Target Date Funds: A Public Service Announcement

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement

Target Date Funds: A Public Service Announcement

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement or to start withdrawing assets. For this article, I will refer to the target date as the “retirement date” because that is how Target Date Funds are typically used.

Target Date Funds are continuing to grow in popularity as Defined Contribution Plans (i.e. 401(k)’s) become the primary savings vehicle for retirement. Per the Investment Company Institute, as of March 31, 2018, there was $1.1 trillion invested in Target Date Mutual Funds. Defined Contribution Plans made up 67 percent of that total.

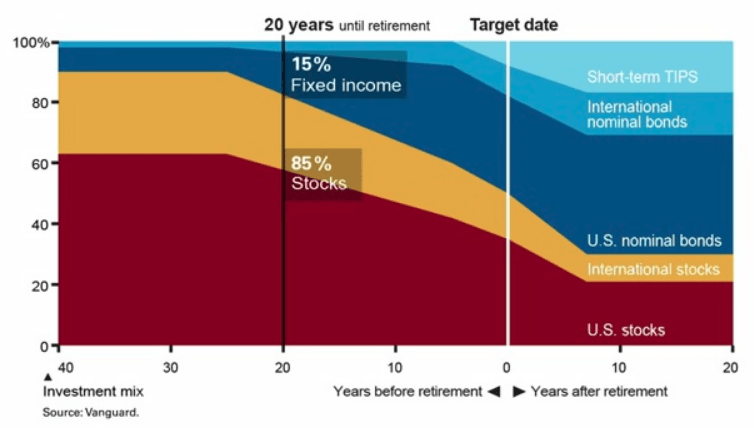

Target Date Funds are often coined as the “set it and forget it” of investments for participants in retirement plans. Target Date Funds that are farther from the retirement date will be invested more aggressively than target date funds closer to the retirement date. Below is a chart showing the “Glide Path” of the Vanguard Target Date Funds. The horizontal access shows how far someone is from retirement and the vertical access shows the percentage of stocks in the investment. In general, more stock means more aggressive. The “40” in the bottom left indicates someone that is 40 years from their retirement date. A common investment strategy in retirement accounts is to be more aggressive when you’re younger and become more conservative as you approach your retirement age. Following this strategy, someone with 40 years until retirement is more aggressive which is why at this point the Glide Path shows an allocation of approximately 90% stocks and 10% fixed income. When the fund is at “0”, this is the retirement date and the fund is more conservative with an allocation of approximately 50% stocks and 50% fixed income. Using a Target Date Fund, a person can become more conservative over time without manually making any changes.

Note: Not every fund family (i.e. Vanguard, American Funds, T. Rowe Price, etc.) has the same strategy on how they manage the investments inside the Target Date Funds, but each of them follows a Glide Path like the one shown below.

The Public Service Announcement

The public service announcement is to remind investors they should take both time horizon and risk tolerance into consideration when creating a portfolio for themselves. The Target Date Fund solution focuses on time horizon but how does it factor in risk tolerance?Target Date Funds combine time horizon and risk tolerance as if they are the same for each investor with the same amount of time before retirement. In other words, each person 30 years from retirement that is using the Target Date strategy as it was intended will have the same stock to bond allocation.This is one of the ways the Target Date Fund solution can fall short as it is likely not possible to truly know somebody’s risk tolerance without knowing them. In my experience, not every investor 30 years from retirement is comfortable with their biggest retirement asset being allocated to 90% stock. For various reasons, some people are more conservative, and the Target Date Fund solution may not be appropriate for their risk tolerance.The “set it and forget it” phrase is often used because Target Date Funds automatically become more conservative for investors as they approach their Target Date. This is a strategy that does work and is appropriate for a lot of investors which is why the strategy is continuing to increase in popularity. The takeaway from this article is to think about your risk tolerance and to be educated on the way Target Date Funds work as it is important to make sure both are in line with each other.For a more information on Target Date Funds please visit https://www.greenbushfinancial.com/target-date-funds-and-their-role-in-the-401k-space/

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Can I Open A Roth IRA For My Child?

Parents always want their children to succeed financially so they do everything they can to set them up for a good future. One of the options for parents is to set up a Roth IRA and we have a lot of parents that ask us if they are allowed to establish one on behalf of their son or daughter. You can, as long as they have earned income. This can be a

Parents will often ask us: “What type of account can I setup for my kids that will help them to get a head start financially in life"?”. One of the most powerful wealth building tools that you can setup for your children is a Roth IRA because all of accumulation between now and when they withdrawal it in retirement will be all tax free. If your child has $10,000 in their Roth IRA today, assuming they never make another deposit to the account, and it earns 8% per year, 40 years from now the account balance would be $217,000.

Contribution Limits

The maximum contribution that an individual under that age of 50 can make to a Roth IRA in 2022 is the LESSER of:

$6,000

100% of earned income

For most children between the age of 15 and 21, their Roth IRA contributions tend to be capped by the amount of their earned income. The most common sources of earned income for young adults within this age range are:

Part-time employment

Summer jobs

Paid internships

Wages from parent owned company

If they add up all of their W-2's at the end of the year and they total $3,000, the maximum contribution that you can make to their Roth IRA for that tax year is $3,000.

Roth IRA's for Minors

If you child is under the age of 18, you can still establish a Roth IRA for them. However, it will be considered a "custodial IRA". Since minors cannot enter into contracts, you as the parent serve as the custodian to their account. You will need to sign all of the forms to setup the account and select the investment allocation for the IRA. It's important to understand that even though you are listed as a custodian on the account, all contributions made to the account belong 100% to the child. Once the child turns age 18, they have full control over the account.

Age 18+

If the child is age 18 or older, they will be required to sign the forms to setup the Roth IRA and it's usually a good opportunity to introduce them to the investing world. We encourage our clients to bring their children to the meeting to establish the account so they can learn about investing, stocks, bonds, the benefits of compounded interest, and the stock market in general. It's a great learning experience.

Contribution Deadline & Tax Filing

The deadline to make a Roth IRA contribution is April 15th following the end of the calendar year. We often get the question: "Does my child need to file a tax return to make a Roth IRA contribution?" The answer is "no". If their taxable income is below the threshold that would otherwise require them to file a tax return, they are not required to file a tax return just because a Roth IRA was funded in their name.

Distribution Options

While many of parents establish Roth IRA’s for their children to give them a head start on saving for retirement, these accounts can be used to support other financial goals as well. Roth contributions are made with after tax dollars. The main benefit of having a Roth IRA is if withdrawals are made after the account has been established for 5 years and the IRA owner has obtained age 59½, there is no tax paid on the investment earnings distributed from the account.

If you distribute the investment earnings from a Roth IRA before reaching age 59½, the account owner has to pay income tax and a 10% early withdrawal penalty on the amount distributed. However, income taxes and penalties only apply to the “earnings” portion of the account. The contributions, since they were made with after tax dollar, can be withdrawal from the Roth IRA at any time without having to pay income taxes or penalties.

Example: I deposit $5,000 to my daughters Roth IRA and four years from now the account balance is $9,000. My daughter wants to buy a house but is having trouble coming up with the money for the down payment. She can withdrawal $5,000 out of her Roth IRA without having to pay taxes or penalties since that amount represents the after tax contributions that were made to the account. The $4,000 that represents the earnings portion of the account can remain in the account and continue to accumulate tax-free. Not only did I provide my daughter with a head start on her retirement savings but I was also able to help her with the purchase of her first house.

We have seen clients use this flexible withdrawal strategy to help their children pay for their wedding, pay for college, pay off student loans, and to purchase their first house.

Not Limited To Just Your Children

This wealth accumulate strategy is not limited to just your children. We have had grandparents fund Roth IRA's for their grandchildren and aunts fund Roth IRA's for their nephews. They do not have to be listed as a dependent on your tax return to establish a custodial IRA. If you are funded a Roth IRA for a minor or a college student that is not your child, you may have to obtain the total amount of wages on their W-2 form from their parents or the student because the contribution could be capped based on what they made for the year.

Business Owners

Sometime we see business owners put their kids on payroll for the sole purpose of providing them with enough income to make the $6,000 contribution to their Roth IRA. Also, the child is usually in a lower tax bracket than their parents, so the wages earned by the child are typically taxed at a lower tax rate. A special note with this strategy, you have to be able to justify the wages being paid to your kids if the IRS or DOL comes knocking at your door.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

403(b) Lawsuits Continue To Spread To More Colleges

In the last 3 years, the number of lawsuits filed against colleges for excessive fees and compliance issues related to their 403(b) plans has increased exponentially. Here is a list of just some of the colleges that have had lawsuit brought against them by their 403(b) plan participants:

In the last 3 years, the number of lawsuits filed against colleges for excessive fees and compliance issues related to their 403(b) plans has increased exponentially. Here is a list of just some of the colleges that have had lawsuit brought against them by their 403(b) plan participants:

Yale

NYU

Duke

John Hopkins

MIT

Columbia

Emory

Cornell

Vanderbilt

Northeastern

USC

The fiduciary landscape has completely changed for organizations, like colleges, that sponsor ERISA 403(b) plans. In 2009, new regulations were passed that brought 403(b) plans up to the compliance standards historically found in the 401(k) market. Instead of slowly phasing in the new regulations, the 403(b) market basically went from zero to 60 mph in a blink of an eye. While some of the basic elements of the new rules were taken care of by the current service providers such as the required written plan documents, contract exchange provisions, and new participant disclosures, we have found that colleges, due to a lack of understanding of what is required to fulfill their fiduciary role to the plan, have fallen very short of putting the policies and procedures in place to protect the college from liabilities that can arise from the 403(b) plan.

Top Violations

Based on the lawsuits that have been filled against the various colleges, here is a list of the most common claims that have been included in these lawsuits:

Excessive fees

Fees associated with multiple recordkeepers

Too many investment options

Improper mutual fund share class

Variable annuity products

Excessive Fees

This is by far number one on the list. As you look at these lawsuits, most of them include a claim that the university breached their fiduciary duty under ERISA by allowing excessive fees to be charged to plan participants.

Here is the most common situation that we see when consulting with colleges that leads to this issue. A college had been with the same 403(b) provider for 60 years. Without naming names, they assume that their 403(b) plan has reasonable fees because all of the other colleges that they know of also use this same provider. So their fees must be reasonable right? Wrong!!

If you are member of the committee that oversees that 403(b) plan at your college, how do you answer this question? How do you know that the fees for your plan are reasonable? Can you show documented proof that you made a reasonable effort to determine whether or not the plan fees are reasonable versus other 403(b) providers?

The only way to answer this question is by going through an RFP process. For colleges that we consult with we typically recommend that they put an RFP out every 3 to 5 years. That is really the only way to be able to adequately answer the question: “Are the plan fees reasonable?” Now if you go through the RFP process and you find that another reputable provider is less expensive than your current provider, you are not required to change to that less expensive provider. However, from a fiduciary standpoint, you should acknowledge at the end of the RFP process that there were lower fee alternatives but the current provider was selected because of reasons X, Y, and Z. Document, document, document!!

Investment Fees / Underperformance / Investment Options

Liability is arising in these 403(b) plans due to

Revenue sharing fees buried in the mutual fund expense rations

Underperformance of the plan investments versus the benchmark / peer group

Too many investment options

Investment options concentrated all in one fund family

Restrictions associate with the plan investment

Investment Policy Statement violations or No IPS

Failure to document quarterly and annual investment reviews

Here is the issue. Typically members of these committees that oversee the 403(b) plan are not investment experts and you need to basically be an investment expert to understand mutual fund share classes, investment revenue sharing, peer group comparisons, asset classes represented within the fund menu, etc. To fill the void, colleges are beginning to hire investment firms to serve as third party consultants to the 403(b) committee. In most cases these firms charge a flat dollar fee to:

Prepare quarterly investment reports

Investment benchmarking

Draft a custom Investment Policy Statement

Coordinate the RFP process

Negotiation plan fees with the current provider

Conduct quarterly and annual reviews with the 403(b) committee

Compliance guidance

Multiple Recordkeepers

While multiple recordkeepers is becoming more common for college 403(b) plans, it requires additional due diligence on the part of the college to verify that it’s in the best interest of the plan participants. Multiple recordkeepers means that your 403(b) plan assets are split between two or more custodians. For example, a college may use both TIAA CREF and Principal for their 403(b) platform. Why two recordkeepers? Most of the older 403(b) accounts are setup as individual annuity contracts. As such, if the college decides to charge their 403(b) provider, unlike the 401(k) industry where all of the plan assets automatically move over to the new platform, each plan participant is required to voluntarily sign forms to move their account balance from the old 403(b) provider to the new 403(b) provider. It’s almost impossible to get all of the employee to make the switch so you end up with two separate recordkeepers.

Why does this create additional liability for the college? Even through the limitation set forth by these individual annuity contracts is out of the control of the college, by splitting the plan assets into two pieces you may be limiting the economies of scale of the total plan assets. In most cases the asset based fees for a 403(b) plan decreases as the plan assets become larger with that 403(b) provider. By splitting the assets between two 403(b) platforms, you are now creating two smaller plans which could result in larger all-in fees for the plan participants.

Now, it may very well be in the best interest of the plan participants to have two separate platforms but the college has to make sure that they have the appropriate documentation to verify that this due diligence is being conducts. This usually happens as a result of an RFP process. Here is an example. A college has been using the same 403(b) provider for the last 50 years but to satisfy their fiduciary obligation to the plan they going through the RFP process to verify that their plan fees are reasonable. Going into the RFP process they had no intention of change provides but as a result of the RFP process they realize that there are other 403(b) providers that offer better technology, more support for the plan sponsor, and lower fees than their current platform. While they are handcuffed by the individual contracts in the current 403(b) plan, they still have control over where the future contributions of the plan will be allocated so they decide that it’s in both the plan participants and the college’s best interest to direct the future contributions to the new 403(b) platform.

Too Many Investment Options

More is not always better in the retirement plan world. The 403(b) oversite committee, as a fiduciary, is responsible for selecting the investments that will be offered in accordance with the plan’s investment menu. Some colleges unfortunately take that approach that if we offer 80+ different mutual funds for the investment that should “cover all of their bases” since plan participants have access to every asset class, mutual fund family, and ten different small cap funds. The plaintiffs in these 403(b) lawsuits alleged that many of the plan’s investment options were duplicates, performed poorly, and featured high fees that are inappropriate for large 403(b) plans.

To make matters worse, if you have 80+ mutual funds on your 403(b) investment menu, you have to conduct regular and on-going due diligence on all 80+ mutual funds in your plan to make sure that they still meet the investment criteria set out in the plan’s IPS. If you have mutual funds in your plan that fall outside of the IPS criteria and those issues have not been addressed and/or documented, if a lawsuit is brought against the college it will be very difficult to defend that the college was fulfilling its fiduciary obligation to the investment menu.

Improper Mutual Fund Share Classes

To piggyback on this issue, what many plan sponsors don’t realize is that by selecting a more limited menu of mutual funds it can lower the overall plan fees. Mutual funds have different share classes and some share classes require a minimum initial investment to gain asset to that share class. For example you may have Mutual Fund A retail share class with a 0.80% internal expense ratio but there is also a Mutual Fund A institutional share class with a 0.30% internal expense ratio. However, the institutional share class requires an initial investment of $100,000 to gain access. If Mutual Fund A is a U.S. Large Cap Stock Fund and your plan offers 10 other U.S. Large Cap Stock Funds, your plan may not meet the institutional share requirement because the assets are spread between 10 different mutual funds within the same asset class. If instead, the committee decided that it was prudent to offer just Mutual Fund A to represent the U.S. Large Cap Stock holding on the investment menu, the plan may be able to meet that $100,000 minimum initial investment and gain access to the lower cost institutional share class.

Variable Annuity Products

While variable annuity products have historically been a common investment option for 403(b) plans, they typically charge fees that are higher than the fees that are charged by most standard mutual funds. In addition, variable annuities can place distribution restrictions on select investment investments which may not be in the plan participants best interest.

The most common issue we come across is with the TIAA Traditional investment. While TIAA touts the investment for its 3% guarantee, we have found that very few plan participants are aware that there is a 10 year distribution restriction associated with that investment. When you go to remove money from the TIAA Traditional fund, TIAA will inform you that you can only move 1/10th of your balance out of that investment each year over the course of the next ten years. You can see how this could be a problem for a plan participant that may have 100% of their balance in the TIAA Traditional investment as they approach retirement. Their intention may have been to retire at age 65 and rollover the balance to their own personal IRA. If they have money in the TIAA Traditional investment that is no longer an option. They would be limited to process a rollover equal to 1/10th of their balance in the TIAA Tradition investment between the age of 65 and 74. Only after age 74 would they completely free from this TIAA withdrawal restriction.

Consider Hiring A Consultant

While this may sound self-serving, colleges are really going to need help with the initial and on-going due diligence associate with keeping their 403(b) plan in compliance. For a reasonable cost, colleges should be able to engage an investment firm that specialized in this type of work to serve as a third party consultant for the 403(b) investment committee. Just make sure the fee is reasonable. The consulting fee should be expressed as a flat dollar amount fee, not an asset based fee, because they are fulfilling that role as a “consultant”, not the “investment advisor” to the 403(b) plan assets.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Life Insurance Do I Need?

Do you even need life insurance? If you have dependants to protect and you do not have enough savings, you will most likely need life insurance. But the question is how much should I have? Well, your home will be one of your biggest assets, and in some cases the money that it makes from its sale when you have passed away is a significant inheritance

Do you even need life insurance? If you have dependants to protect and you do not have enough savings, you will most likely need life insurance. But the question is how much should I have? Well, your home will be one of your biggest assets, and in some cases the money that it makes from its sale when you have passed away is a significant inheritance for your children.

If you do not have dependents or you have enough savings to cover the current and future expenses for your dependents there really is no need for life insurance. Life insurance sales professional can be very aggressive with their sales tactics and sometime they mask their services as "financial planning" but all of their solutions lead to you buying an expensive whole life insurance policy.

Remember, life insurance is simply a transfer of risk. When you are younger, have a family, a mortgage, and are just starting to accumulate assets, the amount of life insurance coverage is usually at its greatest. But as your children grow up, they finish college, you pay your mortgage, you have no debt, and you have accumulated a good amount in retirement savings, your need to transfer that risk diminishes because you have essentially become self-insured. Just because you had a $1M dollar life insurance policy issued 10 years ago does not mean that is the amount you need now.

Which kind of insurance should you get?

It's our opinion that for most individuals term insurance makes the most sense. Insurance agents are always very eager to sell whole life, variable life, and universal life policies. Why? They pay big commissions!! When you compare a $1M 30 year term policy and a $1M Whole Life policy side by side, often times the annual premium for whole life insurance is 10 times that amount of the term insurance policy. Insurance agents will tout that the whole life policy has cash value, you can take loans, and that it's a tax deferred savings vehicle. But often time when you compare that to: "If I just bought the cheaper term insurance and did something else with the money I would have spent on the more expensive whole life policy such as additional pre-tax retirement savings, college savings for the kids, paying down the mortgage, or setting up an investment management account, at the end of the day I'm in a much better spot financially."

How much life insurance do you need?

The most common rule of thumb that I hear is "10 times my annual salary". Please throw that out the window. The amount of insurance you need varies greatly from individual to individual. The calculation to reach the answer is fairly straight forward. Below is the approach we take with our clients:

How much debt do you have? This includes mortgages, car loans, personal loans, credit cards, etc. Your total debt amount is your starting point.

What are your annual expenses? Just create a quick list of your monthly expenses, they do not have to be exact, and our recommendation is to estimate on the high side just to be safe. Then multiply your monthly expense by 12 months to reach your "annual after tax expenses".

How much monthly income do you have to replace? If you are married, we have to look at the income of each spouse. If your monthly expenses are $50,000 per year and the husband earns $30,000 and the wife earns $80,000, we are going to need more insurance on the wife because we have to replace $80,000 per year in income if she were to pass away unexpectedly. Married couples make the mistake of getting the same face value of insurance just because. Look at it from an income replacement standpoint. If you are a single parent or provider, you will just look at the amount of income that is needed to meet the anticipated monthly expenses for your dependents.

Factor in long term savings goals and expenses. Examples of this are the college cost for your children and the annual retirement savings for the surviving spouse.

Example:

Husband: Age 40: Annual Income $70,000

Wife: Age 41: Annual Income $70,000

Children: Age 13 & 10

Total Outstanding Debt with Mortgage: $250,000

Total Annual After Tax Expenses: $90,000

Savings & Investment Accounts: $100,000

Remember there is not a single correct way to calculate your insurance need. This example is meant to help you through the thought process. Let's look at an insurance policy for the husband. We first look at what the duration of the term insurance policy should be. Our top two questions are "when will the mortgage be paid off?" and "when will the kids be done with college?" These are the two most common large expenses that we are insuring against. In this example let's assume they have 20 years left on their mortgage so at a minimum we will be looking at a 20 year term policy since the youngest child will done with their 4 year degree within the next 12 years. So a 20 year term covers both.

Here is how we would calculate the amount. Start with the total amount of debt: $250,000. That is our base amount. Then we need to look at college expense for the kids. Assume $20K per year for each child for a 4 year degree: $160,000. Next we look at how much annual income we need to replace on the husband's life to meet their monthly expense. In this example it will be close to all of it but let's reduce it to $60K per year. It is determined that they will need their current level of income until the mortgage is paid in full so $60,000 x 20 Years = $1,200,000. When you add all of these up they will need a 20 year term policy with a death benefit of $1,610,000. But we also have to take into account that they already have $100,000 in savings and their levels of debt should decrease with each year as time progresses. In this scenario we would most likely recommend a 20 Year Term Policy with a $1.5M death benefit on the husband's life.

The calculation for his wife in this scenario would be similar since they have the same level of income.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.