How The COVID Second Wave Will Impact The Stock Market

As COVID-19 cases continue to rise in the United States, it has left investors wondering what impact this could have for the stock market in coming months. In this article we are going to review

As COVID-19 cases continue to rise in the United States, it has left investors wondering what impact this could have for the stock market in coming months. In this article we are going to review:

Key Indicators To Track

Impact of A Second Full Shutdown

Chances of A Double Dip Recession

Status of Vaccines And COVID-19 Treatments

Government Stimulus Programs In The Works

Key Indicators To Track

We are not completely dismissing the traditional economic indicators such as unemployment rates, GDP, manufacturer’s index, and consumer spending habits. While we are in uncharted waters with this global pandemic, those indicators still allow us to piece together the US economy‘s timeline to recovery. However, it is hard to deny that COVID-19 tracking data such as daily infection rates will have a material impact on the decisions that investors will make in the coming months. From the experts we have spoken to, while daily infection rates would seem to be the most important, the more important data is the hospitalization rate and the number of people in the ICU.

You could potentially have a lot of people getting infected with COVID-19, but as long as they are able to recover before the virus becomes life-threatening, it would indicate that the COVID-19 treatments are working, and the health system is getting better at treating the virus in the early stages. However, if we see hospitalization rates spiking, and the number of people in the ICU increasing dramatically, that could increase the likelihood of another fall shut down in various states, extending the time to recovery.

The numbers are not great right now. The hospitalization rate is just over 80,000, which is much higher than the previous two peaks from earlier in 2020.

If this trend continues, it could put the capacity of the US health system to the test, and it could dramatically increase the number of daily deaths that we are currently seeing from the pandemic.

Government Stimulus Programs

If the current trends continue and the US elected officials determine the best way to reverse the trend is another full shut down of the economy, US citizens and businesses would most likely need support from the government to weather a second shut down. Prior to the presidential elections, Congress was working on a second stimulus package which included another round of checks to be sent to individuals below certain income thresholds, a second round of PPP loans to businesses, state aid, and additional unemployment benefits.

A few quick notes about the stimulus programs. In the preliminary legislation, we did not see any changes to the income threshold to receive the checks from the IRS, but the amounts could potentially be different. This means if you received a check the first time, you will most likely receive a check in the second round. There were several changes made to the criteria of small businesses to receive PPP loan money. Businesses now would have to show a percentage of loss revenue during a specified period to be eligible for the second round of PPP loans. For the unemployment benefits, the primary legislation suggests that it will be a lower bonus amount than the previous $600 per week.

The largest clear and present danger to the market is if the economy goes into a second shut down and Congress is not able to agree upon terms of a second round of stimulus to aid US citizens and businesses. Time will be of the essence, and if Congress waits too long to act, irreversible damage could be done to the US economy, which may prolong the timeline to recovery.

With that said, if Congress is able to provide the economy with the aid it needs to bridge the gap between where we are now to the beginning of the post COVID-19 era, the market could respond very favorably to that environment, even though the news headlines will be ugly in the coming weeks.

The Market Is Forward-Looking

Through all of this, we must remember that the stock market is a forward-looking animal. As we have seen in the past, while the news today may be bad, if the market sees light at the end of the tunnel, it will not necessarily prompt a huge sell off knowing that relief is on the way. As COVID-19 treatments and vaccines continue to gain approval for emergency use, it could provide the market with that reinsurance by mid-2021. The US economy could be on its way to a meaningful recovery, but as I mentioned above, that also assumes that the government will be willing to step in and provide financial support if an economic shutdown takes place in the coming weeks or months.

What does this mean for investors? If you have a long time horizon, it is important to keep your long-term perspective, even though the markets may gyrate in the short term. For conservative investors, it is acknowledging that there are still a lot of variables that have yet to play out over the course of the next few months, and maintaining the appropriate balance between risk and return within their portfolio is key.

Chances of A Double Dip Recession

What are the chances that the market takes another big dive like we saw in March and April of 2020? Based on the information that we have gathered, in my personal opinion, the market could experience a sell off or two before we are on the other side of this pandemic, but I would be surprised if it is of the magnitude that we saw earlier in 2020. The reason for this being, we are most likely towards the end of this pandemic versus the beginning or the middle. During the big sell off at the beginning of 2020, the S&P 500 index dropped by 34%. The market at that point had no way to know what was on the horizon because the virus had just arrived, we were learning about it as it was spreading, and there were no treatments in the works, so the market had no way of forecasting what the timeline could be to recovery. It seems like we are in a much different environment now even though the US Economy faces the threat of a second wave.

A recession is defined as two consecutive quarters of negative GDP growth. If we get a full shutdown of the US economy in the coming weeks or months, it is not off the table that we could have a negative GDP reading for the fourth quarter of 2020 and the first quarter of 2021, technically classifying it as a double dip recession. Only time will tell.

Status of COVID-19 Vaccines And Treatments

It is encouraging that new treatments and vaccines are being approved by the FDA on almost a weekly basis. The challenge becomes the level of production needed, and the distribution of these treatments to the US population. we have to acknowledge that some of these treatments have their own challenges. One of the vaccines that was recently announced has to be stored at a negative 70 degrees Celsius, which is a lot colder then your typical commercial freezer. Special trucks would need to be built to transport it, and special freezers would have to be built and installed to house the vaccine. It also becomes a question of how long the vaccination will last, of if COVID-19 mutates, thus rendering the current vaccines less effective. There are still a lot of question marks even though there seems to be hope around the treatments that are being released now. The positive note is there is both treatments being created for those that have been infected by the virus while at the same time vaccines are being developed to help people from getting the virus in the first place. The stock market will undoubtedly be watching closely to how effective these treatments are at treating the virus, and in turn painting a picture as to the timeline did the economic recovery post COVID-19.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Which Stock Market Index Is Better To Track? The Dow or S&P 500 Index

Today, I’m going explain the difference between the Dow Jones Industrial Average (“The Dow”) and the S&P 500 Index. While both indexes are meant to be an accurate representation of the performance of the US

Today, I’m going explain the difference between the Dow Jones Industrial Average (“The Dow”) and the S&P 500 Index. While both indexes are meant to be an accurate representation of the performance of the US stock market, it’s important to understand the difference between the two.

Why is it important? This year, 2020, is a perfect example why. As I write this article on August 21, 2020, the Dow Jones industrial average is DOWN -2.80% for the year. Meanwhile, the S&P 500 index is UP 4.79% for the year. If both indexes are supposed to be accurate representations of the performance of the stock market, why is one down 2% and the other up 4%?

Special disclosure: I will be mentioning individual companies in this article to help educate you on this topic. These are not recommendations to buy, sell, or hold any of the companies mentioned.

30 companies versus 500 companies

Neither of these indexes are comprised of all of the publicly traded companies in the U.S. stock market. The sponsors of these indexes have hand selected the companies that they have chosen to represent the index. The Dow Index is only made up of 30 companies. The S&P 500 index, as the name suggests, is comprised of 500 companies.

It’s easy for the S&P 500 to win the argument that 500 companies is probably a better representation of the overall stock market versus just the 30 companies that have been hand picked to represent the Dow.

Market sectors

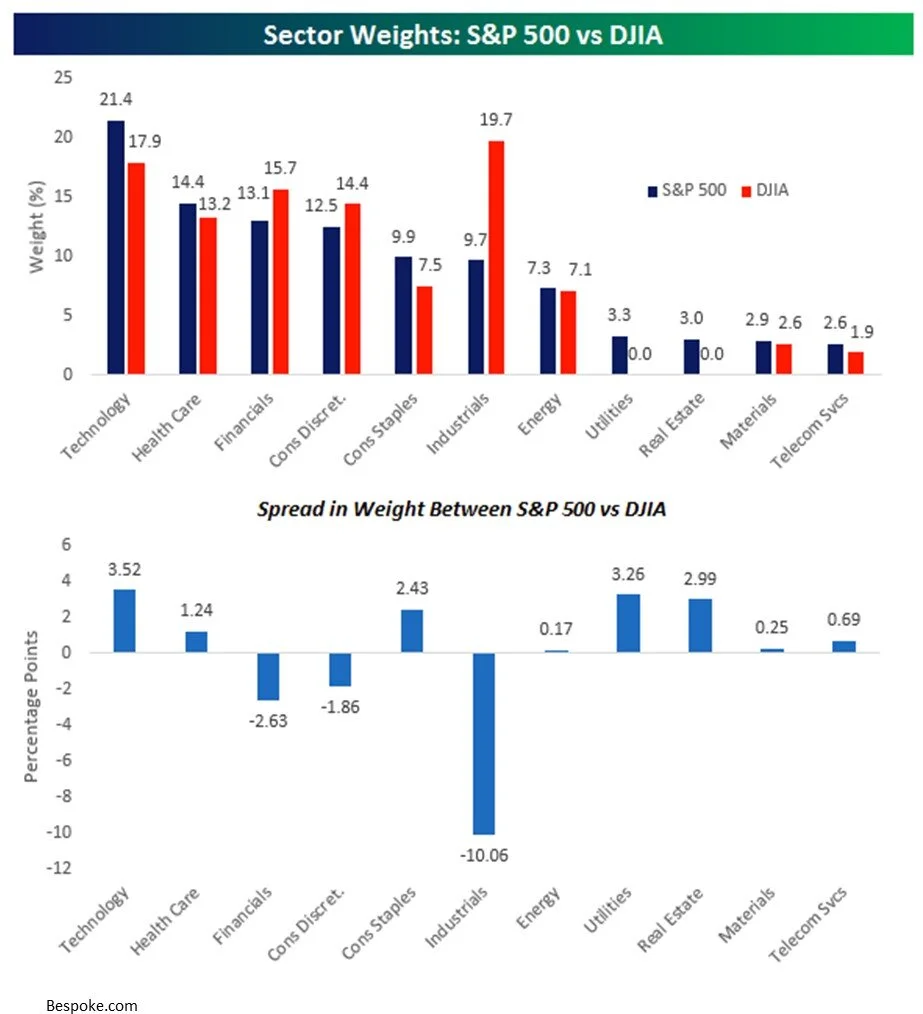

Sector concentration also has a big impact on the performance of these indexes. Stocks are categorized into “sectors” which groups publicly traded companies together by industry. Banks are in the “financial sector”, oil companies are in the “energy sector”, and so on. Since the Dow and the S&P 500 Index have different companies in them, they also have different sector weightings. Below are charts that compare the sector weights in the S&P 500 Index and the DJIA (Dow Jones Industrial Average). The second chart provides a summary of the difference in the sector weightings. 30 companies

The largest two differences in the sector weightings between the S&P 500 Index and the Dow are Industrials and Technology. The S&P 500 Index has a higher concentration of technology stocks (Examples: Apple, Google, Amazon) and a lower concentration of Industrial Stocks (Examples: GE, Catepillar, 3M). So when tech stocks have a good year, all other things being equal, the return of the S&P 500 Index will most likely be higher than the Dow. This explains some of the deviation in the YTD return between the S&P 500 Index and the Dow Index because the technology sector is up 26% YTD while the industrial sector is down 5% YTD.

Price Weighted vs Market Cap Weighted

This is probably the most important difference between the two indexes.

The Dow Index is “Price Weighted”

The S&P 500 Index is “Market Cap Weighted”

Before I jump into the comparison, you first have to understand the pieces that make up these terms.

Stock Price

A company’s stock price is meaningless as a standalone data point. If all you told me was that Company A has a stock price of $25 and Company B has a stock price of $400, I have no idea which company is bigger, which company has performed better, or which company is cheaper to buy. The only thing that stock price tells you is the estimated value of the company divided by the number of shares outstanding.

Let me explain this in an example. I have two separate companies: Jim’s Construction Inc. worth $2M and Albany Software Inc worth $1M. Both companies decide to go public. When a company “goes public”, the ownership of the company moves from the handful of individual private owners to whoever owns the shares of the stock being issued. The company that is going public decides how many shares of stock that it wants to issue. In this example let’s say Albany Software only wants to offer 1,000 shares of stock but Jim’s Construction wants to issue 200,000 shares of stock. Remember, stock price is determined by the value of the company divided by the number of shares issued:

When these two companies go public, Jim’s Construction will have a stock price of $10 per share and Albany Software will have stock price of $1,000 per share. If I showed a group of amateur investors just the stock price of each company and asked them:

Which company is bigger?

Which company is more expensive to buy today?

Which company would you have liked to own 5 years ago?

Most people would answer Albany Software with a stock price of $1,000 per share. When the truth is Jim’s Construction is actually twice the size of Albany Software, both stocks are priced at their fair market value so one is not necessarily more expensive than the other, and assuming these companies went public 5 years ago, there is no way to know which stock has performed better. Maybe 5 years ago Jim’s Construction was trading at $2 per share resulting in a 400% gain versus Albany Software that was trading at $800 per share 5 years ago, only representing a 25% gain.

Market Cap

A company’s “market cap” is just another way of determining the total value of the company. Market cap is calculated by multiplying the number of shares outstanding by the current stock price. If you wanted to compare the size of Apple vs Google:

Apple Stock Price $473 x 4.2 Billion Shares = $2.02 Trillion market cap

Google Stock Price $1,581 x 676 Million Shares = $1.07 Trillion market cap

Again, even through Apple has a much lower stock price than Google, the total value of Apple is twice that of Google.

The Most Important Difference Between S&P & Dow

With that investment lesson under our belts, we are now ready to go full circle back so I can explain why the Dow Index being “Price Weighted” and the S&P 500 Index being “Market Cap Weighted” is so important.

The Dow Jones Index is Price Weighted

Remember the Dow Index is only made up of 30 stocks. When you hear on the news that the Dow Index went up 300 points today or was down 700 points yesterday, the sponsors of the Dow are running a price weighted calculation of the 30 companies within the index. The calculation is simple, it’s just the price per share of each stock divided by a common divisor (historically the number of stocks in the index).

The problem with this calculation, as we discussed above, is that it completely ignores the size or “market cap” of the company. If Apple and Joe’s Construction Inc. both have a share price of $400 per share, should they really be weighted equally in the index? I would argue no, but in the Dow Jones Index they would be weighted equally in index.

The S&P 500 Index is Market Cap Weighted

The S&P 500 Index on the other hand is market cap weighted. The index is made up of the 500 largest U.S. publicly traded companies. Within the index, the larger companies have a bigger impact on performance of the index because each company’s weight in the S&P Index is calculated by taking the market cap of the company divided by the total market cap of all 500 companies in the index.

Since the S&P 500 Index has a larger number of companies and ranks the companies by size within the index, I would argue that the S&P 500 Index is the more appropriate index to track for purposes of determining the true performance of the U.S. stock market.

Tips for Tracking The Indexes

The media likes to report on the Dow because the price movement numbers are bigger and it grabs attention. If both the Dow and the S&P 500 drop by 2% in a single day, that equates to a 554 point drop in the Dow and a 67 point drop in the S&P 500 Index. What grabs more attention?

“Market drops by 554 point!!” or “Market drops by 67 points”

But it’s not uncommon, for all of the reasons that we discussed, for the day-to-day performance of the Dow and S&P 500 Index to be different. One or two companies can have a large impact on the Dow Index and push it up or down for the day which is less likely within the S&P 500 Index because there are 500 companies within the index all moving in their various directions.

I also encourage you to track “percentages” and not “point” movements. The Dow falling by 500 points sounds horrible but you have to remember that the Dow index is currently at 27,739, so a 500 point move only represents a 1.8% change. Back in 2010, when the Dow Index was at 10,000, a 500 point drop was more meaningful because it represented a 5% drop in the index. Just something to keep in mind with both the Dow and the S&P 500 Index at these higher levels.

Remember: Track the S&P 500 Index not the Dow and measure the daily movements in percentages not points. 30 stocks

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Market Selloff: Time To Buy, Sell, or Hold?

Over the past month, the stock market has dropped by 20%. Largely due to the economic impact of the Coronavirus. As the feeling of panic continues to increase here in the U.S., our clients are asking:

Over the past month, the stock market has dropped by 20%. Largely due to the economic impact of the Coronavirus. As the feeling of panic continues to increase here in the U.S., our clients are asking:

Should we be buying stocks at these lower levels?

Is it going to get worse before it gets better?

How quickly do you think the market will bounce back after the virus is contained?

Having managed money for clients through the Tech Bubble, The Great Recession of 2008/2009, and countless market selloffs, while the circumstances are always different from crisis to crisis, there are patterns that seem to be consistent within each market selloff. Being able to identify those patterns is key in determining what the next move should be within your investment portfolio and I’m going to share those with you today.

DISCLOSURE: Throughout this article I will be using examples of industries and companies. These are not recommendations to buy or sell a particular stock. Please consult your investment professional for advice.

Is The Market Oversold?

When there is a market selloff, one of the key questions we’re trying to answer is: “Has the stock market overreacted to the risks that are being presented?” In answering this question, I think the key thing that investors forget is that a company’s stock price represents more than just one year of its earnings. When investors buy a stock it’s typically because they expect that company to grow over the course of multiple years and yield a generous return. Unexpected events like the Coronavirus without question impact those projections but it’s not uncommon for the market to overreact because it’s focused on what’s going to happen to that company’s revenue in the short term.

A good example of this are the airlines in the United States. Due to the Coronavirus companies have canceled conferences, people have canceled vacations, and sporting events have been postponed or are now being played without spectators. That is a direct hit to the airlines in the U.S. because prior to the Coronavirus they had projected a specific amount of revenue to be generated during 2020 based on all that activity. But here comes the key question. Many of the airline stocks in the U.S. have dropped by more than 50% in the past 60 days. If investors believe that the Coronavirus will eventually be contained in the coming months, are those airlines really only worth half of what they were 60 days ago?

Buffett’s Words of Wisdom

I hesitate to use Warren Buffett’s famous quote because it’s used with such frequency but it’s proven to be a valuable investment practice during times of uncertainty: “Be fearful when others are greedy and greedy when others are fearful.” While it’s easy to say, it’s very difficult to execute effectively. Buying low and selling high goes against every human emotion. It often means stepping into the most unloved names, at what would seem to be the worst time, and owning that decision. Right now those investments seem to be the airlines, hotels, cruiselines, oil companies, and other industries directly tied to travel and tourism.

This same concept also applies to the decision to “hold” or not sell your equity holdings when the market is in a panic. Even though no one likes to see their investment accounts lose value, if you were positioned appropriately prior to the start the Coronavirus pandemic, in my professional opinion, you should not be making any adjustments to your portfolio given the recent market events. If however, you were allocated too aggressively based on your own personal risk tolerance or time horizon, you have a much more difficult decision to make.

Short Term vs Long Term Risks

Market selloffs are typically triggered by two types of risks: short term risks and long term risks. Being able to identify which risk the market is facing should greatly influence the decisions that you are making within your investment portfolio.

I’m going to use the airlines again as an example. In my personal option, the Coronavirus represents a short-term risk to the airline industry. In an effort to contain the virus, conferences have been cancelled, companies have told their employees not to travel, people have canceled vacations, etc. But you have to ask yourself this question: “what’s likely to happen once the virus is contained?” Conferences may be rescheduled, business travel resumes, and people map out a new plan for their vacation. There is arguably pent up demand being created right now that the airlines will benefit from once the virus is contained.

Back when 9/11 happened, I viewed that risk as a longer term risk for the airlines because people could choose to permanently change their behavior and choose not to fly for a very long time based on that event. In the 2008 financial crisis, the banks had a long road ahead of them as they executed plans to dig out of their leveraged positions. Problems of this nature usually require more time to fix which is why these longer term risks can justify a move from stocks into bonds.

Winners and Losers

Even with short term risk diversification is key. Just because a risk is a short term risk does not necessarily mean all companies are going to survive it. There is a risk to all companies that are impacted by market events that they run out of cash before the tide turns back to the upside. If you are an investor looking to buy into airlines at these lower levels, it's typically prudent to buy multiple companies in smaller increments, as opposed to establishing a large position in a single airline. Again, just an example, if you decide to buy stock in American Airlines, Delta, Southwest, and United Airlines, the risk of buying low is one of the four may run out of money before the virus is contained and they are forced with filing bankruptcy without a bailout from the government. If you put all of your money into one airline, you are taking on a lot more risk.

Buyer’s Remorse

One of the lessons I’ve learned from buying during a market selloff is you need to keep your long-term perspective. Meaning when you purchase a stock that has dropped significantly, there are forces acting on that company that could cause it to drop by more. You have to be comfortable with that reality and you have to possess the time horizon to weather the storm in the likely case that it could get worse before it gets better.

It’s all too common that investors purchase a stock thinking that since it’s already dropped 30%+ that it can’t possibly go any lower, only to watch it drop by another 30% and then feel pressured to sell it thinking they made a mistake. I call this “buyer’s remorse”. When you play the role of an opportunistic investor, it may take months or years for the benefit to be realized. Investing for a “quick pop” is a fool’s game, especially with the Coronavirus situation. No one knows how long it’s going to take to contain the virus, how badly Q1 and Q2 revenue will be hurt for companies, or will it end up causing a recession. Making the decision to buy stock at lower levels is usually based on the investment thesis that the stock market is overreacting to a relatively short term event and those companies getting hit the hardest will recover over time.

How Much Time Will It Take For the Market To Recover?

No one knows the answer to this question because we have never really been in this situation before. We have been through other epidemics in the past such as SARS, MERS, Swine Flu, and Ebola, but nothing that spread as quickly or as broadly around the globe as the Coronavirus. Since China was ground zero for the virus, the good news is we are already seeing significant progress being made at containing the virus.

As you can see via the blue line in the chart, at the beginning of February China was reporting thousands of new cases every day, but since the beginning of March the line flattens out, meaning the number new people getting infected is tapering off. If the United States follows a similar trajectory, we may see the rate of infection rise significantly in the upcoming days only to see the numbers taper off a month or two from now.

I would argue that we have an added advantage over China and Europe in that we had more time to prepare, we know more about the spread of the virus, and how to contain it. I think the lesson that we learned from Europe was you have to be aggressive in your containment efforts which is why you are seeing the extreme measures that the U.S. is taking to contain the spread of the virus. Those extreme containment efforts hurt the market more in the short term but will hopefully result in less damage to the economy over the longer term.

It’s really a race against time. The longer it takes to contain the virus, the longer it takes for people to get back to work, the longer it takes for people to feel safe traveling again, which results in more companies being put at risk of running out of capital waiting for the recovery to arrive. This is the reason why the Fed is aggressively dropping interest rates right now. Dropping interest rates does absolutely nothing to contain the virus or make people feel safe about traveling but it provides companies that are struggling due to the loss of revenue with access to low interest rate debt to bridge the gap.

A Recession Is Very Possible

A recession is defined as two consecutive quarters of negative GDP growth. With the global slowdown that has taken place in 2020, the U.S. economy may post a negative GDP number for the first quarter. Since it takes a while to bring global supply chains back online and for consumers to return to their normal spending behaviors, it's possible that the U.S. economy could also post a negative GDP number for the second quarter as well. By definition, that puts the U.S. economy in a recession. But it may end up being a very brief recession as the Coronavirus reaches containment, global supply chains come back online, pent up demand for goods and services is fulfilled, and U.S. households and businesses have the dual benefit of having access to lower oil prices and lower interest rates.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus vs. SARS: Buying Opportunity?

As fears of the Coronavirus continue to spread, this week was the largest drop in the stock market since the 2008 / 2009 financial crisis. On Thursday, February 27, 2020, the Dow Jones Index dropped by 1,191 points, making it the

As fears of the Coronavirus continue to spread, this week was the largest drop in the stock market since the 2008 / 2009 financial crisis. On Thursday, February 27, 2020, the Dow Jones Index dropped by 1,191 points, making it the largest single day point drop in the history of the index. As the selling has intensified into the week, clients are asking us what we expect in the upcoming weeks. Should they be buying the dip? Do we expect a further selloff from here?

Like most major market events, we have to look back in history to find similar events that allow us to model how the markets might behave from here. This week, we have conducted extensive research into virus outbreaks that have happened in the past such as SARS, MERS, Zika, and Swine Flu, in an effort to better understand possible outcomes to the Coronavirus epidemic. In this article, I’m going to share with you:

Coronavirus vs SARS / Zika / other epidemics

What makes the Coronavirus different than other epidemics in the past

Why has this selloff been so fast & fierce

Disruptions to the global supply chain

Performance of the stock market following the end of epidemics in the past

Will the Fed lower rates to help the market

When does this become a buying opportunity for investors

Coronavirus vs SARS

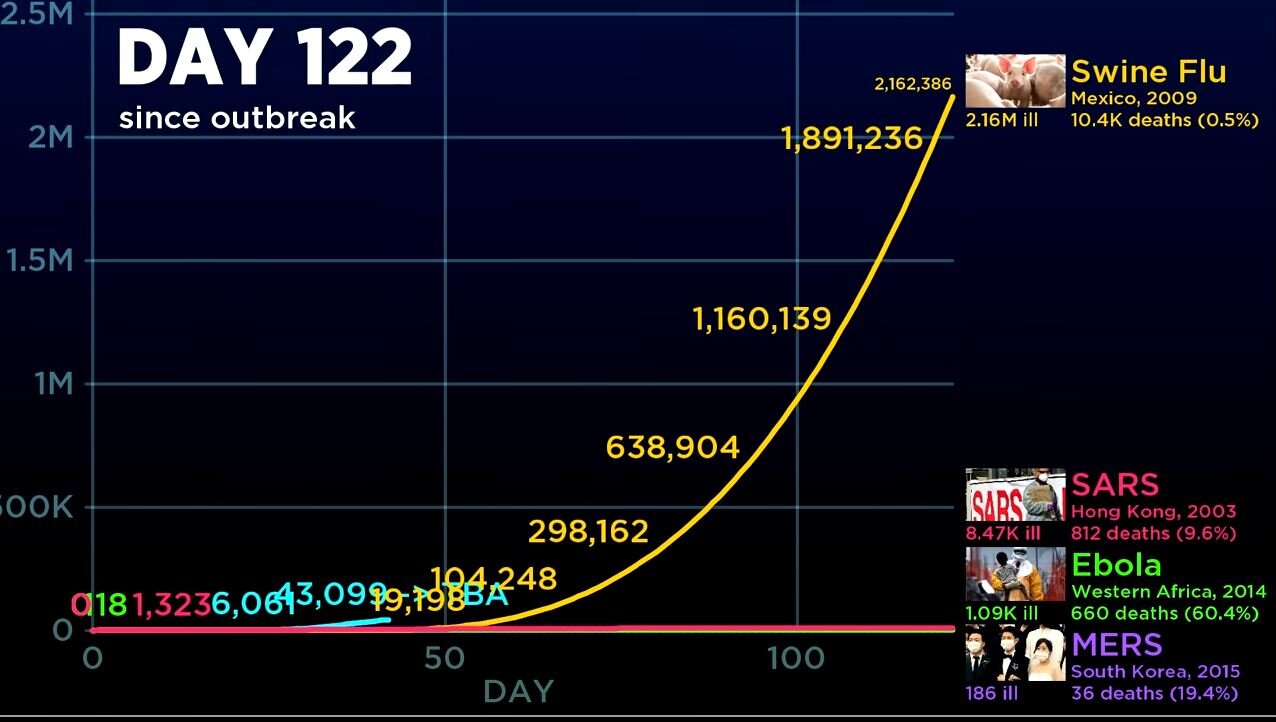

We spent an extensive amount of time comparing Coronvavirus to SARS, and other epidemics in the past. Without a doubt, the Coronavirus is very different than many of the epidemics that we have seen in the past which is making financial modeling very difficult. When we compare the Coronavirus to SARS and other outbreaks, the rate at which the Coronavirus has spread in the first 30 days is unprecedented. Here are a few time lapse charts that compares the infection rate of the Coronavirus to SARS, Ebola, MERS, and Swine Flu.

When you compare SARS to the Coronavirus at Day 19, SARS was much worse out of the gates. By Day 19, SARS had infected 1,490 people and 53 people had died, making the death rate 3.6%. By comparison, at Day 19, Coronavirus had only infected 123 people in China, and resulted in 2 deaths. Making the death rate 1.6%.

However, only 7 days later, at Day 26, the story completely changed:

By Day 26, the number of confirmed cases of Coronavirus rocketed higher, outpacing that of SARS in the early 2000’s. In addition, the death toll for the Coronavirus jumped to 79 people.

But then it continued to get worse. By Day 43, the chart says it all:

By day 43, the number of confirmed cases of the Coronavirus jumped to 43,099 compared to just 3,860 confirmed cases of the SARS virus during that same time period. The death toll for the Coronavirus had risen to over 1,000 people compared to 217 from SARS during that same time period. This chart highlights the main issue with the Coronavirus. It’s spreading faster than government’s are able to control compared to most epidemics in the past.

Now, I say “most” because when we started gathering the data, there is a chart that looks similar to the Coronravirus outbreak. If I move these charts forward to Day 122, this is what happened with the Swine Flu in Mexico in 2009.

The Swine Flu was relatively mute for the first 50 days, but after day 50, the chart looks very similar to the fast spread of the Coronavirus. By Day 122, 2.1M people had been infected with the Swine Flu and over 10,000 people had died.

So why didn’t you hear more about the Swine flu when it was happening? The death rate of the Swing Flu was only 0.5%. Compare this to the current 2.1% estimated death rate of the Coronavirus, which is not as high as the SARS death rate of 4.9%, but it is significantly higher than the Swine Flu. Here is a chart comparing the death rate of SARS, Coronavirus, and MERS:

Another important note, the Swine Flu was fairly wide spread as well. See the chart below from the World Health Organization on the Swine Flu:

However, given how fast the Coronavirus is spreading in it’s early stage, it could end up having a larger global footprint than the Swine Flu if they are unable to contain it soon.

Key Takeaway From The Comparison

Our key takeaway from this comparison is that Coronavirus has spread more quickly in the early stages compared to past epidemics which represents a larger risk to the markets than in the past. Due to the pace of the spread, it’s difficult to put an estimated timeline together for containment. When we look at the comparison of Coronavirus to the Swine Flu, it shows that there could be further downside risks to the markets if the spread of the virus follows a similar glide path.

Coronavirus Disruption To The Market

We issued an article earlier this week explaining the business impact of the Coronavirus.

Article: Coronavirus & The Market Selloff

I just want to quickly summarize again what’s causing the market selloff from a business standpoint. As the Coronavirus continues to spread to other regions, it forces governments to restrict the movements of its people in an effort to contain the spread of the virus. This means transportation is shut down, events are canceled where there would have been large gatherings of people, and employees are not going to work. Also, when people are afraid, they don’t go out to eat, and they don’t go shopping. All of these things have a direct impact on the revenue of the companies that make up the stock market. When these companies entered 2020, there was no expectation that their manufacturing operations could be completely shut down due to a global health epidemic. The stock market right now is trying to determine how much it needs to discount the prices of these companies based on the revenue that’s being lost.

The longer the epidemic continues, the longer it takes people to get back to work, the longer it takes people to resume their normal spending habits, and the more damage it does to the markets.

The China Impact

When comparing SARS to the Coronavirus it’s also important to acknowledge the growth in the size of China’s economy between 2003 and 2020. When the SARS outbreak happened in 2003, China’s economy only represented 8.7% of global GDP. As of 2019, China’s economy now equals 19% of total global GDP. Since the Coronavirus has been the most wide spread in China, It will have a much larger impact on the markets around the globe compared to the SARS outbreak when China was a much smaller player in the global economy.

Valuations in the U.S. Stock Market

In our opinion, one of the other big factors that has fueled the magnitude of the selloff here in the U.S., is the simple fact that going into 2020, the stock market was overvalued already by historic terms. As of December 31, 2019, the P/E ratio of the S&P 500 was 18. The 25 year historical average P/E for the S&P 500 Index is 16. This essentially means that stocks were expensive going into the beginning of the year. When stocks are already arguably overvalued, and a negative event happens, the prices have to drop by more realizing that those companies are not going to produce the earnings growth for the upcoming year that was already baked into the stock price.

Fed Lowering Rates

There is talk now of the Fed coming to the markets aid and lowering interest rates throughout the year. Going into 2020, it was the market’s expectation that the Fed was going to remain on hold for 2020. In my opinion, the rate cuts are probably warranted at this point, given the unexpected slowdown to the global economy as a result of the Coronavirus. But I would also warn that the Fed lowering interest rates is not in itself going to heal the markets. Giving companies access to cheaper capital is not going to make people feel safer about traveling around the globe and it’s not going to help manufacturers resume operations if their employees can’t get to the factory due to travel restrictions.

However, giving companies access to cheaper capital will allow them to better weather the storm while the governments around the world work on a containment plan. Without that access to cheap capital, you could see companies going under because it took revenue too long to ramp back up.

Global Supply Chain

Investors should not underestimate the damage that has been done to the global supply change and how long it takes to get the supply chain back up and running again. A good example are car manufacturers. They do not typically keep large inventories of parts, and if those parts are not being made, they’re not being shipped, meaning they can’t build the cars, so they can’t sell the cars, and revenue drops.

Within the electronics industry, a lot of the products are made up of hundreds if not thousands of components, and the product does not work without all of those components. If there is one computer chip that is made in Korea, and the manufacturing of those chips has been halted, then the end product cannot be built and shipped. The examples go on and on but when you think of manufacturing around the globe being brought offline, it’s not like a light switch where you can go and simply turn it back on. It takes a while for it to get back up and running again. So while investors might think the Coronavirus could just impact Q1 revenue, it’s more likely that it will impact revenue beyond just the first quarter.

When Do You Buy The Dip?

I have received a lot of calls from clients asking if they should begin buying stocks at these lower levels with the anticipation of a bounce back. When we look at other epidemics in the past, there has been a sizable rally in the stock market 6 to 12 months after the epidemic has ended. The chart below shows each epidemic and the subsequent 6 month and 12 month return of the S&P 500 after the epidemic ended. On average, the stock market rose 20% a year following the end of the epidemic which is why investors are eager to buy into the selloff.

In my personal opinion, at some point, the Coronavirus will be contained and it will create an opportunity for investors. There is pent up demand being accumulated now that will need to be filled after the virus is contained. Individuals will most likely reschedule vacations and travel plans once they feel it’s safe to travel around the globe, and the Fed, via lower rates, will have given companies access to even cheaper capital to grow. But as I write this article on February 28th, I caution investors. When you look at the data that we’ve collected, there could definitely be more downside to the selloff if they are unable to contain the spread of the Coronavirus within the next few weeks. The market right now is just trying to guess how much damage has been done with no real solid guidance as to whether it’s guessing right or wrong.

It may be prudent to wait for evidence that progress is being made on the containment efforts of the virus before buying back into the market. For long term investors, it’s important to understand that while the Coronavirus will undoubtedly have an impact on the revenue of companies in 2020, in the past, epidemics have rarely changed the fate of solid companies over the long term.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus & The Market Selloff

Today was a wild ride for the stock market. The Dow Jones posted a loss of 1,031 points on February 24, 2020 as fears of the continued spread of the Coronavirus sparked a selloff in the stock market. Over the past 24 hours, we've

Today was a wild ride for the stock market. The Dow Jones posted a loss of 1,031 points on February 24, 2020 as fears of the continued spread of the Coronavirus sparked a selloff in the stock market. Over the past 24 hours, we've received the following questions from clients that I want to address in this article:

Why is the market selling off on this news?

Do you think the selloff will continue?

Should you be moving money out of stocks into bonds?

Why Is Market Selling Off On This News?

You have to remember that the stock market is made up of individual companies. Each company’s stock price is just an educated guess by investors as to how much those companies are going to make in profits over the next 3 months, 1 year, 5 years, and beyond. Unexpected events like the Coronavirus create large deviations between those educated guesses and actual results.

In the case of the Coronavirus, it’s disrupting the revenue stream of many companies that produce and sell goods across the globe. For example, Nike receives 17% of its revenue from China, and the company has temporarily closed more than half of its stores in China. The stores that remain open are operating on abbreviated hours. If the stores are not open, then they can’t sell Nike shoes and apparel, which will most likely cause Nike’s Q1 revenue to be lower than expected. That in turn could cause the stock price to drop once the Q1 earnings report is released later this year.

But it’s not just Nike. The S&P 500 Index is made up of a lot of companies that sell goods in China and other locations around the world: Apple, Yum Brands, McDonalds, Proctor & Gamble, and the list goes on. Beyond just retail, you have airlines, hotels, and casinos that are being negatively impacted as people cancel travel plans and vacations. The point I’m trying to make is there are real business reasons why the stock market is reacting the way it is, it’s not just displaced fear.

All of these companies are trying to figure out right now what the impact will be to their revenue. The next question then becomes, how much are these companies going to miss by?

Do You Think the Selloff Will Continue?

That leads us into the next questions which is “do you think the selloff will continue?” Historically, contagious disease outbreaks have been quickly contained, such as the SARS outbreak in the early 2000’s. The amount of damage to the markets seems to be highly correlated to the amount of time it takes to contain the outbreak. The longer it takes to contain the outbreak, the longer it takes people to return to work and to return to their normal spending habits. The news broke this morning that there are new confirmed cases of the Coronavirus in Italy and South Korea which makes investors question whether or not the threat has been contained.

Unfortunately, there is no solid answer as to how long the current selloff might last. It could end tomorrow or it could continue off and on over the next few weeks. But it’s important to remember that even though market events like the Coronavirus do impact the short-term profitability of companies, it’s less common that these types of events impact the long-term performance. When you have a selloff sparked by a single market event versus a full blown recession, it’s not uncommon for long term investors to start stepping into the market and buying stocks at these lower levels.

Should You Be Moving Money Out Of Stocks Into Bonds?

This bring us to the final question, should you be making changes to your investment portfolio based on today’s market events? In my opinion, the answer to that is “no” but I think there is a lesson to be learned for investors that are still overweight stocks in their portfolio. Over the past year, the stock market has appreciated rapidly in value but the growth rate of corporate earnings has lagged behind. When this happens, stocks start to become overvalued, and the market becomes more vulnerable to selloffs.

This week the selloff was sparked by the Coronavirus, a few months from now it could be fears surrounding the elections in the U.S., trade, or some other geopolitical event. When you enter the later stages of an economic expansion, volatility, which has been largely absent from the U.S. stock market over the past few years, becomes a common place. Investors that have elected to stay overweight riskier asset classes in the later stages of this economic cycle, need to make sure they have the risk tolerance and discipline to weather these market selloffs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Manufacturing Is Contracting: Another Economic Indicator Flashes Red

Yet another important economic indicator rolled over this week which has triggered a sell-off in the U.S. equity markets. Each month the Institute of Supply Management (“ISM”) issues two reports: Manufacturing ISM ReportNon-

Yet another important economic indicator rolled over this week which has triggered a sell-off in the U.S. equity markets. Each month the Institute of Supply Management (“ISM”) issues two reports:

Manufacturing ISM Report

Non-Manufacturing ISM Report

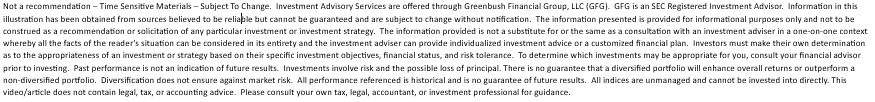

A reading above 50 indicates an expansion and a reading below 50 indicates a contraction. The Manufacturing ISM Report was released on Tuesday and it showed a reading of 47.8 for September indicating that manufacturing in the U.S. is beginning to contract. Not only was it the first contraction of the index within the last few years but the index reached a level not seen since 2009. In this article we will cover:

Why the ISM Index is important

Historically what happens to the stock market after the reading goes below 50?

What caused the unexpected drop in the ISM index?

Manufacturing trends around the globe and how they could impact the U.S. stock market

Why The ISM Index Is Important

The ISM Manufacturing Index tells us how healthy the manufacturing sector of the U.S. economy is. This index is also referred to as the Purchasing Managers Index (PMI) and I will explain why. The ISM issues a monthly survey to more than 300 manufacturing companies. The purchasing managers at these big manufactures are on the front line when it comes to getting a read on the pulse of business conditions. The survey includes questions on the trends in new orders, production, inventories, employment, supply chain, and backlog orders. The ISM assigns weightings to each metric, aggregates all of the responses together, and it results in the data point that signals either an expansion or a contraction.

If most of the manufactures in the U.S. have a ton of new orders, inventories are low, and they are looking to hire more people, that would most likely produce a reading above 50, implying that the outlook is positive for the U.S. economy as these big manufactures ramp up production to meet the increase in demand for their products.

On the other hand, if these surveys show a drop off in new orders, inventories are rising, or hiring has dropped off, that would most likely produce a reading below 50, implying that manufacturing and in turn the U.S. economy is slowing down. Analysts will use the ISM index to get a read on what corporate earnings might look like at the end of the quarter. If the index is dropping during the quarter, this could be foreshadowing a shortfall in corporate earnings for the quarter which the stock market will not find out about until after the quarter end.

Here is a historic snapshot of the ISM’s Manufactures Index:

As you will see in the chart, manufacturing has been slowing over the course of the past year but up until September, it was still expanding at a moderate pace. For September, economists had broadly expected a reading of 50.4 but the ISM report produced a result of 47.8 signaling a contraction for the first time since 2016.

What Does This Mean For The Stock Market?

So in the past, when the ISM Index has gone below 50, what happened to the stock market? To answer that question, let’s start by looking at a chart that shows the correlation between the ISM Index and the S&P 500 Index:

The dark blue line is the ISM index and the light blue line is the S&P 500 Index. Looking at this data, I would highlight the following points:

The ISM Index and the S&P 500 Index seem to move in lockstep. While the ISM might give you a preview of what quarterly earnings might look like, it does not give you a big forward looking preview of bad things to come. By the time the ISM index starts dropping, the stock market is already dropping with it.

We need more data. There have been a few times that the index has gone below 50 within the last 20 years and it has not been followed by a recession. Look at 2016 for example. The ISM index dropped below 50, but if you trimmed your equity positions at that point, you missed the big rally from January 2017 through September 2019. We need more data because historically multiple back to back months of readings below have signaled a recession.

If the index hits 45 or lower within the next few months, watch out below!!

What Caused The Most Recent Drop In The ISM Manufactures Index?

When it comes to unexpected market events, there is usually a wide mote of differing opinions. But it seems like the most recent drop could be attributed to a continued weakening of spending by U.S. businesses. While the U.S. consumer seems to still be strong and spending money, spending by businesses on big ticket items has tapered off over the past few months.

As you will see in the chart above, durable goods orders have dropped over the past two months which is the main barometer for business spending. When businesses are uncertain about the future, they tend to not spend money and business owners have no lack of things to be worried about going into 2020. The growth rate of the U.S. economy has been slowing, uncertainty surrounding global trade continues, and 2020 is an election year. One or more of these uncertainties may need to resolve themselves before businesses are willing to resume spending.

Global Manufacturing Trends

While manufacturing in the U.S. just started contracting in September, the picture is a little darker when we look at the manufacturing trends in other parts of the world. Below is a heat map that shows the PMI Index for countries all around the world. Here is how you read it:

Green is good. Manufacturing is expanding

Yellow is neutral: Manufacturing is flat

Red is bad: Manufacturing is contracting

If you look at 2017 and 2018, there was a lot of green all around the world indicating that manufacturing was expanding around the globe. As we have progressed further into 2019, you are beginning to see more yellow and in some areas of the world there is red indicating contraction. Look at Germany in particular. There has been big change in the economic conditions in Europe and the global economy is very interconnected. The weakness that started in Europe seems to be spreading to other places throughout the globe.

ISM Non-Manufacturing Index

Now, you could make the argument that the U.S. is a services economy and it does not rely heavily on manufacturing, so how much does this contraction in manufacturing really matter? Well, if we switch gears to the ISM Non-Manufacturing Index which surveys the services sector of the US economy, the September report just came out with a reading of 52.6 compared to the 55.3 that the market was expecting. This is also down sharply from the 56.4 reported for August.

While the services sector of the U.S. economy is not contracting yet, it seems like the numbers may be headed in that direction.

What Investors Should Expect

There are pluses and minuses to this new ISM data. The contraction of the ISM Manufactures Index and the deceleration of the growth rate of the ISM Non-Manufactures Index in September is just another set of key economic indicators that are now flashing red. Implying that we may be yet another step closer to the arrival of the next recession in the U.S. economy.

The only small positive that can be taken away from this data is that the Fed now has the weak economic data that it needs to begin aggressively reducing interest rates in the U.S. which could boost stock prices in the short term. But investors have to be ready for the rollercoaster ride that the stock market may be headed towards as these two forces collide in the upcoming months.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Is An Inverted Yield Curve?

Today, August 14, 2019, the main part of the yield curveinverted. This is an important event because an inverted yield curve hashistorically been a very good predictor of a coming recession. In this articlewe will review

Today, August 14, 2019, the main part of the yield curveinverted. This is an important event because an inverted yield curve hashistorically been a very good predictor of a coming recession. In this articlewe will review

What the yield curve is

What it means when the yield curve inverts

Historical data showing why it’s been a goodpredictor of recessions

What it means for investors today

Understanding the Yield Curve

The yield curve is an economic indicator that originates from the bond market. It’s basically a chart that shows the yield of government bonds at different durations. For example, the yield on a two-year treasury note versus a 10 year government bond. In a healthy economic environment, the curve is positively sloped as is illustrated by the chart below.

In a positively sloped yield curve, longer-term bonds have higher yields. Here’s a hypothetical example using CDs. Let’s say you go into that bank and you are trying to decide between buying a 1 year CD or a 5 year CD. In most cases you would naturally expect the 5 year CD to give you a higher level of interest because the bank is locking up your money for 5 years instead of 1 year. If a 1 year CD gives you 1% interest, you might expect a five-year CD to give you 3% interest in a bond market that has a positively sloped yield curve, because the further you go out in duration, the higher the current yield.

However, sticking to our hypothetical example using CD's, there are periods of time when you go into the bank and the 1 year CD has a higher interest rate than a 5 year CD. That would make you ask the obvious question, “Why would anyone to buy a 5 year CD at a lower interest-rate than a 1 year CD? You get a higher investment return on your money for the next year and you get your money back faster?”.

The answer is as such, in the bond market, investors willsometimes buy bonds for a longer duration at a lower current yield because theyexpect a recession to come. When arecession hits, typically the Federal Reserve will start lowering interestrates to help stimulate the economy. When that happens, interest ratestypically drop. Anticipating this drop in interest rates, bond investors are willingto buy bonds today that lock up their money for a longer period of time with alower yield because they expect interest rates to drop in the near future.

So, let’s use the hypothetical CD example again. You go into the bank and the 1 year CD rate is 3% and the 5 year CD rate is 2.5%. In an inverted yield curve situation, investors are buying those 5 year CD’s even though they have a lower interest-rate, because when the recession hits and the Fed starts lowering interest rates when that 1 year CD matures a year from now, the new rate on CD’s may be a 1 year CD at 1% and 1.5% on a 5 year CD. So from an investment standpoint today, it’s a better move to lock in your 2.5% interest rate for 5 years even though the yield is lower than the 1 year CD today. You can see in this example why an inverted yield curve is such a bearish signal for the markets.

Below is an illustration of an inverted yield curve:

It’s a Very Good Predicator of Recessions

When you look at the historical data, it shows how frequently an inverted yield curve has preceded a coming recession. Below is a chart that shows the spread between a 2 year government bond and a 10 year government bond. The yield curve is positively sloped when the blue line is above the dark black line. When the blue line falls below the dark black line, that means that the yield curve is inverted. The grey areas in the chart indicate recessions.

Today, the main part of the yield curve which means the 2year vs the 10 year bonds inverted. However, it’s important to point out that earlier in 2019, the yield onthe 10 year treasury bond dropped below the yield on the 3 month treasury note,so technically this is the second time the yield curve is inverted in 2019.

What Does That Mean for Investors?

If we use history as our guide, the inverted yield curve is a caution light for investors. Historically, the main question people ask next is, “How long after the yield curve inverts does the recession usually begin?”. Here is the chart:

As you can see, the problem with using this data to build an estimates timeline until the next recession is the variance in the data. Even though, in the past 5 recessions, the “average” period of time between the inversion of the yield curve and the subsequent recession was about 12 months, in 2 out of the 5 recessions, the inversion happened within 2 months of the beginning of the next recession. Timing the markets is very difficult and as we get into the later innings of this long economic expansion, the risks begin to mount. For this reason, it very important for investors to revisit their exposure to risk asset to make sure they are properly diversified.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Top 4 Things That You Need To Know About The Trade War With China

The trade negotiations between the U.S. and China have been the center of the stock market’s attention for the past 6 months. One day it seems like they are close to a deal and then the next day both countries are launching new tariffs against each other. While many investors in the U.S. understand the trade wars from the vantage point of the United

The trade negotiations between the U.S. and China have been the center of the stock market’s attention for the past 6 months. One day it seems like they are close to a deal and then the next day both countries are launching new tariffs against each other. While many investors in the U.S. understand the trade wars from the vantage point of the United States, very few people understand China’s side of the equation. The more we learn about China’s motivation and viewpoint, the more we realize that this could be a very long, ugly, and drawn out battle. The main risk is if this battle is not resolved soon it could lead to a recession in the U.S. sooner than expected.

1: China Is Tired Of Being On The Losing End Of Trade Deals

When you look back through history, going as far back as the mid 1800’s, China has been on the losing end of many of it’s trade deals. To summarize that history, when you are a very poor country, and your economy is based primarily on exporting goods to other countries, those countries that are buying your goods have a lot of power over you. If you don’t agree to their terms, they stop buying from you, and your economy collapses. China’s history is filled with trade deals where terms were dictated to them so they feel like they have been taken advantage of.

Now that China has the fastest growing middle class in the world, they are less reliant on trade to fuel their economy. Also, the size of China’s economy is growing extremely fast. The size of a country’s economy is measured by their GDP (Gross Domestic Product). A country’s annual GDP is the dollar value of all the goods and services that are produced in that country in a single year. It’s fascinating to see how quickly China has grown over the past 20 years compared to the U.S.

The numbers speak for themselves. In 2000, the size of China’s economy was only 9% of the U.S. economy. In only a 17-year period, China’s economy is now 67% the size of the U.S. economy and based on current GDP data from both countries, they are still growing at a pace that is about three times faster than the U.S. economy.

China seems to be making a statement to the world in these negotiations that terms will no longer be dictated to them. China now has the economic firepower to negotiate terms as an equal which could drag out the trade negotiations longer than investors expect.

2: Tariff Impact On China vs U.S.

In May, the U.S. raised the tariffs on select goods imported from China from 10% to 25%. China then retaliated by raising their tariffs on US imports from 10% to 25%. We have heard in the news that these tariffs hurt China more than they hurt the U.S. In the short term this would seem to be true. The U.S. imports about $500 Billion in goods from China compared to the $100 Billion in goods that China imports from the U.S.

But the next question is, “if it hurts China more, does it hurt them a lot or a little from the standpoint of their overall economy?” The answer; not as much as you would think. The chart below shows China’s total exports as a percentage of their GDP.

Back in 2007, exports contributed to over 35% of China’s total GDP. As of 2018, exports represent less than 20% of China’s annual GDP. Of their total exports about 18% go to the U.S. So if you do the math, exports to the U.S. equal about 3.6% of China’s total annual GDP. Personally, I was surprised how low that number was. Based on what we have been hearing about the negotiations and how the U.S. is in such a strong position to negotiate, I would have expected the export number to be much larger, but it’s less than 4% of their total GDP. This again may lead investors to conclude that the volatility we are seeing in the markets surrounding the trade negotiations may be an unwelcomed guest that is here to stay for longer than expected.

3: The Impact of Tariffs On The US Economy

While the U.S. is using tariffs as a negotiating tool, it may be the U.S. consumer that ends up paying the price. That washing machine that was $500 in April may end up costing $625 in June. Companies that are importing goods from China and selling them to the U.S. consumer will have to decide whether to absorb the cost of the tariffs which would decrease their net profits or pass those costs onto the consumer in the form of higher prices.

The other problem that you can see in this example is tariffs are inflationary. Meaning they push prices higher. The Fed announced at their last meeting that they were content with keeping interest rates where they are for the remainder of 2019 given the slowing economic growth rate and tame inflation. But if tariffs spark inflation, they may have to reverse course and raise rates unexpectedly to keep the inflation rate under control which would be bad news for the stock market.

4: Global uncertainty

Companies typically do not invest or make plans for growth if the global economy is filled with uncertainty, they pause and wait for the smoke to clear. The longer the trade uncertainty between the U.S. and China persists, the more downward pressure there will be on global economic growth around the world.

Summary

It’s unclear how this situation between the U.S. and China will play out and how long it will be before there is a resolution. In times of uncertainty, investors need to be very aware of how these trends could potentially impact their investment portfolio and it may be the appropriate time to begin building some defensive positions if you have not done so already.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Volatility, Market Timing, and Long-Term Investing

For many savers, the objective of a retirement account is to accumulate assets while you are working and use those assets to pay for your expenses during retirement. While you are in the accumulation phase, assets are usually invested and hopefully earn a sufficient rate of return to meet your retirement goal. For the majority,

Volatility, Market Timing, and Long-Term Investing

For many savers, the objective of a retirement account is to accumulate assets while you are working and use those assets to pay for your expenses during retirement. While you are in the accumulation phase, assets are usually invested and hopefully earn a sufficient rate of return to meet your retirement goal. For the majority, these accounts are long-term investments and there are certain investing ideas that should be taken into consideration when managing portfolios. This article will discuss volatility, market timing and their role in long-term retirement accounts.

“Market timing is the act of moving in and out of the market or switching between asset classes based on using predictive methods such as technical indicators or economic data” (Investopedia). In other words, trying to sell investments when they are near their highest and buy investments when they are near their lowest. It is difficult, some argue impossible, to time the market successfully enough to generate higher returns. Especially over longer periods. That being said, by reallocating portfolios and not experiencing the full loss during market downturns, investors could see higher returns. When managing portfolios over longer periods, this should be done without the emotion of day to day volatility but by analyzing greater economic trends.

So far, the stock market in 2018 has been volatile; particularly when compared to 2017. Below are charts of the S&P 500 from 1/1/2018 – 10/21/2018 and the same period for 2017.

Source: Yahoo Finance. Information has been obtained from sources believed to be reliable and are subject to change without notification.

Based on the two charts above, one could conclude the majority of investors would prefer 2017 100% of the time. In reality, the market averages a correction of over 10% each year and there are years the market goes up and there are years the market goes down. Currently, the volatility in the market has a lot of investors on edge, but when comparing 2018 to the market historically, one could argue this year is more typical than a year like 2017 where the market had very little to no volatility.

Another note from the charts above are the red and green bars on the bottom of each year. The red represent down days in the market and the green represent up days. You can see that even though there is more volatility in 2018 compared to 2017 when the market just kept climbing, both years have a mixture of down days and up days.

A lot of investors become emotional when the market is volatile but even in the midst of volatility and downturns, there are days the market is up. The chart below shows what happens to long-term portfolio performance if investors miss the best days in the market during that period.

Source: JP Morgan. Information has been obtained from sources believed to be reliable and are subject to change without notification.

Two main takeaways from the illustration above are; 1) missing the best days over a period in the market could have a significant impact on a portfolios performance, and 2) some of the best days in the market over the period analyzed came shortly after the worst days. This means that if people reacted on the worst days and took their money from the market then they likely missed some of the best days.

Market timing is difficult over long periods of time and making drastic moves in asset allocation because of emotional reactions to volatility isn’t always the best strategy for long-term investing. Investors should align their portfolios taking both risk tolerance and time horizon into consideration and make sure the portfolio is updated as each of these change multiple times over longer periods.

When risk tolerance or time horizon do not change, most investors should focus on macro-economic trends rather than daily/weekly/monthly volatility of the market. Not experiencing the full weight of stock market declines could generate higher returns and if data shows the economy may be slowing, it could be a good time to take some “chips off the table”. That being said, looking at past down markets, some of the best days occur shortly after the worst days and staying invested enough to keep in line with your risk tolerance and time horizon could be the best strategy.

It is difficult to take the emotion out of investing when the money is meant to fund your future needs so speaking with your financial consultant to review your situation may be beneficial.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

The Stock Market Dropped 800 Points Today. Is This A Warning Sign?

There was a large sell off in the stock market today. The Dow, S&P 500, and Nasdaq all dropped by over 3% in today’s trading session. After a long bull rally, big drops in the stock market often lead investors to the question: “Is this big drop in the market the beginning of something worse to come?” To answer that question, you have to identify what

There was a large sell off in the stock market today. The Dow, S&P 500, and Nasdaq all dropped by over 3% in today’s trading session. After a long bull rally, big drops in the stock market often lead investors to the question: “Is this big drop in the market the beginning of something worse to come?” To answer that question, you have to identify what changed and more importantly what did not change in the economy and the markets over the past two weeks.

Interest Rates Have Spiked

If there is a single indicator or event that we can point to that has triggered the recent sell-off, it would be the dramatic rise in interest rates. Between September 17th and October 10th, the yield on a 10 year government bond went from 3% to 3.23%. Now that may not sound like a big move but interest rates on a 10 year bond moving by 0.23% in less than a month is a big move.

When interest rates go higher, it increases the cost associated with borrowing money. Mortgage News Daily reported yesterday that the average interest rate on a 30-year fixed mortgage is currently at 5% compared to just below 4% a year ago. As interest rates move higher, it may prevent some individuals from being able to finance a mortgage, get a car loan, or it may cause a business to forgo taking that loan to expand their business.

When interest rates rise gradually as they have over the past three years it historically does not prompt a big sell off because those higher rates are slowly integrated into the economy. The yield on the 10 Year Treasury bottomed in May 2016 at 1.46% and has been steadily climbing ever since. In May 2018, the 10 Year Treasury Bond was yielding around 2.80% so it took 2 years from the yield to go up by 1.34% compared to the 0.23% jump that we experience over the past 2 weeks.

Will The Rise In Rates Continue?

We could see a further rise in rates over the next few weeks but at this point, we have probably seen the majority of the big move up. Even though the Fed is expected to raise rates in December and possibly three to four times in 2019, there are other forces at work that are anchoring our rates to lower levels.

The first being the lower level of global interest rates. As you will see on the chart below, as of September 30, 2018, the U.S. is issuing 10 year bonds at 3.46%. When you look at other “credit worthy” counties like Germany, they are issuing their 10 year bonds at 0.69%. So when foreign countries have cash to park, they will gladly take the 3.46% interest rate for 10 years as opposed to 0.69% for 10 years. This makes the demand for US debt high around the global and we are not pressured to issue our debt at higher rates to entice buyers because our rates are already a lot higher than debt being issued by other governments around the world.

The second reason that rates are most likely to remain at lower levels over the next few months is tame inflation. When inflation rises above the Fed’s 2% target rate, they often respond by raising the Fed Funds Rate either more frequently or by larger increments. As you will see in the chart below, the annual year over year change in the core Consumer Price Index (CPI) as of August 2018, which is the Fed’s primary measure of inflation, was only up 2.2%. Very close to the Fed’s target range so the Fed is not behind the inflation curve. If inflation was roaring ahead at 3% or higher it would probably prompt the Fed to raise the Fed Funds rate faster than the market expects.

Rates Are Still At Healthy Levels

Even though interest rates are rising, they are still at historically low levels. Which then prompts the question: “At what level do interest rates become problematic?” If we use history as a guide, it would seem that once the yield on the U.S. 10 year treasury bond reach 4.50%, returns from the stock market come under pressure in the two year following the breach of that threshold. But historically, when rate are where they are now and moving higher, the stock market has traditionally moved higher as interest rates were rising.

See the chart below which illustrated the correlation between interest rates and stock prices. Each dot on this chart represents a 2 year return from the stock market between 1963 and 2018. If there is a positive correlation, that means interest rates are moving higher and stock prices are moving higher at the same time. This is illustrated with a dot placed above the line in the chart. Those are favorable environments and it makes sense because in the early stages of a rising rate environment the Fed is raising rates because the economy is healthy but rates are not higher enough yet where they are harming the growth rate of the economy.

Visa versa when the dots are below the line that means that there is a negative correlation between interest rates meaning interest rates are going up and stock prices are going down.

If you look at where 3.25% would be on the x axis you will not see any dots below the line. That would imply that between 1963 – 2018 when the interest rate on the 10 year treasury bond were at the current level and moving higher, two years later stock prices were always higher. Otherwise you would see a dot below the line. If the stock market were to be lower 2 years from now and interest rates are at their current rates and moving higher, it would be the first time that has ever happened within the last 55 years.

Could stock prices be lower 2 year from now? Sure they could but if you use history as a guide, it would suggest that such an event would have a low probability of occurrence.

Conclusion

As of right now, it would seem that the recent sell-off in the U.S. stock market was triggered by an unexpected rise in interest rates over the past two week. While higher interest rates are often revered as an unwelcome guest to bull markets, history would suggest that interest rates have not reached levels that would prompt an end to the current economic expansion. We would also add that there are other forces at work such as tame inflation rates and a lower global interest rate environment that may prevent a further dramatic increase in rates from the current levels.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.