IRA, which one should you choose? Here are some of the deciding factors:

Employer Match: If the company that you work for offers an employer matching contribution, at a minimum, you should contribute the amount required to receive the full matching contribution, otherwise you are leaving free money on the table.

Roth Contributions: Does your 401(k) plan allow Roth contributions? Depending on your age and tax bracket, it may be advantageous for you to make Roth contributions over pre-tax contributions. If your plan does not allow a Roth option, then it may make sense to contribute pre-tax up the max employer match, and then contribute the rest to a Roth IRA.

Fees: Is there a big difference in fees when comparing your 401(k) account versus an IRA? With 401(k) plans, typically the fees are assessed based on the total assets in the plan. If you have a $20,000 balance in a 401(K) plan that has $10M in plan assets, you may have access to lower cost mutual fund share classes, or lower all-in fees, that may not be available within a IRA.

Investment Options: Most 401(k) plans have a set menu of mutual funds to choose from. If your plan does not provide you with access to a self-directed brokerage window within the 401(k) plan, going the IRA route may offer you more investment flexibility.

Easier Is Better: If after weighing all of these options, it’s a close decision, I usually advise clients that “easier is better”. If you are going to be contributing to your employer’s 401(k) plan, it may be easier to just keep everything in one spot versus trying to successfully manage both a 401(k) and IRA separately.

Maxing Out A 401(k) and IRA

As long as you are eligible from an income standpoint, you are allowed to max out both your employee deferrals in a 401(k) plan and the contributions to your IRA in the same tax year. If you are age 51, married, and your modified AGI is $180,000, you would be able to max your 401(k) employee deferrals at $27,000, you are over the income limit for deducting a contribution to a Traditional IRA, but you would have the option to contribute $7,000 to a Roth IRA.

Advanced Tax Strategy: In the example above, you are above the income threshold to deduct a Traditional IRA but your spouse may not be. If your spouse is not covered by a 401(k) plan, you can make a spousal contribution to a Traditional IRA because the $180,000 is below the income threshold for the spouse that is NOT COVERED by the employer sponsored retirement plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Kiddie Tax & Other Pitfalls When Gifting Assets To Your Kids

Before you gift assets to your children make sure you fully understand the Kiddie Tax rule and other pitfalls associated with making gift to your children……….

There are a number of reasons why parents gift assets to their kids which include:

Reduce tax liability

Protecting assets from the nursing home

Estate planning: Avoiding probate

But the pitfalls are many and most people do not find out about the pitfalls until it’s too late. These pitfalls include:

Kiddie tax rules

Children with self-directed investment accounts

Treatment of long-term capital gains

Gifting cost basis rules

College financial aid impact

Control of the assets

5 Year look-back rule

Divorce

Lawsuits

Distributions from Inherited IRA’s

Kiddie Tax

The strategy of shifting assets from a parent to a child on the surface seems like a clever tax strategy in an effort to shift investment income or capitals gains from the parent that may be in a high tax bracket to their child that is in a low tax backet. Unfortunately, the IRS is aware of this strategy, and they have been aware of it since 1986, which is the year the “Kiddie Tax” was signed into law.

Here is how the Kiddie tax works; if your child’s income is over a certain amount, then the income is taxed NOT at the child’s tax rate, but at the PARENT’S tax rate. Kiddie tax rules do NOT apply to earned income which includes wages, salary, tips, or income from self-employment. Kiddie tax ONLY applies to UNEARNED INCOME which includes:

Taxable interest

Dividends

Capital gains

Taxable Scholarships

Income produced by gifts from grandparents

Income produced by UTMA or UGMA accounts

IRA distributions

There are some exceptions to the rule but in general, your child would be subject to the Kiddie tax if they are:

Under the age of 19; or

Between the ages of 19 and 23, and a full-time student

The only exceptions that apply are if your child:

Has earned income totaling more than half the cost of their support; or

Your child files their tax return as married filing joint

Kiddie Tax Calculation

Here is how the Kiddie tax calculation works. For 2022, the first $1,150 of a child’s unearned income is tax-free, the next $1,150 is taxed at the child’s rate, and any unearned income above $2,300 is taxed at the parent’s marginal income tax rate.

Here is an example, the parents bought Apple stock a long time ago and the stock now has a $30,000 unrealized long term capital gain. Assuming the parents make $200,000 per year in income, if they sell the stock, they will have to pay the Federal 15% long term capital gains tax on the $30,000 gain. But they have a child that is age 16 with no income, so they gift the stock to them, have them sell it, with the hopes of the child capturing the 0% long term cap gains rate since they have no income. Kiddie tax is triggered!! The first $2,300 would be tax free but the rest would be taxed at the parent’s federal 15% long term cap gain rate; oh and if that family was expecting to receive college financial aid two years from now, they might have just made a grave mistake because now that teenager is showing income. A topic for later.

That was an example using long term capital gains rates but if we used a source of unearned income subject to ordinary income tax rates, the jump could go from an assumed 0% to the parents 37% tax rate if they are in the highest fed bracket.

Putting Your Kids on Payroll

While we are on the subject of Kiddie Tax, our clients that own small businesses will sometimes ask “Do I have to worry about the Kiddie tax if I put my kids on payroll through my company?” Fortunately the answer is “No”. Paying your child W2 wages through your company is considered “earned income” and earned income is not subject to the kiddie tax rules.

Children with Self-Directed Investment Accounts

It’s becoming more common for high school and college students to have their own brokerage accounts where they are trading stocks, ETFs, options, cryptocurrency, and mutual funds. But the kiddie rules can come into play when they are buying and selling investments in their accounts. If the parents claim the child as a dependent on their tax return and they buy and then sell an investment within a 12 month period, that would create a short term gain subject to ordinary income tax rates. If that gain is above $2,300, then the kiddie tax is triggered, and the gain would be taxed at the parent’s tax rate not the child’s tax rate. This can lead to tax surprises when the child receives the tax forms from the brokerage platform and then realizes there are big taxes due, and the child may or may not have the money to pay it.

For the child to file their own tax return to avoid this Kiddie tax situation, the child must be earning enough income to provide at least half of their financial support.

Kiddie Tax Form 8615

How do you report the Kiddie tax on your tax return? I spoke with a few CPA’s about this and they normally advise their clients that once the child has unearned income over $2,300, the child, even though they may be a dependent on your tax return, files their own tax return, and with their tax return they file Form 8615 which calculates the Kiddie Tax liability based on their parent’s tax rate.

Impact on College Financial Aid

Before gifting any assets to your child, income producing or not, if you are expecting to receive any form of need based financial aid for your child for college in the future, be very very careful. The FAFSA calculation weighs assets and income differently depending on whether it belongs to the parent or the child.

For assets, if the parent owns it, the balance counts 5.64% against the aid awarded. If the child owns it, the balance counts 20% against the aid awarded. You move a stock into your child’s name that is worth $30,000, if you would have qualified for financial aid, you just cost yourself $4,300 PER YEAR in financial aid.

Income is worse. If you gift your child an asset that produces income or capital gains, income of the parents counts 22% - 47% against college financial aid depending on the size of the household. If the income belongs to the child, it counts 50% against the FAFSA award. Another note, the FAFSA process looks back 2 years for purposes of determining the financial aid award, so even though they may only be a sophomore or junior in high school, you don’t find out about that mistake until 2 years later when they are applying for FAFSA as a freshman in college.

Long Term Capital Gains Treatment

The example that I used earlier with the Apple stock highlights another useful tax lesson. If you are selling a stock, mutual fund, or investment property that you have owned for more than a year, it’s taxed at the preferential long term capital gain rate of 15% as long as your taxable income does not exceed $459,750 for single filers or $517,200 for married filing joint in 2022, it’s a flat 15% tax rate whether it’s a $20,000 gain or a $200,000 gain because the rate does not increase like it does for “earned income”. I make this point because long term capital gain rates are already taxed at a relatively low rate, and if realized by your child, are subject to Kiddie tax so before you jump through all the hoops of making the gift, make sure the tax strategy is going to work.

Gift Cost Basis Rules

When you make a gift, it’s important to understand how the cost basis rules work. When you make a gift, there typically is not an immediate tax event, but the recipient inherits your cost basis in that asset. Gifting an asset does not provide the person making the gift with a tax deduction or erase the unrealized gains, unless of course you are gifting it to a charity or not-for-profit. Let’s keep running with that Apple stock example, you gift the Apple stock to your child with a $30,000 unrealized gain, there is no tax event when the gift is made, but if the child sells the stock the next day, they will have to pay tax on the $30,000 realized gain, and if the kiddie tax applies, it will be taxed at the parent’s tax rate.

Estate Tax Planning: Avoid Probate

Sometimes people will gift assets to their kids in an effort to remove those assets from their estate to avoid probate, a big tax issue surfaces with this strategy. Normally when someone passes away and their kids inherit a house or investments, they receive a “step-up in basis”. A step-up in basis means no matter what the gain was in the house or investment prior to a person passing away, the cost basis to the person that inherits the assets is now the fair market value of that asset as of decedent’s date of death.

Example: You bought your house 20 years ago for $200,000 and it’s now worth $400,000. If you were to pass away tomorrow and your kids inherit your house, they receive a step-up in basis to $400,000 so if they sell the house the next day, they have no tax liability. A huge tax benefit.

But if you gift the house to your kids while you are still alive in an effort to avoid the probate process, your kids now lose the step-up in cost basis because the house never passes through your estate. If you kids sell your house the next day, they will realize a $200,000 gain and have to pay tax on it which at the Federal level of 15%, could cost them $30,000 in taxes which could have been avoided.

There are other ways to avoid probate besides gifting that asset to your kids which allows the asset to avoid the probate process and receive a step up in basis. You could setup a trust to own the asset or change the registration on the account to a “transfer on death” account.

Distributions From An IRA Owned By The Child

If your child inherits an IRA, they may be required to take RMD’s (required minimum distributions) each year from the IRA. Distribution are not only subject to ordinary income tax but they are also subject to Kiddie tax since IRA distributions are considered unearned income. If you child inherits a pre-tax IRA or 401(k) be very careful when taking distribution from the account, especially taking into consideration the new distribution rules for non-spouse beneficiaries.

Control of the Asset

As financial planners, we have seen a lot of crazy things happen. While some teenagers are very responsible, others are not. When you gift an asset directly to child, they may not use that gift as intended. Even with UTMA and UGMA account, the parents only have control until the child reaches age of majority, and then account belongs to them. If there is any concern about how the gifted asset will be managed or distributed, you may want to consider a trust or another type of account that provides the you with more control of the asset.

Lawsuits

From a liability standpoint, if you gift assets to your child, and those assets have a meaningful amount of value, those assets could be exposed to a lawsuit if your child were to ever be sued.

Divorce

If you gift assets to your child and they are already married or get married in the future, depending on what state they live in or how those assets are titled, they could be considered marital property. If a divorce happens at some point in the future, their soon to be ex-spouse could now be entitled to a portion of those gifted assets.

5 Year Lookback Rule

Some parents will gift assets to their children to avoid the spend down process should a long term care event happen at some point in the future and they need to go into a nursing home. Different states have different Medicaid rules but in New York, the gift has to take place 5 years prior to the Medicaid application otherwise the assets are subject to spend down.

The other pitfall of gifting assets to your children is that while you may be able to successfully protect those assets from a Medicaid lookback period, the cost basis issue that we discussed earlier still exists. If you gift the house to your kids, they inherit your cost basis, so when they go to sell the house after you pass, they have to pay tax on the full gain amount, versus if you established a grantor irrevocable trust to own your house, it could satisfy the gift for the 5 year look back period in NY, but then your kids receive a step up in basis when you pass away since the house passes through your estate, and they can sell the house with no tax liability.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Pay 0% Tax On Capital Gains Income

When you sell a stock, mutual fund, investment property, or a business, if you have made money on that investment, the IRS is kindly waiting for a piece of that gain in the form of capital gains tax. Capital gains are taxed differently than the ordinary income that you received via your paycheck or pass-through income from your business. Unlike ordinary

When you sell a stock, mutual fund, investment property, or a business, if you have made money on that investment, the IRS is kindly waiting for a piece of that gain in the form of capital gains tax. Capital gains are taxed differently than the ordinary income that you received via your paycheck or pass-through income from your business. Unlike ordinary income, which has a series of tax brackets that range from 10% to 37% in 2022, capital gains income is taxed at a flat rate at the federal level. Most taxpayers are aware of the 15% long term capital gains tax rate but very few know about the 0% capital gains tax rate and how to properly time the sale of your invest to escape having to pay tax on the gain.

Short-term vs Long-Term Gains

Before I get into this tax strategy, you first have to understand the difference between “short-term” and “long-term” capital gains. Short-term capital gains apply to any investment that you bought and sold in less than a 12 month period. Example, if I buy a stock today for $1,000 and I sell it three months later for $3,000, I would have a $2,000 short-term capital gain. Short-term capital gains are taxed as ordinary income like your paycheck. There is no special tax treatment for short-term capital gains and the 0% tax strategy does not apply.

Long-term capital gains on the other hand are for investments that you bought and then sold more than 12 months later. When I say “investments” I’m using that in broad terms. It could be a business, investment property, stock, etc. When you sell these investments at a gain and you have satisfied the 1 year holding period, you receive the benefit of paying tax on the gain at the preferential “long-term capital gains rate”.

What Are The Long Term Capital Gains Rates?

For federal tax purposes, there are 3 long term capital gains rates: 0%, 15%, and 20%. What rate you pay is determined by your filing status and your level of taxable income in the year that you sold the investment subject to the long term capital gains tax. For 2022, below are the capital gains brackets for single filers and joint filers.

As you will see on the chart, if you are a single filer and your taxable income is below $41,675 or a joint filer with taxable income below $83,350, all or a portion of your long term capital gains income may qualify for the federal 0% capital gains rate.

An important note about state taxes on capital gains income is that each state has a different way of handling capital gains income. New York state is a “no mercy state” meaning they do not offer a special tax rate for long term capital gains. For NYS income tax purposes, your long term capital gains are taxed as ordinary income. But let’s continue our story with the fed tax rules which are typically the lion share of the tax liability.

In a straight forward example, assume you live in New York, you are married, and your total taxable income for the year is $50,000. If you realize $25,000 in long term capital gains, you will not pay any federal tax on the $25,000 in capital gain income but you will have to pay NYS income tax on the $25,000.

Don’t Stop Reading This Article If Your Taxable Income Is Above The Thresholds

For many taxpayers, their income is well above these income thresholds. But I have good news, with some maneuvering, there are legit strategies that may allow you to take advantage of the 0% long term capital gains tax rate even if your taxable income is above the $41,675 single filer and $83,350 joint filer thresholds. I will include multiple examples below as to how our high net worth clients are able to access the 0% long term capital gains rate but I first have to build the foundation as to how it all works.

Using 401(k) Contributions To Lower Your Taxable Income

In years that you will have long term capital gains, there are strategies that you can use to reduce your taxable income to get under the 0% thresholds. Here is an example, I had a client sell a rental property this year and the sale triggered a long term capital gain for $40,000. They were married and had a combined income of $110,000. If they did nothing, at the federal level they would just have to pay the 15% long term capital gains tax which results in a $6,000 tax liability. Instead, we implemented the following strategy to move the $40,000 of capital gains into the 0% tax rate.

Once they received the sale proceeds from the house, we had them deposit that money to their checking account, and then go to their employer and instruct them to max out their 401(k) pre-tax contributions for the remainder of the year. Since they were both over 50, they were each able to defer $27,000 (total of $54,000). They used the proceeds from the house sale to supplement the income that they were losing in their paychecks due to the higher pre-tax 401(k) deferrals. Not only did they reduce their taxable income for the year by $54,000, saving a bunch in taxes, but they also were able to move the full $40,000 in long term capital gain income into the 0% tax bracket. Here’s how the numbers work:

Adjusted Gross Income (AGI): $110,000

Pre-tax 401(k) Contributions: ($54,000)

Less Standard Deduction: ($25,900)

Total Taxable Income: $30,100

In their case, they would be able to realize $53,250 in long term capital gains before they would have to start paying the 15% fed tax on that income ($83,350 – $30,100 = $53,250). Since they were below that threshold, they paid no federal income tax on the $40,000 saving them $6,000 in fed taxes.

“Filling The Bracket”

The strategy that I just described is called “filling the bracket”. We find ways to reduce an individuals taxable income in the year that long term capital gains are realized to “fill up” as much of that 0% long-term capital gains tax rate that we can before it spills over into the 15% long-term capital gains rate.

More good news, it’s not an “all or none” calculation. If you are married, have $60,000 in taxable income, and $100,000 in long term capital gains, a portion of your $100,000 in capital gains will be taxed at the 0% rate with the majority taxed at the 15% tax rate. As you might have guessed the IRS is not going to let you get away with paying 0% on a $100,000 in long term capital gains because you maneuvered your taxable income into the 0% cap gain range. But in this case, $23,350 would be taxed at the 0% long term cap gain rate, and the reminder would be taxed at the 15% long term cap gain rate.

Do Capital Gains Bump Your Ordinary Income Into A Higher Bracket?

When explaining this “filling up the bracket” strategy to clients, the most common question I get is: “If long term capital gains count as taxable income, does that push my ordinary income into a higher tax bracket?” The answer is “no”. In the eyes of the IRS, capital gains income is determined to be earned “after” all of your other income sources.

In an extreme example, let’s say you have $70,000 in ordinary income and $200,000 in capital gains. If your total ordinary income was $70,000 and you file a joint tax return, your top fed tax bracket in 2022 would be 12%. However, if the IRS decided to look at the $200,000 in capital gain income first and then put your ordinary income on top of that, your top federal tax bracket would now be 24%. That would hurt tax wise. Luckily, it does not work that way. Even if you realized $1M in long term capital gains, the $70,000 in ordinary income would be taxed at the same lower tax brackets since it was earned first in the eyes of the IRS.

Work With Your Accountant

Before I get into the more advanced strategies for how this filling up the brackets strategy is used, I cannot stress enough the importance of working with your tax advisor when executing these more complex tax strategies. The tax system is complex and making a shift in one area could hurt you in another area.

Even though these strategies may lower the federal tax rate on your long-term capital gain income, capital gains will increase your AGI (adjusted gross income) for the year which could phase you out of certain deductions, tax credits, increase your Medicare premiums, reduce college financial aid, etc. Your accountant should be able to run tax projections for you in their software to play with the numbers to determine the ideal amount of long-term capital gains that can be realized in a given year without hurting the other aspects of your financial picture.

Strategy #1: I’m Retiring

When people retire, in many cases, their taxable income drops because they no longer have their paycheck and they are typically supplementing their income with social security and distributions from their investment accounts. This creates a tax planning opportunity because these taxpayers sometimes find themselves in the lowest tax bracket that they have been in over the past 30+ years. Here are some of the common examples.

Example 1: The First Year Of Retirement

If you retire at the beginning of the calendar year, you may only have had a few months of paychecks, so your income may be lower in that year. If you have built up cash in your savings account or if you have an after tax investment account that you can use to supplement your income for the remainder of the year to meet your expenses, this may create the opportunity to “fill up the bracket” and realize some long-term capital gains at a 0% federal tax rate in that year.

Example 2: Lower Expenses In Retirement

We have had clients that were making $150,000 per year and then when they retire they only need $40,000 per year to live off of. When you retire, the kids are typically through college, the mortgage is paid off, and your expenses drop so you need less income to supplement those expenses. A portion of your social security will most likely be counted as taxable income but if you do not have a pension, you may have some wiggle room to realize a portion of your long-term capital gains as a 0% rate each year.

Assume this is a single filer. Here is how the numbers would work:

Social Security & IRA Taxable Income: $40,000

Less Standard Deduction: ($12,000)

Total Taxable Income: $28,000

This individual would be able to realize $13,675 in long term capital gains each year at the 0% fed tax tax because the threshold is $41,675 and they are only showing $28,000 in taxable income. Saving $2,051 in fed taxes.

Strategy #2: Business Owner Experiences A Low Income Year

If you have been running a business for 5+ years, you have probably been through those one or two tough years where either revenue drops dramatically or the business incurs a lot of expenses in a single year, lowering your net profits. Do not let these low taxable income years go to waste. If you typically make $250,000+ per year and you have one of these low income years, start planning as soon as possible because once you cross that December 31st threshold, you have wasted a tax planning opportunity. If you are showing no income for that year, you may want to talk to your accountant about realizing some long term capital gains in your brokerage account to realize those gains at a 0% tax rate. Or you may want to consider processing a Roth conversion in that low tax year. There are a number of tax strategies that will allow you to make the most of that “bad year” income wise.

Strategy #3: Leverage Cash Reserves and Brokerage Accounts

If you have been building up cash reserves or you have a brokerage account that you could sell some holdings without incurring big taxable gains, you may be able to use that as your income source for the year which could result in little to no taxable income showing for that tax year. We have seen both retirees and business owners use this strategy.

Business owners have control over when expenses will be realized which influences how much taxable income is being passed through to the business owner. If you can overload expenses into a single tax year instead of splitting it evenly between two separate tax years, that could create some tax planning opportunities.

Strategy #4: Moving To Another State

It’s common for individuals to move to more tax friendly states in retirement. If you live in a state now, like New York, that makes you pay tax on long term capital gain income, and you plan to move to Florida next year and change your state of domicile, you may want to wait to realize your capital gains until you are resident of Florida to avoid having to pay state tax on that income. This has nothing to do with the 0% Fed tax strategy but it might reduce your state income tax bill on those capital gains.

Bottom Line

There are few strategies that allow you to pay 0% in federal taxes on any type of gain. If you are a high income earner, this strategy may not work for you every year but there may be opportunities to use them at some point if income drops or when you enter the retirement years. Again, don’t let those lower income years go to waste. Work with your accountant and determine if “filling the bracket” is the right move for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Roth Conversions In Retirement

Roth conversions in retirement are becoming a very popular tax strategy. It can help you to realize income at a lower tax rate, reduce your RMD’s, accumulate assets tax free, and pass Roth money onto your beneficiaries. However, there are pros and cons that you need to be aware of, because processing a Roth conversion involves showing more taxable income in a given year. Without proper tax planning, it could lead to unintended financial consequences such as:

· Social Security taxed at a higher rate

· Higher Medicare premiums

· Assets lost to a long term care event

· Higher taxes on long term capital gains

· Losing tax deductions and credits

· Higher property taxes

· Unexpected big tax liability

In this video, Michael Ruger will walk you through some of the strategies that he uses with his clients when implementing Roth Conversions. This can be a very effective wealth building strategy when used correctly.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Paying Tax On Inheritance?

Not all assets are treated the same tax wise when you inherit them. It’s important to know what the tax rules are and the distribution options that are available to you as a beneficiary of an estate. In this video we will cover the tax treatment on inheriting a:

· House

· Retirements Accounts

· Stock & Mutual Funds

· Life Insurance

· Annuities

· Trust Assets

We will also cover the:

· Distribution options available to spouse and non-spouse beneficiaries of retirement accounts

· Federal Estate Tax Limits

· Biden’s Proposed Changes To The Estate Tax Rules

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Retirement Account Withdrawal Strategies

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you in more ways than one. Click to read more on how this can effect you.

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you more in taxes long-term, causing you to deplete your retirement assets faster, pay higher Medicare premiums, and reduce the amount of inheritance that your heirs would have received. Retirees will frequently have some combination of the following income and assets in retirement:

· Pretax 401(k) and IRA’s

· Roth IRA IRA’s

· After tax brokerage accounts

· Social Security

· Pensions

· Annuities

As Certified Financial Planner’s®, we look at an individual’s income needs, long-term goals, and map out the optimal withdraw strategy. In this article, I will be sharing with you some of the considerations that we use with our clients when determining the optimal withdrawal strategy.

Layer One : Pension Income

When you develop a withdrawal strategy for your retirement assets it’s similar to building a house. You have to start with a foundation which is taxable income that you expect to receive before you begin taking withdrawals from your retirement accounts. For retirees that have pensions, this is the first layer. Income from pensions are typically taxable income at the federal level but may or may not be taxable at the state level depending on which state you live in and who the sponsor of the pension plan is. While pensions are great, retirees that have pension income have to be very careful about how they make withdrawals from their retirement accounts because any withdraws from pre-tax accounts will stack up on top of their pension income making those withdrawal potentially subject to higher tax rates or cause you to lose tax deductions and credits that were previously received.

Layer Two: Social Security

Social Security income is also something that has to be factored into the mix. Most retirees will have to pay federal income tax on a large portion of their Social Security benefit. When we are counseling clients on their Social Security filing strategy, one of the largest influencers in that decision is what type of retirement accounts that have and how much is in each account. Delaying Social Security each year, increases the amount that an individual receives in the range of 6% to 8% per year forever. As financial planners, we view this as a “guaranteed rate of return” which is tough to replicate in other asset classes. Not turning your Social Security benefit prior to your normal retirement age can:

· Increase 50% spousal benefit

· Increase the survivor benefit

· Increase the value of SS cost of living adjustments

· Reduce the amount required to be withdrawn for other sources

For purposes of this article, we will just look at Social Security as another layer of income but know that depending on your financial situation your Social Security filing strategy does factor into your asset withdrawal strategy.

Roth Accounts: Last To Touch

In most situations, Roth assets are typically the last asset that you touch in retirement. Since Roth assets accumulate and are withdrawn tax free, they are by far the most valuable vehicle to accumulate wealth long-term. The longer they accumulate, the more valuable they are.

The other wonderful feature about Roth IRAs is that there is no required minimum distributions (RMD’s) at age 72. Meaning the government does not force you to take distributions once you have reached a certain age so you can continue to accumulate wealth within that asset class.

Roth’s are also one of the most valuable assets to pass onto beneficiaries because they can continue to accumulate tax free and are withdrawn tax free. For spousal beneficiaries, they can roll over the balance into their own Roth IRA and continue to accumulate wealth tax free. For non-spouse beneficiaries, under the new 10 year rule, they can continue to accumulate wealth for a period of up to 10 years after inheriting the Roth before they are required to distribute the full balance but they don’t pay tax on any of it.

Financial Nerd Note: While Roth are great accumulation vehicles, it’s impossible to protect them from a long term care event spend down situation. They cannot be transferred into a Medicaid trust and they are subject to full spend down for purposes of qualifying for Medicaid in New York since there is no RMD requirements. It’s just a risk that I want you to be aware of.

Pre-tax Assets

Pre-taxed retirement assets often include:

· Traditional & Rollover IRAs

· 401k / 403b / 457 plans

· Deferred compensation plans

· Qualified Annuities

When you withdraw money from these pre-tax sources you have to pay federal income tax on the amount withdrawn but you may also have to pay state income tax as well. If you live in a state that has state income tax, it’s very important to understand the taxation rules for retirement accounts within your state.

For example, New York has a unique rule that each person over the age of 59½ is allowed to withdraw $20,000 from a pre-tax retirement account without having to pay state income tax. Any amounts withdrawn over that threshold in a given tax year are subject to state income tax.

Pretax retirement accounts are usually subject to something called a required minimum distribution (RMD). The IRS requires you to start taking small distributions out of your pre-tax retirement accounts at 72. Without proper guidance, retirees often make the mistake of withdrawing from their after tax assets first, and then waiting until they are required to take the RMD’s from their pre-tax retirement accounts at age 72 and beyond. But this creates a problem for many retirees because it causes:

· The distribution to be subject to higher tax rates

· Loss of tax deductions and credits

· Increase the tax ability of Social Security Increase Medicare premiums Loss of certain property tax credits for

seniors

· Other adverse consequences……

Instead as planners, we proactively plan ahead and ask questions like:

“instead of waiting until age 72 and taking larger RMD’s from the pre-tax account, does it make sense to start making annual distribution from the pre-tax retirement accounts leading up to age 72, thus spreading those distribution in lower amounts, across more tax year resulting in:

· Lower tax liability

· Lower Medicare premiums

· Maintaining tax deductions and credits

· The assets last longer due to a lower aggregate tax liability

· More inheritance for their family members

Since everyone’s tax situation and retirement income situation is different, we have to work closely with their tax professional to determine what the right amount is to withdraw out of the pre-tax retirement accounts each year to optimize their net worth long-term.

After Tax Accounts

After tax assets can include:

· Savings accounts

· Brokerage accounts

· Non-qualified annuities

· Life Insurance with cash value

Just because I’m listing them as “after tax assets” does not mean the whole account value is free and clear of taxes. What I’m referring to is the accounts listed above typically have some “cost basis” meaning a portion of the account it what was originally contributed to the account and can be withdrawal tax fee. The appreciation within the account would be taxes at either ordinary income or capital gains rates depending on the type of the account and how long the assets have been held in the account.

Having after tax assets often provides retirees with a tax advantage because they may be able to “choose their tax rate” when they retire. Meaning they can choose to withdrawal “X” amount from an after tax source and pay little know taxes and show very little taxable income in any given year which opens the door for more long term advanced tax planning.

Withdrawal Strategies

Now that have covered all of the different types of retirement assets and how they are taxed, let move into some of the common withdrawal strategies that we use with our clients:

Retirees With All Three: Pre-tax, Roth, and After-tax Assets

When retirees have all three types of retirement account sources, the strategy usually involves leaving the Roth assets for last, and then meeting with their accountant to determine the amount that should be withdrawn out of their pre-tax and after tax accounts year to minimize the amount of aggregate taxes that they pay long term.

Example: Jim and Carol are both age 67 and just retired and they financial picture consists of the following:

Joint brokerage account: $200,000

401(k)’s: $500,000

Roth IRA‘s: $50,000

Combined Social Security: $40,000

Annual Expenses $100,000

Residents of New York State

An optimal withdrawal strategy may include the following:

Assuming we recommend that they turn on Social Security at their normal retirement age, it will provide them with $40,000 pre-tax Income, 85% of their Social Security benefit will be taxed at the federal level but there will be no state tax deal, resulting in an estimated $35,000 after tax.

That means we need an additional $65,000 after-tax per year from another source to meet their $100,000 per year in expenses. Instead of taking all the money from their joint brokerage account, we could have them rollover their 401(k) balances into Traditional IRAs and then take $20,000 distributions each from their accounts which they not have to pay state income tax on because it’s below the $20K threshold. That would result in another $40,000 in pre-tax income, translating to $35,000 after-tax.

The final $30,000 that is needed to meet their annual expenses would most likely come from their after tax brokerage account unless their accountant advises differently.

This strategy accomplishes a number of goals:

1) We are withdrawing pre-tax retirement assets in smaller increments and taking advantage of the New York

State tax free portion every year. This should result in lower total taxes paid over their lifetime as opposed to waiting until RMD’s start at age 72 and then being required to take larger distributions which could push them over the $20,000 annual limit making them subject in your state tax income tax and higher federal tax rates.

2) We are preserving the after-tax brokerage account for a longer period of time as opposed to using it all to supplement their expenses which would only last for about two years and then they would be forced to take all of their distributions from their pre-tax retirement account making them subject to a higher tax liability

3) For the Roth accounts, we are law allowing them to continue to accumulate as much as possible resulting in more tax free dollars to be withdrawn in the future, or if they pass onto their children, they are inheriting a larger assets that can be withdrawn tax free.

All Pre-Tax Retirement Savings

It’s not uncommon for retirees to have 100% of their retirement savings all within a pre-tax sources like 401(k)s, 403(b)s, traditional IRA‘s, and other types of pre-tax retirement account. This makes the withdrawal strategy slightly more tricky because if there are any big one-time expenses that are incurred during retirement, it forces the retiree to take a large withdrawal from a pre-tax source which also increases the tax liability associate the distribution.

A common situation that we often have to maneuver around is retirees that have plans to purchase a second house in retirement but in order to do that they need to have the cash to come up with a down payment. If they don’t have any after-tax retirement savings, those amounts will most likely have to come from a pre-tax account. Withdrawing $60,000 or more for a down payment can lead to a higher tax liability, higher Medicare premiums the following year, and make a larger portion of your Social Security taxable. For clients in the situation, we often have to plan a few year ahead, and will begin taking pre-text Distributions over multiple tax years leading up to the purchase of the retirement house in an effort to spread the tax liability over multiple years and avoiding the adverse tax and financial consequences of taking one large distribution.

Since many retirees are afraid of taking on debt in retirement, we often get the question in these second house situations is “Should I just take a big distribution from my retirement, pay for the house in full, and not have a mortgage?” If all of the retirement assets are tied up in pre-tax sources, it typically makes the most sense to take a mortgage which allows you to then take smaller distributions from your IRA accounts over multiple tax years to make the mortgage payments compared to taking an enormous tax hit by withdrawing $200,000+ out of a pre-tax return account in a single year.

Pensions With No Need For Retirement Accounts

For retirees that have pensions, it’s not uncommon for their pension and Social Security to provide enough income to meet all of their expenses. But these individual may also have pre-tax retirement accounts and the question becomes “what do we do with them if we don’t need them, and we expect the kids to inherit them?”

This situation often involves a Roth conversion strategy where each year we convert money from the pre-tax IRA’s over to Roth IRA’s. This allows those retirement accounts to accumulate tax free and ultimately withdrawn tax free by the beneficiaries. Versus if they continue to accumulate in pre-tax retirement accounts, the beneficiaries will have to distribute those accounts within 10 years and pay tax on the full balance.

Also when those retirees turn age 72 they have to start taking required minimum distributions which they don’t necessarily need. Since they are receiving pension and Social Security income, those distributions from the retirement accounts could be subject to higher tax rates. By proactively moving assets from a pre-tax source to a Roth source we are essentially reducing the amount of retirement assets that will be subject to RMD’s at age 72 because Roth assets are not subject to RMD‘s.

Using this Roth conversion strategy, it’s also not uncommon for us to have these retirees delay their Social Security. Since Social Security is taxable at the federal level, if we delay Social Security, it gives us more room to process larger Roth conversions because it free up those lower tax brackets. At the same time, it also allows Social Security to accumulate at a guaranteed rate of 6% - 8%.

Nerd Note: When you process these Roth conversions, make sure you’re taking into account the tax liability that’s being generated. You have to have a way to pay the taxes on the amounts converted because the money goes directly from your traditional IRA to your Roth IRA. Retirees that implement this strategy typically have large cash holdings, after tax retirement holdings, or we convert some of the money, and take pre-tax IRA distribution to cover the taxes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Estimated Tax Payments Still Due April 15th

The IRS extended the tax filing deadline for 2020 from April 15th to May 15th. Click to read more on the questions that we are getting from business owners, retirees, and individuals taxpayers.

The IRS extended the tax filing deadline for 2020 from April 15th to May 15th. The question that we are getting from business owners, retirees, and individuals taxpayer are:

1) Are my 1st Quarter Estimated Tax Payments Due On 4/15 or 5/15?

2) When is the deadline for making IRA contributions for 2020?

3) When is my 2020 tax liability due: April 15th or May 15th?

4) How are the $10,200 in tax free unemployment benefits begin handled? Do you have to amend your 2020 tax return?

DISCLOSURE: This is for educational purposes only. This is not tax advice. For tax advice, please consult your tax professional.