At What Age Does A Child Have To File A Tax Return?

When your children begin working and they receive their first W2, the question from parents is often “Do they have to file a tax return?” In this video we will cover

When your children begin working and they receive their first W2, the question from parents is often “Do they have to file a tax return?” In this video we will cover:

At what age are you required to file a tax return

The $12,400 income threshold

Tax refunds for children

Impact on the IRS Stimulus Checks

Can you still claim them as a dependent if they file a tax return?

Kiddie Tax

DISCLOSURE: This is for educational purposes only. This is not tax advice. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.Money Smart Board blog

Will Moving From New York to Florida In Retirement Save You Taxes?

I am getting the question much more frequently from clients - "When I retire, does it make sense from a tax standpoint to change my residency from New York to Florida?". When I explain how the taxes work

I am getting the question much more frequently from clients - "When I retire, does it make sense from a tax standpoint to change my residency from New York to Florida?". When I explain how the taxes work between New York and Florida, most people are disappointed to find out that it either makes no difference tax wise, or it is less of a difference than they thought. I think too many people wrongly assume that changing your state domicile from New York to Florida is a no-brainer. Whether or not it will have a big impact for you depends on your personal financial situation for retirement. For some individuals, it will save them a lot of taxes, but for most, the tax impact may be minimal. You have to consider:

How Social Security is taxed in NY

The $20,000 NYS exemption on the distributions from retirement accounts

How state pensions are taxed

The property tax breaks in NY once you are over 65

Hidden Medicare cost if you leave New York

How much your NY tax liability would be in retirement

Cost of Living

Estate tax laws

It probably seems like a lot of factors to consider, but all of them should be factored in before you decide to pack up the car and move to Florida for retirement.

How Social Security Is Taxed In New York

Many people do not realize that when you receive Social Security payments in retirement, it is considered taxable income at the federal level for most individuals. While most individuals will pay federal income tax on their Social Security benefits, you do not have to pay NYS income taxes on social security. If you are married, you and your spouse are each receiving $25,000 for social security, and you do not save any state income taxes on the $50,000 by moving to Florida, since New York does not tax your social security benefits.

NYS Tax Exemption On First $20,000 Distributed From Retirement Accounts

If you are NYS resident and over the age of 59½, New York does not make you pay state tax on the first $20,000 distributed from a corporate pension, IRA, 401(k) or other retirement plan. Married couples get to double that at $20,000 each for a total of $40,000.

If we build on the social security example above, assume you and your spouse are each getting $25,000 in Social Security, and you can withdraw $20,000 each out of your IRA account without having to pay NYS income tax:

So, now you are up to $90,000 in annual income without a dime in income tax paid to New York State.

Taxes on Public Pension

If you have a pension with New York State, local government, federal government, or certain public authorities, you do not have to pay state taxes on that pension income in retirement.

Given that we are based out of Albany, NY, we have a lot of financial planning clients that have pensions through New York State. Building again on the social security and IRA example above, now assume we have a married couple that both worked for New Year State and each have pensions for $50,000 each. They do not have to pay NYS income tax on the pension income, they have no NYS income tax on social security, and no state income tax on the first $20K each out of their NYS 457 Plan or IRA’s.

We are now up to $190,000 in annual income with zero dollars paid in NYS income taxes.

Property Tax Credits

It is no secret that New York State has high property taxes compared to other states which can often be one of the larger expenses in retirement after the mortgage is paid off. Most New York residents are familiar with the STAR program which reduces the property taxes for homeowners that make less than $500,000 in income. What many retirees do not realize is that there is something called the “Enhanced STAR” credit once you reach age 65, which can further reduce your school taxes.

However, the income limitation for the Enhanced STAR credit is much lower than the regular STAR program. The extra exemption is limited to individuals age 65 and older making less than $86,000 per year in income. A special note: income from annuities and IRA’s do not count toward the $86,000 income limitation.

While Florida may have lower property taxes compared to New York State, if you can qualify for the Enhanced STAR program, the difference in property taxes may be closer than you think.

SNOW BIRDS: This Enhanced STAR program is a big deal for our clients that are snowbirds that go back and forth from New York to Florida. If you plan to maintain a residence in New York and the have a second house in Florida, if you formally change your state of domicile to Florida, your are no longer Eligible for the STAR program, because you are no longer a New York State resident. So, you think you might be saving property taxes by making this move, but your property taxes for your house in New York could actually go up by thousands of dollars since you are no longer eligible for the STAR credit.

Medicare Consideration

When you retire, what is often the largest expenses for retirees? The answer is healthcare. While New York is known for its higher property taxes and higher income taxes, not many people realize are lucrative health insurance benefits until after they have left the state. When you turn age 65, you typically have to enroll in Medicare, which provides you with your healthcare coverage. But Medicare does not pay for everything, so most individuals will enroll in either a Medicare Supplemental or Medicare Advantage Plan to fill on the cost gaps that Medicare does not cover. Unfortunately, most retirees do not understand the difference between a Medicare Supplemental Plan and a Medicare Advantage Plan.

If you do not know the difference, here is our YouTube Video on the topic: Medicare Supplemental Plans (Medigap) vs Medicare Advantage Plans

Here is a quick summary of the issue: Medicare advantage plans can carry a lower monthly cost but you sign up for a Medicare Advantage Plan, you are no longer covered by Medicare. With Medicare supplemental plans, you are covered by Medicare, and the insurance policy supplements your Medicare coverage. In New York, we have the luxury that each year you can decide whether you want to switch from a Medicare Advantage Plan to a Medicare Supplement Plan and visa versa if your health needs change. That is only allowed in two states right now, New York and Connecticut.

If you were to change your state of domicile from New York to Florida, as soon as you become a Florida resident, you no longer have that option available to you. If you are enrolled in a Medicare Advantage plan, you may not be able to change back to Medicare coverage with a Supplemental Plan in the future if your healthcare need change. That is a big deal in retirement, so you really to analyze what type of coverage you when you make the move to Florida.

What Is Your New Tax State Liability

It is a given that no one likes to pay taxes and we would all like to pay less, but before you go through all of these maneuvers to save taxes, you should quantify how much you are actually saving. For example, let us say we have a marriage couple, and their retirement expenses required them to withdraw $30,000 annually from their retirement accounts over and above the NYS $20K exemption amount. Ignoring for now any standard deduction for tax purposes, they would have a New York State tax liability of approximately $2,200. So you have to ask yourself the question, “Is moving to Florida worth saving $2,200 per year in taxes?”.

Cost of Living

There are a few other factors that should be considered in this decision. The first being the difference in the cost of living between New York and Florida. It is not uncommon for the cost of living to be lower in the southern states compared to the northeaster so your retirement dollar may go further.

Estate Planning

While it is kind of morbid to think about, estate laws vary state by state, meaning, depending on the size of your state, your state tax liability may vary depending on whether you're a resident of New York versus Florida. For individuals that have large estates, this could me a bigger factor in their decision of whether or not to make the move.

People That Save Taxes By Moving

All things considered, for some individuals, making the decision to change you state of domicile from New York to Florida, could save them a tremendous amount of tax dollars but it depends on what your income picture will look like in retirement. For individuals that plan to take larger distributions out of retirement accounts and may have earned income in retirement, it could give more weight did the decision to change your state of domicile but it is important to talk with a tax professional to fully evaluate all the moving pieces before making the decision.

Changing Your State of Residency

If you plan to maintain houses in both New York and Florida but plan to change your state of domicile to Florida for tax purposes make sure you know all of the rules. It is not as easy as just declaring that I am a Florida resident because I spent more than half of the year in Florida. Below is our video that details all of the items that need to be consider when changing your state of domicile from New York to Florida.

Video: How Do I Change My State Residency For Tax Purposes

Disclosure: This is for educational purposes only. It is not tax advice. For tax advice, please consult your financial professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

When You Make Cash Gifts To Your Children, Who Pays The Tax?

A very common question that we frequently receive from clients is “If I want to make a cash gift to my kids, do I have to pay gift taxes?” The answer to that question depends on number of items such as: The amount of the gift

A very common question that we frequently receive from clients is “If I want to make a cash gift to my kids, do I have to pay gift taxes?” The answer to that question depends on number of items such as:

The amount of the gift

Your lifetime exclusion limit

What state you live in

However, there are other things to consider beyond just these items that I'm going to cover in this article such as:

How gifts are taxed

The annual gifting limit

Your lifetime gifting limit

Cash vs Non-cash gifts (cars, houses, stock)

Tax forms that need to be submitted to the IRS

Advanced gifting strategies

Beware the cost basis pitfall when gifting

The Annual Gift Limits

Each year The IRS sets a limit on the amount that you can gift to any one person without it counting towards your lifetime exclusion amount. In 2021, the annual gifting limit is $15,000 but that amount can change from year to year. Many people assume that as long as their gifts are below that dollar threshold that no gift tax has to be paid but if they gift over that annual limit then someone has to pay gift tax. For most individual, that is not the case due to the lifetime exclusion limits.

Lifetime Gifting Limits

There is something in the federal tax law called the lifetime estate and gifting exclusion. This is the dollar limit that you are allowed to either gift away during your lifetime or that you are able to pass onto your heir after you die without having to pay federal income tax. The limits in 2021 are very high. Each individual has a $11.7 million lifetime exemption ($23.4M combined for married couples) before anyone would owe federal tax on a gift or inheritance.

In other words, you could gift your son or daughter $10 million dollars today, and no one would owe any federal gift tax on that amount. So wait……..then what’s the deal with the $15,000 annual gift limit? Each year you are allowed to gift away $15,000 to ANY NUMBER OF PEOPLE and it will not count AGAINST your $11.58M lifetime exclusion allowance.

Example: You have 5 children and you gift each of them $15,000. Since you did not exceed the $15,000 annual limit to any one person, no one owes any federal tax on the gift, and you still have your full $11.58M lifetime exclusion amount.

If instead, you made a $100,000 gift to one child, that’s $85,000 over the $15,000 annul limit, your $11.58M lifetime exclusion amount is reduced by $85,000 so you only have $11.49M left.

As you can see, gift tax is only an issue for individuals that plan to gift very large amounts over their lifetime or will have big estates when they pass away because the gift and estate exclusion is an aggregate amounts.

Filing A Gift Tax Return

If you keep your gifts below $15,000 per year to any one person, it’s not a taxable event, and there is nothing that you need to file with your tax return. If however, you decide to make a gift to someone above the $15,000 per year annual limit, no one will owe any federal gift tax, but you will have to file a gift tax return with your personal tax return which provides the IRS with the amount that you gifted over the annual gift exclusion limit. This is how the IRS tracks how much of your lifetime exclusion you have used.

State Taxes

You also have to be aware of your state gifting laws because they can vary from the federal limits. While many states have annual gift exclusions and lifetime exclusion limits similar to the IRS, the limits can vary.

For example, in New York for 2021, the lifetime estate and gifting limit for an individual is $5.93 million. Still a large amount but only half of the federal limit. If you gift someone $8M, you may not own federal tax but you could owe state taxes. When you get to these higher gifting thresholds you also have to be aware of generation skipping tax (GST) depending on who the recipient is of the gift.

Gifting Limits Subject To Change In The Future

Be aware that these limits have changed in the pasts and they will most likely change at some point in the future. Given the size of our federal and state government deficits, at some point these government entities may need to make changes to the tax laws to generate more income for the government to repay the debt. For example, they could reduce the federal lifetime exemption from $11.5M to $1M per person which would generate more income for the government when people pass away or make large gifts.

There are two lessons here. First, don't be wasteful with your lifetime exemption amount because the limits could be reduced in the future and you may need it to avoid taxes when your assets past your heirs. Second, if you have a large estate, now is the time to be consider making large gifts while the federal lifetime limits are still at historically higher levels so those gifts are hopefully grandfathered in under the current tax laws.

Advanced Gifting Strategies

Some clients have a desire to give large amounts but do not want to eat into their lifetime a estate and gift exclusion allowance. Promissory notes can sometimes be used to execute these advanced gifting strategies.

For example, your daughter is starting a business, and you would like to gift her $200,000 to help get the business off the ground. Instead of gifting her $200,000 in a single year eating up $185,000 of your lifetime exclusion, you could structure the gift as a loan. You draft a promissory note for the $200,000 loan, can you make the loan duration such that the annual loan payments are below $15,000 per year. You issue her a $200,000 check for the loan which is no longer considered a gift and then each year you gift her $15,000 to basically make the loan payments back to you. If you are married, you can gift her $30,000 per year to make loan payments, $15,000 from you and $15,000 from your wife. You would then write into your will that if you pass away before the loan is paid in full that they loan is forgiven.

Cost Basis Pitfall

The annual and lifetime gifting limits exist whether you are gifting someone cash or a non-cash items like a car or a house but you have to be aware of the cost basis pitfalls associated with gifting non-cash assets. When you make a gift to someone, the amount of the gift is based on the fair market value of that asset when the gift is made, however the person receiving the gift inherits your cost basis in that asset. Versus, if they inherit the assets from you, they receive a step-up in basis.

Let me explain this via an example. The most common example that we see is parents gifting their house to their kids while they're still alive. Assume the parents bought the house 30 years ago for $50,000 and now the house is worth $300,000. If they give the house to their kids today, they have made a $300,000 gift in a single year, it does not trigger a tax event because it's still below their lifetime exclusion, but the kids inherit their cost basis of $50,000. Meaning, when they pass away and the kids sell the house, assuming the house sells for $300,000, they would have to pay tax on the $250,000 gain.

Instead, if the parents retained ownership of the house, when the parents pass away, their kids would receive a “step-up in basis” meaning their cost basis in the house is the value of the house as of the date of death. If they sell the house for $300,000 and their cost basis in the house is now stepped up to $300,000, they would not owe any tax saving thousand of dollars in taxes that would have been paid under the gifting scenario.

Lesson: When gifting non-cash assets that have appreciated in value, make sure you're aware of the tax impact. A little advantage tax strategy, if you have a desire to gift money to a charity or not-for-profit, sometimes it makes sense to do so with assets that have appreciated in value because when they sell them they don't have to pay taxes given their not-for-profit status. Be sure to consult wit your tax advisor when executing these advanced gifting strategies.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The U.S. Government Debt Crisis Is Almost Here

With the massive amount of money that has been printed by the U.S. Government this year, a U.S. government debt crisis is looming. In this video we will walk you through:

With the massive amount of money that has been printed by the U.S. Government this year, a U.S. government debt crisis is looming. In this video we will walk you through:

• Probability that a debt crisis will occur

• When the U.S. Government Debt Crisis could begin

• Should you be making changes to your investment allocation?

• Possible solutions to stave off the debt crisis

• Data that we use to track the government debt trends

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How The COVID Second Wave Will Impact The Stock Market

As COVID-19 cases continue to rise in the United States, it has left investors wondering what impact this could have for the stock market in coming months. In this article we are going to review

As COVID-19 cases continue to rise in the United States, it has left investors wondering what impact this could have for the stock market in coming months. In this article we are going to review:

Key Indicators To Track

Impact of A Second Full Shutdown

Chances of A Double Dip Recession

Status of Vaccines And COVID-19 Treatments

Government Stimulus Programs In The Works

Key Indicators To Track

We are not completely dismissing the traditional economic indicators such as unemployment rates, GDP, manufacturer’s index, and consumer spending habits. While we are in uncharted waters with this global pandemic, those indicators still allow us to piece together the US economy‘s timeline to recovery. However, it is hard to deny that COVID-19 tracking data such as daily infection rates will have a material impact on the decisions that investors will make in the coming months. From the experts we have spoken to, while daily infection rates would seem to be the most important, the more important data is the hospitalization rate and the number of people in the ICU.

You could potentially have a lot of people getting infected with COVID-19, but as long as they are able to recover before the virus becomes life-threatening, it would indicate that the COVID-19 treatments are working, and the health system is getting better at treating the virus in the early stages. However, if we see hospitalization rates spiking, and the number of people in the ICU increasing dramatically, that could increase the likelihood of another fall shut down in various states, extending the time to recovery.

The numbers are not great right now. The hospitalization rate is just over 80,000, which is much higher than the previous two peaks from earlier in 2020.

If this trend continues, it could put the capacity of the US health system to the test, and it could dramatically increase the number of daily deaths that we are currently seeing from the pandemic.

Government Stimulus Programs

If the current trends continue and the US elected officials determine the best way to reverse the trend is another full shut down of the economy, US citizens and businesses would most likely need support from the government to weather a second shut down. Prior to the presidential elections, Congress was working on a second stimulus package which included another round of checks to be sent to individuals below certain income thresholds, a second round of PPP loans to businesses, state aid, and additional unemployment benefits.

A few quick notes about the stimulus programs. In the preliminary legislation, we did not see any changes to the income threshold to receive the checks from the IRS, but the amounts could potentially be different. This means if you received a check the first time, you will most likely receive a check in the second round. There were several changes made to the criteria of small businesses to receive PPP loan money. Businesses now would have to show a percentage of loss revenue during a specified period to be eligible for the second round of PPP loans. For the unemployment benefits, the primary legislation suggests that it will be a lower bonus amount than the previous $600 per week.

The largest clear and present danger to the market is if the economy goes into a second shut down and Congress is not able to agree upon terms of a second round of stimulus to aid US citizens and businesses. Time will be of the essence, and if Congress waits too long to act, irreversible damage could be done to the US economy, which may prolong the timeline to recovery.

With that said, if Congress is able to provide the economy with the aid it needs to bridge the gap between where we are now to the beginning of the post COVID-19 era, the market could respond very favorably to that environment, even though the news headlines will be ugly in the coming weeks.

The Market Is Forward-Looking

Through all of this, we must remember that the stock market is a forward-looking animal. As we have seen in the past, while the news today may be bad, if the market sees light at the end of the tunnel, it will not necessarily prompt a huge sell off knowing that relief is on the way. As COVID-19 treatments and vaccines continue to gain approval for emergency use, it could provide the market with that reinsurance by mid-2021. The US economy could be on its way to a meaningful recovery, but as I mentioned above, that also assumes that the government will be willing to step in and provide financial support if an economic shutdown takes place in the coming weeks or months.

What does this mean for investors? If you have a long time horizon, it is important to keep your long-term perspective, even though the markets may gyrate in the short term. For conservative investors, it is acknowledging that there are still a lot of variables that have yet to play out over the course of the next few months, and maintaining the appropriate balance between risk and return within their portfolio is key.

Chances of A Double Dip Recession

What are the chances that the market takes another big dive like we saw in March and April of 2020? Based on the information that we have gathered, in my personal opinion, the market could experience a sell off or two before we are on the other side of this pandemic, but I would be surprised if it is of the magnitude that we saw earlier in 2020. The reason for this being, we are most likely towards the end of this pandemic versus the beginning or the middle. During the big sell off at the beginning of 2020, the S&P 500 index dropped by 34%. The market at that point had no way to know what was on the horizon because the virus had just arrived, we were learning about it as it was spreading, and there were no treatments in the works, so the market had no way of forecasting what the timeline could be to recovery. It seems like we are in a much different environment now even though the US Economy faces the threat of a second wave.

A recession is defined as two consecutive quarters of negative GDP growth. If we get a full shutdown of the US economy in the coming weeks or months, it is not off the table that we could have a negative GDP reading for the fourth quarter of 2020 and the first quarter of 2021, technically classifying it as a double dip recession. Only time will tell.

Status of COVID-19 Vaccines And Treatments

It is encouraging that new treatments and vaccines are being approved by the FDA on almost a weekly basis. The challenge becomes the level of production needed, and the distribution of these treatments to the US population. we have to acknowledge that some of these treatments have their own challenges. One of the vaccines that was recently announced has to be stored at a negative 70 degrees Celsius, which is a lot colder then your typical commercial freezer. Special trucks would need to be built to transport it, and special freezers would have to be built and installed to house the vaccine. It also becomes a question of how long the vaccination will last, of if COVID-19 mutates, thus rendering the current vaccines less effective. There are still a lot of question marks even though there seems to be hope around the treatments that are being released now. The positive note is there is both treatments being created for those that have been infected by the virus while at the same time vaccines are being developed to help people from getting the virus in the first place. The stock market will undoubtedly be watching closely to how effective these treatments are at treating the virus, and in turn painting a picture as to the timeline did the economic recovery post COVID-19.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Process of Selling A Business - Pitfalls To Avoid

For business owners, selling the business is often the single most important financial transaction in their lifetime. Since this is such an important event, we created a video series that will guide business owners through the

For business owners, selling the business is often the single most important financial transaction in their lifetime. Since this is such an important event, we created a video series that will guide business owners through the selling process. Dave Wojeski, a partner at Greenbush Financial, has spent years in the merger acquisition space, focusing on business transaction between $5M and $100M in value. Over the course of these 3 videos, Dave will share the following information about the sell side of these business transactions:

Video 1: Valuation & Prepping Your Business For Sale

Knowing when it’s the right time to sell your business

How to determine the value of your business

The returns that buyers typical expect from the acquisition of your business

Prepping your business for sale to command a higher valuation

Video 2: The Process of Selling Your Business

The steps associated with selling your business

Professionals involved in the selling process

Letter of Intent (LOI), Due Diligence, and Purchase Agreement Terms

Special considerations when selling the business to your children

Video 3: Pitfalls To Avoid When Selling Your Business

Common pitfalls to avoid when selling your business

Employment agreements post sale

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Have to Pay Tax When I Sell My House?

When you sell your primary residence, and meet certain requirements, you may be able to exclude all or a portion of your capital gain in the property from taxes. In this article, I am going to cover the $250,000

When you sell your primary residence, and meet certain requirements, you may be able to exclude all or a portion of your capital gain in the property from taxes. In this article, I am going to cover the $250,000 capital gains exclusion for single filers, and the $500,000 capital gains exclusion for married couples filing joint. However, as financial planners, we have also run into some unique situations where clients:

Live in an owner-occupied duplex and rent one half of the property

Have a home office and have been taking depreciation as a tax benefit

Moving into a rental property and made it their primary residence

For homeowners that fall into one of the unique categories, they may face an unexpected tax consequence when the go to sell their property. They may wrongly assume the large capital gains exclusion associated with selling a primary residence will cover gains and depreciation that was taken on the rental portion of the property.

$250,000 / $500,000 Capital Gain Exclusion

When you sell an asset that is appreciated in value, in most cases you must pay tax on the amount of value that that asset has gained since you purchased it. For real estate, if you have held the property for more than 12 months, you typically have to pay long term capital gains tax on the amount of the appreciation. However, for your primary residence, the IRS offers taxpayers some relief if certain requirements are met. These conditions are that:

The home must be considered your primary residence based on IRS rules

You must have occupied the house for at least 2 of the last 5 years

If you meet these requirements, when you go to sell your house the IRS offers the following capital gains exclusion amounts:

Single Filers: $250,000

Married Filing Joint: $500,000

If you are a single tax filer, meet the primary residence requirements, and the gain in your house is not more than $250,000, you will not pay any tax when you sell it. For married couples filing joint, as long as the gain in the property is not more than $500,000, you will not pay any tax when you sell it. Do not mistake the sales price of the house with the amount of the capital gain. If you are married and sell your house for $600,000, that does not necessarily mean that you are going to have to pay tax when you sell it. If you purchased the property 10 years ago for $400,000, and you sell it today for $600,000, you have a $200,000 gain in the property. Since the capital gain exclusion for married couples filing joint is $500,000, you do not have to pay any tax on the gain when you sell your house.

Calculation of Your Cost Basis

When you calculate the gain in your house, you take the sales price of the house, minus the purchase price of the house, minus the cost of any capital improvements that you made to the house while you owned it, minus any commissions that you paid to the realtor. For example, I'm a single filer and I bought a house for $200,000, 10 years later I sell the house for $500,000. when I lived in the house I made $50,000 of capital improvements and when I sold the house I paid the realtor a 5% Commission.

Since the total capital gain is below the $250,000 threshold, I will not pay any tax when I sell the house.

NOTE ABOUT CAPITAL IMPROVEMENTS: You should have documented proof of your capital improvements. Anytime you make major house renovations, you should keep the receipts in case you are ever audited by the IRS and have to justify those capital improvements.

You Can Use The Exemption Multiple Times

This capital gains exception on your primary residence can be used more than once during your lifetime. The only restriction is the exemption can be used only once every two years. For example, let us say you are married and file a joint tax return. You buy your first house for $200,000, and 10 years later sell it for $400,000. In this scenario, you will not pay any tax when you sell your primary residence. Now assume you then take that $200,000 gain and use it as a down payment on your new house and the purchase price of that new house is $400,000, you live in that house for 15 years, and then sell it for $700,000. You will again be able to exclude the full gain in that property when you sell it.

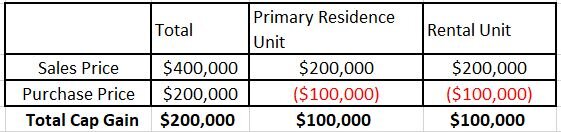

Capital Gains Rule For A Rental That Is Owner Occupied

Here is our first unique situation: It is not uncommon for someone to buy a duplex, live in 1/2 as their primary residence, and rent the other half to a tenant. The question becomes when you go to sell the duplex, how does the capital gains exclusion work since technically it was also your primary residence. This is tricky. In the eyes of the IRS, the duplex is 2 separate properties. The half that you live in is your primary residence, and the half that is rented is actually an investment property. Only the half that you live in as your primary residence is eligible for the primary residence capital gains exclusion. The rented portion of the property is not eligible for the capital gains exclusion.

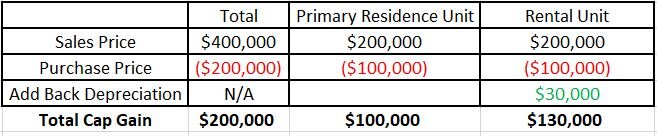

For example, I found a duplex for $200,000, I live in 1/2 as my primary residence and I rent the other half to a tenant. 10 years later I decide to sell the duplex for $400,000. even though I'm a single filer and technically have a $250,000 gain exclusion for my primary residence, that unfortunately will not cover the full gain in the property when I sell it. Here is how I have to allocate the gain between the two units:

The $100,000 gain associated with my principal residence unit is exempt from taxes because it's below the $250,000 exclusion for a single filer. However, the $100,000 capital gain associated with the rental unit, I will have to pay tax on. Since I also owned the house for more than a year, I would pay long-term capital gains rates on the $100,000 which could mean 15% Federal Tax and State Tax. Assuming the State Tax is 5%, I would owe 20% in taxes on the $100,000 gain equaling a $20,000 tax bill.

Recapture of Deprecation

When individuals own rental properties, it is not uncommon for the owner to be taking depreciation on the value of the rental property. Depreciation is a tax strategy which allows you to realize the expense of the property and use those expense to offset income from the property, thus reducing the owner’s tax liability. However, when you sell a property, you have to recapture the depreciation that was previously taken as a tax benefit. Therefore, not only would you potentially have to pay tax on the gain of the rental unit, but you have to factor in that appreciation which is taxed at a different rate than long-term capital gains.

Let us build on the example with the duplex we just discussed. Over the course of the 10 years that I own the property, I took $30,000 worth of depreciation against the property to reduce the tax liability against the rental income I was receiving from the tenant. When I sell the house, the cost basis of my primary residence unit and the rental unit will be different due to the depreciation adjustment. See below:

As you see in the example above, I have a larger gain on the rental unit because I had to add the $30,000 appreciation amount to the gain (or in the accounting terms, it reduced my cost basis by another $30,000). In this situation the $100,000 gain associated with the primary residence unit is 100% excluded from taxes because it is below my $250,000 single filer exemption. However, on the rental unit I will have to pay tax on the $130,000 gain, but the $130,000 is not all taxed at the long-term capital gains rate. The $30,000 in depreciation recapture is taxed at a flat 25% tax rate, whereas the remaining $100,000 and gain is entirely taxed at long-term cap gains rates.

Why does the IRS tax depreciation recapture at a different rate? They recognize that you use the depreciation to offset income that was originally taxed at ordinary income tax rates, which could be as high as 37% or more. So, they are essentially asking you to pay more tax on the portion of the game assigned to the tax deductions you took while you owned it.

A SPECIAL NOTE ABOUT DEPRECIATION: Depreciation recapture is limited to the lesser of the gain or the depreciation previously taken. For example, if you took $100,000 in depreciation against the property but the gain when you sold the property was only $50,000, when you sell the property you have to pay tax on the $50,000 gain, but it will be at the full 25% depreciation recapture rate. You do not have to pay tax on the full $100,000 depreciation recapture when you sell the property.

Moving Into A Rental Property To Avoid Capital Gains Tax

This is another unique situation that we run into sometimes. Individuals that own rental property that has appreciated in value, or sometimes get the idea that if I move into the property and make it my primary residence for two years, all of the gain in that property will then be sheltered by my primary residence capital gains exclusion. The rule of thumb in these situations is if you have thought of it, the IRS has probably thought of it as well, and has probably put some form of restrictions in place. That is unfortunately true of this strategy as well. In 2009 The IRS created a “qualified vs non-qualified use” test:

Qualified uses the period of time that the house is considered your primary residence. Non-qualified uses the period of time that that house was an investment property. The test applies to ownership periods beginning in 2009, and it ultimately determines that even if you have met all the requirements in making that house your primary residence, when you go to sell it the test will determine how much of the gain exclusion you get to apply when you sell the house.

For example, if you rented out a vacation home for 10 years and then you moved into the house for three years as your primary residence, when you go to sell, the capital gains exclusion is limited to 3/13 of the capital gain the property.

Let's assume I buy a vacation home for $300,000, and rented it out as an investment property for 10 years. I move into the house and make it my primary residence for three, but now have decide to sell it for $700,000. Since I am married and file a joint tax return, it is easy to assume I am eligible for a $500,000 capital gains exclusion on my primary residence. However, in this situation I cannot shelter the full gain because the IRS would apply the qualified use test.

$400,000 Capital Gain x 3/13 = $92,307

When I sell the property and realize the $400,000 gain, I am only able to exclude $92,307 from taxes using the primary residence gain exclusion. The remainder of the gain would be taxed at long term capital gains rate and any depreciation recapture would apply.

Selling Your Primary Residence With A Home Office

For an individual that has been claiming a tax deduction for a home office, a word of caution: If you have taken depreciation over the years for the home office, when you sell the primary residence, you will be eligible for the capital gains exclusion, but you will have to recapture the depreciation that you claimed over the years.

DISCLOSURE: This article does not contain tax advice and is for educational purposes only. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A CFP® Explains: Wills, Health Proxy, Power of Attorney, & Trusts

When we are constructing financial plans for clients, we inevitably get to the estate planning portion of the plan, and ask them “Do you have updated wills, a health proxy, and a power of attorney in place?

When we are constructing financial plans for clients, we inevitably get to the estate planning portion of the plan, and ask them “Do you have updated wills, a health proxy, and a power of attorney in place?” The most common responses that we receive are:

“I know we should have but we never did”

“I did but it was over 10 years ago”

“I have a will but not a health proxy or a power of attorney”

“I have heard about trusts, should I have one?”

The Will, Health Proxy, and Power of Attorney are the three main estate documents that most people should have. In this article I will review:

How Wills work and items that you should include in your Will

Why you should have a Health Proxy and how they work

Power of Attorney

The probate process

Considering a testamentary trust

Assets that pass outside of the Will

Revocable Trusts & Irrevocable Trusts

Estate planning tips

How much does it cost to establish a will, health proxy, and a power of attorney

Establishing A Will

The most basic estate document that most people are aware of is a written Will. The Will provides specific guidance as to who will receive your assets after you have passed away. The Will also establishes who would be the guardian of your minor children should you pass away prior to your children reaching the age of majority. Without a Will, state laws and the court system that know nothing about you, will decide who receives your assets and who will be the guardian of your minor children; not a situation that most people want.

The Will can be a very simple document. If you are married and have children, the Will may state that if you pass away everything goes to your spouse but if both you and your spouse were to pass away simultaneously, the assets go to the children. For individuals or married couples without children, or for married couples that have been divorced, it’s also critical to have a Will to provide direction as to what will happen to your assets if you were to pass away.

You can engage an estate attorney to complete a simple Will or if your Will is very simple and straightforward, you may elect to use a do-it-yourself option through a platform like Legal Zoom. We typically encourage clients to meet with an estate attorney because when it comes to estate planning many people don’t know what questions to ask to get the right documents and plan in place. If you are married with minor children, and you and your spouse were to pass away leaving all the assets to the kids, with a simple Will, they would have access to their full inheritance at age 18. An 18 year old having access to large sums of money may not be an optimal situation. In those cases, you may want to include a testamentary trust or revocable trust in your estate plan to put some restrictions in place as to how and when your children will have access to their inheritance.

Probate

I'm going pause here for a moment and explain what probate is and the probate process. When someone passes away, all of the assets included in their estate go through what's called a “probate process”. The probate process is a legal process of accounting for all of your assets, debts, and transferring your assets to the beneficiaries of your estate. The person listed in your will as the “executor” is responsible for coordinating the probate process. Depending on the size of the estate, your executor will usually work with an attorney, an accountant, and possibly appraiser, to:

Value the assets in your estate

Work with the courts to process your estate

Pay outstanding expenses or debts

Coordinate the transfer of assets to your beneficiaries

Since the probate process is a legal process involving the courts, the process often takes longer than beneficiaries expect. Individuals will make the incorrect assumption that when you pass away, they just read the will, and your beneficiaries receive the assets within a few days or weeks; unfortunately that's not that case. It’s not uncommon for the probate process to take 6 to 12 months and there are expenses involved with probating an estate. If it’s a complex estate, it could take over a year to complete the probate process.

For these reasons, it’s a common goal with estate planning to find ways to avoid the probate process and pass you assets directly to your beneficiaries. I will explain more about these strategies later on. But circling back to our discussion about the Will, if all you have is a Will, when you pass away, the assets in your estate will pass through this probate process.

Testamentary Trusts

There are a lot of different types of trusts within in estate planning world. One of the most basic and common trusts, especially for individuals with children under that age of 25, is a testamentary trust. A testamentary trust is a trust that is built into your will. With at testamentary trust, you are not establishing a trust today , but rather, if you pass away, a trust is established during the probate process and you can direct assets to the trust. Building a testamentary trust into your Will gives you some control over how the assets are distributed to the beneficiaries after you have passed away.

It's common for individuals or married couples with children under that age of 25, to build these testamentary trusts into their Wills. I will illustrate how these trusts work in the example below.

Example: Jim and Sarah have two children, Rob age 14 and Wendy age 8. Between the value of their house, life insurance policies, and other assets, their estate would total $1.5M. Jim & Sarah realize that if something were to happen to them tomorrow, they would not want their kids to inherit $1.5M when they turn age 18 because they might not go to college, they may try to start a business that fails, buy a Corvette, etc. In their Will they establish a Testamentary Trust that states that if both parents pass away prior to the children turning age 25, all of their assets will flow into a trust, and that Sarah’s brother Harold will serve as the trustee. Harold as the trustee is able to distribute cash from the trust for living expenses, education, health expenses, and other expenses deemed necessary for the well being of the children. The children will receive 1/3 of their inheritance at age 25, 30, and 35.

You can design these testamentary trusts however you would like. In the Will you would designate who will be the trustee of your trust and the terms of the trust.

IMPORTANT NOTE: Testamentary trusts do not avoid probate like other trusts do. The trust is established as part of the probate process.

Revocable Trusts & Irrevocable Trusts

It's also common for individuals and married couples to consider establishing either a Revocable Trust or Irrevocable Trust as part of their estate planning. These are separate from Testamentary Trusts. Revocable Trusts and Irrevocable Trusts are being established today and assets owned by the trust pass in accordance with the terms set forth in the trust document. There are material differences between these two types of trusts but some primary reasons why people establish these types of trust are to:

Avoid probate

Protecting assets from a long term event

Control how and when assets are distributed beyond the date of death

Reducing the size of the estate

Advanced tax strategies

Assets That Pass Outside of The Will

There are certain assets that pass outside of the Will. Many of these “other assets” pass by “contract”, meaning there are beneficiaries designated on those accounts. A common example of assets that pass by contract are 401(k) accounts, IRA’s, annuities, and life insurance. When you set up those accounts you typically designate beneficiaries for each account and your Will could say something completely different. The assets that pass by contract do not have to go through the probate process unless the beneficiary listed on the account is your estate which is usually not an advantageous election for most individuals.

Transfer On Death Accounts (TOD)

One of the estate planning strategies that we use with clients is instead of holding an individual investment account in the name of the individual, we will register the account as a “transfer on death” (TOD) account. If you have an individual brokerage account and you pass away, the value of that account will have to go through probate. By simply adding the TOD feature to an existing individual brokerage account which lists beneficiaries similar to a 401(K) or IRA account, that account now avoids probate, and passes by contract directly to the beneficiaries.

Depending on the assets that make up your estate, you may be able to setup TOD accounts as opposed to going through the process of setting up trusts but it varies from person to person.

Power of Attorney

Let’s shift gears now over to the Power of Attorney document. A Power of Attorney document is important because it allows someone to step into your shoes and handle your financial affairs, should you become incapacitated. Some common examples are:

Example 1: If you're in a car accident and end up in a coma, for accounts that are held only in your name, such as a checking account, investment account, or credit card, they will only speak to you. Being married does not give your spouse access financially to those accounts while you are still alive but your spouse may need access to them to continue to pay your bills or get access to cash to pay expenses while you're incapacitated. Having a power of attorney document would allow your spouse or trusted individual named as your “agent” to act financially on your behalf.

Example 2: Having a power of attorney in place is key for Long Term Care events. If you have a spouse or parent and they have a stroke, develop dementia, or another health event that renders them unable to handle their personal finances, you could step in as their agent and handle their personal finances. In long term care situations that can often mean paying a nursing home, applying for Medicaid, paying medical bills, or shifting the ownership of assets to protect from a Medicaid spend down.

The Power of Attorney can also be built so your agent is not given that power today but rather it would only be given if a triggering event happened sometime in the future. With this document you really have to name someone you 100% trust. As financial planners, we have seen cases where there is abuse of the Power of Attorney powers and it’s never pretty. It's not uncommon for a power of attorney to allow the agent to make gifts as a planning tool, but that might also include gifts to themselves, so you have to fully trust your agent and the powers that you provide to them.

Health Proxy

The health proxy is usually the least fun estate document to complete but is equally important. In this document you are naming the individual that has the right to make your health decisions for you if you are incapacitated. This document spells out what you want and don’t want to have happen if certain health events occur. While it's not uncommon for individuals to be a little uncomfortable completing this document due to the nature of the questions, it's a lot better to complete it now, versus your family members trying to determine what your wishes would be when a severe health event has already occurred.

The health proxy will list items like:

Would you be willing to be put on life support?

If you could not eat, would you allow them to use a feeding tub

Resuscitation preferences

Willingness to accept blood transfusions

Again, not fun things to think about but by you making these decisions while you are of sound body and mind, it takes away the difficult situation where your family members have to decide in the heat of the moment what you would have wanted. That situation can sometimes tear families apart.

Keep Your Estate Plan Up To Date

All too often, we run into this situation where a client will acknowledge that they have estate documents, but they were established 20 years ago, and they never made any changes. It makes sense to meet with your estate attorney and revisit your estate plan:

Every five years

If you move to a different state

When Congress makes major changes to the estate tax rules

The estate laws vary state by state. If we have clients that are planning to move and they plan to change their state of domicile to another state, we will often encourage them to meet with an estate attorney within that state once the move is complete. Congress has also made a number of changes to the federal estate tax laws over the past few years, with potentially more in the works, and not revisiting the estate plan could end up costing your beneficiaries tens of thousands of dollars in estate taxes that could have been avoided with some advanced planning.

Cost of Estate Documents

The cost of establishing a Will, Health Proxy, Power of Attorney, and Trusts, often varies based on the complexity of your estate plan. A simple Will may cost less than $1,000 to establish through an estate attorney. Establishing all three documents: Will, Health Proxy, and Power of Attorney may cost somewhere between $1,000 - $3,000. While it's not uncommon for individuals to be surprised by the cost of setting up these estate documents, I always urge people to think about the cost of not having those documents in place. The probate process with professionals involved could cost thousands of dollar, your beneficiaries could lose thousands of dollars in taxes that could have been avoided, not to mention the emotional toll on your family trying to figure out what you would have wanted without clear guidance from your estate documents. Revocable Trusts and Irrevocable Trust

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Protect Assets From The Nursing Home

When a family member has a health event that requires them to enter a nursing home or need full-time home health care, it can be an extremely stressful financial event for their spouse, children, grandchildren, or caretaker

When a family member has a health event that requires them to enter a nursing home or need full-time home health care, it can be an extremely stressful financial event for their spouse, children, grandchildren, or caretaker. The monthly cost of a nursing home is typically between $10,000 - $15,000 per month and without advanced planning it often requires a family to spend through almost all of their assets before they qualify for Medicaid.

As we all live longer, we become more frail in our 80’s and 90’s, which increases the probability of a long term care event occurring. Many individuals that we meet with have already experienced a long term care event with their parent or grandparents and they have seen first hand the painful process of watching them spend through all of their assets. For couples that are married, it can leave the spouse that is not in need of care in a very difficult financial situation as pensions, social security, and martial assets have to be pledged toward the cost of the care for their spouse. For individuals and widows, the burden is placed on their family or friends to scramble to liquidate assets, access personal financial records, and watch the inheritance for their heirs be depleted in a very short period of time.

I often ask my clients this simple question, “Would you rather your house and assets go to your kids or go to the nursing home?” As you would guess, most people say “my kids”. With enough advanced planning you have that choice and today I’m going to walk you through some of the strategies that we use with our clients to protect assets from long term care events.

Strategies Vary State By State

Since the Medicaid rules vary from state to state, the strategies that I'm presenting in this article can be used by New York State residents. However, if you are resident of another state, this article will still help you to understand asset protection strategies that are commonly used but you should consult with an elder law expert in your state to determine the appropriate application of these strategies.

Long Term Care Insurance

While having a long term care insurance policy in place is ideal because if a long term event occurs it pays out and covers the cost, there are a number of challenges associated with long-term care insurance including:

Insurance companies will rarely issue policies after you reach age 70

If you have any issues within your health history, they may not issue you a policy

The cost of the policies can be expensive

It’s not uncommon for a good long-term care insurance policy to cost an individual between $4,000 and $6,000 per year. The reason why the insurance is more expensive than other types of insurance is there is a high likelihood that if you live past age 65, at some point you will experience a long term care event. Insurance companies don’t like that. Insurance companies like issuing policies for events that have a low probability of occurring, similar to life insurance. In addition, when these long term care policies pay out, they pay out big dollar amounts because the costs are so high. For these reasons, long-term care insurance policies have become more of a luxury item instead of a common solution that is used by individuals and family to protect their assets from a long term care event.

So if you don’t have a long-term care insurance policy, what can you do to protect your assets from a long-term event?

Establish A Medicaid Trust

If an individual does not have a long term care insurance policy to help protect against the cost of a long term care event, the next strategy to consider is setting up a Medicaid Trust to own their non-retirement assets. Non-retirement assets can include a house, investment account, stocks, non-qualified annuities, permanent life insurance policies, and other assets not held within a Traditional IRA or other type of pre-tax retirement account. This is how the strategy works:

Establish a Medicaid Trust

Transfer assets from the individual’s name into the name of the trust

Assets are held in the trust for at least 5 years

The individual experiences a long term care event requiring them to enter a nursing home

Since the trust has owned the assets for more than 5 years, they are no longer countable assets, the individual can automatically qualify for Medicaid as long as their assets outside of the trust are below the asset allowance threshold; Medicaid pays the nursing home for their care, and the trust assets are preserved for the spouse and their heirs.

Medicaid 5 Year Look Back Period

In New York, Medicaid has a 5 year look back period. The 5 year look back period was put into place to prevent individuals from gifting away all of their assets right before or after they experience a long term care event in an effort to qualify for Medicaid. In 2020, New York requires residents to spend down all of their countable assets until they are below the $15,750 asset allowance threshold. Once below that level, the individual qualifies for Medicaid, and Medicaid will pay the nursing home costs. When an individual submits a Medicaid application, they request 5 years worth of financial records. If that individual gave any asset away within the last five years, whether it’s to a person or a trust, those asset will be brought back in as “countable assets” required to be spent down before the individual will qualify for Medicaid.

Example: Jim is 88 years old and has $100,000 in his savings account. His health is beginning to deteriorate and he gifts $90,000 to his kids in an effort to reduce his assets to qualify for Medicaid. Two years later Jim has a stroke requiring him to enter a nursing home, and only has $10,000 in his savings account. When he applies for Medicaid, they will request 5 years worth of his bank records and discover that he gifted $90,000 away to his kids two years ago. That $90,000 is a countable asset subject to spend down even though he no longer has it. But it gets worse, his kids spent the $90,000, so they are unable to return the $90,000 to Jim. Jim is not eligible for Medicaid and there is no cash available to pay for his care.

Medicaid Trust Strategy

For the Medicaid Trust strategy to work, the assets have to be put into the trust 5 years prior to submission of the Medicaid application. Once the assets are owned by the trust for more than 5 years, regardless of the dollar value in the trust, it’s no longer a countable asset, and the individual can automatically qualify for Medicaid.

Example: At age 84, Jim sets up an Medicaid trust, and moves $90,000 of his $100,000 in cash into the trust. At age 90, Jim has a stroke requiring him to enter a nursing home, but now since the assets were in the trust for more than 5 years, he is no longer required to spend down the $90,000, and he qualifies for Medicaid. That $90,000 is now reserved for his kids who are the beneficiaries of the trust.

Establishing a trust instead of gifting assets away to family members can help to preserve those assets against the situation where the individual does not make it past the 5 year look back period and the money gifted has already been spent by the beneficiaries.

How Do Medicaid Trusts Work?

Medicaid trusts are considered “irrevocable trusts” which means when you move assets into the trust you technically do not own them anymore. By setting up a trust, you are essentially establishing an entity, with it’s own Tax ID, to own your assets. The thought of giving away assets often scares individuals away for setting up these trusts but it shouldn’t. Estate attorneys often include language in the trust documents to offer some flexibility. Before I go into some examples, I first want to define some trust terms:

Grantor: The grantor is the person that currently owns the assets and is now gifting it (or transferring it) into their trust. If for example, you are doing this planning for your parents, they would be the “grantors” of the trust.

Trustee: The trustee is the individual or individual(s) that are responsible for managing the assets owned by the trust. This is typically not the grantor. The reason being is if you gift your assets to a trust but you still have full control of it, the question arises, have you really given it away? In most cases, the grantor will designate one or more of their children as trustees. The trustees are responsible for carrying out the terms of the trust

Beneficiaries: The beneficiaries of the trust are the individuals that are entitled to receive the assets typically after the grantor or grantors have passed away. It’s common for the beneficiaries of the trust to be the same as the beneficiaries listed in a person’s will.

Access to Income

When you gift assets to a Medicaid trust, you technically no longer have access to the principle, but grantors still have access to any “income” generated by the trust assets. This is most easily explained as an example.

Mark & Sarah have traditional IRA’s, their primary residence, and an investment account with a value of $200,000. They do not anticipate needing to access the $200,000 to supplement their income and want to protect that asset from a long term care event so they know that their kids will inherit it. They establish a Medicaid trust with their two children designated a co-trustees and they move the ownership of the house and the $200,000 investment account into the name of the trust. If the holdings in the $200,000 investment account are producing dividend and interest income, Mark & Sarah are allowed to receive that income each year because they always have access to the income generated by the trust, they just can’t access the principal portion of the trust assets.

Revoke Part Of The Trust

Estate attorneys may also build in a feature which allows the trustees to “revoke“ all or a portion of the trust assets. Let’s build on the Mark & Sarah example above:

Mark and Sarah gift their house and the $200,000 investment account to their Medicaid trust but two years later Sarah incurs an unforeseen medical event and they need access to $50,000. Since the trustee was given the power to revoke all or a portion of the trust asset, the trustee works with the estate attorney to revoke $50,000 of the trust assets in the investment account and send it to the grantors (Mark & Sarah). The $150,000 remaining in the investment account continues to work toward that 5 year look back period, and Mark & Sarah have the money they need for the medical expenses.

Gifts To The Beneficiaries

An alternative solution to the same scenario listed above is that the trustees can be given the power to gift assets to the beneficiaries while the grantors are still alive. Essentially the trustees, who are often also the beneficiaries of the trust, gift themselves assets from the trust, and then turn around and gift those assets back to the grantors. In the Mark & Sarah example above, instead of revoking part of the trust assets, their children, who are the trustees, gift $50,000 to themselves, and then turn around and gift $50,000 to their parents (Mark & Sarah) to pay their medical bills. But with gifting powers, you really have to trust the individuals that are serving as trustees of your Medicaid trust because they cannot be required to gift the money back to the grantor.

Putting Your House In The Trust

It's common for individuals to think: “Well all I have is my house, I don’t have any investment accounts, so there is no point in setting up a trust because my house is always protected.” That's incorrect. If you own your house and you experience a long term care event:

Your primary residence is not a countable assets for Medicaid eligibility and you can qualify for Medicaid while still owning your house

Medicaid cannot force you to sell your house while you or your spouse are still alive and then spend down those assets for your care

However, and this is super important, even though your primary residence is not a countable asset and they can't force you to sell it while you or your spouse are still alive, Medicaid can put a LIEN against your house for the amount that they pay the nursing home for your care. So when you or your spouse pass away, the value of your house is included in your estate, Medicaid will force the estate to sell the house and they will recapture the amount that they paid for your care.

Example: Linda’s husband Tim passed away three years ago and she is the surviving spouse. Her only asset is the primary residence that she lives in worth $250,000 with no mortgage. Linda has a stroke and is required to enter a nursing home. Because she has no other assets besides her primary residence, she qualifies for Medicaid, and Medicaid pays for the cost of her care at the nursing home. Linda passes away 2 year later. During that two year period in the nursing home, Medicaid paid $260,000 for her care. Linda's children, who were expecting to inherit the house when she passed away, now find out that Medicaid has a lien against the house for $260,000; meaning when they sell the house, the full $250,000 goes directly to Medicaid, and the kids receive nothing.

If Linda had put the house into a Medicaid trust 5 years prior to her stroke, she would have immediately qualified for Medicaid, but Medicaid would not be entitled to put a lien against her primary residence. When she passes away, since the house is owned by the trust, there is no probate, and her children receive the full value of the house.

Again, the way I phrase this to my clients is, would you rather your kids inherit your house or would you rather it go to the nursing home? With some advance planning you have a choice.

The Cost of Setting Up A Trust

The other factor that has scared some people away from setting up a Medicaid trust is the setup cost. It’s not uncommon for an estate attorney to charge between $3,000 - $8,000 to setup a Medicaid trust. But in the example that we just looked at above with Linda, you are spending $5,000 today to setup a trust, that is going to potentially protect an asset worth $250,000.

The next objection, “well what if I spend the money setting up the trust and I don’t make it past the 5 year look back period?” If that’s the case, the $5,000 that you spent on setting up the trust is just $5,000 less that nursing home is going to receive for your care. To qualify for Medicaid, you have to spend down your assets below the $15,750 threshold so if you have countable assets above that amount, you would have lost the money to nursing home anyway.

Countable Assets

I have mentioned the term “countable assets” a few times throughout this article; countable assets are the assets that are subject to that Medicaid spend down. Instead of going through the long list of assets that are countable it's easier to explain which assets are NOT countable. The value of your primary residence is not a countable asset even though it's subject to the lien. Pre-tax retirement accounts such as Traditional IRA’s and 401(k) plans are not countable assets. Pre-paid funeral expenses up to a specific dollar threshold are also not a countable asset. Outside of those three assets, almost everything else is a countable asset.

Retirement Accounts

As I just mentioned above, pre-tax retirement accounts are not subject to the Medicaid spend down, however, Medicaid does require you to take required minimum distributions (RMD’s) from those pre-tax retirement accounts each year and contribute those directly to the cost of your care. Notice that I keep saying “pre-tax”, that’s because Roth IRA’s are countable assets subject to spend down. If you have $100,000 in a Roth IRA, Medicaid will require you to spend down that account until you reach the $15,750 in total countable assets qualifying you for Medicaid.

Pensions & Social Security

You can use Medicaid trusts to protect assets but they cannot be used to protect “income”. Monthly pension payments and Social Security income are subject to the Medicaid income threshold. For individuals that are single or widowed, your income has to below $875 per month in 2020 to qualify for Community Medicaid and below $50 per month for Chronic Care Medicaid. If an individual is receiving social security, pensions, or other income sources above that threshold, all of that income automatically goes toward their care.

If you are married and your spouse is the one that has entered the nursing home, you are considered the “community spouse”. As the community spouse you are allowed to keep $3,216 per month in income.

Example: Rob and Tracey are married, Rob just entered the nursing home, but Tracey is still living in their primary residence. Their monthly income is as follows:

Rob Social Security: $2,000

Tracy Social Security: $2,000

Rob Pension: $3,000

Total Monthly Income: $7,000

Of the $7,000 in total monthly income that Tracey is used to receiving, once Rob qualifies for Medicaid, she will only be receiving $3,216 per month. The rest of the monthly income would go toward Rob’s care at the nursing home.

Community Spouse Asset Allowance

If you are married and your spouse has a long term care event requiring them to go into a nursing home and you plan to apply for Medicaid, you as the community spouse are allowed to keep countable assets up to the greater of:

$74,820; or

One-half of the couple’s total combined assets up to $128,640 (in 2020)

Take Action

Unless you have a long term care insurance policy or enough assets set aside to offset the financial risk of a long term care event occurring in the future, setting up a Medicaid trust may make sense. But I also want to provide you with a quick list of considerations when establishing a Medicaid trust:

You should only transfer assets to the trust that you know you are not going to need to supplement your income in retirement.

Step up in basis: By establishing a Medicaid trust as opposed to gifting assets directly to individuals, the estate attorney can include language that will allow the assets of the trust to receive a step up in basis when the grantor passes away which can mitigate a huge tax hit for the beneficiaries.

For these strategies to work it takes advanced planning so start the process now. Each asset that is transferred into the trust has its own 5 year look back period. The sooner you get the assets transferred into the trust, the sooner that clock starts.

If you are doing this planning for a parent, grandparent, or other family member, it's important to consult with professionals that are familiar with the elder law and Medicaid rules for the state that the individual resides in. These rules, limits, and trust strategies vary from state to state.

Contact Us For Help If you are a New York resident doing this type of planning for yourself or for a family member that is a resident of New York, please feel free to reach out to us with questions. We can help you to better understand how to protect assets from a long term care events and connect you with an estate attorney that can assist you with the establishment of Medicaid trust if the trust route is the most appropriate strategy for asset protection. Disclosure: This article is for educational purposes only. It does not contain legal, Medicaid, or tax advice. You should consult with a professional for advice tailored to your personal financial situation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

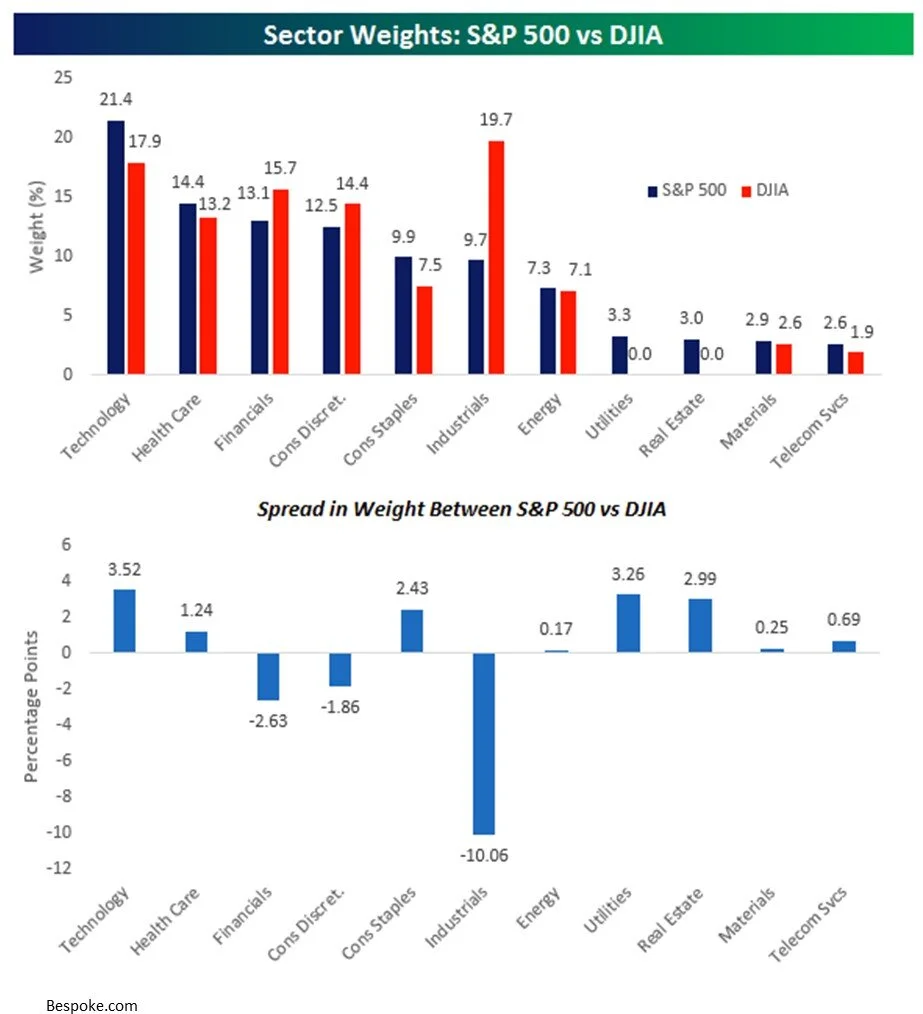

Which Stock Market Index Is Better To Track? The Dow or S&P 500 Index

Today, I’m going explain the difference between the Dow Jones Industrial Average (“The Dow”) and the S&P 500 Index. While both indexes are meant to be an accurate representation of the performance of the US