Secure Act 2.0: Roth Simple IRA Contributions Beginning in 2023

With the passage of the Secure Act 2.0, for the first time ever, starting in 2023, taxpayers will be allowed to make ROTH contributions to Simple IRAs. Prior to 2023, only pre-tax contributions were allowed to be made to Simple IRA plans.

With the passage of the Secure Act 2.0, for the first time ever, starting in 2023, taxpayers will be allowed to make ROTH contributions to Simple IRAs. Prior to 2023, only pre-tax contributions were allowed to be made to Simple IRA plans.

Roth Simple IRAs

So what happens when an employee walks in on January 3, 2023, and asks to start making Roth contributions to their Simple IRA? While the Secure Act 2.0 allows it, the actual ability to make Roth contributions to Simple IRAs may take more time for the following reasons:

The custodians that provide Simple IRA accounts to employees may need more time to create updated client agreements to include Roth language

Employers may need to decide if they want to allow Roth contributions to their plans and educate their employees on the new options

Employers will need to communicate to their payroll providers that there will be a new deduction source in payroll for these Roth contributions

Employees may need time to consult with their financial advisor, accountant, or plan representative to determine whether they should be making Roth or Pre-tax Contributions to their Simple IRA.

Mandatory or Optional?

Now that the law has passed, if a company sponsors a Simple IRA plan, are they required to offer the Roth contribution option to their employees? It’s not clear. If the Simple IRA Roth option follows the same path as its 401(k) counterpart, then it would be a voluntary election made by the employer to either allow or not allow Roth contributions to the plan.

For companies that sponsor Simple IRA plans, each year, the company is required to distribute Form 5304-Simple to the employees. This form provides employees with information on the following:

Eligibility requirements

Employer contributions

Vesting

Withdrawals and Rollovers

The IRS will most likely have to create an updated Form 5304-Simple for 2023, which includes the new Roth language. If the Roth election is voluntary, then the 5304-Simple form would most likely include a new section where the company that sponsors the plan would select “yes” or “no” to Roth employee deferrals. We will update this article once the answer is known.

Separate Simple IRA Roth Accounts?

Another big question that we have is whether or not employees that elect the Roth Simple IRA contributions will need to set up a separate account to receive them.

In the 401(k) world, plans have recordkeepers that track the various sources of contributions and the investment earnings associated with each source so the Pre-Tax and Roth contributions can be made to the same account. In the past, Simple IRAs have not required recordkeepers because the Simple IRA account consists of all pre-tax dollars.

Going forward, employees that elect to begin making Roth contributions to their Simple IRA, they may have to set up two separate accounts, one for their Roth balance and the other for their Pre-tax balance. Otherwise, the plans would need some form of recordkeeping services to keep track of the two separate sources of money within an employee’s Simple IRA account.

Simple IRA Contribution Limits

For 2023, the annual contribution limit for employee deferrals to a Simple IRA is the LESSER of:

100% of compensation; or

Under Age 50: $15,500

Age 50+: $19,000

These dollar limits are aggregate for all Pre-tax and Roth deferrals; in other words, you can’t contribute $15,500 in pre-tax deferrals and then an additional $15,500 in Roth deferrals. Similar to 401(k) plans, employees will most likely be able to contribute any combination of Pre-Tax and Roth deferrals up to the annual limit. For example, an employee under age 50 may be able to contribute $10,000 in pre-tax deferrals and $5,500 in Roth deferral to reach the $15,500 limit.

Employer Roth Contribution Option

The Secure Act 2.0 also included a provision that allows companies to give their employees the option to receive their EMPLOYER contributions in either Pre-tax or Roth dollars. However, this Roth employer contribution option is only available in “qualified retirement plans” such as 401(k), 403(b), and 457(b) plans. Since a Simple IRA is not a qualified plan, this Roth employer contribution option is not available.

Employee Attraction and Retention

After reading all of this, your first thought might be, what a mess, why would a company voluntarily offer this if it’s such a headache? The answer: employee attraction and retention. Most companies have the same problem right now, finding and retaining high-quality employees. If you can offer a benefit to your employees that your competitors do not, it could mean the difference between a new employee accepting or rejecting your offer.

The Secure Act 2.0 introduced a long list of new features and changes to employer-sponsored retirement plans. These changes are being implemented in phases over the next few years, with some other big changes starting in 2024. The introduction of Roth to Simple IRA plans just happens to be the first of many. Companies that take the time to understand these new options and evaluate whether or not they would add value to their employee benefits package will have a competitive advantage when it comes to attracting and retaining employees.

Other Secure Act 2.0 Articles:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Self-Employment Income In Retirement? Use a Solo(k) Plan To Build Wealth

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy

Self-Employment Income In Retirement? Use a Solo(k) Plan To Build Wealth

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy.”

What Is A Solo(K)

A Solo(k) plan is an employer-sponsored retirement plan that is only allowed to be sponsored by owner-only entities. It works just like a 401(k) plan through a company but without the high costs or administrative hassles. The owner of the business is allowed to make both employee deferrals and employer contributions to the plan.

Solo(k) Deferral Limits

For 2023, a business owner is allowed to contribute employee deferrals up to a maximum of the LESSER of:

100% of compensation; or

$30,000 (Assuming the business owner is age 50+)

Pre-tax vs. Roth Deferrals

Like a regular 401(K) plan, the business owner can contribute those employee deferrals as all pre-tax, all Roth, or some combination of the two. Herein lies the ample wealth-building opportunity. Roth assets can be an effective wealth accumulation tool. Like Roth IRA contributions, Roth Solo(k) Employee Deferrals accumulate tax deferred, and you pay NO TAX on the earnings when you withdraw them as long as the account owner is over 59½ and the Roth account has been in place for more than five years.

Also, unlike Roth IRA contributions, there are no income limitations for making Roth Solo(k) Employee Deferrals and the contribution limits are higher. If a business owner has at least $30,000 in compensation (net profit) from the business, they could contribute the entire $30,000 all Roth to the Solo(K) plan. A Roth IRA would have limited them to the max contribution of $7,500 and they would have been excluded from making that contribution if their income was above the 2023 threshold.

A quick note, you don’t necessarily need $30,000 in net income for this strategy to work; even if you have $18,000 in net income, you can make an $18,000 Roth contribution to your Solo(K) plan for that year. The gem to this strategy is that you are beginning to build this war chest of Roth dollars, which has the following tax advantages down the road……

Tax-Free Accumulation and Withdrawal: If you can contribute $100,000 to your Roth Solo(k) employee deferral source by the time you are 70, if you achieve a 6% rate of return at 80, you have $189,000 in that account, and the $89,000 in earnings are all tax-free upon withdrawal.

No RMDs: You can roll over your Roth Solo(K) deferrals into a Roth IRA, and the beautiful thing about Roth IRAs are no required minimum distributions (RMD) at age 72. Pre-tax retirement accounts like Traditional IRAs and 401(k) accounts require you to begin taking RMDs at age 72, which are forced taxable events; by having more money in a Roth IRA, those assets continue to build.

Tax-Free To Beneficiaries: When you pass assets on to your beneficiaries, the most beneficial assets to inherit are often a Roth IRA or Roth Solo(k) account. When they changed the rules for non-spouse beneficiaries, they must deplete IRAs and retirement accounts within ten years. With pre-tax retirement accounts, this becomes problematic because they have to realize taxable income on those potentially more significant distributions. With Roth assets, not only is there no tax on the distributions, but the beneficiary can allow that Roth account to grow for another ten years after you pass and withdraw all the earnings tax and penalty-free.

Why Not Make Pre-Tax Deferrals?

It's common for these self-employed retirees to have never made a Roth contribution to retirement accounts, mainly because, during their working years, they were in high tax brackets, which warranted pre-tax contributions to lower their liability. But now that they are retired and potentially showing less income, they may already be in a lower tax bracket, so making pre-tax contributions, only to pay tax on both the contributions and the earnings later, may be less advantageous. For the reasons I mentioned above, it may be worth foregoing the tax deduction associated with pre-tax contributions and selecting the long-term benefits associated with the Roth contributions within the Solo(k) Plan.

Now there are situations where one spouse retires and has a small amount of self-employment income while the other spouse is still employed. In those situations, if they file a joint tax return, their overall income limit may still be high, which could warrant making pre-tax contributions to the Solo(k) plan instead of Roth contributions. The beauty of these Solo(k) plans is that it’s entirely up to the business owner what source they want to contribute to from year to year. For example, this year, they could contribute 100% pre-tax, and then the following year, they could contribute 100% Roth.

Solo(k) versus SEP IRA

Because this question comes up frequently, let's do a quick walkthrough of the difference between a Solo(k) and a SEP IRA. A SEP IRA is also a popular type of retirement plan for self-employed individuals; however, SEP IRAs do not allow Roth contributions, and SEP IRAs limit contributions to 20% of the business owner’s net earned income. Solo(K) plans have a Roth contribution source, and the contributions are broken into two components, an employee deferral and an employer profit sharing.

As we looked at earlier, the employee deferral portion can be 100% of compensation up to the Solo(K) deferral limit of the year, but in addition to that amount, the business owner can also contribute 20% of their net earned income in the form of a profit sharing contribution.

When comparing the two, in most cases, the Solo(K) plan allows business owners to make larger contributions in a given year and opens up the Roth source.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

401(K) Cash Distributions: Understanding The Taxes & Penalties

When an employee unexpectedly loses their job and needs access to cash to continue to pay their bills, it’s not uncommon for them to elect a cash distribution from their 401(K) account. Still, they may regret that decision when the tax bill shows up the following year and then they owe thousands of dollars to the IRS in taxes and penalties that they don’t have.

When an employee unexpectedly loses their job and needs access to cash to continue to pay their bills, it’s not uncommon for them to elect a cash distribution from their 401(K) account. Still, they may regret that decision when the tax bill shows up the following year and then they owe thousands of dollars to the IRS in taxes and penalties that they don’t have. But I get it; if it’s a choice between working a few more years or losing your house because you don’t have the money to make the mortgage payments, taking a cash distribution from your 401(k) seems like a necessary evil. If you go this route, I want you to be aware of a few strategies that may help you lessen the tax burden and avoid tax surprises after the 401(k) distribution is processed. In this article, I will cover:

How much tax do you pay on a 401(K) withdrawal?

The 10% early withdrawal penalty

The 401(k) 20% mandatory fed tax withholding

When do you remit the taxes and penalties to the IRS?

The 401(k) loan default issue

Strategies to help reduce the tax liability

Pre-tax vs. Roth sources

Taxes on 401(k) Withdrawals

When your employment terminates with a company, that triggers a “distributable event,” which gives you access to your 401(k) account with the company. You typically have the option to:

Leave your balance in the current 401(k) plan (if the balance is over $5,000)

Take a cash distribution

Rollover the balance to an IRA or another 401(k) plan

Some combination of options 1, 2, and 3

We are going to assume you need the cash and plan to take a total cash distribution from your 401(k) account. When you take cash distributions from a 401(k), the amount distributed is subject to:

Federal income tax

State income tax

10% early withdrawal penalty

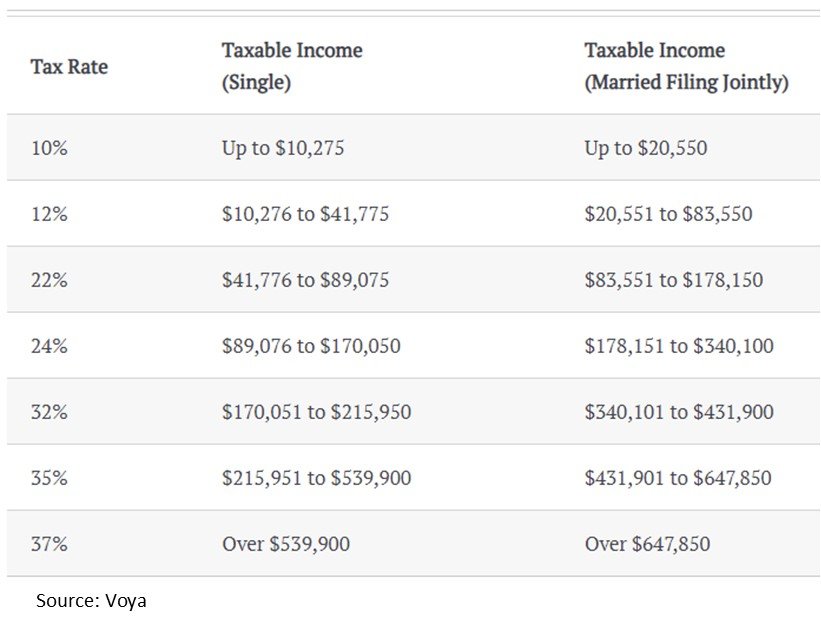

I’m going to assume your 401(k) account consists of 100% of pre-tax sources; if you have Roth contributions, I will cover that later on. When you take distributions from a 401(k) account, the amount distributed is subject to ordinary income tax rates, the same tax rates you pay on your regular wages. The most common question I get is, “how much tax am I going to owe on the 401(K) withdrawal?”. The answer is that it varies from person to person because it depends on your personal income level for the year. Here are the federal income tax brackets for 2022:

Using the chart above, if you are married and file a joint tax return, and your regular AGI (adjusted gross income) before factoring in the 401(K) distribution is $150,000, if you take a $20,000 distribution from your 401(k) account, it would be subject to a Fed tax rate of 24%, resulting in a Fed tax liability of $4,800.

If instead, you are a single filer that makes $170,000 in AGI and you take a $20,000 distribution from your 401(k) account, it would be subject to a 32% fed tax rate resulting in a federal tax liability of $6,400.

20% Mandatory Fed Tax Withholding Requirement

When you take a cash distribution directly from a 401(k) account, they are required by law to withhold 20% of the cash distribution amount for federal income tax. This is not a penalty; it’s federal tax withholding that will be applied toward your total federal tax liability in the year that the 401(k) distribution was processed. For example, if you take a $100,000 cash distribution from your 401(K) when they process the distribution, they will automatically withhold $20,000 (20%) for fed taxes and then send you a check or ACH for the remaining $80,000. Again, this 20% federal tax withholding is not optional; it’s mandatory.

Here's where people get into trouble. People make the mistake of thinking that since taxes were already withheld from the 401(k) distribution, they will not owe more. That is often an incorrect assumption. In our earlier example, the single filer was in a 32% tax bracket. Yes, they withheld 20% in federal income tax when the distribution was processed, but that tax filer would still owe another 12% in federal taxes when they file their taxes since their federal tax bracket is higher than 20%. If that single(k) tax filer took a $100,000 401(k) distribution, they could own an additional $12,000+ when they file their taxes.

State Income Taxes

If you live in a state with a state income tax, you should also plan to pay state tax on the amount distributed from your 401(k) account. Some states have mandatory state tax withholding similar to the required 20% federal tax withholding, but most do not. If you live in New York, you take a $100,000 401(k) distribution, and you are in the 6% NYS tax bracket, you would need to have a plan to pay the $6,000 NYS tax liability when you file your taxes.

10% Early Withdrawal Penalty

If you request a cash distribution from a 401(k) account before reaching a certain age, in addition to paying tax on the distribution, the IRS also hits you with a 10% early withdrawal penalty on the gross distribution amount.

Under the age of 55: If you are under the age of 55, in the year that you terminate employment, the 10% early withdrawal penalty will apply.

Between Ages 55 and 59½: If you are between the ages of 55 and 59½ when you terminate employment and take a cash distribution from your current employer’s 401(k) plan, the 10% early withdrawal penalty is waived. This is an exception to the 59½ rule that only applies to qualified retirement accounts like 401(k)s, 403(b)s, etc. But the distribution must come from the employer’s plan that you just terminated employment with; it cannot be from a previous employer's 401(k) plan.

Note: If you rollover your balance to a Traditional IRA and then try to take a distribution from the IRA, you lose this exception, and the under age 59½ 10% early withdrawal penalty would apply. The distribution has to come directly from the 401(k) account.

Age 59½ and older: Once you reach 59½, you can take cash distributions from your 401(k) account, and the 10% penalty no longer applies.

When Do You Pay The 10% Early Withdrawal Penalty?

If you are subject to the 10% early withdrawal penalty, it is assessed when you file your taxes; they do not withhold it from the distribution amount, so you must be prepared to pay it come tax time. The taxes and penalties add up quickly; let’s say you take a $50,000 distribution from your 401(k), age 45, in a 24% Fed tax bracket and a 6% state tax bracket. Here is the total tax and penalty hit:

Gross 401K Distribution: $50,000

Fed Tax Withholding (24%) ($12,000)

State Tax Withholding (6%) ($3,000)

10% Penalty ($5,000)

Net Amount: $30,000

In the example above, you lost 40% to taxes and penalties. Also, remember that when the 401(k) platform processed the distribution, they probably only withheld the mandatory 20% for Fed taxes ($10,000), meaning another $10,000 would be due when you filed your taxes.

Strategies To Reduce The Tax Liability

There are a few strategies that you may be able to utilize to reduce the taxes and penalties assessed on your 401(k) cash distribution.

The first strategy involves splitting the distribution between two tax years. If it’s toward the end of the year and you have the option of taking a partial cash distribution in December and then the rest in January, that would split the income tax liability into two separate tax years, which could reduce the overall tax liability compared to realizing the total distribution amount in a single tax year.

Note: Some 401(k) plans only allow “lump sum distributions,” which means you can’t request partial withdrawals; it’s an all or none decision. In these cases, you may have to either request a partial withdrawal and partial rollover to an IRA, or you may have to rollover 100% of the account balance to an IRA and then request the distributions from there.

The second strategy is called “only take what you need.” If your 401(k) balance is $50,000, and you only need a $20,000 cash distribution, it may make sense to rollover the entire balance to an IRA, which is a non-taxable event, and then withdraw the $20,000 from your IRA account. The same taxes and penalties apply to the IRA distribution that applies to the 401(k) distribution (except the age 55 rule), but it allows the $30,000 that stays in the IRA to avoid taxes and penalties.

Strategy three strategy involved avoiding the mandatory 20% federal tax withholding in the same tax year as the distribution. Remember, the 401(K) distribution is subject to the 20% mandatory federal tax withholding. Even though they're sending that money directly to the federal government on your behalf, it actually counts as taxable income. For example, if you request a $100,000 distribution from your 401(k), they withhold $20,000 (20%) for fed taxes and send you a check for $80,000, even though you only received $80,000, the total $100,000 counts as taxable income.

IRA distributions do not have the 20% mandatory federal tax withholding, so you could rollover 100% of your 401(k) balance to your IRA, take the $80,000 out of your IRA this year, which will be subject to taxes and penalties, and then in January next year, process a second $20,000 distribution from your IRA which is the equivalent of the 20% fed tax withholding. However, by doing it this way, you pushed $20,000 of the income into the following tax year, which may be taxed at a lower rate, and you have more time to pay the taxes on the $20,000 because the tax would not be due until the tax filing deadline for the following year.

Building on this example, if your federal tax liability is going to be below 20%, by taking the distribution from the 401K you are subject to the 20% mandatory fed tax withholding, so you are essentially over withholding what you need to satisfy the tax liability which creates more taxable income for you. By rolling over the money to an IRA, you can determine the exact amount of your tax liability in the spring, and distribute just that amount for your IRA to pay the tax bill.

Loan Default

If you took a 401K loan and still have an outstanding loan balance in the plan, requesting any type of distribution or rollover typically triggers a loan default which means the outstanding loan balance becomes fully taxable to you even though no additional money is sent to you. For example, if You have an $80,000 balance in the 401K plan, but you took a loan two years ago and still have a $20,000 outstanding loan balance within the plan, if you terminate employment and request a cash distribution, the total amount subject to taxes and penalties is $100,000, not $80,000 because you have to take the outstanding loan balance into account. This is also true when they assess the 20% mandatory fed tax withholding. The mandatory withholding is based on the balance plus the outstanding loan balance. I mention this because some people are surprised when their check is for less than expected due to the mandatory 20% federal tax withholding on the outstanding loan balance.

Roth 401(k) Early Withdrawal Penalty

401(k) plans commonly allow Roth deferrals which are after-tax contributions to the plan. If you request a cash distribution from a Roth 401(k) source, the portion of the account balance that you actually contributed to the plan is returned to you tax and penalty-free; however, the earnings that have accumulated on that Roth source you have to pay tax and potentially the 10% early withdrawal penalty on. This is different from pre-tax sources which the total amount is subject to taxes and penalties.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

401K Loans: Pros vs Cons

There are a number of pros and cons associated with taking a loan from your 401K plan. There are definitely situations where taking a 401(k) loan makes sense but there are also number of situations where it should be avoided.

There are a number of pros and cons associated with taking a loan from your 401K plan. There are definitely situations where taking a 401(k) loan makes sense but there are also number of situations where it should be avoided. Before taking a loan from your 401(k), you should understand:

How 401(k) loans work

How much you are allowed to borrow

Duration of the loans

What is the interest rate that is charged

How the loans are paid back to your 401(k) account

Penalties and taxes on the loan balance if you are laid off or resign

How it will impact your retirement

Sometimes Taking A 401(k) Loan Makes Sense

People are often surprised when I say “taking a 401(k) loan could be the right move”. Most people think a financial planner would advise NEVER touch your retirement accounts for any reasons. However, it really depends on what you are using the 401(k) loan for. There are a number of scenarios that I have encountered with 401(k) plan participants where taking a loan has made sense including the following:

Need capital to start a business (caution with this one)

Resolve a short-term cash crunch

Down payment on a house

Payoff high interest rate credit cards

Unexpected health expenses or financial emergency

I will go into more detail regarding each of these scenarios but let’s do a quick run through of how 401(k) loans work.

How Do 401(k) Loans Work?

First, not all 401(k) plans allow loans. Your employer has to voluntary allow plan participants to take loans against their 401(k) balance. Similar to other loans, 401(k) loans charge interest and have a structured payment schedule but there are some differences. Here is a quick breakout of how 401(k) loans work:

How Much Can You Borrow?

The maximum 401(k) loan amount that you can take is the LESSER of 50% of your vested balance or $50,000. Simple example, you have a $20,000 vested balance in the plan, you can take a 401(K) loan up to $10,000. The $50,000 limit is for plan participants that have balances over $100,000 in the plan. If you have a 401(k) balance of $500,000, you are still limited to a $50,000 loan.

Does A 401(k) Loan Charge Interest?

Yes, 401(k) loans charge interest BUT you pay the interest back to your own 401(k) account, so technically it’s an interest free loan even though there is interest built into the amortization schedule. The interest rate charged by most 401(k) platforms is the Prime Rate + 1%.

How Long Do You Have To Repay The 401(k) Loan?

For most 401(k) loans, you get to choose the loan duration between 1 and 5 years. If you are using the loan to purchase your primary residence, the loan policy may allow you to stretch the loan duration to match the duration of your mortgage but be careful with this option. If you leave the employer before you payoff the loan, it could trigger unexpected taxes and penalties which we will cover later on.

How Do You Repay The 401(k) Loan?

Loan payments are deducted from your paycheck in accordance with the loan amortization schedule and they will continue until the loan is paid in full. If you are self employed without payroll, you will have to upload payments to the 401(k) platform to avoid a loan default.

Also, most 401(K) platforms provide you with the option of paying off the loan early via a personal check or ACH.

Not A Taxable Event

Taking a 401(k) loan does not trigger a taxable event like a 401(k) distribution does. This also gives 401(k)’s a tax advantage over an IRA because IRA’s do not allow loans.

Scenarios Where Taking A 401(k) Loans Makes Sense

I’ll start off on the positive side of the coin by providing you with some real life scenarios where taking a 401(k) loan makes sense, but understand that all of the these scenarios assume that you do not have idle cash set aside that could be used to meet these expenses. Taking a 401(k) loan will rarely win over using idle cash because you lose the benefits of compounded tax deferred interest as soon as you remove the money from your account in the form of a 401(k) loan.

Payoff High Interest Rate Credit Cards

If you have credit cards that are charging you 12%+ in interest and you are only able to make the minimum payment, this may be a situation where it makes sense to take a loan from your 401(k) and payoff the credit cards. But………but…….this is only a wise decision if you are not going to run up those credit card balances again. If you are in a really bad financial situation and you may be headed for bankruptcy, it’s actually better NOT to take money out of your 401(k) because your 401(k) account is protected from your creditors.

Bridge A Short-Term Cash Crunch

If you run into a short-term cash crunch where you have a large expense but the money needed to cover the expense is delayed, a 401(k) loan may be a way to bridge the gap. A hypothetical example would be buying and selling a house simultaneously. If you need $30,000 for the down payment on your new house and you were expecting to get that money from the proceeds from the sale of the current house but the closing on your current house gets pushed back by a month, you might decide to take a $30,000 loan from your 401(k), close on the new house, and then use the proceeds from the sale of your current house to payoff the 401(k) loan.

Using a 401(k) Loan To Purchase A House

Frequently, the largest hurdle for first time homebuyers when planning to buy a house is finding the cash to satisfy the down payment. If you have been contributing to your 401(k) since you started working, it’s not uncommon that the balance in your 401(k) plan might be your largest asset. If the right opportunity comes along to buy a house, it may makes sense to take a 401(k) loan to come up with the down payment, instead of waiting the additional years that it would take to build up a down payment outside of your 401(k) account.

Caution with this option. Once you take a loan from your 401(k), your take home pay will be reduced by the amount of the 401(k) loan payments over the duration of the loan, and then you will a have new mortgage payment on top of that after you close on the new house. Doing a formal budget in advance of this decision is highly recommended.

Capital To Start A Business

We have had clients that decided to leave the corporate world and start their own business but there is usually a time gap between when they started the business and when the business actually starts making money. It is for this reason that one of the primary challenges for entrepreneurs is trying to find the capital to get the business off the ground and get cash positive as soon as possible. Instead of going to a bank for a loan or raising money from friends and family, if they had a 401(k) with their former employer, they may be able to setup a Solo(K) plan through their new company, rollover their balance into their new Solo(K) plan, take a 401(k) loan from their new Solo(k) plan, and use that capital to operate the business and pay their personal expenses.

Again, word of caution, starting a business is risky, and this strategy involves spending money that was set aside for the retirement years.

Reasons To Avoid Taking A 401(k) Loan

We have covered some Pro side examples, now let’s look at the Con side of the 401(k) loan equation.

Your Money Is Out of The Market

When you take a loan from your 401(k) account, that money is removed for your 401(k) account, and then slowly paid back over the duration of the loan. The money that was lent out is no longer earning investment return in your retirement account. Even though you are repaying that amount over time it can have a sizable impact on the balance that is in your account at retirement. How much? Let’s look at a Steve & Sarah example:

Steve & Sarah are both 30 years old

Both plan to retire age 65

Both experience an 8% annualize rate of return

Both have a 401(K) balance of $150,000

Steve takes a $50,000 loan for 5 years at age 30 but Sarah does not

Since Sarah did not take a $50,000 loan from her 401(k) account, how much more does Sarah have in her 401(k) account at age 65? Answer: approximately $102,000!!! Even though Steve was paying himself all of the loan interest, in hindsight, that was an expensive loan to take since taking out $50,000 cost him $100,000 in missed accumulation.

401(k) Loan Default Risk

If you have an outstanding balance on a 401(k) loan and the loan “defaults”, it becomes a taxable event subject to both taxes and if you are under the age of 59½, a 10% early withdrawal penalty. Here are the most common situations that lead to a 401(k) loan defaults:

Your Employment Ends: If you have an outstanding 401(K) loan and you are laid off, fired, or you voluntarily resign, it could cause your loan to default if payments are not made to keep the loan current. Remember, when you were employed, the loan payments were being made via payroll deduction, now there are no paychecks coming from that employer, so no loan payment are being remitted toward your loan. Some 401(k) platforms may allow you to keep making loan payments after your employment ends but others may not past a specified date. Also, if you request a distribution or rollover from the plan after your have terminated employment, that will frequently automatically trigger a loan default if there is an outstanding balance on the loan at that time.

Your Employer Terminates The 401(k) Plan: If your employer decides to terminate their 401(k) plan and you have an outstanding loan balance, the plan sponsor may require you to repay the full amount otherwise the loan will default when your balance is forced out of the plan in conjunction with the plan termination. There is one IRS relief option in the instance of a plan termination that buys the plan participants more time. If you rollover your 401(k) balance to an IRA, you have until the due date of your tax return in the year of the rollover to deposit the amount of the outstanding loan to your IRA account. If you do that, it will be considered a rollover, and you will avoid the taxes and penalties of the default but you will need to come up with the cash needed to make the rollover deposit to your IRA.

Loan Payments Are Not Started In Error: If loan payments are not made within the safe harbor time frame set forth by the DOL rules, the loan could default, and the outstanding balance would be subject to taxes and penalties. A special note to employees on this one, if you take a 401(k) loan, make sure you begin to see deductions in your paycheck for the 401(k) loan payments, and you can see the loan payments being made to your account online. Every now and then things fall through the cracks, the loan is issued, the loan deductions are never entered into payroll, the employee doesn’t say anything because they enjoy not having the loan payments deducted from their pay, but the employee could be on the hook for the taxes and penalties associated with the loan default if payments are not being applied. It’s a bad day when an employee finds out they have to pay taxes and penalties on their full outstanding loan balance.

Double Taxation Issue

You will hear 401(k) advisors warn employees about the “double taxation” issue associated with 401(k) loans. For employees that have pre-tax dollars within their 401(k) plans, when you take a loan, it is not a taxable event, but the 401(k) loan payments are made with AFTER TAX dollars, so as you make those loan payments you are essentially paying taxes on the full amount of the loan over time, then once the money is back in your 401(k) account, it goes back into that pre-tax source, which means when you retire and take distributions, you have to pay tax on that money again. Thus, the double taxation issue, taxed once when you repay the loan, and then taxed again when you distribute the money in retirement.

This double taxation issue should be a deterrent from taking a 401(k) loan if you have access to cash elsewhere, but if a 401(k) loan is your only access to cash, and the reason for taking the loan is justified financially, it may be worth the double taxation of those 401(k) dollars.

I’ll illustrate this in an example. Let’s say you have credit card debt of $15,000 with a 16% interest rate and you are making minimum payments. That means you are paying the credit card company $2,400 per year in interest and that will probably continue with only minimum payments for a number of years. After 5 or 6 years you may have paid the credit card company $10,000+ in interest on that $15,000 credit card balance.

Instead, you take a 401(k) loan for $15,000, payoff your credit cards, and then pay back the loan over the 5-year period, you will essentially have paid tax on the $15,000 as you make the loan payments back to the plan BUT if you are in a 25% tax bracket, the tax bill will only be $3,755 spread over 5 years versus paying $2,000 - $2,500 in interest to the credit card company EVERY YEAR. Yes, you are going to pay tax on that $15,000 again when you retire but that was true even if you never took the loan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can You Contribute To An IRA & 401(k) In The Same Year?

There are income limits that can prevent you from taking a tax deduction for contributions to a Traditional IRA if you or your spouse are covered by a 401(k) but even if you can’t deduct the contribution to the IRA, there are tax strategies that you should consider

The answer to this question depends on the following items:

Do you want to contribute to a Roth IRA or Traditional IRA?

What is your income level?

Will the contribution qualify for a tax deduction?

Are you currently eligible to participate in a 401(k) plan?

Is your spouse covered by a 401(k) plan?

If you have the choice, should you contribute to the 401(k) or IRA?

Advanced tax strategy: Maxing out both and spousal IRA contributions

Traditional IRA

Traditional IRA’s are known for their pre-tax benefits. For those that qualify, when you make contributions to the account you receive a tax deduction, the balance accumulates tax deferred, and then you pay tax on the withdrawals in retirement. The IRA contribution limits for 2022 are:

Under Age 50: $6,000

Age 50+: $7,000

However, if you or your spouse are covered by an employer sponsored plan, depending on your level of income, you may or may not be able to take a deduction for the contributions to the Traditional IRA. Here are the phaseout thresholds for 2022:

Note: If both you and your spouse are covered by a 401(k) plan, then use the “You Are Covered” thresholds above.

BELOW THE BOTTOM THRESHOLD: If you are below the thresholds listed above, you will be eligible to fully deduct your Traditional IRA contribution

WITHIN THE PHASEOUT RANGE: If you are within the phaseout range, only a portion of your Traditional IRA contribution will be deductible

ABOVE THE TOP THRESHOLD: If your MAGI (modified adjusted gross income) is above the top of the phaseout threshold, you would not be eligible to take a deduction for your contribution to the Traditional IRA

After-Tax Traditional IRA

If you find that your income prevents you from taking a deduction for all or a portion of your Traditional IRA contribution, you can still make the contribution, but it will be considered an “after-tax” contribution. There are two reasons why we see investors make after-tax contributions to traditional IRA’s. The first is to complete a “Backdoor Roth IRA Contribution”. The second is to leverage the tax deferral accumulation component of a traditional IRA even though a deduction cannot be taken. By holding the investments in an IRA versus in a taxable brokerage account, any dividends or capital gains produced by the activity are sheltered from taxes. The downside is when you withdraw the money from the traditional IRA, all of the gains will be subject to ordinary income tax rates which may be less favorable than long term capital gains rates.

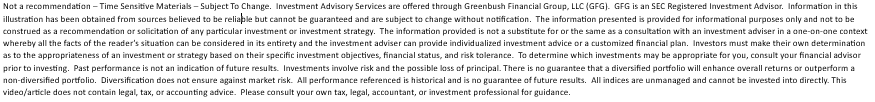

Roth IRA

If you are covered by a 401(K) plan and you want to make a contribution to a Roth IRA, the rules are more straight forward. For Roth IRAs, you make contributions with after-tax dollars but all the accumulation is received tax free as long as the IRA has been in existence for 5 years, and you are over the age of 59½. Unlike the Traditional IRA rules, where there are different income thresholds based on whether you are covered or your spouse is covered by a 401(k), Roth IRA contributions have universal income thresholds.

The contribution limits are the same as Traditional IRA’s but you have to aggregate your IRA contributions meaning you can’t make a $6,000 contribution to a Traditional IRA and then make a $6,000 contribution to a Roth IRA for the same tax year. The IRA annual limits apply to all IRA contributions made in a given tax year.

Should You Contribute To A 401(k) or an IRA?

If you have the option to either contribute to a 401(k) plan or an IRA, which one should you choose? Here are some of the deciding factors:

Employer Match: If the company that you work for offers an employer matching contribution, at a minimum, you should contribute the amount required to receive the full matching contribution, otherwise you are leaving free money on the table.

Roth Contributions: Does your 401(k) plan allow Roth contributions? Depending on your age and tax bracket, it may be advantageous for you to make Roth contributions over pre-tax contributions. If your plan does not allow a Roth option, then it may make sense to contribute pre-tax up the max employer match, and then contribute the rest to a Roth IRA.

Fees: Is there a big difference in fees when comparing your 401(k) account versus an IRA? With 401(k) plans, typically the fees are assessed based on the total assets in the plan. If you have a $20,000 balance in a 401(K) plan that has $10M in plan assets, you may have access to lower cost mutual fund share classes, or lower all-in fees, that may not be available within a IRA.

Investment Options: Most 401(k) plans have a set menu of mutual funds to choose from. If your plan does not provide you with access to a self-directed brokerage window within the 401(k) plan, going the IRA route may offer you more investment flexibility.

Easier Is Better: If after weighing all of these options, it’s a close decision, I usually advise clients that “easier is better”. If you are going to be contributing to your employer’s 401(k) plan, it may be easier to just keep everything in one spot versus trying to successfully manage both a 401(k) and IRA separately.

Maxing Out A 401(k) and IRA

As long as you are eligible from an income standpoint, you are allowed to max out both your employee deferrals in a 401(k) plan and the contributions to your IRA in the same tax year. If you are age 51, married, and your modified AGI is $180,000, you would be able to max your 401(k) employee deferrals at $27,000, you are over the income limit for deducting a contribution to a Traditional IRA, but you would have the option to contribute $7,000 to a Roth IRA.

Advanced Tax Strategy: In the example above, you are above the income threshold to deduct a Traditional IRA but your spouse may not be. If your spouse is not covered by a 401(k) plan, you can make a spousal contribution to a Traditional IRA because the $180,000 is below the income threshold for the spouse that is NOT COVERED by the employer sponsored retirement plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Make Pre-tax or Roth 401(k) Contributions?

When you become eligible to participate in your employer’s 401(k), 403(b), or 457 plan, you will have to decide what type of contributions that you want to make to the plan.

When you become eligible to participate in your employer’s 401(k), 403(b), or 457 plan, you will have to decide what type of contributions that you want to make to the plan. Most employer sponsored retirement plans now offer employees the option to make either Pre-tax or Roth contributions. A number of factors come into play when deciding what source is the right one for you including:

Age

Income level

Marital status

Income need in retirement

Withdrawal plan in retirement

Abnormal income years

You have to consider all of these factors before making the decision to contribute either pre-tax or Roth to your retirement plan.

Pre-tax vs Roth Contributions

First, let’s start off by identifying the differences between pre-tax and Roth contributions. It’s pretty simple and straight forward. With pre-tax contributions, the strategy is “don’t tax me on it now, tax me on it later”. The contributions are deducted from your gross pay, they deduct FICA tax, but they do not withhold federal or state tax which in doing so, you are essentially lowering the amount of your income that is subject to federal and state income tax in that calendar year. The full amount is deposited into your 401K, the balance accumulates tax deferred, and then when you retire, and pull money out, that is when you pay tax on it. The tax strategy here is taking income off the table when you are working and in a higher tax bracket, and then paying tax on that money after you are retired, your paychecks have stopped, and you are hopefully in a lower tax bracket.

With Roth contributions, the strategy is “pay tax on it now, don’t pay tax on it later”. When your contributions are deducted from your pay, they withhold FICA, as well as Federal and State income tax, but when you withdraw the money in retirement, you don’t have to pay tax on any of it INCLUDING all of the earnings.

Age

Your age and your time horizon to retirement are a big factor to consider when trying to decide between pre-tax or Roth contributions. In general, the younger you are and the longer your time horizon to retirement, the more it tends to favor Roth contributions because you have more years to build the earning in the account which will eventually be withdrawn tax-free. In contrast, if you’re within 10 years to retirement, you have a relatively short period of time before withdrawals will begin from the account, making pre-tax contributions may make the most sense.

When you end up in one of those mid time horizon ranges like 10 to 20 years to retirement, the other factors that we’re going to discuss have a greater weight in arriving at your decision to do pre-tax or Roth.

Income level

Your level of income also has a big impact on whether pre-tax or Roth makes sense. In general, the higher your level of income, the more it tends to favor pre-tax contributions. In contrast, lower to medium levels of income, can favor Roth contributions. Remember pre-tax is “don’t tax me on it now, tax me on it later”, and the strategy is you are assuming that you are in a higher tax bracket now during your earning years then you will be in retirement when you don’t have a paycheck. By contrast, a 22 year old, that has accepted their first job, will most likely be at the lowest level of income over their working career, and have the expectation that their earnings will grow overtime. This situation would favor making Roth contributions because you are paying tax on the contributions while you are still in a low tax bracket and then later on when your income rises, you can switch over to pre-tax.

Marital status

Your marital status matters because if you’re married and you file a joint tax return, you have to consider not just your income but your spouse’s income. If you make $30,000 a year, that might lead you to think that Roth is a good option, but if your spouse makes $200,000 a year, your combined income on your joint tax return is $230,000 which puts you in a higher tax bracket. Assuming you’re not going to need $230,000 per year to live off of in retirement, pre-tax contributions may be more appropriate because you want the tax deduction now.

A change in your marital status can also influence the type of contributions that you’re making to the plan. If you are a single filer making $50,000 a year, you may have been making Roth contributions but then you get married and your spouse makes $100,000 a year, since your income will now be combined for tax filing purposes, it may make sense for you to change your elections to pre-tax contributions.

These changes can also take place when one spouse retires and the other is still working. Prior to the one spouse retiring, both were earning income, and both were making pre-tax contributions. Once one of the spouses retires the income level drops, the spouse that is still working may want to switch to Roth contributions given their much lower tax rate.

Withdrawal plan in retirement

You also have to look ahead to your retirement years and estimate what your income picture might look like. If you anticipate that you will need the same level in retirement that you have now, even though you might have a shorter time horizon to retirement, it may favor making Roth contributions because your tax rate is not anticipated to drop in the retirement years. So why not pay tax on the contributions now and then receive the earnings on the account tax-free, as opposed to making pre-tax contributions and having to pay tax on all of it. The benefit associated with pre-tax contributions assumes that you’re in a higher tax rate now and when you withdraw the money you will be in a lower tax bracket.

Some individuals accumulate balances in their 401(k) accounts but they also have pensions. As they get closer to retirement, they realize between their pension and Social Security, they will not need to make withdrawals from their 401(k) account to supplement their income. In many of those cases, we can assume a much longer time horizon for those accounts which may begin to favor Roth contributions. Also, if those accounts are going to continue to accumulate and eventually be inherited by their children, from a tax standpoint, it’s more beneficial for children to inherit a Roth account versus a pre-tax retirement account because they have to pay tax on all of the money in a pre-tax retirement account as some point.

Abnormal income years

It’s not uncommon during your working years to have some abnormal income years where your income ends up being either significantly higher or significantly lower than it normally is. In these abnormal years it often makes sense to change your pre-tax or Roth approach. If you are a business owner, you typically make $300,000 per year, but the business has a bad year, and you’re only going to make $50,000 this year, instead of making your usual pre-tax contributions, it may make sense to contribute Roth that year. If you are a W-2 employee, and the company that you work for is having a really good year, and you expect to receive a big bonus at the end of the year, if you’re contributing Roth it may make sense to switch to pre-tax anticipating that your income will be much higher for the tax year.

Another exception can happen in the year that you retire. Some companies will issue bonuses or paid out built up sick time or vacation time which can count as taxable income. In those years it may make sense to make larger pre-tax contributions because the income in that final year may be much higher than normal.

Frequently Asked Questions About Roth Contributions

When we are educating 401K plan participants on this topic, there are a few frequently asked questions that we receive:

Do all retirement plans allow Roth contributions?

ANSWER: No, Roth contributions are a voluntary contribution source that a company has to elect to offer to its employees. We are seeing a lot more plans that offer this benefit but not all plans do.

Can you contribute both Pre-Tax and Roth at the same time to the plan?

ANSWER: Yes, if your plan allows Roth contributions you are normally able to contribute both pre-tax and Roth to the plan simultaneously. However, the annual deferral limits are aggregated for purposes of all employee elective deferrals. For example, in 2024, the maximum employee deferral limits are as follows:

Under the age of 50: $23,000

Age 50+: $30,500

You can contribute all pre-tax, all Roth, or any combination of the two but those amounts are aggregated together for purposes of assessing the annual dollar limits.

Do you have to set up a separate account for your Roth contributions to the 401K?

ANSWER: No. The Roth contributions that you make out of your paycheck to the plan are just tracked as a separate source within the 401K plan. They have to do this because when it comes to withdrawing the money, they have to know how much of your account balance is pre-tax and what amount is Roth. Typically, on your statements, you will see your total balance, and then it breaks it down by money type within your account.

What happens when I retire and I have Roth money in my 401K account?

ANSWER: For those that contribute Roth to their accounts, it's common for them to have both pre-tax and Roth money in their account when they retire. The pre-tax money could be from employee deferrals that you made or from the employer contributions. When you retire, you can set up both a rollover IRA and a Roth IRA to receive the rollover balance from each source.

SPECIAL NOTE: The Roth source has a special 5 year holding rule. To be able to withdraw the earnings from the Roth source tax free, you have to be over the age of 59 ½ AND the Roth source has to have been in existence for at least 5 years. Here is the problem, that five-year holding clock does not transfer over from a Roth 401(k) to a Roth IRA. If you did not have a Roth IRA a prior to the rollover, you would have to re satisfy the five-year holding period within the Roth IRA before making withdraws. We normally advise clients in this situation that they should set up a Roth IRA with $1 five years prior to retirement to start that five-year clock within the Roth IRA so by the time they rollover the Roth 401(k) balance they are free and clear of the 5 year holding period requirement. (Assuming their income allows them to make a Roth IRA contribution during that $1 year)

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Cash Balance Plans: $100K to $300K in Pre-tax Contributions

DB/DC combo plans can allow business owners to contribute $100,000 to $300,000 pre-tax EACH YEAR which can save them tens of thousands of dollars in taxes.

A Cash Balance Plan for small business owners can be one the best ways to shelter large amounts of income from taxation each year. Most small business owners are familiar with 401(K) plans, SEP IRA’s, Solo(k) Plans, and Simple IRA’s, but these “DB/DC Combo” plans bring the tax savings for business owners to a whole new level. DB/DC combo plans can allow business owners to contribute $100,000 to $300,000 pre-tax EACH YEAR which can save them tens of thousands of dollars in taxes. In this article I’m going to walk you through:

How cash balance plans and DB/DC combo plans work

Which companies are the best fit for these plans

How the contribution amount is calculated each year

Why an actuary is involved

How long should these plans be in place for?

The cost of maintaining these plans

How they differ from 401(k) plans, SEP IRA, Solo(k), and Simple IRA plans

The Right Type of Company

When we put one of these DB/DC combo plans in place for a client, most of the time, the company has the following characteristics:

Less than 20 full time employees

The business is producing consistent cash flow

Business owners are making $300K or more per year

Business owner is looking for a way to dramatically reduce their tax liability

Company already sponsors either a 401(k), Solo(k), Simple IRA, or SEP IRA

What Is A Cash Balance Plan?

This special plan design involves running a 401(k) plan and Cash Balance Plan side by side. 401(K) plans, SEP IRAs, and Simple IRAs are considered a “defined contribution plans”. As the name suggests, a defined contribution plan defines the maximum hard dollar amount that you can contribute to the plan each year. The calculation is based on the current, here and now benefit. For 2021, the maximum annual contribution limits for a 401(k) plan is either $58,000 or $64,500 depending on your age.

A Cash Balance Plan is considered a “defined benefit plan”; think a pension plan. Define benefit plans define the benefit that will be available to you at some future date and the contribution that is required today is a calculation based on the dollar amount needed to meet that future benefit. They have caps but the caps are much higher than defined contribution plans and they vary based on the age and compensation of the business owner. Also, even though they are pension plans, they typically payout the benefit as a lump sum pre-tax amount that can be rolled over to either an IRA or other type of qualified plan.

As mentioned earlier, these Combo plans can provide annual pre-tax contribution in excess of $300,000 per year for some business owners. Now that is the maximum but you do not have to design your plan to be based on the maximum contribution. Some small business owners would prefer to just contribute $100,000 - $150,000 pre-tax per year if that was available, and these combo plans can be designed to meet those contribution levels.

Employee Demographic

Employee demographic play a huge role as to whether or not these plans work for a given company. Similar to 401(K) plans, cash balance plans are subject to nondiscrimination testing year which requires the company to make an employer contribution to eligible employees based on amounts that are contributed to the owner’s accounts. But it’s not as big of a jump in contribution level to the employees that many business owners expect. It's not uncommon a company to already be sponsoring a company retirement plan which is providing the employees with an employer contribution equal to 3% to 5% of the employees annual compensation. Many of these DB/DC combo plans only require a 7.5% total contribution to pass testing. Thus, making an additional 2.5% of compensation contributions to the employees can open up $100,000 - $250,000 in additional pre-tax contributions for the business owner. In many cases, the tax savings for the business owner more than pays for the additional contribution to the employee so everyone wins. The employee get more and the business owner gets a boat load of tax savings.

The age and annual compensation of the owner versus the employees also has a large impact. In general, this plan design works the best for businesses where the average age of the employees is much lower than the age of the business owner, and the business owner’s compensation is much higher than that of the average employee. These plans are very common for dentists, doctors, lawyers, consultants, and any other small business that fits this owner vs employee demographic.

If you have no employees or it’s an owner only entity, even better. You just graduated to the higher contribution level without additional contributions to employees.

Reminder: You only have to count full time employees. ERISA defines full time employees as being employed for at least 1 year and working over 1,000 hours during that one year period. If you have employees working less than 1,000 hours a year, they may never become eligible for the plan.

The 3 Year Rule

When you adopt a Cash Balance Plan, you typically have to keep the plan in place for at least 3 years. The IRS does not want you to have one great year, contribute $300,000 pre-tax, and then terminate the plan the next year. Unlike 401(k) plans, cash balance plans have minimum funding requirements each year which is why businesses have to have more predictable revenue streams for this plan design to makes sense.

However, you can build in fail safe into the plan design to help protect against bad years in the business. Since no business owner knows what is going to happen over the next three years, we can build into the plan design a “lesser of” statement which calculates the contribution for the business owner based on the “lesser of the ERISA max comp limit for the year or the owners comp for that tax year.” If the business owner makes $500,000, they would use the ERISA comp limit of $290,000 for 2021. If it’s a horrible year and the business owner only makes $50,000 that year, the required contribution would be based on that lower compensation level, reducing the required contribution for that year.

After 3 years, the company has the option to voluntarily terminate the cash balance plan, and the business owner can rollover his or her balance into the 401(k) plan or rollover IRA.

Contributions Are Due Tax Filing Deadline Plus Extension

The company is not required to fund these plans until tax filing deadline plus extension. If the business is a 12/31 fiscal year end and you adopt the plan in November, you would not be required to fund the contribution until either September 15th or October 15th of the following year depend on how your business is incorporated.

Assumed Rates of Return

Unlike a 401(k) plan where each employee has their own account that they have control over, Cash Balance Plans are pooled investment account, because the company is responsible for producing the rate of return in the account that meets or beats the actuarial assumptions. The annual rate of return target for the cash balance plan can sometimes be tied to a treasury bond yield, flat rate, or other metric used by the actuary within the ERISA guidelines. If the plan assets underperform the assumed rate of return, it could increase the required contribution for that year. Vice versa, if the plan assets outperform the assumed rate, it can decrease the required contribution for the year. The additional risk taken on by the company has to be considered when selecting the appropriate asset allocation for the cash balance account.

Annual Plan Fees

Since cash balance plans are defined benefit plans, you will need an actuary to calculate the required minimum contribution each year. Since most of these plans are DC/DB combo plans, the 401(K) plan and the Cash Balance Plan need to be tested together for purposes of passing year end testing. A full 401(k) may carry $1,000 - $3,000 in annual administration cost each year depending on your platform, whereas running both a 401(K) and Cash Balance Plan may increase those administration costs to $4,000 - $7,000 depending again on the platform and the number of employees.

While these plans can carry a higher cost, you have to weigh it against the tax savings that the business owner is realizing by having the DC/DB combo plan in place. If they are able to contribute an additional $200,000 over just their 401(K), that could save them $80,000 in taxes. Many business owners in the top tax bracket are willing to pay an additional $3,000 in admin fees to save $80,000 in taxes.

Run Projections

As a business owner, you have to weigh the additional costs of sponsoring the plan against the amount of your tax savings. For the right company, these combo plans can be fantastic but it’s not a set it and forget it type plan design. As the employee demographics within the company change over the years it can impact this cost benefit analysis. We have seen cases where hiring just one employee has thrown off the whole plan design a year later.

If you would like to learn more about this plan design or would like us to run a projection for your company, feel free to reach out to us for a complementary consult.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus Relief: $100K 401(k) Loans & Penalty Free Distributions

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans.

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans. These new distribution options will provide employees and business owners with access to their retirement accounts with the:

10% early withdrawal penalty waived

Option to spread the income tax liability over a 3-year period

Option to repay the distribution and avoid taxes altogether

401(k) loans up to $100,000 with loan payments deferred for 1 year

Many individuals and small businesses are in a cash crunch. Individuals are waiting for their IRS Stimulus Checks and many small business owners are in the process of applying for the new SBA Disaster Loans and SBA Paycheck Protection Loans. Since no one knows at this point how long it will take the IRS checks to arrive or how long it will take to process these new SBA loans, people are looking for access to cash now to help bridge the gap. The CARES Act opened up options within pre-tax retirement accounts to provide that bridge.

10% Early Withdrawal Penalty Waived

Under the CARES Act, “Coronavirus Related Distributions” up to $100,000 are not subject the 10% early withdrawal penalty for individuals under the age of 59½. The exception will apply to distributions from:

IRA’s

401(K)

403(b)

Simple IRA

SEP IRA

Other types of Employer Sponsored Plans

To qualify for the waiver of the 10% early withdrawal penalty, you must meet one of the following criteria:

You, your spouse, or a dependent was diagnosed with the COVID-19

You are unable to work due to lack of childcare resulting from COVID-19

You own a business that has closed or is operating under reduced hours due to COVID-19

You have experienced adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced because of COVID-19

They obviously made the definition very broad and it’s anticipated that a lot of taxpayers will qualify under one of the four criteria listed above. The IRS may also take a similar broad approach in the application of these new qualifying circumstances.

Tax Impact

While the 10% early withdrawal penalty can be waived, in most cases, when you take a distribution from a pre-tax retirement account, you still have to pay income tax on the distribution. That is still true of these Coronavirus Related Distributions but there are options to help either mitigate or completely eliminate the income tax liability associated with taking these distributions from your retirement accounts.

Tax Liability Spread Over 3 Years

Normally when you take a distribution from a pre-tax retirement account, you have to pay income tax on the full amount of the distribution in the year that the distribution takes place.

However, under these new rules, by default, if you take a Coronavirus-Related Distribution from your 401(k), IRA, or other type of employer sponsored plan, the income tax liability will be split evenly between 2020, 2021, and 2022 unless you make a different election. This will help individuals by potentially lowering the income tax liability on these distributions by spreading the income across three separate tax years. However, taxpayers do have the option to voluntarily elect to have the full distribution taxed in 2020. If your income has dropped significantly in 2020, this may be an attractive option instead of deferring that additional income into a tax year where your income has returned to it’s higher level.

1099R Issue

I admittedly have no idea how the tax reporting is going to work for these Coronavirus-Related Distributions. Normally when you take a distribution from a retirement account, the custodian issues you a 1099R Tax Form at the end of the year for the amount of the distribution which is how the IRS cross checks that you reported that income on your tax return. If the default option is to split the distribution evenly between three separate tax years, it would seem logical that the custodians would now have to issue three separate 1099R tax forms for 2020, 2021, and 2022. As of right now, we don’t have any guidance as to how this is going to work.

Repayment Option

There is also a repayment option associated with these Coronavirus Related Distributions, that will provide taxpayers with the option to repay these distributions back into their retirement accounts within a 3-year period and avoid having to pay income tax on these distributions. If individuals elect this option, not only did they avoid the 10% early withdrawal penalty, but they also avoided having to pay tax on the distribution. The distribution essentially becomes an “interest free loan” that you made to yourself using your retirement account.

The 3-year repayment period begins the day after the individual receives the Coronavirus Related Distribution. The repayment is technically treated as a “rollover” similar to the 60 day rollover rule but instead of having only 60 days to process the rollover, taxpayers will have 3 years.

The timing of the repayment is also flexible. You can either repay the distribution as a:

Single lump sum

Partial payments over the course of the 3 year period

Even if you do not repay the full amount of the distribution, any amount that you do repay will avoid income taxation. If you take a Coronavirus Related Distribution, whether you decide to have the distribution split into the three separate tax years or all in 2020, if you repay a portion or all of the distribution within that three year window, you can amend your tax return for the year that the taxes were paid on that distribution, and recoup the income taxes that you paid.

Example: I take a $100,000 distribution from my IRA in April 2020. Since my income is lower in 2020, I elect to have the full distribution taxed to me in 2020, and remit that taxes with my 2020 tax return. The business has a good year in 2021, so in January 2022 I return the full $100,000 to my IRA. I can now amend my 2020 tax return and recapture the income tax that I paid for that $100,000 distribution that qualified as a Coronavirus Related Distribution.

No 20% Withholding Requirement

Normally when you take cash distributions from employee sponsored retirement plans, they are subject to a mandatory 20% federal tax withholding; that requirement has been waived for these Coronavirus Related Distributions up to the $100,000 threshold, so plan participants have access to their full account balance.

Cash Bridge Strategy

Here are some examples as to how individuals and small business owners may be able to use these strategies.

For small business owners that intend to apply for the new SBA Disaster Loan (EIDL) and/or SBA Paycheck Protection Program (PPP), the underwriting process will most likely take a few weeks before the company actually receives the money for the loan. Some businesses need cash sooner than that just to keep the lights on while they are waiting for the SBA money to arrive. A business owner could take a $100,000 from the 401(K) plan, use that money to operate the business, and they have 3 years to return that money to 401(k) plan to avoid having to pay income tax on that distribution. The risk of course, is if the business goes under, then the business owner may not have the cash to repay the loan. In that case, if the owner was under the age of 59½, they avoided the 10% early withdrawal penalty, but would have to pay income tax on the distribution amount.

For individuals and families that are struggling to make ends meet due to the virus containment efforts, they could take a distribution from their retirement account to help subsidize their income while they are waiting for the IRS Stimulus checks to arrive. When they receive the IRS stimulus checks or return to work full time, they can repay the money back into their retirement account prior to the end of the year to avoid the tax liability associated with the distribution for 2020.

401(k) Plan Sponsors

I wanted to issue a special note the plan sponsors of these employer sponsored plans, these Coronavirus Related Distributions are an “optional” feature within the retirement plan. If you want to provide your employees with the opportunity to take these distributions from the plan, you will need to contact your third party administrator, and authorize them to make these distributions. This change will eventually require a plan amendment but companies have until 2022 to amend their plan to allow these Coronavirus Related Distributions to happen now, and the amendment will apply retroactively.

$100,000 Loan Option

The CARES Act also opened up the option to take a $100,000 loan against your 401(k) or 403(b) balance. Normally, the 401(k) maximum loan amount is the lesser of:

50% of your vested balance OR $50,000

The CARES Act includes a provision that will allow plan sponsors to amend their loan program to allow “Coronavirus Related Loans” which increases the maximum loan amount to the lesser of:

100% of your vested balance OR $100,000

To gain access to these higher loan amounts, plan participants have to self attest to the same criteria as the waiver of the 10% early withdrawal penalty. But remember, loans are an optional plan provision within these retirement plans so your plan may or may not allow loans. If the plan sponsors want to allow these high threshold loans, similar to the Coronavirus Related Distributions, they will need to contact their plan administrator authorizing them to do so and process the plan amendment by 2022.

No Loan Payments For 1 Year

Normally when you take a 401(K) loan, the company begins the payroll deductions for your loan payment immediately after you receive the loan. The CARES act will allow plan participants that qualify for these Coronavirus loans to defer loan payments for up to one year. The loan just has to be taken prior to December 31, 2020.

Caution

While the CARES ACT provides some new distribution and loan options for individuals impacted by the Coronavirus, there are always downsides to using money in your retirement account for purposes other than retirement. The short list is:

The money is no longer invested

If the distribution is not returned to the account within 3 years, you will have a tax liability

If you use your retirement account to fund the business and the business fails, you could have to work a lot longer than you anticipated

If you take a big 401(k) loan, even though you don’t have to make loan payments now, a year from the issuance of the loan, you will have big deductions from your paycheck as those loan payments are required to begin.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

$5,000 Penalty Free Distribution From An IRA or 401(k) After The Birth Of A Child or Adoption

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child