Stock Options 101: ISO, NQSO, and Restricted Stock

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

Stock options give you the right to purchase a specific number of shares of the company’s stock at a fixed price. There is typically a vesting schedule attached to option grants that specify when you have the right to exercise your stock options. Companies can offer employees:

Incentive Stock Options (“ISO”)

Nonqualified Stock Options (“NQSO”)

Restricted Stock

It is very important to understand how these different types of options and grants are taxed otherwise it could lead to unfortunate tax surprises down the road.

Non-Qualified Stock Options (NQSO)

A non-qualified stock option (NQSO) is a type of stock option that does not qualify for special favorable tax treatment under the US Internal Revenue Code. Thus the word nonqualified applies to the tax treatment (not to eligibility or any other consideration). NQSOs are the most common form of stock option and may be granted to employees, officers, directors, contractors, and consultants.

You pay taxes on these options at the time of exercise. For tax purposes, the exercise spread is compensation income and is therefore reported on your IRS Form W-2 for the calendar year of exercise.

Example: Your stock options have an exercise price of $30 per share. You exercise them when the price of your company stock is $100 per share. You have a $70 spread ($100 – 30) and thus $70 per share is included in your W2 as ordinary income.

Your company will withhold taxes—income tax, Social Security, and Medicare—when you exercise the options.

When you sell the shares, whether immediately or after a holding period, your proceeds are taxed under the rules for capital gains and losses. You report the stock sale on Form 8949 and Schedule D of your IRS Form 1040 tax return.

Incentive Stock Options (ISO)………..

Incentive stock options (ISOs) qualify for special tax treatment under the Internal Revenue Code and are not subject to Social Security, Medicare, or withholding taxes. However, to qualify they must meet rigid criteria under the tax code. ISOs can be granted only to employees, not to consultants or contractors. There is a $100,000 limit on the aggregate grant value of ISOs that may first become exercisable (i.e. vest) in any calendar year. Also, for an employee to retain the special ISO tax benefits after leaving the company, the ISOs must be exercised within three months after the date of termination.

After you exercise these options, if you hold the acquired shares for at least two years from the date of grant and one year from the date of exercise, you incur favorable long-term capital gains tax (rather than ordinary income tax) on all appreciation over the exercise price. However, the paper gains on shares acquired from ISOs and held beyond the calendar year of exercise can subject you to the alternative minimum tax (AMT). This can be problematic if you are hit with the AMT on theoretical gains but the company's stock price then plummets, leaving you with a big tax bill on income that has evaporated.

Very Important: If you have been granted ISOs, it’s important to understand how the alternative minimum tax can affect you prior to exercising your stock options.

Restricted Stock……………….

Your company may no longer be granting you stock options, or may be granting fewer than before. Instead, you may be receiving restricted stock. While these grants don't give you the same potentially life-altering, wealth-building upside as stock options, they do have additional benefits compared to ISO’s and NQSO’s.

The value of stock options, such as ISO’s and NQSO’s, depend on how much (or whether) your company's stock price rises above the price on the grant date. By contrast, restricted stock has value at vesting even if the stock price has not moved or even dropped since grant.

Depending on your attitude toward risk and your experience with swings in your company's stock price, the certainty of your restricted stock's value can be appealing. By contrast, stock options (ISO & NQSO) have great upside potential but can be "underwater" (i.e. having a market price lower than the exercise price). This is why restricted stock is often granted to a newly hired executive. It may be awarded as a hiring bonus or to make up for compensation and benefits, including in-the-money options and nonqualified retirement benefits, forfeited by leaving a prior employer.

Of course, the very essence of restricted stock is that you must remain employed until the shares vest to receive its value. While you may have between 30 and 90 days to exercise stock options after voluntary termination, unvested grants of restricted stock are often forfeited immediately. Thus, it is an extremely effective “golden handcuff” to keep you at your company.

Fewer Decisions

Unlike a stock option, which requires you to decide when to exercise and what exercise method to use, restricted stock involves fewer decisions. When you receive the shares at vesting—which can be based simply on the passage of time or the achievement of performance goals—you may have a choice of tax-withholding methods (e.g. cash, sell shares for taxes), or your company may automatically withhold enough vested shares to cover the tax withholding. Restricted stock is considered "supplemental" wages, following the same tax rules and W-2 reporting that apply to grants of nonqualified stock options.

Tax Decisions

The most meaningful decision with restricted stock grants is whether to make a Section 83(b) election to be taxed on the value of the shares at grant instead of at vesting. Whether to make this election, named after the section of the Internal Revenue Code that authorizes it, is up to you. (It is not available for Restricted Stock Units (RSUs), which are not "property" within the meaning of Internal Revenue Code Section 83)

If a valid 83(b) election is made within 30 days from the date of grant, you will recognize as of that date ordinary income based on the value of the stock at grant instead of recognizing income at vesting. As a result, any appreciation in the stock price above the grant date value is taxed at capital gains rates when you sell the stock after vesting.

While this can appear to provide an advantage, you face significant disadvantages should the stock never vest and you forfeit it because of job loss or other reasons. You cannot recover the taxes you paid on the forfeited stock. For this reason, and the earlier payment date of required taxes on the grant date value, you usually do better by not making the election. However, this election does provide one of the few opportunities for compensation to be taxed at capital gains rates. In addition, if you work for a startup pre-IPO company, it can be very attractive for stock received as compensation when the stock has a very small current value and is subject to a substantial risk of forfeiture. Here, the downside risk is relatively small.

Dividends

Unlike stock options, which rarely carry dividend equivalent rights, restricted stock typically entitles you to receive dividends when they are paid to shareholders.

However, unlike actual dividends, the dividends on restricted stock are reported on your W-2 as wages (unless you made a Section 83(b) election at grant) and are not eligible for the lower tax rate on qualified dividends until after vesting.

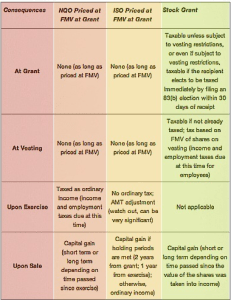

Comparison Chart

Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide tax advice. For tax advice, please consult your accountant.

Michael Ruger

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

For business owners, selling the business is often the single most important financial transaction in their lifetime. Since this is such an important event, we created a video series that will guide business owners through the

It just keeps getting better for small business owners. On June 17, 2020, the SBA released the updated PPP Forgiveness Application. In addition to making the forgiveness application easier to complete, the new application

On June 3, 2020, Congress passed the Paycheck Protection Program (PPP) Flexibility Act which provided much needed relief to many businesses that were trying to qualify for full forgiveness of their SBA PPP Loan

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans.

On March 27, 2020, Congress officially passed the CARES Act which includes the SBA Paycheck Protection Program. This program offers loans to small businesses that can be forgiven if certain conditions are met.

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

The end of the year is always a hectic time but taking the time to sit with a tax professional and determine what tax strategies will work best for you may save thousands on your tax bill due April 15th. As the deadline for your taxes starts to get closer, you may be in such a rush to file them on time that you make some mistakes in the process, but

Employer sponsored retirement plans are typically the single most valuable tool for business owners when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

This strategy is for high income earners that make too much to contribute directly to a Roth IRA. In recent years, some of these high income earners have been implementing a “backdoor Roth IRA conversion strategy” to get around the Roth IRA contribution limitations and make contributions to Roth IRA’s via “conversions”. For the 2020 tax year, your

Starting your own business is an incredible achievement, and for most, your business will shape your life not only professionally but personally. That being said, setting up your business in the correct way and having the necessary pieces in place day one is extremely important.

There are a lot of options available to small companies when establishing an employer sponsored retirement plan. For companies that have employees in addition to the owners of the company, the question is do they establish a 401(k) plan or a Simple IRA?The right fit for your company depends on:

Employer sponsored retirement plans are typically the single most valuable tool for business owner when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

But with all of the different types of plans to choose from which one is the right one for your business? Most business owners are familiar with how 401(k) plans work but that might not be the right fit given variables such as:

Starting your own business can be an exciting and rewarding experience. It can offer numerous advantages such as being your own boss, setting your own schedule and making a living doing something you enjoy. But, becoming a successful entrepreneur requires thorough planning, creativity, and hard work. After making the decision to start your

Types of Retirement Plans

The comparing retirement plans chart gives business owners the ability to compare different types of plans available to their company.

Types of Retirement Plans

The comparing retirement plans chart gives business owners the ability to compare different types of plans available to their company.

Click on the PDF link in the green box below.

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits As the economy continues to slow, unemployment claims continue to rise at historic rates.

The business plan for a startup business provides entrepreneurs with a guide in creating a business plan and items to consider when starting a new business.

The comparing retirement plans chart gives business owners the ability to compare different types of plans available to their company.

Provides individuals with clarification on the rollover rules for retirement accounts and IRA’s.

The expense planner is used to determine your annual after tax expenses both now and in retirement.

The financial planning questionnaire is used to gather information in the initial phase of the financial planning process with Greenbush Financial Group.

Rollover Chart

Provides individuals with clarification on the rollover rules for retirement accounts and IRA’s.

Rollover Chart

Provides individuals with clarification on the rollover rules for retirement accounts and IRA’s.

Click on the PDF link in the green box below.

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits As the economy continues to slow, unemployment claims continue to rise at historic rates.

The business plan for a startup business provides entrepreneurs with a guide in creating a business plan and items to consider when starting a new business.

The comparing retirement plans chart gives business owners the ability to compare different types of plans available to their company.

Provides individuals with clarification on the rollover rules for retirement accounts and IRA’s.

The expense planner is used to determine your annual after tax expenses both now and in retirement.

The financial planning questionnaire is used to gather information in the initial phase of the financial planning process with Greenbush Financial Group.

Expense Planner

The expense planner is used to determine your annual after tax expenses both now and in retirement.

Expense Planner

The expense planner is used to determine your annual after tax expenses both now and in retirement.

Click on the PDF link in the green box below.

Expense Planner

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits As the economy continues to slow, unemployment claims continue to rise at historic rates.

The business plan for a startup business provides entrepreneurs with a guide in creating a business plan and items to consider when starting a new business.

The comparing retirement plans chart gives business owners the ability to compare different types of plans available to their company.

Provides individuals with clarification on the rollover rules for retirement accounts and IRA’s.

The expense planner is used to determine your annual after tax expenses both now and in retirement.

The financial planning questionnaire is used to gather information in the initial phase of the financial planning process with Greenbush Financial Group.

Financial Planning Questionnaire

The financial planning questionnaire is used to gather information in the initial phase of the financial planning process with Greenbush Financial Group.

Financial Planning Questionnaire

The financial planning questionnaire is used to gather information in the initial phase of the financial planning process with Greenbush Financial Group.

Click on the PDF link in the green box below.

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits As the economy continues to slow, unemployment claims continue to rise at historic rates.

The business plan for a startup business provides entrepreneurs with a guide in creating a business plan and items to consider when starting a new business.

The comparing retirement plans chart gives business owners the ability to compare different types of plans available to their company.

Provides individuals with clarification on the rollover rules for retirement accounts and IRA’s.

The expense planner is used to determine your annual after tax expenses both now and in retirement.

The financial planning questionnaire is used to gather information in the initial phase of the financial planning process with Greenbush Financial Group.

Year End Tax Strategies

The end of the year is always a hectic time but taking the time to sit with a tax professional and determine what tax strategies will work best for you may save thousands on your tax bill due April 15th. As the deadline for your taxes starts to get closer, you may be in such a rush to file them on time that you make some mistakes in the process, but

The end of the year is always a hectic time but taking the time to sit with a tax professional and determine what tax strategies will work best for you may save thousands on your tax bill due April 15th. As the deadline for your taxes starts to get closer, you may be in such a rush to file them on time that you make some mistakes in the process, but don't worry, you won't be the only one. If you don't have the relevant tax strategy in place, you are more prone to mistakes. So, the purpose of this article is to discuss some of the most common tax strategies that may apply to you. It may be worth contacting a company that specializes in tax services if you're unsure of how to go about these strategies though. Some of the deadlines for these strategies aren't until tax filing but the majority include an action item that must be done by December 31st to qualify and therefore taking the time before year end is crucial.

Taxable Investment Accounts

Offset some of the realized gains incurred during the year by selling investments in loss positions. Often times dividends received and sales made in a taxable investment account are reinvested. Although the owner of the account never received cash in the transaction, the gain is still realized and therefore taxable. This may cause an issue when the cash is not available to pay the tax bill. By selling investments in a loss position prior to 12/31, you will offset some, if not all, of the gain realized during the year. If possible, sell enough investments in a loss position to take advantage of the maximum $3,000 loss that can be claimed on your tax return.

Note: The IRS recognized this strategy was being abused and implemented the "wash sale" rule. If you sell an investment in a loss position to diminish gains and then repurchase the same investment within 30 days, the IRS does not allow you to claim the loss therefore negating the strategy.

Convert a Traditional IRA to a Roth IRA

If you are in a low income year and will be taxed at a lower tax bracket than projected in the future, it may make sense to convert part of a traditional IRA to a Roth IRA. The current maximum contribution to a Roth IRA in a single year is $5,500 if under 50 and $6,500 if 50 plus. You will pay taxes on the distributions from the traditional but the benefit of a Roth is that all the contributions and earnings accumulated is tax free when distributed as long as the account has been opened for at least 5 years. Roth accounts are typically the last touched during retirement because you want the tax free accumulation as long as possible. Also, Roth accounts can be passed to a beneficiary who can continue accumulating tax free. Roth money is after tax money and therefore the IRS allows you to withdraw contributions tax and penalty free and let the earnings continue to accumulate tax free. If you don't have the cash come tax time to cover the conversion, you can convert the Roth money back to a traditional IRA by tax filing plus extension and the account will be treated as the Roth conversion never took place.

Donate to Charity if you Itemize

If you itemize deductions on your tax return, go through your closet and donate any clothing or household goods that you no longer use. There are helpful tools online that will allow you to value the items donated but be sure you keep record of what was donated and have the charity give you a receipt.

Max Out Your Employer Sponsored Retirement Plan

If you know you will be hit with a big tax bill and want to defer some of the taxes, max out your retirement plan if you haven't already. Employer sponsored plans, such as 401(k)'s, must be funded through payroll by 12/31 and therefore it is important to make this determination early and request your payroll department start upping your contribution for the remaining payroll periods in the year. The maximum for 401(k)'s in 2015 and 2016 is $18,000 if under 50 and $24,000 if 50 plus.

Business Owners – Cut Checks by 12/31

If your company had a great year and the cash is available, use it to pay for expenses you would normally hold off on. This could mean paying state taxes early, paying invoices you usually wait until the end of the payment term, paying monthly expenses like health or general insurance, or buying new office equipment. This might also mean investing in new office furniture such as chairs and desks, or more storage space for all of your paperwork and electronics. Above all, by getting the checks cut by 12/31, you realize the expense in the current year and will decrease your tax bill.

Business Owners – Set Up a Retirement Plan

For owners with no full time employees, a Single(k) plan being put in place by 12/31 will allow you to fund a retirement account up to the 401(k) limits mentioned early. As long as the plan is established by 12/31, the owner will be able to fund the plan any time before tax filing plus extension. If the plan is not established by 12/31, other options like the SEP IRA are available to take money off the table come tax time.With tax laws continuously changing, it is important to consult with your tax professional as there may be strategies available to you that could save you money. Don't procrastinate as some planning before the end of the year may be necessary to take full advantage.

About Rob.........

Hi, I'm Rob Mangold. I'm the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

When parents gift money to their kids, instead of having the money sit in a savings account, often parents will set up UTMA accounts at an investment firm to generate investment returns in the account that can be used by the child at a future date. Depending on the amount of the investment income, the child may be required to file a tax return.

When a business owner sells their business and is looking for a large tax deduction and has charitable intent, a common solution is setting up a private foundation to capture a large tax deduction. In this video, we will cover how foundations work, what is the minimum funding amount, the tax benefits, how the foundation is funded, and more…….

There is a little-known, very lucrative New York State Tax Credit that came into existence within the past few years for individuals who wish to make charitable donations to their SUNY college of choice through the SUNY Impact Foundation. The tax credit is so large that individuals who make a $10,000 donation to the SUNY Impact Foundation can receive a dollar-for-dollar tax credit of $8,500 whether they take the standard deduction or itemize on their tax return. This results in a windfall of cash to pre-selected athletic programs and academic programs by the donor at their SUNY college of choice, with very little true out-of-pocket cost to the donors themselves once the tax credit is factored in.

It seems as though the likely outcome of the 2024 presidential elections will be a Trump win, and potentially full control of the Senate and House by the Republicans to complete the “full sweep”. As I write this article at 6am the day after election day, it looks like Trump will be president, the Senate will be controlled by the Republicans, and the House is too close to call. If the Republicans complete the full sweep, there is a higher probability that the tax law changes that Trump proposed on his campaign trail will be passed by Congress and signed into law as early as 2025.

Due to changes in the tax laws, fewer individuals are now able to capture a tax deduction for their charitable contributions. In an effort to recapture the tax deduction, more individuals are setting up Donor Advised Funds at Fidelity and Vanguard to take full advantage of the tax deduction associated with giving to a charity, church, college, or other not-for-profit organizations.

Self-employed individuals have a lot of options when it comes to deducting expenses for their vehicle to offset income from the business. In this video we are going to review:

1) What vehicle expenses can be deducted: Mileage, insurance, payments, registration, etc.

2) Business Use Percentage

3) Buying vs Leasing a Car Deduction Options

4) Mileage Deduction Calculation

5) How Depreciation and Bonus Depreciation Works

6) Depreciation recapture tax trap

7) Can you buy a Ferreri through the business and deduct it? (luxury cars)

8) Tax impact if you get into an accident and total the vehicle

Picking the right stocks to invest in is not an easy process but all too often I see retail investors make the mistake of narrowing their investment research to just stocks that pay dividends. This is a common mistake that investors make and, in this article, we are going to cover the total return approach versus the dividend payor approach to investing.

There is a sea change happening in the investment industry where the inflows into ETF’s are rapidly outpacing the inflows into mutual funds. When comparing ETFs to mutual funds, ETFs sometimes offer more tax efficiency, trade flexibility, a wider array of investment strategies, and in certain cases lower trading costs and expense ratios which has led to their rise in popularity among investors. But there are also some risks associated with ETFs that not all investors are aware of……..

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

There has been a lot of confusion surrounding the required minimum distribution (RMD) rules for non-spouse, beneficiaries that inherited IRAs and 401(k) accounts subject to the new 10 Year Rule. This has left many non-spouse beneficiaries questioning whether or not they are required to take an RMD from their inherited retirement account prior to December 31, 2023. Here is the timeline of events leading up to that answer

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax overpayments. Requesting a FICA tax refund requires action on your part and an understanding of how the FICA tax is calculated.

Are you considering filing for a tax extension? It can be a great way to give yourself more time to organize your financial documents and ensure that the information on your return is accurate. But before you file the extension, here are a few things you should know.

The PTET (pass-through entity tax) is a deduction that allows business owners to get around the $10,000 SALT cap that was put in place back in 2017. The PTET allows the business entity to pay the state tax liability on behalf of the business owner and then take a deduction for that expense.

When an employee unexpectedly loses their job and needs access to cash to continue to pay their bills, it’s not uncommon for them to elect a cash distribution from their 401(K) account. Still, they may regret that decision when the tax bill shows up the following year and then they owe thousands of dollars to the IRS in taxes and penalties that they don’t have.

Claiming the $7,500 tax credit for buying an EV (electric vehicle) or hybrid vehicle may not be as easy as you think. First, it’s a “use it or lose it credit” meaning if you do not have a federal tax liability of at least $7,500 in the year that you buy your electric vehicle, you cannot claim the full $7,500 credit and it does not carryforward to future tax years.

There are income limits that can prevent you from taking a tax deduction for contributions to a Traditional IRA if you or your spouse are covered by a 401(k) but even if you can’t deduct the contribution to the IRA, there are tax strategies that you should consider

Before you gift assets to your children make sure you fully understand the Kiddie Tax rule and other pitfalls associated with making gift to your children……….

When you sell a stock, mutual fund, investment property, or a business, if you have made money on that investment, the IRS is kindly waiting for a piece of that gain in the form of capital gains tax. Capital gains are taxed differently than the ordinary income that you received via your paycheck or pass-through income from your business. Unlike ordinary

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you in more ways than one. Click to read more on how this can effect you.

The IRS extended the tax filing deadline for 2020 from April 15th to May 15th. Click to read more on the questions that we are getting from business owners, retirees, and individuals taxpayers.

If you took a COVID distribution from a retirement account, IRA, 401(K), in 2020, you will have to report it on your taxes. Here are the special tax forms that you will need to report your COVID distribution. DISCLOSURE: This is for…

When your children begin working and they receive their first W2, the question from parents is often “Do they have to file a tax return?” In this video we will cover

I am getting the question much more frequently from clients - "When I retire, does it make sense from a tax standpoint to change my residency from New York to Florida?". When I explain how the taxes work

A very common question that we frequently receive from clients is “If I want to make a cash gift to my kids, do I have to pay gift taxes?” The answer to that question depends on number of items such as: The amount of the gift

When you sell your primary residence, and meet certain requirements, you may be able to exclude all or a portion of your capital gain in the property from taxes. In this article, I am going to cover the $250,000

Congress passed the CARES Act in March 2020 which provides individuals with IRA, 401(k), and other employer sponsored retirement accounts, the option to waive their required minimum distribution (RMD) for the 2020 tax year.

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child

A required minimum distribution (RMD) is the amount that the IRS requires you to take out of your retirement account each year when you hit a certain age or when you inherit a retirement account from someone else. It’s important to plan tax-wise for these distributions because they can substantially increase your tax liability in a given year;

Should I Establish an Employer Sponsored Retirement Plan?

Employer sponsored retirement plans are typically the single most valuable tool for business owners when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

Employer sponsored retirement plans are typically the single most valuable tool for business owners when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

But with all of the different types of plans to choose from which one is the right one for your business? Most business owners are familiar with how 401(k) plans works but that might not be the right fit given variables such as:

# of Employees

Cash flows of the business

Goals of the business owner

There are four main stream employer sponsored retirement plans that business owners have to choose from:

SEP IRA

Single(k) Plan

Simple IRA

401(k) Plan

Since there are a lot of differences between these four types of plans we have included a comparison chart at the conclusion of this newsletter but we will touch on the highlights of each type of plan.

SEP IRA PLAN

This is the only employer sponsored retirement plan that can be setup after 12/31 for the previous tax year. So when you are sitting with your accountant in the spring and they deliver the bad news that you are going to have a big tax liability for the previous tax year, you can establish a SEP IRA up until your tax filing deadline plus extension, fund it, and take a deduction for that year.

However, if the company has employees that meet the plan's eligibility requirement, these plans become very expensive very quickly if the owner(s) want to make contributions to their own accounts. The reason being, these plans are 100% employer funded which means there are no employee contributions allowed and the employer contribution is uniform for all plan participants. For example, if the owner contributes 15% of their income to the SEP IRA, they have to make an employer contribution equal to 15% of compensation for each employee that has met the plans eligibility requirement. If the 5305-SEP Form, which serves as the plan document, is setup correctly a company can keep new employees out of the plan for up to 3 years but often times it is either not setup correctly or the employer cannot find the document.

Single(k) Plan or "Solo(k)"

These plans are for owner only entities. As soon as you have an employee that works more than 1000 hours in a 12 month period, you cannot sponsor a Single(k) plan.

The plans are often times the most advantageous for self-employed individuals that have no employees and want to have access to higher pre-tax contribution levels. For all intents and purposes it is a 401(k) plan, same contributions limits, ERISA protected, they allow loans and Roth contributions, etc. However, they can be sponsored at a much lower cost than traditional 401(k) plans because there are no non-owner employees. So there is no year-end testing, it's typically a boiler plate plan document, and the administration costs to establish and maintain these plans are typically under $400 per year compared to traditional 401(k) plans which may cost $1,500+ per year to administer.

The beauty of these plans is the "employee contribution" of the plan which gives it an advantage over SEP IRA plans. With SEP IRA plans you are limited to contributions up to 25% of your income. So if you make $24,000 in self-employment income you are limited to a $6,000 pre-tax contribution.

With a Single(k) plan, for 2021, I can contribute $19,500 per year (another $6,500 if I'm over 50) up to 100% of my self-employment income and in addition to that amount I can make an employer contribution up to 25% of my income. In the previous example, if you make $24,000 in self-employment income, you would be able to make a salary deferral contribution of $18,000 and an employer contribution of $6,000, effectively wiping out all of your taxable income for that tax year.

Simple IRA

Simple IRA's are the JV version of 401(k) plans. Smaller companies that have 1 – 30 employees that are looking to start are retirement plan will often times start with implementing a Simple IRA plan and eventually graduate to a 401(k) plan as the company grows. The primary advantage of Simple IRA Plans over 401(k) Plans is the cost. Simple IRA's do not require a TPA firm since they are self-administered by the employer and they do not require annual 5500 filings so the cost to setup and maintain the plan is usually much less than a 401(k) plan.

What causes companies to choose a 401(k) plan over a Simple IRA plan?

Owners want access to higher pre-tax contribution limits

They want to limit to the plan to just full time employees

The company wants flexibility with regard to the employer contribution

The company wants a vesting schedule tied to the employer contributions

The company wants to expand investment menu beyond just a single fund family

401(k) Plans

These are probably the most well recognized employer sponsored plans since at one time or another each of us has worked for a company that has sponsored this type of plan. So we will not spend a lot of time going over the ins and outs of these types of plan. These plans offer a lot of flexibility with regard to the plan features and the plan design.

We will issue a special note about the 401(k) market. For small business with 1 -50 employees, you have a lot of options regarding which type of plan you should sponsor but it's our personal experience that most investment advisors only have a strong understanding of 401(k) plans so they push 401(k) plans as the answer for everyone because it's what they know and it's what they are comfortable talking about. When establishing a retirement plan for your company, make sure you consult with an advisor that has a working knowledge of all these different types of retirement plans and can clearly articulate the pros and cons of each type of plan. This will assist you in establishing the right type of plan for your company.

Michael Ruger

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

When parents gift money to their kids, instead of having the money sit in a savings account, often parents will set up UTMA accounts at an investment firm to generate investment returns in the account that can be used by the child at a future date. Depending on the amount of the investment income, the child may be required to file a tax return.

When a business owner sells their business and is looking for a large tax deduction and has charitable intent, a common solution is setting up a private foundation to capture a large tax deduction. In this video, we will cover how foundations work, what is the minimum funding amount, the tax benefits, how the foundation is funded, and more…….

There is a little-known, very lucrative New York State Tax Credit that came into existence within the past few years for individuals who wish to make charitable donations to their SUNY college of choice through the SUNY Impact Foundation. The tax credit is so large that individuals who make a $10,000 donation to the SUNY Impact Foundation can receive a dollar-for-dollar tax credit of $8,500 whether they take the standard deduction or itemize on their tax return. This results in a windfall of cash to pre-selected athletic programs and academic programs by the donor at their SUNY college of choice, with very little true out-of-pocket cost to the donors themselves once the tax credit is factored in.

It seems as though the likely outcome of the 2024 presidential elections will be a Trump win, and potentially full control of the Senate and House by the Republicans to complete the “full sweep”. As I write this article at 6am the day after election day, it looks like Trump will be president, the Senate will be controlled by the Republicans, and the House is too close to call. If the Republicans complete the full sweep, there is a higher probability that the tax law changes that Trump proposed on his campaign trail will be passed by Congress and signed into law as early as 2025.

Due to changes in the tax laws, fewer individuals are now able to capture a tax deduction for their charitable contributions. In an effort to recapture the tax deduction, more individuals are setting up Donor Advised Funds at Fidelity and Vanguard to take full advantage of the tax deduction associated with giving to a charity, church, college, or other not-for-profit organizations.

Self-employed individuals have a lot of options when it comes to deducting expenses for their vehicle to offset income from the business. In this video we are going to review:

1) What vehicle expenses can be deducted: Mileage, insurance, payments, registration, etc.

2) Business Use Percentage

3) Buying vs Leasing a Car Deduction Options

4) Mileage Deduction Calculation

5) How Depreciation and Bonus Depreciation Works

6) Depreciation recapture tax trap

7) Can you buy a Ferreri through the business and deduct it? (luxury cars)

8) Tax impact if you get into an accident and total the vehicle

Picking the right stocks to invest in is not an easy process but all too often I see retail investors make the mistake of narrowing their investment research to just stocks that pay dividends. This is a common mistake that investors make and, in this article, we are going to cover the total return approach versus the dividend payor approach to investing.

There is a sea change happening in the investment industry where the inflows into ETF’s are rapidly outpacing the inflows into mutual funds. When comparing ETFs to mutual funds, ETFs sometimes offer more tax efficiency, trade flexibility, a wider array of investment strategies, and in certain cases lower trading costs and expense ratios which has led to their rise in popularity among investors. But there are also some risks associated with ETFs that not all investors are aware of……..

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

There has been a lot of confusion surrounding the required minimum distribution (RMD) rules for non-spouse, beneficiaries that inherited IRAs and 401(k) accounts subject to the new 10 Year Rule. This has left many non-spouse beneficiaries questioning whether or not they are required to take an RMD from their inherited retirement account prior to December 31, 2023. Here is the timeline of events leading up to that answer

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax overpayments. Requesting a FICA tax refund requires action on your part and an understanding of how the FICA tax is calculated.

Are you considering filing for a tax extension? It can be a great way to give yourself more time to organize your financial documents and ensure that the information on your return is accurate. But before you file the extension, here are a few things you should know.

The PTET (pass-through entity tax) is a deduction that allows business owners to get around the $10,000 SALT cap that was put in place back in 2017. The PTET allows the business entity to pay the state tax liability on behalf of the business owner and then take a deduction for that expense.

When an employee unexpectedly loses their job and needs access to cash to continue to pay their bills, it’s not uncommon for them to elect a cash distribution from their 401(K) account. Still, they may regret that decision when the tax bill shows up the following year and then they owe thousands of dollars to the IRS in taxes and penalties that they don’t have.

Claiming the $7,500 tax credit for buying an EV (electric vehicle) or hybrid vehicle may not be as easy as you think. First, it’s a “use it or lose it credit” meaning if you do not have a federal tax liability of at least $7,500 in the year that you buy your electric vehicle, you cannot claim the full $7,500 credit and it does not carryforward to future tax years.

There are income limits that can prevent you from taking a tax deduction for contributions to a Traditional IRA if you or your spouse are covered by a 401(k) but even if you can’t deduct the contribution to the IRA, there are tax strategies that you should consider

Before you gift assets to your children make sure you fully understand the Kiddie Tax rule and other pitfalls associated with making gift to your children……….

When you sell a stock, mutual fund, investment property, or a business, if you have made money on that investment, the IRS is kindly waiting for a piece of that gain in the form of capital gains tax. Capital gains are taxed differently than the ordinary income that you received via your paycheck or pass-through income from your business. Unlike ordinary

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you in more ways than one. Click to read more on how this can effect you.

The IRS extended the tax filing deadline for 2020 from April 15th to May 15th. Click to read more on the questions that we are getting from business owners, retirees, and individuals taxpayers.

If you took a COVID distribution from a retirement account, IRA, 401(K), in 2020, you will have to report it on your taxes. Here are the special tax forms that you will need to report your COVID distribution. DISCLOSURE: This is for…

When your children begin working and they receive their first W2, the question from parents is often “Do they have to file a tax return?” In this video we will cover

I am getting the question much more frequently from clients - "When I retire, does it make sense from a tax standpoint to change my residency from New York to Florida?". When I explain how the taxes work

A very common question that we frequently receive from clients is “If I want to make a cash gift to my kids, do I have to pay gift taxes?” The answer to that question depends on number of items such as: The amount of the gift

When you sell your primary residence, and meet certain requirements, you may be able to exclude all or a portion of your capital gain in the property from taxes. In this article, I am going to cover the $250,000

Congress passed the CARES Act in March 2020 which provides individuals with IRA, 401(k), and other employer sponsored retirement accounts, the option to waive their required minimum distribution (RMD) for the 2020 tax year.

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child

A required minimum distribution (RMD) is the amount that the IRS requires you to take out of your retirement account each year when you hit a certain age or when you inherit a retirement account from someone else. It’s important to plan tax-wise for these distributions because they can substantially increase your tax liability in a given year;

How is my Social Security Benefit Calculated?

The top two questions that we receive from individuals approaching retirement are:

What amount will I received from social security?

When should I turn on my social security benefits?

The top two questions that we receive from individuals approaching retirement are:

What amount will I received from social security?

When should I turn on my social security benefits?

Are you eligible to receive benefits?

As you work and pay taxes, you earn Social Security “credits.” In 2015, you earn one credit for each $1,220 in earnings—up to a maximum of four credits a year. The amount of money needed to earn one credit usually goes up every year. Most people need 40 credits (10 years of work) to qualify for benefits.

When will I begin receiving my social security benefit?

You are entitled to your full social security benefit at your “Normal Retirement Age” (NRA). Your NRA varies based on your date of birth. Below is the chart that social security uses to determine your “normal retirement age” or “full retirement age”:

For example, if you were born in 1965, your NRA would be 67. At 67, you would be eligible for your full retirement benefit.

Delayed Retirement or Early Retirement

You can claim benefits as early as age 62, but your monthly check will be cut by 25% for the rest of your life. The way the math works out, for each year you take your social security benefit prior to your normal retirement age, you benefit is permanently reduce by 6% for each year you take it prior to your NRA.

On the opposite end of that scenario, if you delay claiming past your NRA, you will get a delayed credit of approximately 8% per year plus cost of living adjustments.

There are a number of variables that factor into this decision as to when to turn on your benefit. Some of the main factors are:

Your health

Do you plan to keep working?

What is your current tax bracket?

The amount of retirement savings that you have

Income difference between spouses

What amount will I receive from social security?

Social security uses a fairly complex formula for calculating social security retirement benefits but the short version is the formula uses your highest 35 years of income. If you have less than 35 years are income, zeros are entered into the average for the number of years you are short of 35 years of income. They also apply an inflation adjustment to your annual earnings in the calculation.

You can obtain your Social Security statement by creating an account at www.ssa.gov. Your statement contains lots of valuable information, such as:

Your estimated benefit amount at full retirement age

Eligibility for benefits

A detailed history of how much you've earned each year

Keep in mind that the figures in your statement are just estimates, and your eventual benefit amount could be quite different, especially if you're relatively young now.

Michael Ruger

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Prior to 2025, it was very easy to explain to an employee what the maximum Simple IRA contribution was for that tax year. Starting in 2025, it will be anything but “Simple”. Thanks to the graduation implementation of the Secure Act 2.0, there are 4 different limits for Simple IRA employee deferrals that both employees and companies will need to be aware of.

When the Secure Act passed in 2019, a new option was opened up for excess balances left over in 529 accounts called a “Qualified Loan Repayment” option. This new 529 distribution option allows the owner of a 529 to distribute money from a 529 account to repay student loans for the beneficiary of the 529 account AND the beneficiary’s siblings. However, this distribution option is not available to everyone, and there are rules and limits associated with these new types of distributions.

When parents gift money to their kids, instead of having the money sit in a savings account, often parents will set up UTMA accounts at an investment firm to generate investment returns in the account that can be used by the child at a future date. Depending on the amount of the investment income, the child may be required to file a tax return.

Do you have enough to retire? Believe it or not, as financial planners, we can often answer that question in LESS THAN 60 SECONDS just by asking a handful of questions. In this video, I’m going to walk you through the 60-second calculation.

Good news for 401(k) and 403(b) plan participants turning age 60 – 63 starting in 2025: there is now an enhanced employee catch-up contribution thanks to Secure Act 2.0 that passed back in 2022. For 2025, the employee contributions limits are as follows: Employee Deferral Limit $23,500, Age 50+ Catch-up Limit $7,500, and the New Age 60 – 63 Catch-up: $3,750.

There are many reasons why individuals decide to surrender their annuities. Unfortunately, one of the most common reasons that we see is when individuals realize that they were sold the annuity by a broker and that annuity investment was either not in their best interest or they discover that there are other investment solutions that will better meet the investment objectives. This situation can often lead to individuals making the tough decision to cut their losses and surrender the annuity. But before surrendering their annuity, it’s important for investors to understand the questions to ask the annuity company about the surrender fees and potential tax liability before making e the final decision to end their annuity contract.

When a business owner sells their business and is looking for a large tax deduction and has charitable intent, a common solution is setting up a private foundation to capture a large tax deduction. In this video, we will cover how foundations work, what is the minimum funding amount, the tax benefits, how the foundation is funded, and more…….

As an investment firm, November and December is considered “tax-loss harvesting season” where we work with our clients to identify investment losses that can be used to offset capital gains that have been realized throughout the year in an effort to reduce their tax liability for the year. But there are a lot of IRS rule surrounding what “type” of realized losses can be used to offset realized gains and retail investors are often unaware of these rules which can lead to errors in their lost harvesting strategies.

There is a little-known, very lucrative New York State Tax Credit that came into existence within the past few years for individuals who wish to make charitable donations to their SUNY college of choice through the SUNY Impact Foundation. The tax credit is so large that individuals who make a $10,000 donation to the SUNY Impact Foundation can receive a dollar-for-dollar tax credit of $8,500 whether they take the standard deduction or itemize on their tax return. This results in a windfall of cash to pre-selected athletic programs and academic programs by the donor at their SUNY college of choice, with very little true out-of-pocket cost to the donors themselves once the tax credit is factored in.

It seems as though the likely outcome of the 2024 presidential elections will be a Trump win, and potentially full control of the Senate and House by the Republicans to complete the “full sweep”. As I write this article at 6am the day after election day, it looks like Trump will be president, the Senate will be controlled by the Republicans, and the House is too close to call. If the Republicans complete the full sweep, there is a higher probability that the tax law changes that Trump proposed on his campaign trail will be passed by Congress and signed into law as early as 2025.

Qualified Charitable Distributions are an advanced tax strategy used by individuals who are age 70½ or older who typically make annual contributions to their church, charity, or other not-for-profit organizations. QCDs allow individuals who have pre-tax IRAs to send money directly from their IRA to their charity of choice, and they avoid having to pay tax on those distributions. However, a client recently asked an excellent question:

“Can you process a qualified charitable distribution from an Inherited IRA? If yes, does that QCD also count toward the annual RMD requirement?”

Squarespace Excerpt: As individuals approach retirement, they often begin reviewing their annual expenses, looking for ways to trim unnecessary expenses so their retirement savings last as long as possible now that their paychecks are about to stop for their working years. A common question that comes up during these client meetings is “Should I get rid of my life insurance policy now that I will be retiring?”

When clients are looking to purchase a new car one of the most common questions that we receive is “Should I Buy or Lease?” To get the answer, we interviewed a Certified Financial Planner and the owner of Rensselaer Honda to educate our audience on the pros and cons of buying vs leasing.

When we are working with clients on their estate plan, one of the primary objectives is to assist them with titling their assets so they avoid the probate process after they pass away. For anyone that has had to serve as the executor of an estate, you have probably had firsthand experience of how much of a headache the probate processes which is why it's typically a goal of an estate plan to avoid the probate process altogether.

Due to changes in the tax laws, fewer individuals are now able to capture a tax deduction for their charitable contributions. In an effort to recapture the tax deduction, more individuals are setting up Donor Advised Funds at Fidelity and Vanguard to take full advantage of the tax deduction associated with giving to a charity, church, college, or other not-for-profit organizations.

Self-employed individuals have a lot of options when it comes to deducting expenses for their vehicle to offset income from the business. In this video we are going to review:

1) What vehicle expenses can be deducted: Mileage, insurance, payments, registration, etc.

2) Business Use Percentage

3) Buying vs Leasing a Car Deduction Options

4) Mileage Deduction Calculation

5) How Depreciation and Bonus Depreciation Works

6) Depreciation recapture tax trap

7) Can you buy a Ferreri through the business and deduct it? (luxury cars)

8) Tax impact if you get into an accident and total the vehicle

The Social Security Administration recently announced that the cost-of-living adjustment (COLA) for 2025 will only be 2.5% for 2025. That is a much lower COLA increase than we have seen in the past few years, with a COLA increase of 3.2% in 2024 and an increase of 8.7% in 2023. According to the Social Security Administration, the 2.5% increase in 2025 will result, on average, in a $50 per month increase to social security recipients.

When you separate service from an employer, you have to make decisions with regard to your 401K plan. It’s important to understand the pros and cons of each option while also understanding that the optimal solution often varies from person to person based on their financial situation and objectives. The four primary options are:

1) Leave it in the existing 401(k) plan

2) Rollover to an IRA

3) Rollover to your new employer’s 401(k) plan

4) Cash Distribution

Picking the right stocks to invest in is not an easy process but all too often I see retail investors make the mistake of narrowing their investment research to just stocks that pay dividends. This is a common mistake that investors make and, in this article, we are going to cover the total return approach versus the dividend payor approach to investing.

There is a sea change happening in the investment industry where the inflows into ETF’s are rapidly outpacing the inflows into mutual funds. When comparing ETFs to mutual funds, ETFs sometimes offer more tax efficiency, trade flexibility, a wider array of investment strategies, and in certain cases lower trading costs and expense ratios which has led to their rise in popularity among investors. But there are also some risks associated with ETFs that not all investors are aware of……..

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

The Fed cut the Federal Funds Rate by 0.50% on September 18, 2024 which is not only the first rate cut since the Fed started raising rates in March 2022 but it was also a larger rate cut than the census expected. The consensus going into the Fed meeting was the Fed would cut rates by 0.25% and they doubled it. This is what the bigger Fed rate cut historically means for the economy

The most common questions that I receive when clients are about to purchase their next car is “should I buy it or lease it?” The answer depends on a number of factors including how long do you typically keep cars for, how many miles do you drive each year, the amount of the down payment, maintenance considerations, or do you have any teenagers in the family that will be driving soon?

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

There are special non spouse beneficiary rules that apply to minor children when they inherit retirement accounts. The individual that is assigned is the custodian of the child, we'll need to assist them in navigating the distribution strategy and tax strategy surrounding they're inherited IRA or 401(k) account. Not being aware of the rules can lead to IRS tax penalties for failure to take requirement minimum distributions from the account each year.

When you are the successor beneficiary of an Inherited IRA the rules are very complex.

A common mistake that beneficiaries of retirement accounts make when they inherit either a Traditional IRA or 401(k) account is not knowing that if the decedent was required to take an RMD (required minimum distribution) for the year but did not distribute the full amount before they passed, the beneficiaries are then required to withdrawal that amount from the retirement account prior to December 31st of the year they passed away. Not taking the RMDs prior to December 31st could trigger IRS penalties unless an exception applies.

In July 2024, the IRS released its long-awaited final regulations clarifying the annual RMD (required minimum distribution) rules for non-spouse beneficiaries of retirement accounts that are subject to the new 10-year rule. But like most IRS regulations, it’s anything but simple and straightforward.

The Fed made a significant policy error last week by deciding not to cut the Fed Funds rate and the stock market is now responding to that error via the selloff we have seen over the past week. Unfortunately, this policy error is nothing new. Throughout history, the Fed typically waits too long to begin reducing interest rates after inflation has already abated and they seem to be on that path again.

Investors have to be ready for many surprises in 2024. While the US economy was able to escape a recession in 2023, if anything, it has increased the chances of either a recession or a market pullback in the first half of 2024.

Do I Have to Pay Taxes on my Social Security Benefit?

If your “combined income” exceeds specific annual limits, you may owe federal income taxes on up to 50% or 85% of your Social Security benefits. The limits for federal income tax purposes are listed in the chart below.

If your “combined income” exceeds specific annual limits, you may owe federal income taxes on up to 50% or 85% of your Social Security benefits. The limits for federal income tax purposes are listed in the chart below.

The federal income thresholds are not indexed for inflation, so they are the same every year. “Combined income” is defined as adjusted gross income plus any tax-exempt interest plus 50% of your Social Security Benefit. Some states tax Social Security Benefits, whereas others do not tax them. See the chart below:

Michael Ruger

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications.

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy

A 529 account owned by a grandparent is often considered one of the most effective ways to save for college for a grandchild. But in 2023, the rules are changing………

If you are age 65 or older and self-employed, I have great news, you may be able to take a tax deduction for your Medicare Part A, B, C, and D premiums as well as the premiums that you pay for your Medicare Advantage or Medicare Supplemental coverage.

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

More and more retires are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain……

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you in more ways than one. Click to read more on how this can effect you.

Medicare has important deadlines that you need to be aware of during your initial enrollment period. Missing those deadlines could mean gaps in coverage, penalties, and limited options when it comes to selecting a Medicare

Social Security payments can sometimes be a significant portion of a couple’s retirement income. If your spouse passes away unexpectedly, it can have a dramatic impact on your financial wellbeing in retirement. This is especially

As you approach age 65, there are a lot of very important decisions that you will have to make regarding your Medicare coverage. Since Medicare Parts A & B by itself have deductibles, coinsurance, and no maximum out of pocket

The SECURE Act was passed into law on December 19, 2019 and with it came some big changes to the required minimum distribution (“RMD”) requirements from IRA’s and retirement plans. Prior to December 31, 2019, individuals

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits,

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents

Inherited IRA’s can be tricky. There are a lot of rules surrounding;

Establishment and required minimum distribution (“RMD”) deadlines

Options available to spouse and non-spouse beneficiaries

Strategies for deferring required minimum distributions

Special 60 day rollover rules for inherited IRA’s

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option.

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distirbution from your pre-tax IRA directly to a chiartable organizaiton. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to

If you are turning age 72 this year, this article is for you. You will most likely have to start taking required minimum distributions from your retirement accounts. This article will outline:

There is a little known loophole in the social security system for parents that are age 62 or older with children still in high school or younger. Since couples are having children later in life this situation is becoming more common and it could equal big dollars for families that are aware of this social security filing strategy.

There are three key estate documents that everyone should have: Will, Health Proxy, Power of Attorney, If you have dependents, such as a spouse or children, the statement above graduates from “should have” to “need to

This question comes up a lot when a parent makes a cash gift to a child or when a grandparent gifts to a grandchild. When you make a cash gift to someone else, who pays the tax on that gift? The short answer is “typically no one does”. Each individual has a federal “lifetime gift tax exclusion” of $5,400,000 which means that I would have to give

Many of our clients own individual stocks that they either bought a long time ago or inherited from a family member. If they do not need to liquidate the stock in retirement to supplement their income, the question comes up “should I just gift the stock to my kids while I’m still alive or should I just let them inherit it after I pass away?” The right answer is

Can I Receive Social Security Benefits While I'm Still Working?

The short answer is "Yes". But you may not want to depending on when you plan to turn on your social security benefits and how much you plan to earn each year from working.

The short answer is "Yes". But you may not want to depending on when you plan to turn on your social security benefits and how much you plan to earn each year from working.

Electing social security benefits AFTER your Normal Retirement Age

For social security, your Normal Retirement Age (NRA), is the age you are eligible to receive full retirement benefits. Your NRA is based on your date of birth and the table is listed below:

Once you reach your NRA, you are allowed to begin receiving social security benefits without having to worry about the social security "earnings test". Meaning that you can earn as much as you want working and they will not reduce your social security benefit. You are free and clear.

Electing social security benefits BEFORE your Normal Retirement Age

If you turn on your social security benefits prior to reaching your Normal Retirement Age, you will be subject to the "earnings test" each year. For social security recipients who will not reach full retirement age in the 2016 calendar year, the first $15,720 in earnings is exempt. Beyond that amount, every $2 in earnings will reduce your social security benefits by $1. It's a fairly steep penalty. The general rule is if you plan to earn over the $15,720 threshold and you will not hit your normal retirement age for social security in 2016, do not elect to begin taking social security early because you will lose most of it from the "earned income penalty".

Electing social security benefits in the year your reach "Normal Retirement Age"

For social security recipients who will attain full retirement age during 2016, the first $41,880 is exempt, and the reduction is just $1 for every $3 in earnings beyond that point. Plus, only the months before your birthday count toward the total.

We advise our clients in this situation to keep their pay stub from the payroll period prior to reaching Normal Retirement Age because the IRS may contact them the following year to prove the amount of income that they earned prior to receiving their first social security payment.

Michael Ruger

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications.